Photo by Paris Bilal / Unsplash

Yen Carry Trade

Definition

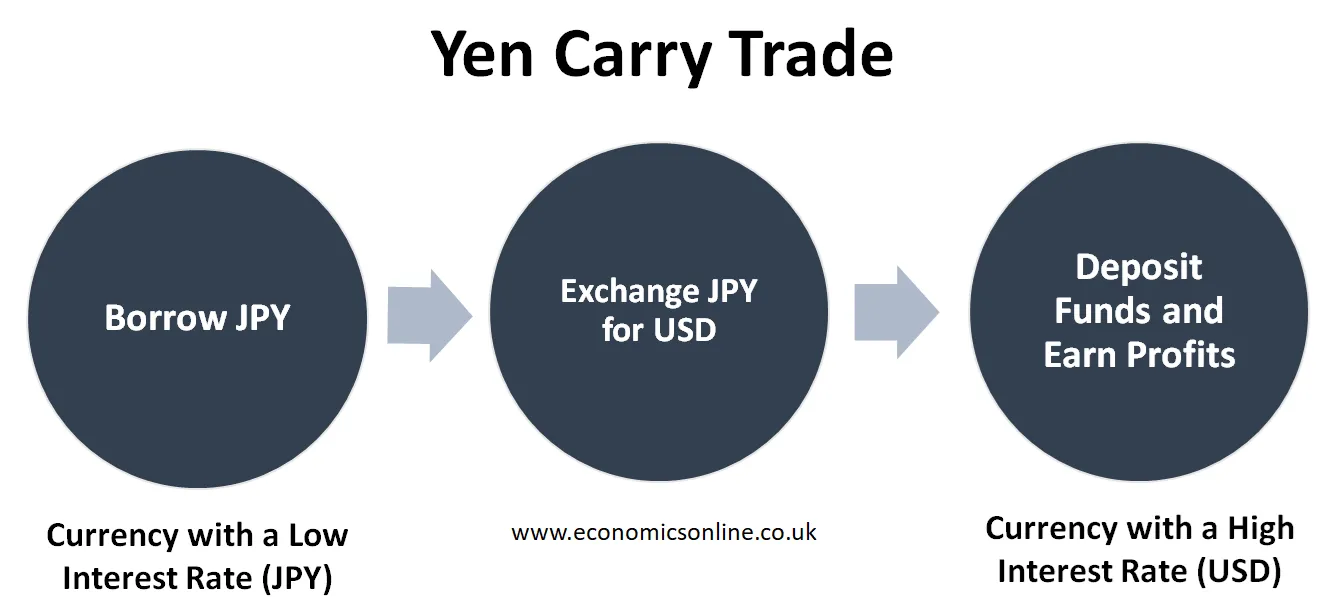

A carry trade is a strategy of borrowing a low-interest rate currency and converting it into a high-interest rate currency to generate profits. Yen carry trade is involved in borrowing Japanese yen (JPY) at a low interest rate in order to invest in other currencies (for example, USD) and assets offering high returns. The very name of this trade comes from the fact that the currency borrowed in this trade is the Japanese yen (JPY).

Yen carry trade is being unwound by Japan’s rate increases due to the volatility of the yen and impending rate cuts in the United States and other economies.

Currency Carry Trade

A strategy in which traders borrow in a low-interest rate currency and then invest in the high-interest rate currency for the purpose of gaining profit from the interest rate differential is called a currency carry trade. Particularly, a currency carry trade involves using leverage to maximise any kind of potential return.

For example, a carry trade can be done simply by finding and selling a low-yielding currency and buying a high-yielding one. One of the most popular carry trades is trading the low-yielding or even negatively yielding yen (JPY) against currencies, such as the U.S. dollar (USD), Mexican pesos, Australian dollar (AUD), and New Zealand dollar (NZD).

