Photo by Anne Nygård / Unsplash

What Caused the Stock Market Crash of 1929?

Introduction

The stock market crash of 1929 started on October 29, 1929. This day is also known as “Black Tuesday,” because this was the day when the DJIA (Dow Jones Industrial Average) thrusted nearly 13% in heavy trading. Although panic selling materialised in the first week, the greatest decline happened in the following two years consecutively as the Great Depression became evident. The Dow Jones Industrial Average (DJIA) reached its lowest point on 8 July 1932, which was 89% less than its September 1929 peak. This was also defined as the most significant bear market in the history of Wall Street. Until 1954, this market would not return to its peak of 1929.

Explanation

The stock market crash of 1929 accompanied a bull market manifested by a five-year increase in the DJIA. At that time, industrial companies traded at a P/E ratio (price-to-earnings ratio) of over 15, and their original valuations did not seem contrary after a decade of record productivity growth in the manufacturing sector. It was also noticed that the overproduction in many industries led to an oversupply of many goods, like iron, steel, and other durable goods. When producers came to know that there was not enough demand and the buyers for their goods were less, they started selling their products at low prices in order to increase their sales, which resulted in decreased share prices. The Federal Reserve also used a strategy to reduce the investor supposition by increasing the rediscount rate from 5% to 6% in August 1929. According to some experts, it was a move that hindered economic growth and decreased stock market liquidity, resulting in making markets more exposed to rapid price falls.

A Period of Phenomenal Growth

In the early 1920s, the companies experienced a great deal of success by exporting goods to Europe, which was reconstructing from World War I. At that time, the unemployment rate was low, and automobiles expanded across the country, resulting in increased jobs and efficiencies for the overall economy. The stock prices surged until the peak of 1929. In the 1920s, investing in the stock market was the national hobby for those who could afford it and also for those who could not. At that time, the economic growth created an environment in which projections about stock almost became a hobby, with the general public wanting a portion of the market. Many of them started buying stocks on margin.

Margin

The process of buying an asset in which the buyer only pays a percentage of the asset’s value and borrows the remaining portion from banks or other brokers is called margin. From 1917 to 1929, the credit margin increased from 12% to 20% of New York Stock Exchange (NYSE) market value.

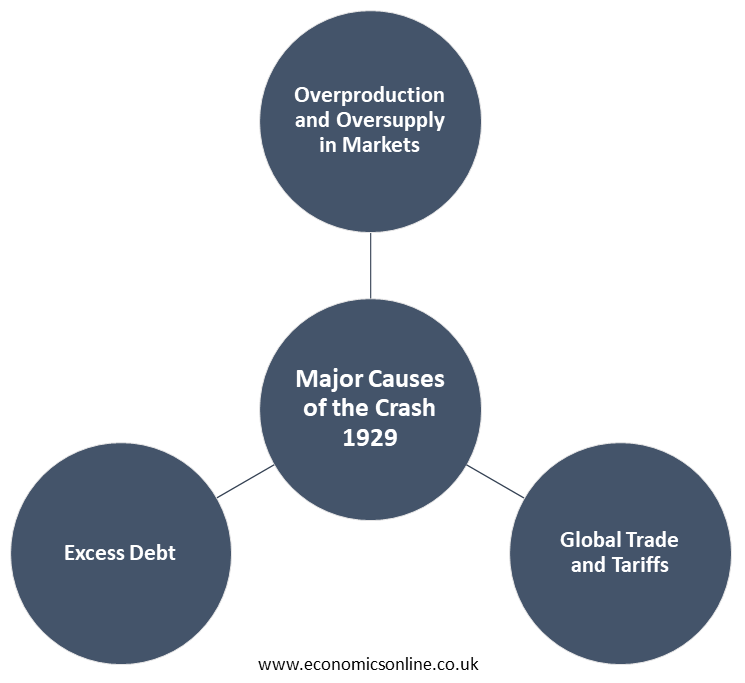

Major Causes of the Crash 1929

The following are some major causes of the stock market crash of 1929:

Overproduction and Oversupply in Markets

May people were not purchasing stocks on crux; they were actually buying then on expectations of rising share prices. Increasing share prices brought more people into the market. They were convinced that it was a process of making easy money. In the middle of 1929, the economy got paralysed due to the overproduction, which led to oversupply in many countries and in many markets, like farm crops, iron, and steel. At that time, companies were forced to sell their products at lower prices, and share prices began to fluctuate.

Global Trade and Tariffs

With Europe emerging from the Great War and continuous increased production, the oversupply of agricultural products pressurised American farmers to sell their produce at low prices. This was a result of a prolonged series of laws by the United States Congress in order to raise the tariffs on goods imported from Europe. Therefore, the tariffs increased beyond agricultural goods. Many nations also imposed tariffs on their imports from the U.S. or any other countries. This increase in tariffs leading to an increase in prices had destructive impacts on international trade. For example, international trade in the form of imports and exports was reduced by 66% from 1929 to 1934.

