Photo by Jesse Donoghoe / Unsplash

Does the US President Control Inflation?

Introduction

Inflation happens when the general price level of products goes up over time. Inflation can happen when spending on products or services exceeds their production. The general price level can also increase due to supply constraints that increase the cost of production for goods or services. Inflation can also occur when consumers, enjoying the benefits of a booming economy by spending their excess cash more quickly than producers, increase their production process.

Generally, inflation is one of the main concerns for governments as well as individuals because inflation increases the cost of living and makes everyday expenses, like gas, groceries, and other things like utilities, more expensive. When prices rise, consumption or purchasing power decreases, which means that consumers get less by paying more money. A high inflation is also a problem for governments and its presidents because it puts questions on their ability to run the economy.

Is the US President Responsible for Inflation?

Recently, in the US presidential debate, the former President Donald Trump put blame on President Joe Biden for the high rate of inflation during the post-pandemic era. Is Donald Trump right in his blame on President Biden? Is it true from the economics point of view that the Biden administration created inflation in America? Can US president cause inflation? A president’s control and actions play an important part in shaping inflation, however, inflation is a complex process that can be caused by many factors, and the relation between policies and prices is not always straightforward. Governments are trying to keep the inflation lower by promoting economic growth (an increase in the real GDP) without reducing the purchasing power of the currency.

Inflation’s Unpredictability

When prices are high, employees demand high wages. When employees receive high wages, they can be able or afford to spend more. Due to which, the aggregate demand increases, which leads to higher prices. This can cause a wage-price spiral. Inflation control takes time because methods used to fight it do not immediately affect the economy, for example, higher interest rates.

Who’s Responsible to Control Inflation?

A nation’s central bank is responsible for controlling inflation through monetary policy. The main function of monetary policy is to change interest rates on an immediate basis to control inflation. A fiscal policy authorised through legislative actions is also helpful in controlling inflation. Governments may also increase taxes and reduce government spending in order to reduce inflation in a country.

In the United States, the Federal Open Market Committee (FOMC) is responsible for controlling the overall inflation. It is a Federal Reserve body that regularly amends the government’s monetary policy in order to achieve the Fed’s goals, such as stable prices and maximum employment.

Price Controls

The price caps or floors that are authorised by a government and only applied to some particular goods are called price controls. Wage controls can also be implemented in combination with price controls to triumph over wage-push inflation.

In the United States, President Richard Nixon implemented a 90-day freeze on prices and wages to overcome the rise in inflation in 1971. At first, this attempt was considered effective and became popular, but it was not able to control prices when, due to World War II, in 1973, inflation reached its highest levels.

Regardless of some interceding factors, like the Arab oil embargo, poor harvests, the complexity of the 1970s price control system, and the end of the Bretton Woods System, many economists take the 1970s as evidence enough that price controls are not suitable tools for managing inflation.

Contractionary Monetary Policy

Nowadays, contractionary monetary policy is considered a main and effective source of controlling inflation. The main goal of a contractionary monetary policy is to reduce the money supply within an economy by raising interest rates. Due to this, economic growth slows down by making credit more expensive to obtain, which is helpful in reducing businesses’ and consumers’ spending.

A higher interest rate on government securities also helps to slow growth by propelling investors and banks to purchase Treasury securities, which guarantee them a fixed rate of return, rather than riskier equity investments that benefit from low rates.

