An image of the stock exchange monitor.

Black Thursday

Introduction

A notorious day in the history of the stock market is known as Black Thursday. On 24th October, 1929, Thursday, the market opened 11% lower than yesterday’s close, causing panicked selling of stock that resulted in a day of heavy trading. Black Thursday was the first day of the Great Stock Market Crash of 1929, and it lasted till October 29. Black Thursday, also known as the day of sales and shopping, is a display of Black Friday because it begins on Thanksgiving Day, which is considered the start of the holiday shopping season.

Historical Background

In U.S. history, Black Thursday inaugurated the end of one of the longest-running bull markets. In the whole decade of the 1920s, the stock prices had been gradually inflating, rising to strange and unfamiliar heights. The DJIA (Dow Jones Industrial Average) inflated six times from 63 in August 1921 to 381 in September 1929. Therefore, exactly when the NYSE (New York Stock Exchange) opened on that tragic Thursday in 1929, the inflated equity prices were making investors and financial experts anxious. At the annual National Business Conference, an economist, Roger Babson, made a forecast on 5th September that a crash is coming sooner or later, and it may be horrendous. During September, the stock prices revolved, with sudden reductions and rapid improvements. This nervousness pursued into October as well. In reality, the DJIA fell 4.6% on 23rd October. A Washington Post highlight declared that a huge selling wave causes near-panic as stocks collapse.

At that time, the stock market had already expired nearly about 20% as its record close of 381 on 3rd September. On 24th October, Thursday, when trading began, the Dow Jones Industrial Average deflated 11% in the first few hours. Heavy trading volume was more threatening; it was about to hit the record 12.9 million shares, which was three times the normal amount by the end of the day. At the time, in New York, there were three major banks, like Morgan Bank, Chase National Bank, and National City Bank of New York. These banks created a fund of $750 million, from which they bought stocks in order to bring back trust in the markets. At the end of that trading day, the DJIA actually retrieved a bit, closing at 2% lower, at 299.47.

Consequences of Black Thursday

Banks’ and investors’ reinforcement efforts worked for a time. The DJIA closed higher at 301.22 on Friday. On Black Monday, the Dow only fell 13% in light trading to 260.64 on 28th October. This decline had led to an all-out panic the next day. On 29th October, Tuesday, by the end of trading, the Dow Jones Industrial Average (DJIA) had declined to 230.07, which was a 12% loss, also known as Black Tuesday. After the stock market crash, the Dow continued declining for three consecutive years, reaching the lowest point at 41.22 on 8th July 1932. The Dow Jones Industrial Average had lost approximately 90% of its value as it was high on 3rd September 1929. In reality, the Dow did not reach its highest again for 25 years until 23rd November, 1954. Many individual and institutional investors had leased or leveraged in order to purchase stocks, and that crash (Black Thursday) had eradicated them financially, which led to extensive bank failures. Sequentially, that became the stimulus that sent the U.S. into the Great Depression of 1930.

Importance of Black Thursday

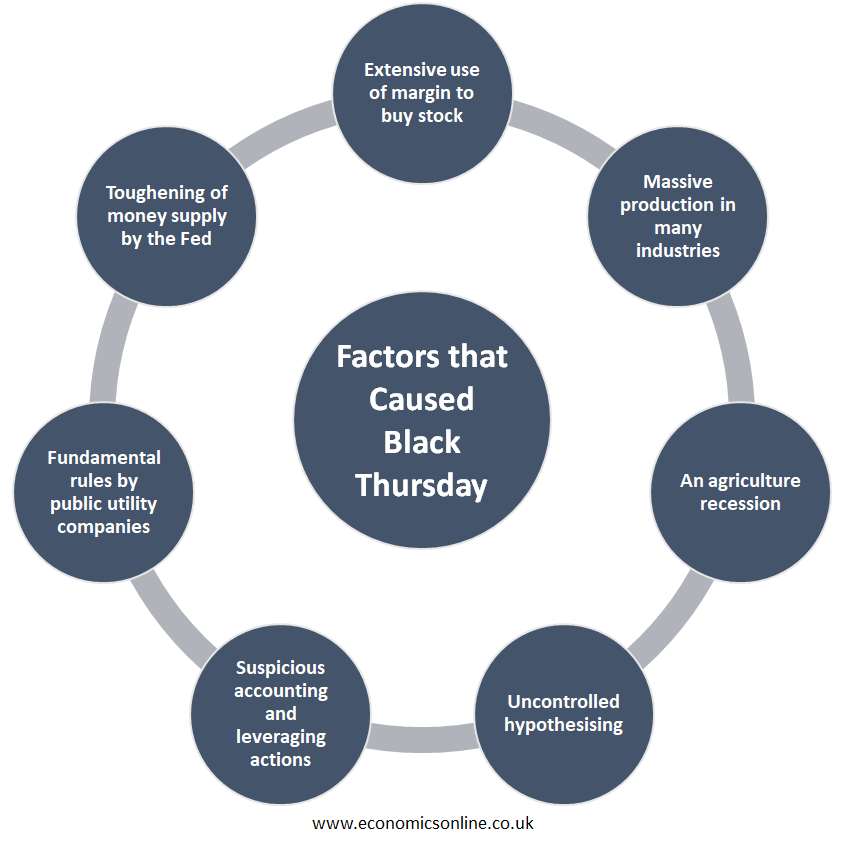

The stock market crash of 1929 was caused by multiple factors. These factors include extensive use of margin to buy stock, massive production in many industries, an agriculture recession, uncontrolled hypothesising, suspicious accounting and leveraging actions by investment consigns, the fundamental rules and regulations by public utility companies, and a toughening of money supply by the Federal Reserves (Fed).

