Photo by Anne Preble / Unsplash

Did Food Prices Increase during the Great Depression?

Introduction

Typically, food prices are fairly stable in a recession. But when recession is very deep, it leads to a period of deflation, due to which food prices may decrease by a similar amount. Within a few months, the recession of 1929 developed into a more serious problem, like the Great Depression. At that time, people were out of work, the production system was down, and resources and commodities became scarce across the entire country.

Historical Background

During the great depression of 1929-33, there was an extended decrease in prices due to a significant decrease in aggregate demand. In the United States, due to bank failures, there was also a decrease in money supply.

At that time, many farmers were not just destroyed by the Dust Bowl and inability to produce something. It was found that they suffered by lowering prices and producing too much. Many Americans were unable to afford their products, and this decreasing demand further decreased the prices, so that even selling their products became unprofitable. The main reason behind this was that there were no large-scale programmes that could even distribute the unused food. Many crops were spoilt or became rotted in piles in the field, untouched.

For example, in 1932, in America, the Imperial Valley of California lost 2.8 million watermelons and 22.4 million pounds of tomatoes because they could not be sold, rather than spreading poverty and hunger.

In 1933, President Roosevelt allotted a budget of $75 million to the Federal Emergency Relief Administration just to buy food for farmers and to provide them revenue in order to provide them a reason to continue farming.

Deflationary Pressures in Recession

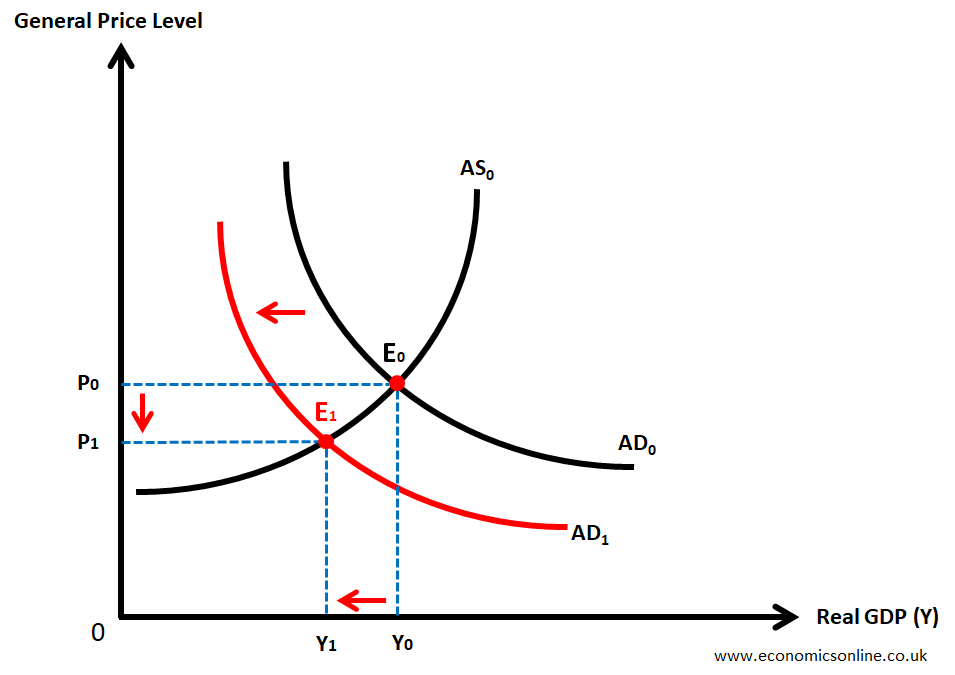

The following graph illustrates a decrease in general price level (deflation) in a recession.

In the above graph, we have taken general price level on the vertical axis (Y-axis) and the real GDP (Y) on the horizontal axis (X-axis). The initial macroeconomic equilibrium is at E0 which means that the initial general price level is P0 and the real GDP (national income) is Y0. There is a fall in the aggregate demand curve from AD0 to AD1 during the era of recession, which leads to a fall in the general price level (deflation) from P0 to P1.

Stability of Food Prices

The income elasticity of demand for food is very low. During recessions, when income decreases, individuals cut back spending on luxurious or expensive items, like motor cars, luxury houses, etc., but keep buying general necessary items, like food. However, staple items, such as rice and bread, will not see any significant fall in demand. That is why companies may feel less need to cut food prices than other goods.

