Photo by Nicholas Ceglia / Unsplash

Why is Turkey a Bad Economy?

Introduction

Turkey, officially called the Republic of Türkiye, is the 18th largest economy in the world by nominal GDP in 2024, according to the IMF, and is the founding member of the G20 and OECD. Turkey has been showing poor economic performance for the last many years. For example, the lowest inflation rate in Turkey in any month of 2024 is 49.38% in the month of September. It has been facing double digit inflation since 2017, with the exception of a couple of months when the inflation rate fell below 10%. In the last ten years, the Turkish Lira (TRY) has lost its value against the US Dollar by approximately 1400%, from TRY 2.25 per USD in October 2024 to TRY 34.27 per USD in October 2024. Along with a high rate of inflation and depreciating currency, Turkey is also facing high borrowing costs, a deficit on the current account of balance of payments, and increasing loan defaults. In this article, we will look into the details of the poor economic performance of Turkey.

What’s Wrong with Turkey’s Economy?

Recep Tayyip Erdoğan has been the president of Turkey since 2014. Many economists and financial experts are of the view that the main causes of Turkey’s economic turmoil are the excessive current account deficit and large amounts of private foreign-currency-dominated debt, along with President Recep Tayyip Erdoğan’s rising authoritarianism and his unorthodox ideas about interest rate policies. Some analysts also showed concerns about the leveraging effects of the geopolitical frictions with the United States. Following the imprisonment of the American pastor Andrew Brunson, who was constricted of spying charges after the failed 2016 Turkish coup d'état attempt. The Trump administration also inserted pressure on Turkey by imposing further punishments. The economic punishments then doubled the tariffs on Turkey, as on imported steel they rise up to 50% and on aluminium to 20%. Due to which, Turkish steel was priced out of the U.S. market, which previously accounted for 13% of the total Turkey’s steel export. After 2020, 2021, and recovery from the COVID-19 pandemic, the interest rates were lowered from 19% to 14% due to the replacement of Turkish Central Bank chief Naci Ağbal with Şahap Kavcıoğlu, before hitting 8.5% in May 2023. Since June 2023, the interest rate is increasing with a current value of 50%. The Turkish Lira lost 44% of its value in 2021 alone.

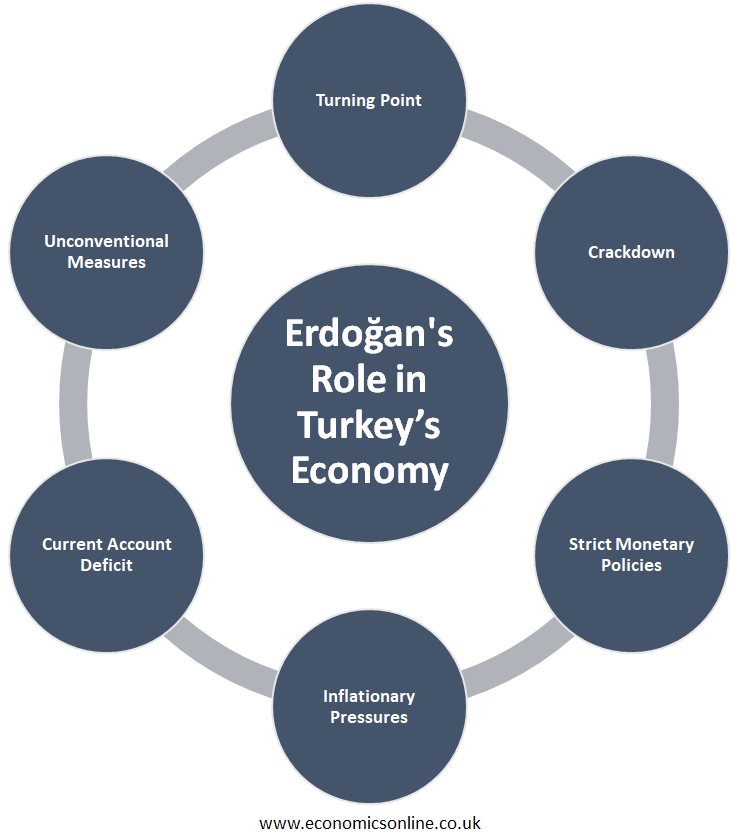

Erdoğan's Role in Turkey’s Economy

Erdoğan and his ruling AKP, known as the Justice and Development Party, have been in power since 2014. In the decade long regime, Turkey’s economic performance has deteriorated significantly on account of economic mismanagement. Recently, the situation is getting worse with rapid inflation, falling lira, an increasing interest rate, and the failure of the government to cool inflation.

