Photo by Celvin Purnama / Unsplash

The Inefficiency of Venture Capital in the Modern Economy: A Result of Oversaturation and Excess Capital

The relevance of Venture Capital (VC) in propelling innovation has been acknowledged for years. This is because it has been able to make it possible for startups to expand and develop really fast through its financial backing. By providing funds to such small upcoming firms, Venture Capitalists (VCs) have promoted emergence of new fields as well revolutionizing technologies globally; hence creating jobs upon jobs everywhere in the world. Nevertheless, lately there has been an increase in inefficiency within the VC ecosystem; too many institutions are going for a piece of pie which is more than what the market can carry. Over saturation leads to subsisting returns for both investors and entrepreneurs when the plenty of money worsens rather than solve inherent dysfunctions in venture capital purposes. In this paper we will explore why this is such an inefficient system and what it means for the larger economy as well as possible ways that might help make it better for future operations.

The Rise of Venture Capital and Its Traditional Role

Venture capital was established as a means of catering for risky startups that promised high returns yet could not access money through bank loans or public stocks/trades. It pooled money from wealthy individuals and institutional Investor thus they could afford to invest directly into early-stage companies at a time when they needed it most knowing that they would get back handsome rewards later when they sold their shares in such firms by either merging them together or buying out-ostensibly by offering it for sale on the Stock Exchange through an Initial Public Offering (IPO).

The Boom of Venture Capital Firms

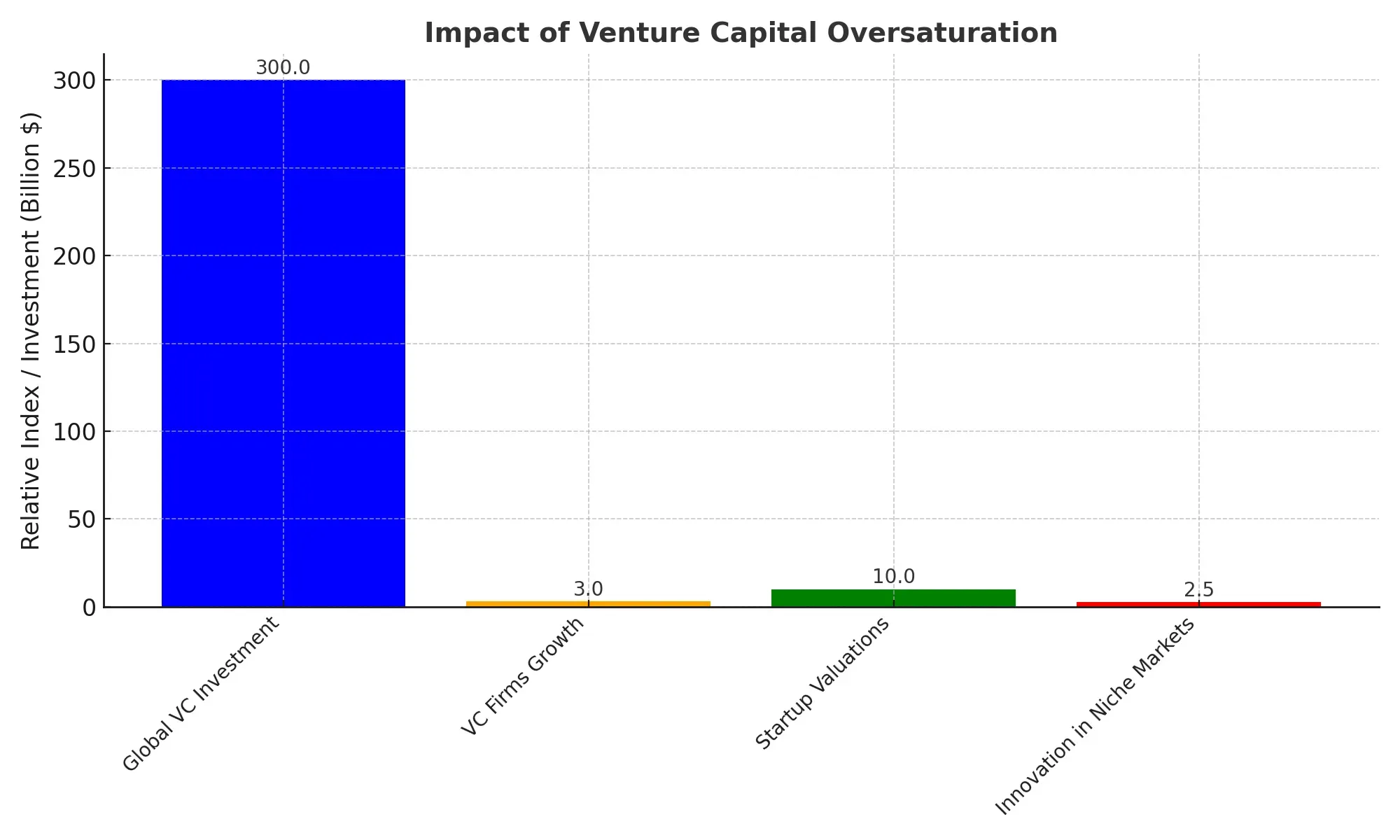

Venture capital has experienced a significant transformation over the past twenty years. The amount of money coming into the VC sector has greatly increased due to reasons like high rise of institutional investors, rising private equity access, and a general move towards speculative investments. In 2021, global VC investments exceeded $300 billion, according to PitchBook data, which was a significant uptick from $100 billion in 2017. Correspondingly, a huge surge in capital inflows saw an equally rapid rise in the number of VC companies across the globe.