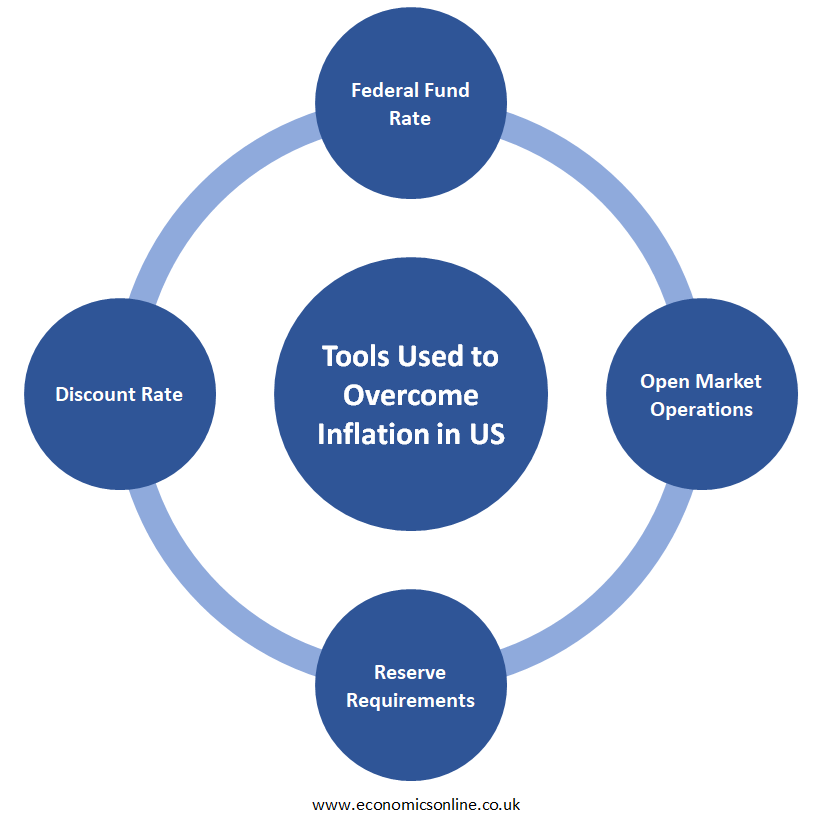

Tools Used to Overcome Inflation in the US

There are some major tools that the U.S. central bank or the Federal Reserve used to overcome inflation across the country.

Federal Fund Rate

The rate at which banks lend money to each other overnight is called the federal fund rate. This overnight lending and borrowing of money is a wide flow of cash among financial institutions that allow banks to consume their excess cash profitably and carefully maintain the adequate cash reserves they require to do their daily business.

The Federal Reserve is not able to directly set the federal fund rate. The ideal range of the Feds fund rate is declared by the FOMC. Then, FOMC also adjusts the other two interest rates: the interest on reserves and the overnight reverse repurchase agreement rate (RRP) in order to push interbank rates into the ideal range of Fed funds.

Interest on Reserves

The rate that banks earn on their deposits with the Federal Reserve is called interest on reserves. The United States has never defaulted on its debt till date because the interest on reserves is considered a risk-free rate and the lowest interest rate any lender would require.

Overnight RRP Rate

It also has a similar function for financial institutions that do not have deposits with the Federal Reserve. This overnight RRP rate entitles only those institutions to particularly purchase a federal security and then resell it to the Fed the next day. The difference between the price at which the fed security is bought and sold is called the ON RRP rate.

The Federal Reserve encourages other banks and lenders to increase rates on their riskier loans and syphon more of their money to the no-risk Federal Reserve by increasing interest on reserves and overnight RRP rates. In this way, the money supply reduced, and it also reduced the effect of inflation.

Open Market Operations

An example of open market operations (OMO) is the reverse repurchase agreements. The OMO refers to the buying and selling of Treasury securities. These OMOs are the tools used by the Federal Reserve to increase or decrease the money supply by buying and selling Treasury securities.

A weekly financial report, the Federal Reserve Balance Sheet, is used to indicate what the Fed owns and what it owes, rises when the Fed purchases securities, and reduces when it sells them. The Fed policy of buying securities reduces the pressures on the interest rates and promotes liquidity in the financial markets, while selling securities puts pressures on interest rates and demotes liquidity in the financial markets.

Reserve Requirements

Till date, the Federal Reserve is the one who is responsible for managing money supply through reserve requirements, or the amount of money banks were legally required to keep on hand to cover their withdrawals. Banks required more money to hold back so that they had to lend less money to consumers.

Discount Rate

The interest rate charged on given loans by the Federal Reserves to commercial banks and other financial institutions is called a discount rate. The discount rate is always the same across all the Reserve Banks, and it is set by the mutual consensus of each regional bank’s board of directors and the Fed’s board of governors.

