What Is An Economic Stimulus Package?

An economic stimulus package is an effort made by the government to lead the economy out of an economic slowdown or recession while boosting economic growth. There are two main ways to stimulate the economy: first, expansionary monetary policy, and second, expansionary fiscal policy. In most cases, however, economic stimulus packages refer to fiscal policy.

Fiscal Policy

Fiscal policy consists of a change in taxation or spending to influence aggregate demand. A fiscal stimulus may involve:

- Tax cuts. By cutting income taxes, disposable income increases, which means people will spend more. Tax cuts are most effective when targeted at people with low incomes. This is because low-income earners have a higher marginal propensity to consume.

- Government spending increases. Increased government spending works as an injection into the economy, resulting in higher aggregate demand.

The 2009 United States Economic Stimulus

The United States Congress approved a package in February of 2009 which consisted of new federal government spending on unemployment assistance, infrastructure, health, and education. Tax cuts were also a part of this package.

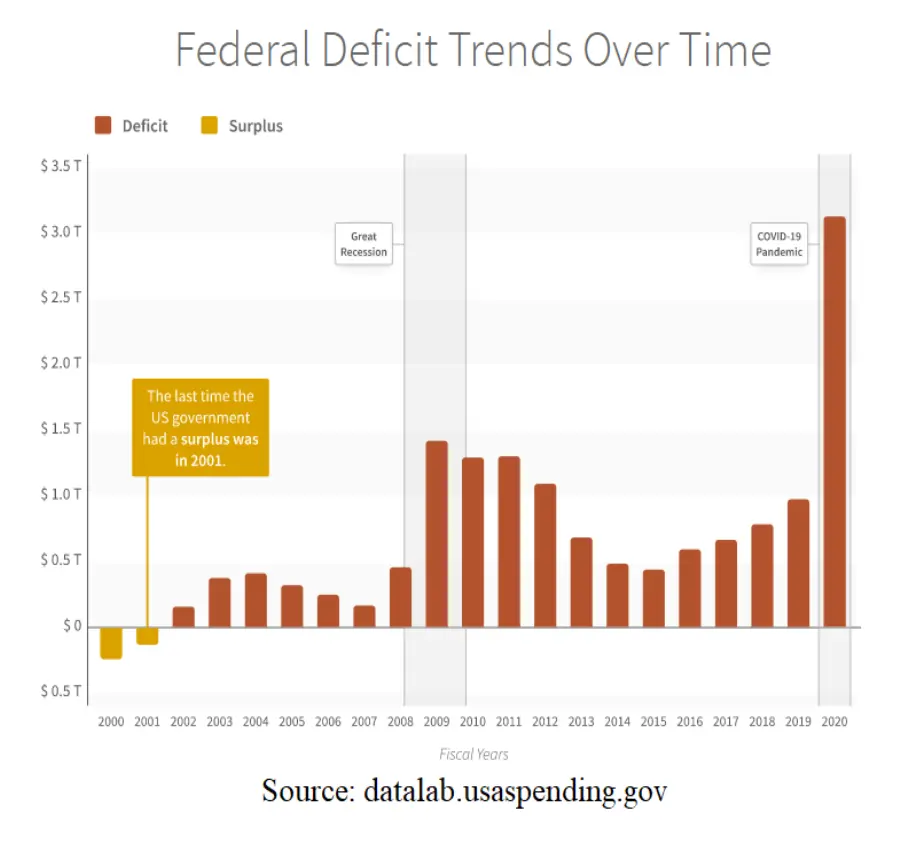

The sharp rise in the federal deficit in 2009 demonstrates two points:

- The recession led to a decrease in tax revenues.

- The rise in the federal deficit was caused by the economic stimulus of the Obama administration.

Potential Problems of Fiscal Expansion

- Increased levels of higher government borrowing, which leads to higher debt to GDP

- No guarantee of effectiveness in increasing aggregate demand, in the case that people decide to save their tax cuts rather than spending them

- May lead to crowding out, which is when higher government spending leads to a parallel decrease in private sector spending (however, Keynesian economic theorists argue that crowding out will not occur if the stimulus package is implemented during a period of negative output gap because there are surplus savings in the economy)

- Success is dependent on the size of the multiplier effect

Types of Fiscal Stimulus

Consider what would happen if Congress cut taxes for the highest earners and the wealthy. In this case, the stimulus would have a small multiplier effect due to the fact that if the wealthy gain tax cuts, they’re not likely to spend a large portion of the extra income. They’re much more likely to only spend a small percentage of it. On the other hand, if low-income earners are the recipients of a tax cut, the multiplier effect would be much greater since they’re likely to spend a higher percentage of the extra income.

Infrastructure Spending vs. Transfer Payments

In Keynesian models, the most effective type of stimulus is infrastructure spending, which consists of hiring unemployed workers. The multiplier effect is larger when the unemployed gain work. On the other hand, if the stimulus involves cash transfers such as higher pensions, there will be less of a direct impact on the economy.

The efficiency of infrastructure spending also determines the impact on the wider economy. For instance, if infrastructure spending reduces traffic congestion, then the economy will benefit from long-term supply-side benefits as well. However, if the infrastructure spending goes to misplaced projects, the effects on productivity won’t be nearly as large. Some economists make the argument that it can be challenging to identify enough infrastructure spending projects to spend on all at one time.

It’s important to note, however, that Keynes stated the primary goal of fiscal stimulus was to boost aggregate demand. He argued that policies were worth pursuing during a recession, even if it required digging holes in the ground.

Monetary Policy

One way to reliably increase consumer spending and investment is to cut interest rates.

Lower interest rates:

- Reduce borrowing costs

- Increase disposable income by reducing mortgage interest payments

- Cut back on incentives to save

- Can boost exports due to depreciation of the exchange rate