In exchange for an IMF rescue, the last government (before Erdoğan) had introduced reforms, like an independent central bank, finance and banking regulators, proper public ownership rules, and taking steps to reduce public debt and deficits.

The AKP wisely stuck into these reforms, which paid handsome amounts of dividends. Due to this move, inflation, which was above 50% in 2001, reduced to a single digit within three years.

From 2002-2007, foreign investment improved, allowing annual economic growth to average 7%. This had resulted in sizeable productivity gains and benefitted large parts of society by reducing inequality.

Then, the global financial crisis of 2007-2008 caused Turkish exports to collapse badly, but the country recovered relatively quickly after advanced economies reduced their interest rates to almost zero. This practice encouraged investors to borrow cheaply and invest money into emerging markets such as Türkiye for the sake of handsome returns.

Turning Point

The turning point came in 2013 both economically and physically. Substantiations in Istanbul against construction activity in Gezi Park, which is one of the last remaining green areas in the city, turned into a nationwide movement against the growing government’s authoritarianism.

Crackdown

Erdoğan responded with a rapid crackdown by positioning rampage police and obstructing hundreds of protesters. This would become a defining characteristic of the regime, interpreting to all other aspects of the governance.

Strict Monetary Policies

During the same time, potential investors started pulling back from emerging markets because the US Federal Reserve started a tight monetary stance. There have been many cycles of tightening and loosening of monetary policy, but the money didn’t return to Türkiye.

In May 2023, foreign ownership of Turkish government bonds has fallen from 25% to below 1% in 2023. Investors had to withdraw more than $7 billion from the stock market.

After a referendum in 2017, domestic and foreign investors’ concerns grew worse, creating an executive presidency that presented enormous powers to Erdoğan. He has used this to the full by efficiently reducing most institutions to independent entities only on paper.

Inflationary Pressures

The central bank of Turkey played a vital role in destroying the country's economy. As inflationary pressures started to increase in 2021, and unlike all other central banks, the Turkish central bank also lowered the interest rates from 19% to 8.5%. This pressure pushed inflation to a higher rate of 84% in August 2022.

Erdoğan's role in reducing interest rates to promote growth has severely weakened the Turkish lira, which has reduced 80% against the US dollar in the last five years.

Current Account Deficit

Turkey’s imports are much higher than its exports, resulting in a current account deficit of 6% of GDP. In order to sustain lira, the authorities have misused a huge amount of foreign exchange reserves. Authorities also have resorted to swapping agreements with friendly Gulf nations, such as the United Arab Emirates. In these agreements, Türkiye has borrowed Emirati dirhams in exchange for lira, but it is not the proper solution to the problem. In April 2023, the net foreign currency reserves of Türkiye have reduced to negative $67 billion.

Unconventional Measures

Authorities in Türkiye have been forced to impose unconventional measures to keep the economy working. They have included protecting lira bank deposits against US dollar depreciation by promising to make up any kind of losses, needing exporters to lay down 40% of their foreign currency earnings, and barring banks from lending to other companies with significant foreign currency holdings.