Discount Window

A lending facility through which short-term loans are made is called a discount window. The primary purpose of the discount window is to fulfil the bank’s short-term liquidity needs and maintain stability in the overall banking system. Therefore, the discount rate is another interest rate that can be increased to temper inflation.

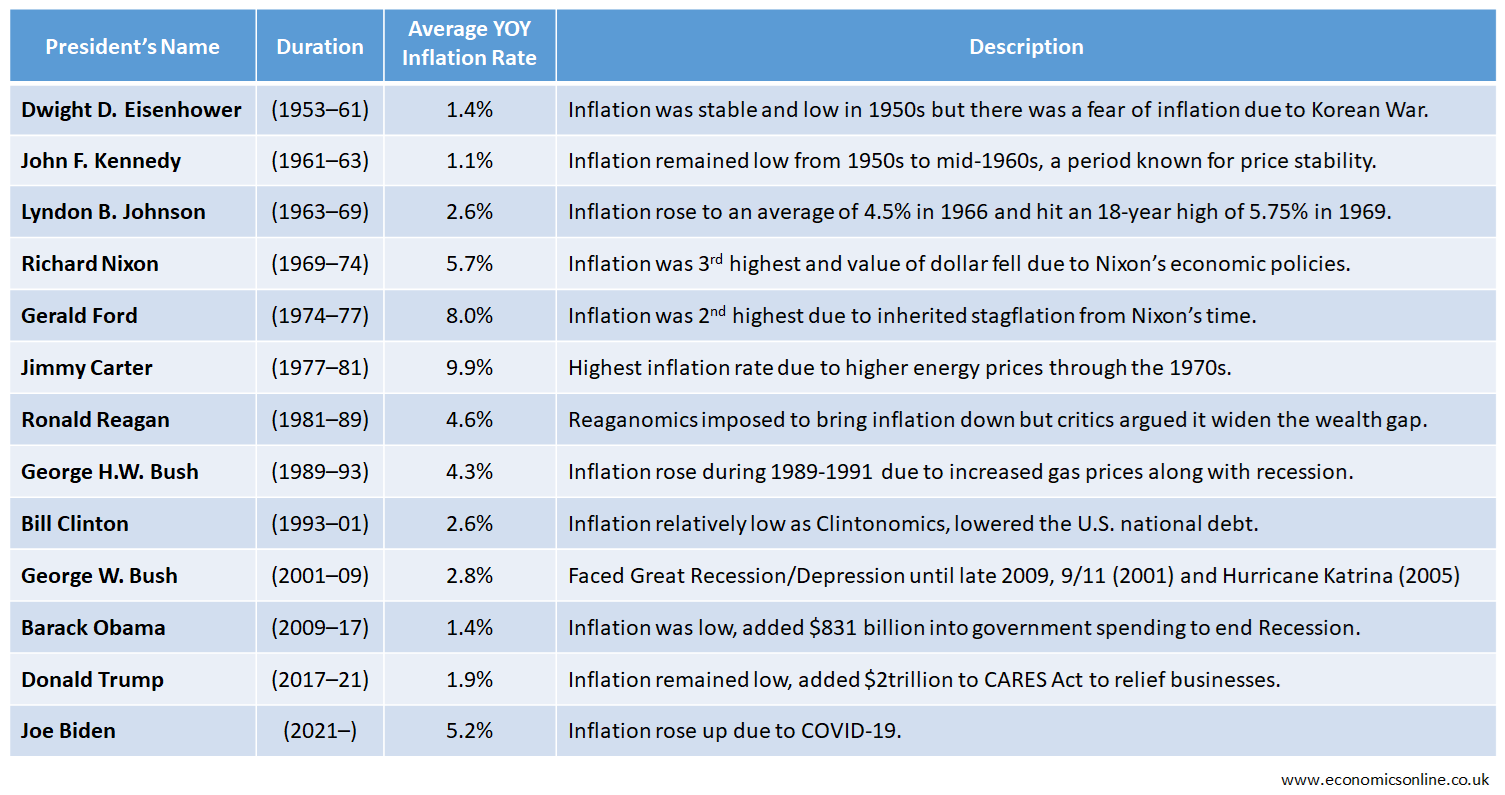

Average Yearly Inflation Rate by Presidents of US

The average year-to-year inflation rate is calculated by the Seasonally Adjusted Consumer Price Index (CPI) for all items in the basket of goods by taking the average year-over-year changes for the duration of each president’s term.