During a deep recession, people might expect a price war to appear in expensive electronics and motor cars, but they are very unlikely to see a price war, especially for food items. Therefore, when the recession is too deep and there is a lack of advantages for the unemployed, then food will also face a decrease in demand, just like the Great Depression.

Food Prices during the Great Depression

During the Great Depression, the food prices were badly crashed. This happened due to the combination of many factors, which are given below; some of them were also not related to the recession itself.

Oversupply of Food

During the 1920s, people had faced an oversupply of food. In 1929, bumper harvests had seen even more oversupply.

Increased Unemployment

At the beginning of the great depression, prices had fallen dramatically. For example, in the United States, the unemployment rate increased to 20% along with a decrease in wages. In the 1930s, there was very little in the way of unemployment relief, due to which the unemployed people of the labor force and their families were not able to buy or afford food.

Demand and Supply

The combined effect of decreasing demand and excess supply also caused consumer prices to fall. The food was also destroyed repeatedly, due to which many were going hungry.

Chicago Wheat Prices

The prices of Chicago wheat also decreased from $1.40 per bushel in July 1929 to 49 cents in 1931, which was approximately a 66% fall in prices. Similarly, the prices of corn, chicken, butter, potatoes, beans, flour, and eggs also went down significantly.

The Dust Bowl

In 1933, due to bad weather conditions, the dust bowl harvests in the agricultural production started to decline rapidly, and prices increased back to over a dollar by 1933. From 1933 to 1940, food prices in the agricultural sector rose, but the economy remained below full capacity.

Food Price Inflation during a Recession

During a recession, it is possible to have food price inflation. This inflation can occur if companies face cost-push factors, like crop failure, bad weather, and increased prices of imports.

Currency Depreciation

Countries might face food price inflation because a recession happens during a faster depreciation in the currency, which can cause the price of imported food to rise.

Cost-Push Factors

The United Kingdom had also faced some periods of high inflation during the recession of 2008-2012. At that time, the inflation rate had reached over 5% due to cost-push factors or depreciation, which can cause a continuous rise in food prices.

Supply Shock

There can also be food inflation if a recession is related to a supply shock. For example, a shortage of fruit pickers during the COVID-Recession can cause a significant increase in food prices.

Trade War and Tariff Barriers

Food inflation can also be caused if there is a trade war and the load of tariff barriers on food items.

Food Prices during the COVID-19 Recession

There are different possibilities related to the food price change during the recession of COVID-19.

Falling Demand

Firstly, the demand for food is falling because of the hospitality sector, such as tourism and restaurants. They are experiencing a huge fall in demand for food. That is why there is a big fall in demand for food, including some foodstuffs related to dining out, like high-end fish, dairy, and cheese.

Rising Demand

The demand for food is also rising in the supermarkets in order to compensate for the loss. But it is also true that if people do not go out for dinners and dining at restaurants and hotels, then the overall demand for food stays lower. For example, if people go to a restaurant, they might order an expensive fish or have a cheese course, but at home they often skip on the plate of cheese. Major cheese producer countries like France are also experiencing a dramatic decrease in demand, causing a decrease in the price of cheese. UK fishermen are also facing a decrease in the price of fish.

Impact on Supply

A major and unknown effect of this Corona recession is the quarantine measures, which affect the overall supply of food. For example, if farms do not hire people to pick fruits or food, this will cause a major increase in prices for food.

Printing Money and Recession

Another problem is that sometimes recession can also lead to deflation. There is no doubt saying that the opposite can also happen. For example, when the government responds to decreasing outputs by printing money, this will lead to inflation or even hyperinflation in the country, such as when the Zimbabwean government printed money and caused the hyperinflation of 2008. But it is also possible that governments can print money during a deep recession without causing inflation. In 2020, governments were creating money, but the inflation was also low at that time.

Conclusion

In conclusion, the impact on food inflation is fairly masked in the times of normal post-war recession by providing benefits to the unemployed. The demand for food is not really affected, and prices also stay fairly stable. However, during a very deep global recession, the demand for food also decreases because people stop spending on food items, especially luxury goods. It is possible that this behaviour of people could cause food deflation like what happened during the great depression of the 1930s (1929-33). At the same time, food prices can be directly affected by microeconomic factors, not only by macroeconomic factors, like oversupply in the market.