How it Works

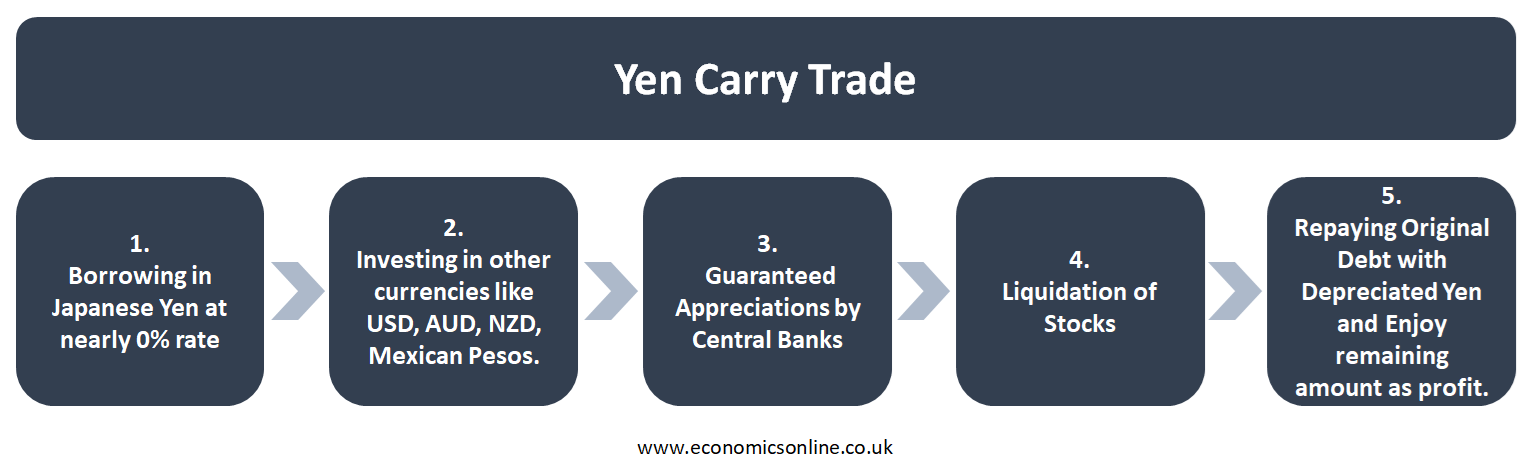

The currency carry trade works on the motto of “buy low, sell high.” In the Forex market, a currency carry trade is one of the most famous trading strategies. At the end of every short-term trade, investors can convert the dollars or pesos back into the Japanese yen and repay the loans. Typically for a dollar-yen trade, the annualised returns can be around 5% to 6%, which is normally a difference between the U.S. and Japanese rates with the chances of more gains if the yen were to depreciate during that term.

Understanding Yen Carry Trade

The first step is to borrow the Japanese yen and convert it into the U.S. dollars or other currencies of interest. The next step is to invest the converted dollars into a higher-paying security in U.S. dollars with maximum rates. If the exchange rate moves opposite to yen, then traders make maximum profits, but if the yen becomes stronger, then the traders do not make handsome profits or may experience a loss.

Example

For example, consider a Japanese bank offering loans at an interest rate of 0.5% per annum. A trader borrows ¥3,000,000 and exchanges them for $20,000, assuming the exchange rate of ¥150/$. The trader invests this $20,000 in U.S. bonds with a return of 5% per annum. This means that the trader earns a 4.5% profit after settling the loan taken from Japanese bank. Here are the calculations:

Loan from Japanese bank = ¥3,000,000

USD after exchanging JPY at ¥150/$ = $20,000

Return on USD Bonds at 5% = 5% of $20,000 = $1,000

Total amount of USD = $20,000 + $1,000 = $21,000

JPY after exchanging USD at ¥150/$ = ¥3,150,000

Interest to be paid to Japanese bank = 0.5% of ¥3,000,000 = ¥15,000

Amount to be paid to Japanese bank = Loan + Interest = ¥3,000,000 + ¥15,000 = ¥3,015,000

Profit after settling the debt = ¥3,150,000 - ¥3,015,000 = ¥135,000

Profit as a percentage of loan = (¥135,000 / ¥3,000,000) x 100% = 4.5%

In this example, we have assumed that the exchange rate between JPY and USD is constant at ¥150/$. Any appreciation of JPY or depreciation of USD will make this trade less profitable. Any depreciation of JPY or appreciation of USD will make this trade more profitable. Moreover, the changes in interest rates by Japanese or U.S. banks will also change the profitability scenario. An increase in interest rates by Japanese banks or a decrease in interest rates by U.S. banks will make this trade less profitable and vice versa.

Origin of Yen Carry Trade

The origin of the yen carry trade started back in 1990, when Japan’s policy rates went down to zero after its asset price bubble burst. Due to which Japanese investors jumped to international markets in order to get better yields rather than getting zero yields at home, plunging trillions of dollars into foreign markets and hence, turning Japan into the world’s largest creditor nation.

Recent carry trade, which typically consists of borrowing yen by international investors, started to turn out in 2013, under the quantitative and qualitative easing of Prime Minister Shinzo Abe, which conflicted with increasing interest rates in the U.S. and depreciating the yen. Until the end of 2022 and 2023, those trades reached new enormous proportions as the Federal Reserves increased rates rapidly to boost inflation as the Bank of Japan (BOJ) also kept its short-term rates negative, and as a result, the yen collapsed.

What is the Size of Yen Carry Trade?

It is difficult to give an exact number about the size of this trade; however, according to some economists and analysts, as an estimate of yen-funded trade in the world, there are about $350 billion in short-term loans by Japanese banks. It is also possible that this number is an exaggeration if some of those short-term loans are commercial transactions between banks, or these could be loans to foreign businesses that need yen. But this could be the actual size of this trade because there could be billions of yen; the Japanese could borrow for themselves to invest in the markets at home. The actual situations could be expanded because of how hedge funds and computer-driven funds get leverage. Also massive investments have been made abroad, like Japanese pension funds, insurers, and other investors. The Ministry of Finance shows data about these investments. It states that Japan’s foreign portfolio investments were $666.86 trillion at the end of March 2024, which is approximately more than half in interest rate-sensitive debt assets, and most of them are long-term.