Highest Average Inflation Rate in the US

The president who had the highest average yearly inflation rate was Jimmy Carter, with an inflation rate of 9.9% during his term in office from 1977 to 1981. In the United States, inflation is commonly measured by the consumer price index (CPI). The consumer price index was first introduced as an economic indicator, which indicated the highest rate of year-to-year inflation of about 17.8% in 1971 in the United States.

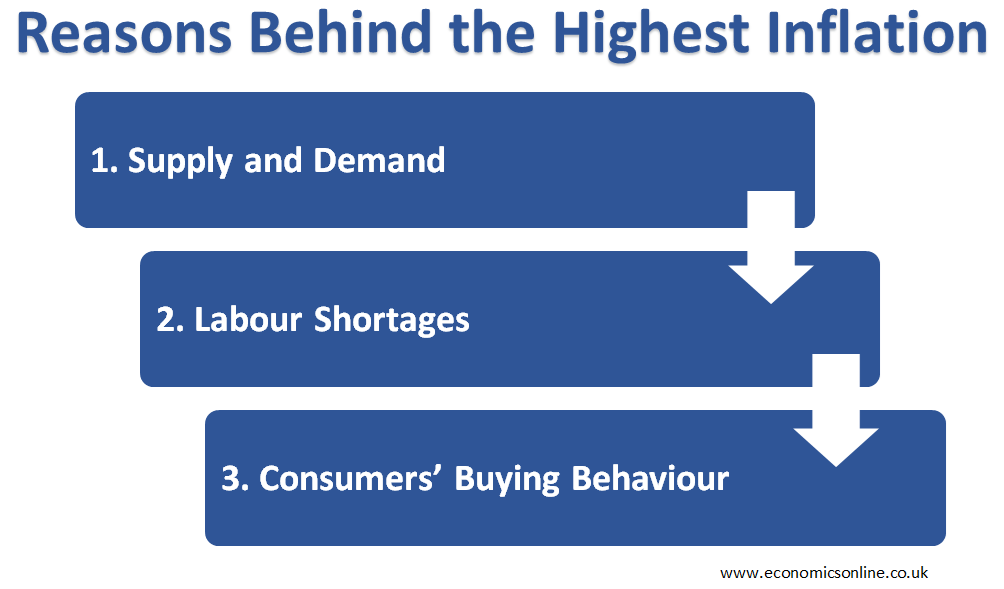

Reasons behind the Highest Inflation

The following are major reasons behind the highest inflation in the United States:

Supply and Demand

Inflation has so many limbs. At the upper end, inflation is mainly a cause of mismatched demand and supply between products produced and services offered. The pandemic also flipped the whole dynamics as it disrupted the global supply chains.

Labour Shortages

There were also labour shortages. The pandemic or illness sidelines the employees across country borders. At that time, childcare centres were shut down, making it hard for parents to work. Other people were worried about being ill during work. Some economists also said that a decline in immigration also reduced the supply of workers leading to the labor shortage.

Consumers’ Buying Behaviour

When China shut down factories, cargo ships could not be unloaded, causing a decrease in the overall supply of goods. Due to this, consumers’ buying behaviour changed. People bought more physical stuff, like desks for their home offices and living room furniture, as they had to spend more time at home. This is a huge shift from the pre-pandemic norms when Americans preferred to spend more money on services, like dining out, going to movies, concerts, and travel. When the U.S. economy reopened broadly, there was a high demand for goods, which caused food shortages leading to price increases.

Conclusion

In conclusion, a president’s actions can affect the inflation in a country, but there are also many other factors that must be observed when examining and analysing the major causes behind price rises. The fiscal policy is also influenced by the presidents, and each president’s economic policy, like rate hikes, tax cuts for taxpayers, government aid, and military spending, particularly affects the whole economy. Therefore, outside a president’s control, there are also many external factors, like economic downturns, wars, and public health crises, which also contribute to the inflation.