Increased investment opportunities and the establishment of new start-ups are just some of the positives from this capital inflow. However, this has resulted in a few inefficiencies as well. An overabundance of firms seeking out few promising start-ups has made it harder to select and fund those with high potentials. There are various problems associated with oversupply of money in such areas as startups’ valuation hyperinflation, over-capitalized startups, and absence of real differentiation among the VC firms.

How Oversupplied Capital Market Affects Venture Capital

One of the main inefficiencies that result from the oversupply of venture capital is the inflation of startup valuations. There has been intense competition among these financial institutions which has pushed up prices for investments in such particular sectors as technology and biotechnology. Previously making do with relatively small amounts for their initial round(s) unlike today when some early stage multi-million dollar funding rounds go to such companies at valuations that have no linkage whatsoever to their performance or their potential for growth.

This has led to overvaluation of startups whose future profits are exaggerated. Since then so many companies have been financed without any defined path to breaking even or running a business model that can run independently without further funding. Consequently, more and more “zombie startups” emerged which are those firms still receiving money but hardly have any hope of doing well or rewarding their shareholders.

For venture capitalists (VCs), such an overvalued environment poses a dilemma. Firstly, they are being forced by their backers to invest at a fast pace making them pick out firms that have been overpriced in terms of their worth. Secondly, the availability of too many funds has seen VCs concentrating on the same number of startups leading to an increase in the competition and consequently prices. This usually ends up forcing venture capitalists into overpaying for investments resulting in reduced returns over time.

The Impact on Entrepreneurs and Innovation

The issue with venture capital not being efficient affects entrepreneurs, investors as well as the whole innovation ecosystem in a bad way. Too much capital and too many venture firms in the market make entrepreneurs forced to accept money offers on unfavorable terms. This leads to having more aggressive terms that include higher equity demands focusing more on short-term exits rather than long-term growth from among VCs that are competing for high-potential startups.

With more venture capitalists competing for funding startups, it becomes hard for individuals starting businesses to keep control over them. It is possible for early stage funding rounds to include several investors each having their own expectations and requirements. Thus, providing a platform for fragmented ownership which makes it harder for founders to have a clear vision for their company . There are instances when large amounts of money will lead to many companies working on similar ideas thereby reducing the ability of start-ups to separate themselves from others or make profits.

Moreover, inflation due to too much capital availability creates an environment whereby growth is pursued regardless of costs; this in turn results into rapid scaling up without caring whether profits are achieved or not including those companies which do not consider making revenues today (Paul Graham). Vanity metrics like user acquisition cost or revenue growth have become more popular than ever before as opposed to building something solid that can last for many years according to Paul Graham. Consequently, many good ideas are crowded out by pressure for expansion on every front, leaving behind only those start-ups aiming at quick wins but not long-term value creation.

The Long-Term Effects of Oversaturation

In the end, when there is too much venture capital in the market it could mean negative things for an economy at large. With huge inflows of cash into new businesses-mostly within technology sector-only; innovation stagnates across other branches due to lack of funds-for example Manufacturing has fewer chances compared to the ones within the internet space Minerals might be found near each other so why bother exploring other options related with mining activities? Also infrastructural development which takes decades before it matures unlike software development cannot attract any investor Today even farmers do not get much attention from VCs.

This may reduce the total profit that can be gained from investments in young businesses because even though there are numerous startups, they compete for customers hence they are unable to become successful enough or acquire more capital. Moreover, in such oversaturated markets, less chances of achieving significant returns on investment exist since majority high-quality opportunities get used up by other more successful overcapitalized companies.

Resource misallocation can lead to funds being disproportionately directed toward sectors or startups that may lack the potential to create meaningful value. For instance, startups in trendy fields often attract significant investment, even when they struggle to differentiate themselves or face intense competition. Meanwhile, innovative startups in niche areas—despite their potential for significant long-term economic contributions—may find it challenging to secure adequate funding. This imbalance can stifle high-potential innovation and growth in less prominent sectors, ultimately hindering broader economic progress.

Solutions to Address the Inefficiencies in Venture Capital

To address the inefficiencies in venture capital, several solutions could be implemented to better align capital with the needs of startups and the broader economy.

First, VC firms could focus more on specialized sectors and niche markets, where competition is less intense, and where they can provide meaningful support to startups. This could help reduce the oversaturation of capital in popular sectors like technology and biotech, and create more opportunities for innovation in other industries.

Second, venture capitalists could adopt a more long-term investment approach, prioritizing sustainable growth over rapid scale. This would require a shift away from the “growth at all costs” mentality that has dominated the industry in recent years, and a greater focus on building businesses that are profitable and resilient. By taking a more patient approach to investment, VCs could help reduce the pressure on startups to meet unrealistic growth targets and create more sustainable business models.

Finally, greater collaboration among VC firms, institutional investors, and governments could help direct capital toward areas of the economy that are underserved or overlooked. By fostering partnerships and creating incentives for investment in industries like infrastructure, manufacturing, and renewable energy, the venture capital ecosystem could become more balanced and better aligned with the long-term needs of the economy.

Conclusion

The venture capital industry has become increasingly inefficient due to the oversaturation of capital and the proliferation of VC firms competing for limited investment opportunities. This has led to inflated valuations, overfunded startups, and a focus on short-term growth at the expense of long-term sustainability. While venture capital remains a crucial driver of innovation, its current inefficiencies are hindering both investors and entrepreneurs, as well as stifling broader economic growth. To optimize the venture capital ecosystem, a shift toward more specialized, long-term investment strategies is needed, along with greater collaboration between investors, entrepreneurs, and governments to ensure that capital is deployed in a way that maximizes value and drives innovation across all sectors of the economy.