Industrial crane unloading coal with a large coal pile and a cooling tower in the background.

Introduction to BRICS+: Economic and Political Evolution

Key Takeaways

- Economic Goals: The BRICS+ nations want to become global powers, even though their economies are very different.

- Growing Influence: New members like Saudi Arabia, Iran, the UAE, Egypt, and Ethiopia make BRICS+ more important in energy and metals markets.

- Resource Power: The group produces a lot of the world’s wheat, rice, and metals, making it crucial for food and raw materials.

- Challenges to Unity: Political and economic differences make it hard for BRICS+ to work as a team.

- Impact on Europe: Europe might need to focus more on mining and resource security if BRICS+ controls more of the metals market.

Introduction to BRICS+: Economic and Political Evolution

In 2001, Brazil, Russia, and India have officially listed themselves as joining the quartet such previously termed by economist Jim O'Neill as the container of the initials 'BRIC'. It was followed by South Africa in 2011, becoming the fifth member of the group and BRICS+ that saw the light of the day in 2023 as multifarious other states adjoined the coalition such as Saudi Arabia, Iran, the UAE, Egypt, and Ethiopia. One among the numerous as well as the most noteworthy difference between them all lies in the differing economic bases, and together, they are building political relations. It is such that they want to have a bigger say at the international stage. What distinguishes the group and the commodity focus in the latest membership countries to join BRICS agreement significantly will be that they are resource-rich, just like Saudi Arabia, and therefore, they can always remain one step ahead in dealing with those which capture primary resources. While not fully united, BRICS+ is becoming more important in international affairs.

