Sunlit view of the Kaaba in Mecca with pilgrims and surrounding high-rise buildings.

Saudi Arabia’s Strategic Pursuit of Mineral Resources and Regional Influence

Saudi Arabia’s Vision for Global Leadership in the Minerals Value Chain

Saudi Arabia shared an outline of its aims during the Future Minerals Forum, held in Riyadh in January 2024, to become a key player in the global commodities and minerals value chain. The kingdom boasted of its huge material resources, its strategic location, and its very bright market prospects, as well as its close relations with other countries. Therefore, the kingdom holds all factors that make it a suitable counterpart for later global leadership in metals. Metals are accepted as crucial in the execution of Saudi Arabia’s Vision 2030 program to diversify its economy and lessen its dependence on oil revenue. The Kingdom is setting up for a new future, in which oil may not be so dominant in all economic matters.

The global demand for metals related to renewable energy systems, advanced batteries, and digital systems will increase with a shift to low-carbon technology. Many initiatives are being prepared for benefiting from the global trend; one of the most important directions is diversification into a number of metals-specific strategies. They encompass the development of domestic mining and foreign investors or positioning in the entire region as a command center of energy and metals trade.

Mineral Wealth as the Basis for Economic Diversification

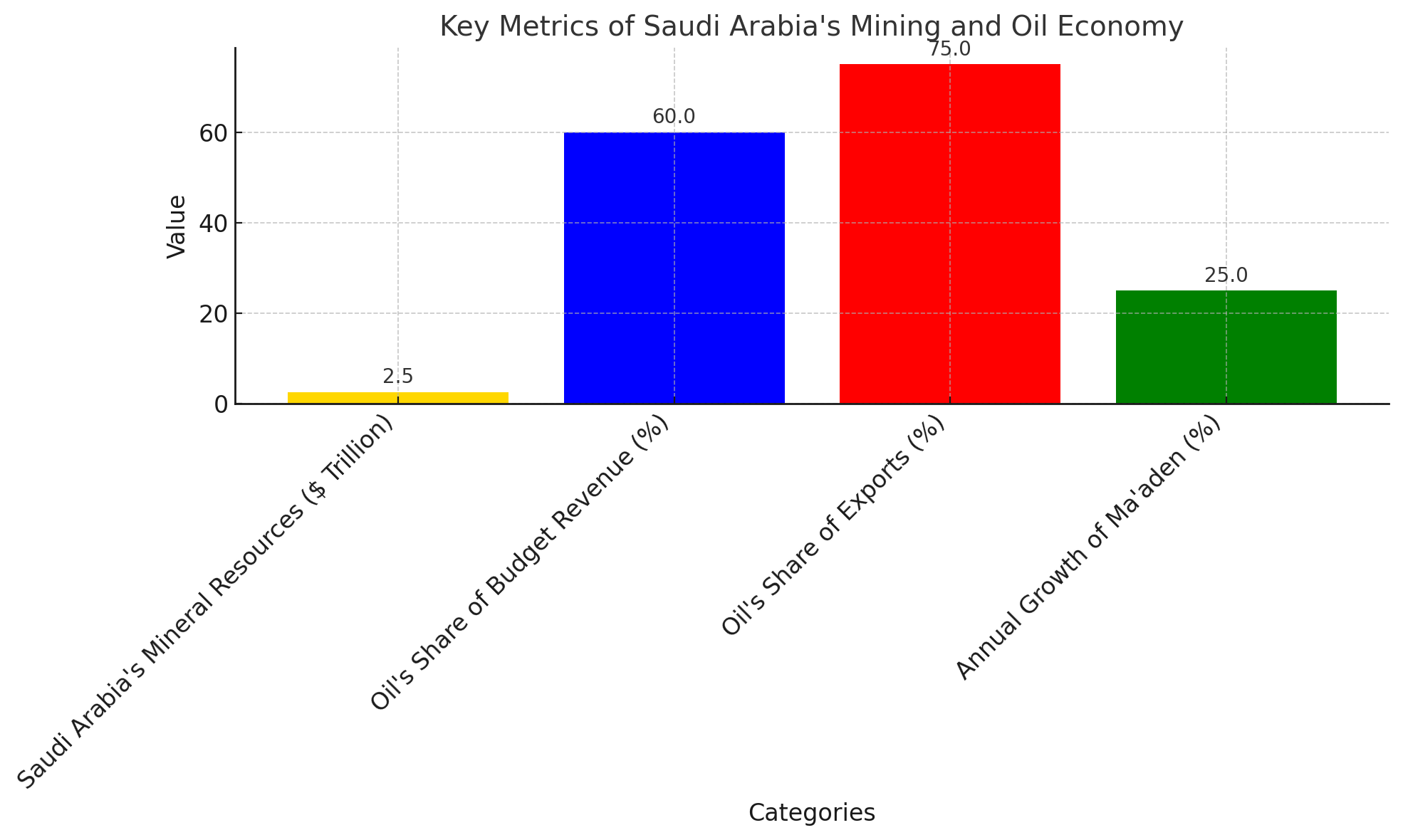

Saudi Arabia's economy heavily depended on oil for a long time. Hence, oil accounts for 60% of government budget revenue and over 75% of exports. Yet the world has been heading to sustainable energy and a shift to hydrocarbons has been challenging. Nonetheless, the future is something that could be prepared for. In this regard, Saudi Arabia launched its "Vision 2030," which focuses on economic diversification, including tourism, education, manufacturing and mining, in 2016.