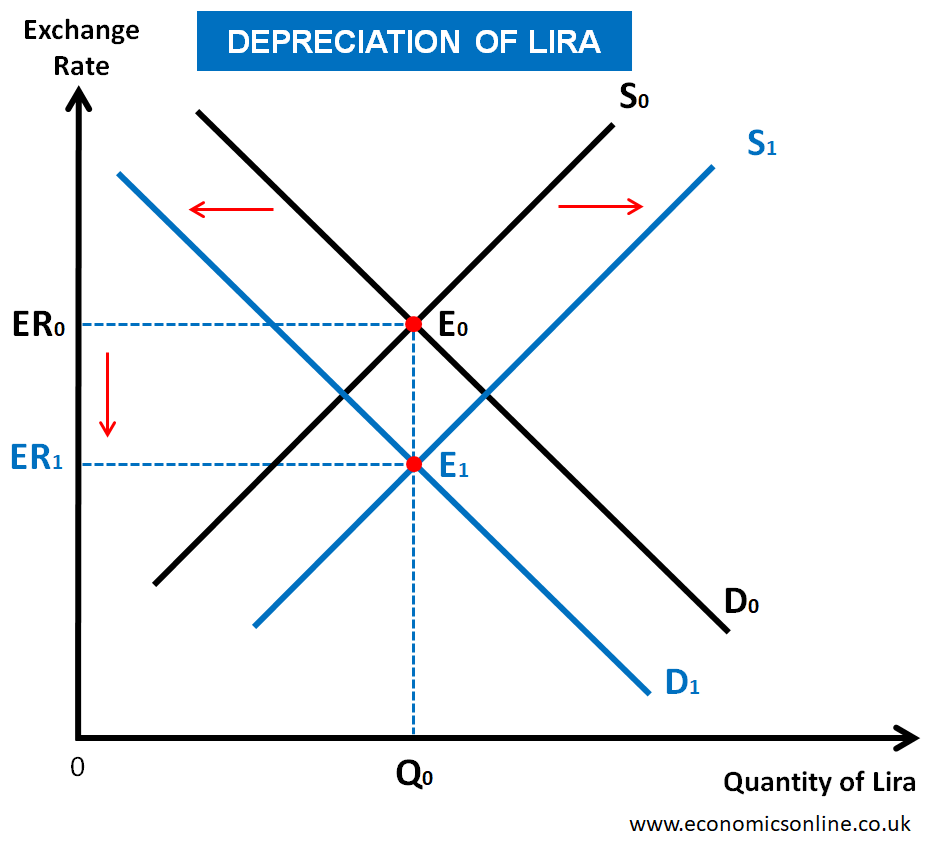

Reasons Behind Turkey’s Currency Fall

In record, Turkey’s lira fell by approximately 1400% against the US dollar in the past decade. The main cause of this currency depreciation is current account deficit. A higher value of imports means a higher supply of Turkish lira in the foreign exchange market. A lower value of exports means a lower demand for Turkish lira in currency market. An increase in supply and a decrease in demand for a currency will lead to its depreciation. This is illustrated by the following graph:

A weak currency also means that imports will become expensive. Türkiye, which is totally dependent on imported raw materials, will have to pay more for everything, such as energy to food that is priced in dollars. This has contributed to cost-push inflation. Today, high inflation is affecting households and businesses with high-priced groceries, utility bills, and other things.

Turkey Suffering Economically

On January 22, 2022, Turkey’s Finance Minister, Nureddin Nebati, declared that he expects a 40% increase in the inflation rate in the next couple of weeks. A continuous increase in Turkey’s inflation has caused many severe and pervasive economic challenges, for example, rising prices for consumer goods and gas. To some extent, the depreciating currency was stabilised by Erdogan’s government through emergency measures in December 2023. However, concerns still remain about the future prospects of Turkey’s economy, particularly under the leadership of Turkish President Recep Tayyip Erdogan.

Conclusion

In economics, high inflation is considered the mother of all evil in the economy. A high rate of inflation is typically controlled by using monetary policy measures such as an increase in interest rate. This increases the cost of borrowing for individuals and firms, leading to a fall in aggregate demand and, hence, controlled inflation. But Turkey’s decision to lower the interest rate in 2020, 2022, and 2023 did the opposite by fuelling the inflation rate further. Due to economic challenges with Turkey, it could force Turkey to be less supportive of NATO financially and would seriously strain relations that Turkey had with the West, particularly with the United States. On the other hand, the continuous economic developments may force Turkey to develop better relationships with like-minded autocrats, for example, Vladimir Putin or Xi Jinping.