The Stock Market Crash of 1929, or Black Thursday, had one importance, which is that it provoked a complete revamp of the United States’ securities industry. The U.S. SEC (Securities and Exchange Commission) was formed, and significant new regulations were introduced by authorities, like the Securities Act of 1933 and the Securities Exchange Act of 1934.

Black Thursday Shopping

Black Thursday has had a more positive and significant nuance attached to it in recent years. In the United States, it is a nickname of an affectionate shopper for the Thanksgiving holiday. Many retailers in the U.S. are open on Thanksgiving in an attempt to get an early start on the furious shopping of Black Friday and to fight with rival e-commerce sites and trending online stores. The word Black of Black Friday was mainly referred to as the black ink, which was traditionally used to record the financial benefits or gains by accountants, while the word red was mainly used to record financial losses. This shopping category of Black Thursday has led to increasing aversion among the retailers’ employees. They complain that they are forced to leave the Thanksgiving family dinners early in order to show up for work on time.

Black Tuesday

29th October 1929 was known as Black Tuesday because on that day there was a sharp decline in the stock market, particularly with the Dow Jones Industrial Average (DJIA) severely affected in high trading volumes. The Dow declined 12%, and it was the biggest one-day fall in the entire history of the stock market. On Black Tuesday, more than 16 million shares were traded in the panic sell-off, which successfully ended the Roaring Twenties and dragged the global economy into the Great Depression.

Reasons for Stock Price Fall on Black Tuesday

The trust and faith in the stock market had been damaged badly due to the significant declines in the DJIA on the preceding Black Thursday and Black Monday. Nonetheless, an association of banks attempts to recapture the investors’ trust and faith through heavy buying of stocks, causing panic reposed upon the previous one. Many financiers faced margin calls due to price falls because they had borrowed money to buy stocks, and now they need more funds and money in order to maintain their positions in the stock market. If they could not maintain their positions, they had to sell their current shares, which also caused prices to decline further. Another reason is that the trading became so wild that stock tickers, which are physical telegraph machines that investigated stock prices, could not maintain, delaying by hours and hours, and chaos over the lack of updated information and knowledge stimulated the panic to sell.

Differences between Black Thursday and Black Tuesday

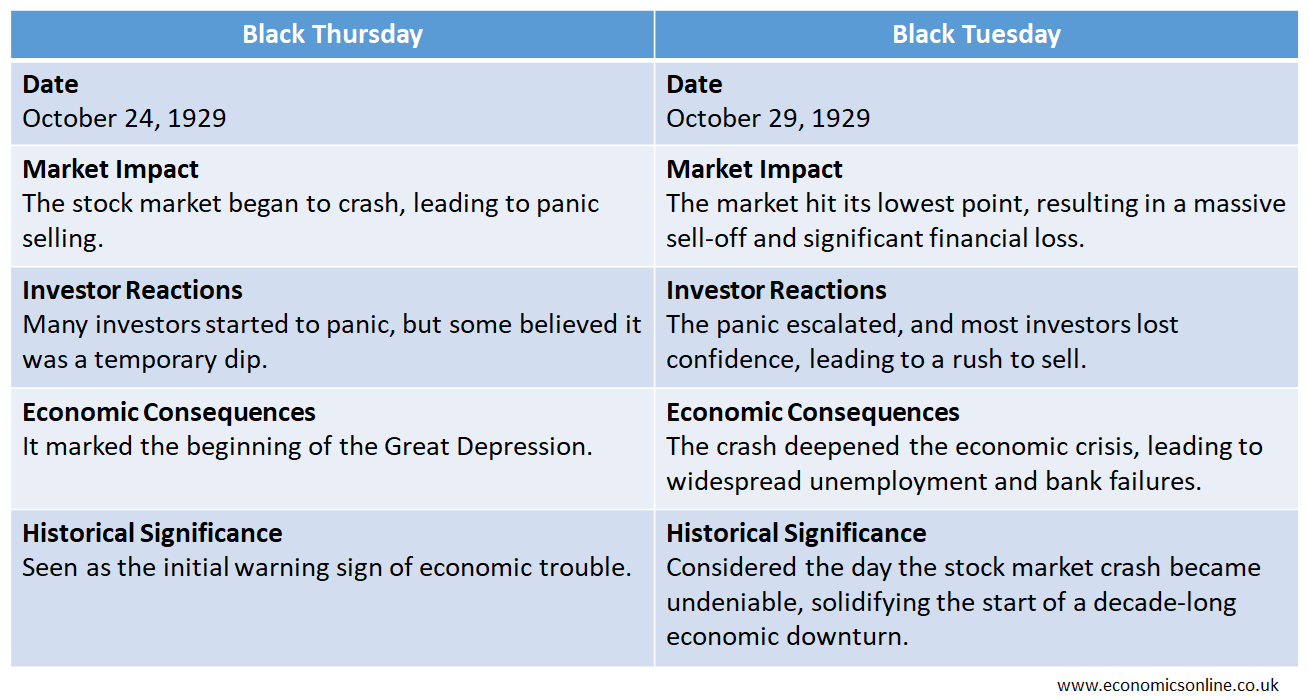

The following table contains the main points of difference between Black Thursday and Black Tuesday.

Conclusion

In conclusion, Black Thursday was the beginning of the stock market crash of 1929, when panicked selling resulted in the DJIA remarkably reduced in value and paved the way for the Great Depression to occur. Black Thursday was also followed by a complete revamp of the U.S. financial system, originating regulatory agencies like the Securities and Exchange Commission, and the execution of other regulatory acts and laws to protect investors and other financiers.