Woman leaning on the hood fo an electric car against a sunset backdrop.

The Shift to Electric Vehicles: Europe’s Strategic Challenges and Opportunities

Introduction: The EU Ban and What It Means

The European Union has plans to forbid new combustion engine vehicles by 2035, thereby pushing the entire car industry in Europe to focus on electric vehicles (EVs). This change is happening fast because the world's EV market is expected to grow by as much as 10 percent every year until the year 2028. Even though Europe has been strong in making traditional cars, it’s falling behind other big players in EVs, like China’s BYD (17.5% of the market in 2023) and Tesla from the U.S. (12.5%).

One of the most important parts of EVs is the battery. Batteries are essential for the performance and cost of electric vehicles (EVs). Europe is investing a lot of funds in creating a gigafactory-like space for battery production. As an example, in October 2023, the European Investment Bank announced that it would be contributing €450 million towards this starting from 2025. Still, Europe needs to improve every part of the battery-making process, from getting the raw materials, hich are valuable commodities, to refining them.

The Battery Supply Chain: Many Steps Involved

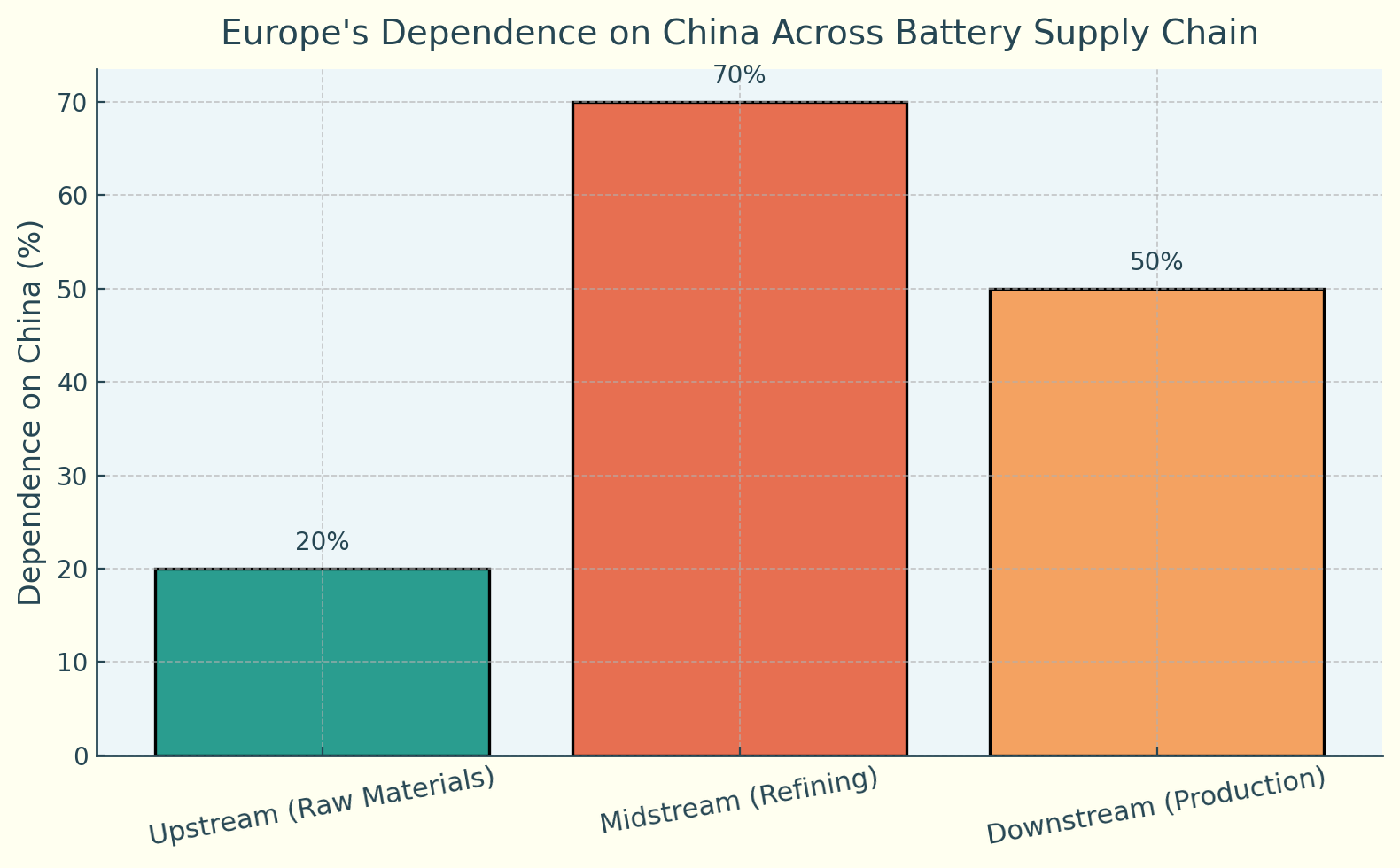

For Europe to compete in the EV market, it has to invest in all parts of the battery-making process, which includes three main stages:

- Upstream Stage: This is about mining raw materials like lithium, nickel, and cobalt. These resources are controlled by a few big companies. For instance, in 2022, two companies—Chile’s SQM and the U.S.’s Albemarle—controlled 36% of the global lithium supply.

- Midstream Stage: Here, raw materials are processed and turned into parts that can be used in batteries. Europe depends heavily on China for this:

- Over 40% of lithium is refined by Chinese companies.

- China handles 65% of nickel refining and 93% of manganese refining.

- More than 50% of key battery parts, like anodes and cathodes, are also made in China.

- Downstream Stage: This is about making battery cells, assembling them, and running gigafactories. Europe is trying to build gigafactories, but it’s not investing enough in the earlier stages of the process. For example, demand for lithium is expected to go up 40 times by 2040, but Europe’s supply chain is not growing fast enough to keep up.

Problems and Opportunities

Europe’s reliance on China for important parts of the battery-making process is a big problem. While mining raw materials happens worldwide, Europe needs to do more refining and midstream work to secure its battery supply chain. To hit the 2035 target, Europe could try a few approaches:

- Make Deals with Other Countries: Europe should work with countries that have lots of lithium and other key materials to get steady and affordable supplies.

- Build Local Industries: By investing in factories and refining plants in Europe, the EU can reduce its reliance on imports and strengthen its own industry.

- Recycling Batteries: Recycling is a big opportunity that hasn’t been fully used yet. By focusing on reusing old batteries, Europe could reduce the need for new raw materials and gain an advantage in a growing market.

- Work Together Across Europe: The EU needs a common policy to make battery production more efficient and cheaper. A united effort could help the whole industry improve faster.

Energy Security and Sustainability

Europe is under pressure to move away from fossil fuels because they’re expensive and harmful to the environment. In order to address this issue, Europe must concentrate on renewable energy and sustainable technologies. Recycling batteries and making improvements in energy efficiency are important parts of aligning such energy security with environment goals.

Conclusion: What’s Next?

Besides the 2035 deadline, Europe will have to face the challenge of meeting much tougher emissions targets; it could lead to more stringent bans in all countries associated with the assessees. The modernisation of the existing production infrastructure and mining systems for the production of batteries would solve such problems. The result of such investments will be through cooperation, public-private partnerships, and a focus on sustainability in the result of making Europe the leader in the forthcoming EV market. The next ten years will be a breaking point for Europe as it will have to prove that it can manage this immense transition without falling behind the rest of the pack in terms of environmental impact and competitiveness.