Excess Debt

In 1929, when the stock market crashed, the banks started offering margin calls. A large number of shares were bought on margin by the general public. The entire stock market was pushed downwards as a result of the margin calls. Investors started selling their entire portfolios due to the shortage of cash on the sidelines, and many potential investors were vanished, and the FDIC (Federal Deposit Insurance Corporation), which usually guarantees depositors’ funds, was also wiped out. During the crash, Americans started withdrawing their money from banks, and banks, on the other hand, which had made too many bad loans, were left with potential losses.

Public Utilities in 1929

Many electric companies were integrated into holding companies, capturing about two-thirds of the American industry by 1929. In 1928, the FTC (Federal Trade Commission) reported that the prejudiced practices conducted by these holding companies, like exploiting subsidiaries through service contracts and window-dressed accounting, including inflated property values and depreciation, were a threat to the investor. As new constitutions were proposed to regulate the public utilities industry in October 1929, the resulting sell-off plunged through the system as investors who had purchased stocks on margins then became forced sellers.

The Great Depression and Bank Failures

The Federal Reserve delayed to address the initial crash and avert the wave of bank failures that disabled the financial system. The Treasury Secretary Andrew Mellon said to President Herbert Hoover that if we liquidate stocks, liquidate labour, liquidate farmers, and liquidate real estate, it will eradicate the decomposition out of the system. At that time, the demand for American stocks had been aided by funds lent to foreign investors. However, this type of vendor-financed demand depleted, especially for American goods at the time of the crash.

This stock market crash of 1929 indicated the Great Depression, where approximately 15 million citizens of America lost their jobs and almost half of the country’s banks failed by 1933. The demand and production demolished, triggering bread lines and homelessness in the country. At that time, farmers were compelled to let crops decompose, due to which many starved. Many farmers also migrated to other cities in search of jobs as the droughts caused dust and high winds in the South, which is known as the Dust Bowl.

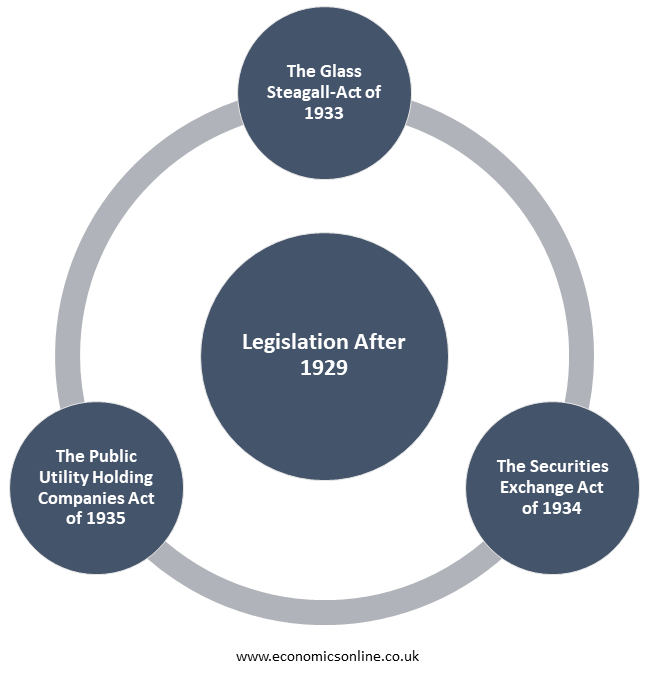

Legislation After 1929

The Great Depression accompanied an era of protectionism, isolationism, and nationalism. The legendary Smoot-Hawley Tariff Act in 1930 began a helix of beggar-thy-neighbour economic policies. The lack of government surveillance is regarded as the main cause of the crash in 1929 because the policies are based on laissez-faire economic theories. In response to these theories, Congress passed some federal regulations or legislation that aimed at stabilising the markets.

The Glass Steagall Act of 1933

This act forced commercial banks to abstain from investment banking activities in order to protect depositors from significant losses that can be caused by bank suppositions. The Federal Deposit Insurance Corporation was also created as a result of this act.

The Securities Exchange Act of 1934

This act was formed to control transactions of securities on the secondary market to guarantee greater financial transparency and less manipulation or fraud.

The Public Utility Holding Companies Act of 1935

This act effectively deconstructed the nation’s largest electric companies to limit the damage of a single company failure.

Conclusion

In conclusion, like other market crashes, for instance, recessions or depressions, there is also a complex network of affecting factors that can cause a crash or a recession, like the stock market crash of 1929. The stock market crash of 1929 was also caused by multiple factors, like an economic boom after World War I, overproduction and oversupply in many key industries, greater use of margins in buying stocks, a shortage of global buyers around the world due to the war, and many more. The legislation and regulatory authorities have learnt from some of the mistakes and avoided them, but others are still contributing to bring out future crashes.