Economic and Strategic Implications of Expansion

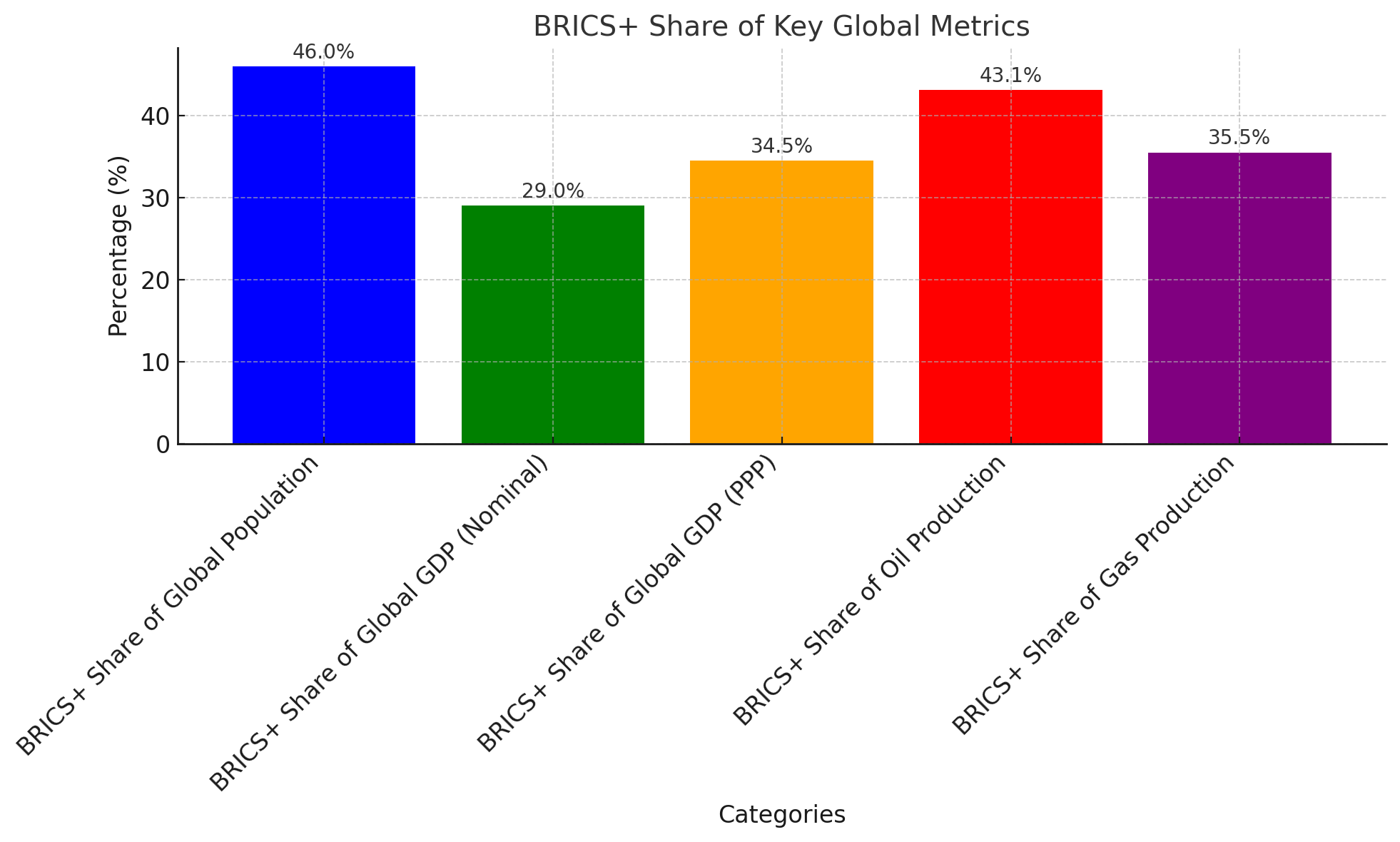

The BRICS+ nations now make up 46% of the world’s population and 29% of global GDP, or 34.5% when measured in purchasing power parity (PPP). With their resources and size, they are key players in energy and metals markets.

Energy Markets

The addition of Saudi Arabia and the UAE gives BRICS+ more control over oil, with 43.1% of global production and 44% of reserves. They also hold 35.5% of global gas production and 53% of reserves. China is also trying to include countries like Nigeria and Kazakhstan, which would make the group even stronger in energy. These resources are important for global industries, making BRICS+ a bigger player in this area.

Metals and Decarbonization

Metals like rare earth elements, copper, and cobalt are necessary for clean energy technologies, such as wind turbines, solar panels, and electric vehicles. Many metals are being produced by BRICS+ countries today, which significantly strengthens their leading role in the transition into green energy production. For instance, China produces the highest amount of the rare-earth metals, as does Brazil when it comes to iron-ore and aluminum-material production. Hence, the group has also become very important in the global turn toward sustainability.

Economic Models and Trade Patterns

BRICS+ economies mostly depend on state-led growth and using natural resources. They account for 25% of global exports, but trade within BRICS+ itself is only 15%. Most trade is still with G7 countries.

The group’s share of global GDP is significant—30% in nominal terms and 31% in PPP, which is more than the G7. But their economies are very different. For example, China focuses on leading in green technologies, while Saudi Arabia is working to move away from oil. India relies a lot on its service industry. These differences make it difficult for BRICS+ to work as a fully united group.

Potential Formation of a Resource Bloc

The BRICS+ countries’ control of important resources has raised concerns about a possible metals cartel. They could coordinate resource extraction and trade to increase their influence. For example, China recently banned exporting rare earth processing technologies to keep its lead in this field.

The group could become even more powerful by including resource-rich countries like Chile or the Democratic Republic of Congo. But disagreements and different priorities among members make it hard to expand further. For instance, Ethiopia and Egypt have long-standing issues over water from the Grand Ethiopian Renaissance Dam, which shows how internal disputes can complicate collaboration.

Risks and Strategic Responses for Europe

The rise of BRICS+ is a challenge for resource-dependent regions like Europe. Metals are important for Europe’s green energy goals, and any price increases could hurt its ecological transition. The energy crisis caused by Russia’s invasion of Ukraine is a reminder of the risks of relying too much on external resources.

European Strategic Measures

The Critical Raw Materials Act will actually work to lessen the dependence on critical and rare earth elements by harnessing recycling and responsible mining in Europe for the betterment that the continent stands to gain. Along the same vein, it will help the EU in severely reducing its dependency on resource producers of BRICS+. The EU might also form trade deals with other resource-rich nations outside BRICS+ to make sure it has enough materials. Investing in better recycling technologies could also help ensure stable supply chains in the future.

Conclusion

The BRICS+ nations are becoming more powerful in energy, metals, and food markets. But their political and economic differences make it hard for them to act as a unified group. For Europe and other regions, this means they need to focus on securing their supply chains and reducing reliance on external resources. At the same time, how BRICS+ manages its own internal challenges—like disputes between members or economic differences—will decide if it can achieve its bigger goal of reshaping global power.