The graph below highlights key metrics showcasing Saudi Arabia’s reliance on oil and the potential of its mineral resources:

Saudi Arabia has mineral resources worth an estimated $2.5 trillion, but a lot of this remains unexplored. The country is rich in gold, copper, zinc, nickel, rare earth elements, and other minerals needed for modern technology. With these resources, Saudi Arabia hopes to meet the rising global demand while boosting its own industrial growth.

In an effort to enhance mining, the Ministry of Industry and Mineral Resources is joined by the Saudi Geological Survey (SGS). In 2023, mineral exploration incentives accounted for about $182 million while 33 new mining licenses were set up to call for more activities. However, Ma'aden is the principal company in the field. It grew by more than 25% every year for the past three years and boasts an estimated market value of $50 billion. In addition to establishing a joint venture with Public Investment Fund (PIF) of Saudi Arabia, Manaura Minerals recently secured a 10% interest in the base metals division of the Brazilian mining operations of Vale. It is a clear indication that Saudi Arabia has an aspiration to navigate through the global mining industry.

Tying Minerals to the Energy Transition

Saudi Arabia's mineral resources, therefore, become closely related to a global drive to go renewable. The Kingdom is working to integrate its mining sector with industries focused on clean technologies. In 2023, for example, Saudi Arabia entered a $5.6 billion contract with China's manufacturer of electric cars, Human Horizon. By 2026, Saudi Arabia would have to produce 125,000 electric vehicles every year to meet its end of the deal, employing metals sourced locally for the batteries.

This phrase brings out vertical integration, where mining and process manufacturing go hand in hand to generate more value to the country, contributing in the high seas of country quests for economic and technological advancements as the nation moves towards a low-carbon economy trend worldwide. This is how Saudi Arabia has been becoming an important part of the global transition into a low-carbon economy. It already covers multiple parts of the energy transition value chain.

Becoming a Regional and Global Hub

Saudi Arabia’s ambitions don’t stop at mining and manufacturing. The Kingdom also wants to become a major hub for energy and metals trade. Thanks to its location, Saudi Arabia can link resource-rich African nations to growing Asian markets. Referred to as a 'Super Region' by the nation, it incorporates about 79 countries that lie across Africa, the Middle East, and even places such as Central Asia. This region, which accommodates a bit over one-half of the rest of the total human societies existing today, accounts for about 12% of the world's gross GDP. Yet, in terms of good financing, safe infrastructure, and much less well-paid manpower, this region is in great atrophy.

To address these issues, Saudi Arabia will collaborate and make trade-deals. It also plans a regional metals exchange to join the platform of world metals exchanges competing in London and Shanghai. And it is possible by hosting events like the Future Minerals Forum that Saudi Arabia will foster international cooperation and assert itself as a leader in the global metals business sector.

The Kingdom’s location near Europe and Asia makes it attractive to global investors who want reliable supply chains for critical minerals. Saudi Arabia is also investing in transportation, ports, and logistics to strengthen its position as a global trade hub. The steps taken are not only binding the country to its neighbors but they can also play a greater role in the global energy transition.

Challenges and Opportunities

Even though Saudi Arabia has big plans for the minerals value chain, there are challenges. Building a competitive mining sector needs a lot of investment in infrastructure, skilled workers, and new technology. At the same time, there is tough competition from established mining countries like Australia, China, and Chile. The Kingdom also has to address environmental concerns and make sure its mining practices follow global sustainability standards to attract investors.

Indeed, signs of progress were quite evident; Saudi Arabia is working by partnering with international enterprises and clean energy technologies to build a strong foundation, with an augmenting government policy that drives its growth. The kingdom will definitely be a major contender in the global minerals sector with the overcoming of bound-induced failures and investments in innovation.

Conclusion

The expansion into mineral activities signifies the expansion of the Saudi Arabian economy in mining activities for the global platform, part of a broader Vision 2030. The mining activities backed by its vast mineral resources, location, and focus on renewable energy have made the nation develop a lot of mineral projects to make the kingdom a strong contender. Promotion comes by a backing from the governments, international partnerships, and, in a broader sense, long-term visions. Saudi Arabia will definitely be a serious player in even shaping the future of global mining and metals industries because it and the evolving supply chain truly deserves a good player in meeting critical minerals needs.