Unwinding of Yen Carry Trade

The unwinding of this trade means that the investors stop or decrease the use of this trading strategy. This unwinding was observed when the Bank of Japan started to increase interest rates in March 2024, ending an 8-year period of negative interest rates. The overnight rate of yen is 0.25%, while the U.S. dollar rates are 5.5%. Analysts say that carry trades are more sensitive to currency moves and rate expectations as compared to the actual level of rates. This move narrowed the yield gap, which completely wiped out the short or minor gains in pure yen-dollar carry trades. Investors are forced to de-leverage them and also shed other bonds and stock holdings.

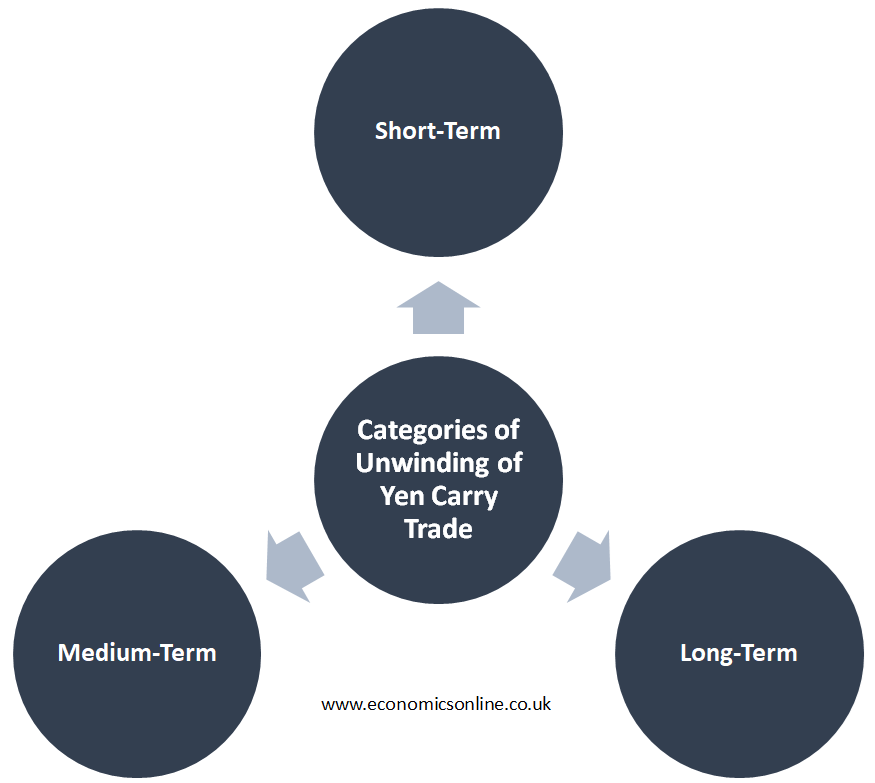

According to some indicators, the unwinding can be categorised into three types:

Short-Term Unwinding

In a short-term unwinding, the situation can be understood by examining yen contracts pursued by the Commodity Futures Trading Commission. On 2nd July 2024, investors such as hedge funds were having 190,000 contracts worth $15.6 billion that were betting on a depreciated yen. On 31st July 2024, on the day of the Bank of Japan meeting, those contracts were halved in their worth and were approximately backed to the flat line by Tuesday, 6th August 2024. The short term unwinding is mainly attributed to the expectation of an upward movement of interest rates by Japanese banks.

Medium-Term Unwinding

To understand the medium-term unwinding of this trade, one should observe the pattern of the Japanese banks’ foreign lending. Sometimes, this kind of lending is to non-banks, such as asset managers, and it has been rising since 2010. Lending, particularly foreign lending in yen, increased in the last couple of years as the rates increased outside Japan as compared to the rates in Japan. The Japanese rates remained low. According to the data by BIS (Bank of International Settlements), in March 2024, the total loans were $1 trillion. For future investors who are concerned about margin calls that can force urgent sell-off, asset managers look to reduce any carry trades and repay yen loans over the medium term, dependent upon their estimated currency and rate moves.

Long-Term Unwinding

In case of long-term unwinding for longer-term carry trade size, Japan's long-term net investment position can tell the tale. In the U.S. treasuries and among other top five in ownership of non-Japanese stocks, the biggest non-U.S. investors are the Japanese investors. The Bank of Japan’s current stance offers the possibilities for the reversal of more than a decade of outflows of capital perceived by investors worldwide. It is impossible that all the outbound investments from Japan will reverse the designated scope of investment opportunities outside of Japan. This means that this type of unwinding will be a net result of inflows and outflows of JPY from Japan.

Conclusion

In conclusion, a yen carry trade is simply borrowing yen at low rates, investing it into other currencies with high rates, and gaining profits by investing in another country’s currency. After gaining profits, investors are able to repay borrowing and enjoy gains. Those stock markets that are less exposed to technology, the yen, the dollar, others with stable economic backgrounds and below-average valuations are most probably able to bear future unwinding of the yen carry trade. Due to these reasons, Europe’s stock market progressed much more than that of the United States or Japan on Monday, 5th August.