Photo by Clay Banks / Unsplash

Analysis of Productivity and Growth Disparities Between the United States and Europe (2010–2023)

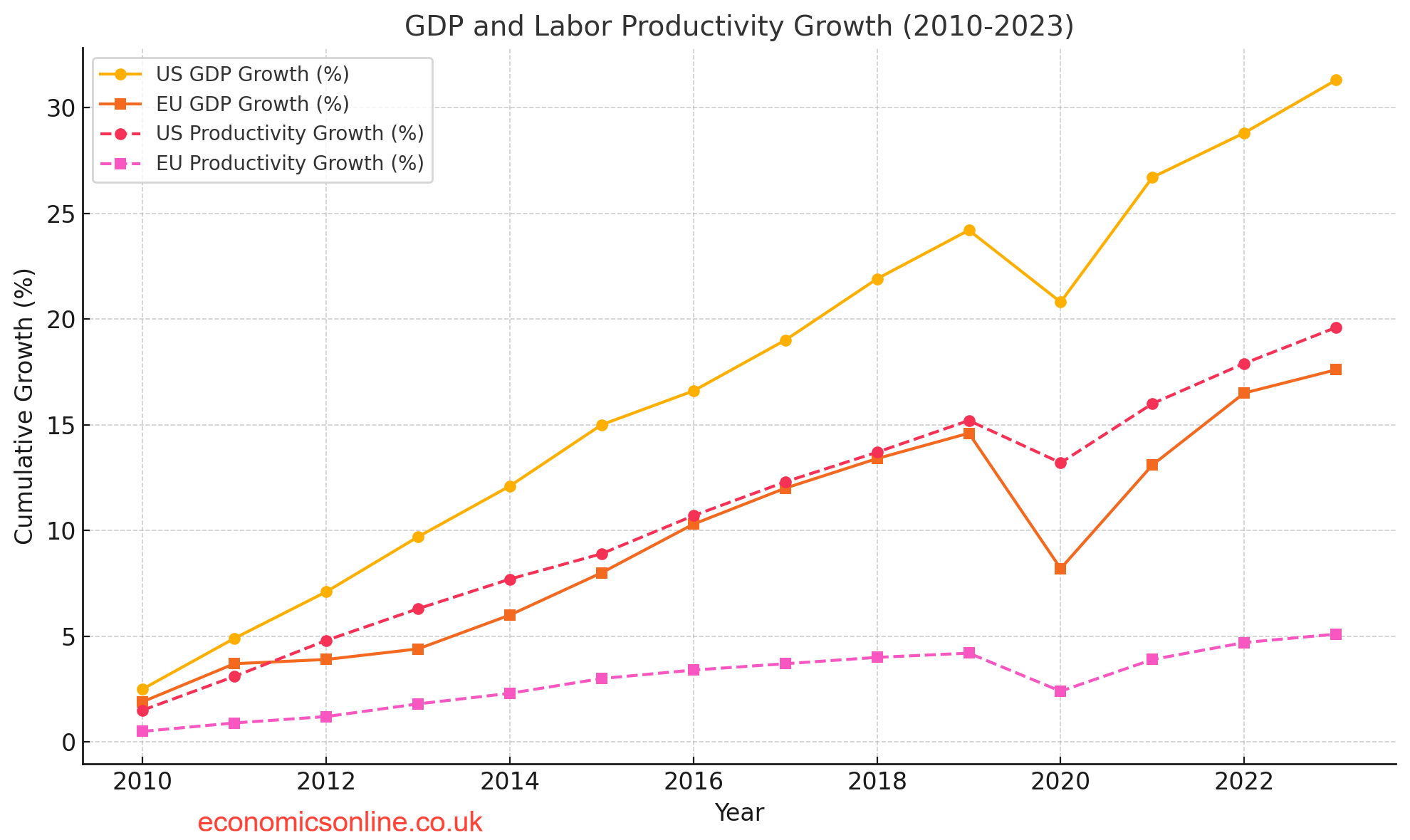

Between 2010 and 2023, the U.S. economy grew 34% in terms of GDP, which is much faster than the European Union’s 21% and the eurozone’s 18%. This GDP growth rate is based on constant volume, so it doesn’t include exchange rate changes. During the same time, labor productivity in the U.S. went up by 22%, but in the eurozone, it only increased by 5%.

The growing economic difference between the U.S. and Europe, noticeable since the early 2010s, can’t just be explained by demographics, like differences in the working-age population growth.

The main reason behind this gap is the big difference in productivity growth. If you look at recent numbers, the U.S. labor productivity went up by 1.7% in the four quarters leading up to 2023, but the eurozone actually saw a drop of 0.6%. It’s really important to understand what’s causing this gap in productivity, but experts and policymakers are still debating the reasons.

Competing Ideas About Europe's Productivity Problem

One idea is that Europe's productivity issues come from difficulties in hiring workers, which became a bigger problem around 2017, right when productivity started stagnating. This theory suggests companies, unable to find new workers, kept extra staff even when they didn’t really need them. But this explanation doesn’t fully work, since the U.S. has also faced major hiring issues without its productivity slowing down.

Another theory says Europe’s problem might come from more less-qualified workers joining the labor force, which could lower the average skill level. But this doesn’t seem convincing either. Research shows that employment in Europe has grown equally across all skill levels, so the overall skill level of the workforce hasn’t really changed.

Structural Problems: Investment and R&D

The two most solid explanations for Europe’s productivity issues are low investment in advanced technologies—like AI, computing, and software—and not spending enough on research and development (R&D). When you look at data from OECD countries, it’s clear these factors play a huge role in productivity. Studies show that if a country increases its tech investment rate by 1%, its productivity grows by 0.8% a year. Similarly, a 1% rise in R&D spending as part of GDP adds 0.9% to annual productivity growth.

By 2022, the U.S. was spending 5% of its GDP on tech investment, while the eurozone was spending only 2.8%. The U.S. also spent 3.5% of its GDP on R&D compared to the eurozone’s 2.3%. Since 2016–2017, the U.S. has been increasing its investments in both tech and R&D, which is making the productivity gap with Europe even bigger.

Europe’s Risk of Falling Into a Low-Productivity Cycle

This reduction in technology purchases and amount spent on research and development multiplies Europe’s problem, risking a vicious cycle, in which low productivity is a precursor to low growth. Consequently, a lack of innovation further makes Europe less attractive to foreign investors and brings in less tax revenue, leaving government with fewer resources to invest in measures that are necessary to boost productivity and competitiveness.

What Europe Can Do to Catch Up

To close the gap with the U.S., Europe needs to focus on two main areas:

- Changing How Businesses Invest It is now 2024 and business investment rates in the U.S. are similar to those in the eurozone, about 13.5% of GDP. But, the U.S. pours much more of its money into advanced technologies-5% of GDP-compared to the eurozone, which only allocates up to 2.8%. Albeit susceptible to burstiness, higher perplexity, European companies will be forced to pour more investment into advanced technology just to be able to sustain their competition.

- Increase Allocation on R&D and Education. The continent has to invest much more in research and universities. The funding of business and academic research that characterizes the U.S. is the standard example in productivity growth. Europe has to catch up by spending more in these areas to become a serious global competitor and drive innovation.

Summary

A major difference in slower productivity growth and even slower economic growth in Europe than the US rests in its lower spending on technology and research. This must be corrected to avoid a protracted period of slow growth and further loss of its global position. However, if it is going to stand a chance at recovery, investment must be smarter and higher in research and innovation to regain economic muscle and competitive ability from the U.S.