An image of stacks of coins and an upward arrow.

What is Monetarism?

Monetarism Definition

Monetarism is a school of thought in economics which says that an increase in the money supply is the main cause of inflation in an economy. As the name suggest, the theory of monetarism revolves around money supply. This theory says that any increase in the money supply can decrease unemployment in the short run but will only create inflation in the long run. This theory states that the total amount of money in an economy is the primary variable which the governments should control in order to manage the economy in terms of inflation and economic stability.

The monetarism school of through believes that there should be free markets with no or limited government intervention and the central banks, such as the Fed, should use monetary policy in order to manage the economy. For example, when the central bank, reduces interest rates and increases the money supply, as the part of expansionary monetary policy, the aggregate demand and economic growth are increased in the short run, but there will be inflation in the long run.

Monetarists

Those economists who believe that the economy can be managed by controlling the growth of the money supply are called monetarists. They believe that inflation is always and everywhere a monetary phenomenon. They favour the monetarism school of thought in managing the economy through the control of money growth.

Historical Background

Monetarism became famous in the 1970s, a decade after high inflation and low economic growth rates. In the United States and the United Kingdom, monetarism policies were used to lower inflation rates. In 1979, when inflation rates reached extremely high levels in the United States, approximately 20%, the Federal Reserve shifted its operating strategy to monetarist theory. In 2007, when the United States and the rest of the world were hit by global recession, Milton Friedman - the proponent of monetarism, said that increasing the money supply and lowering interest rates would help stimulate economic growth in the U.S.

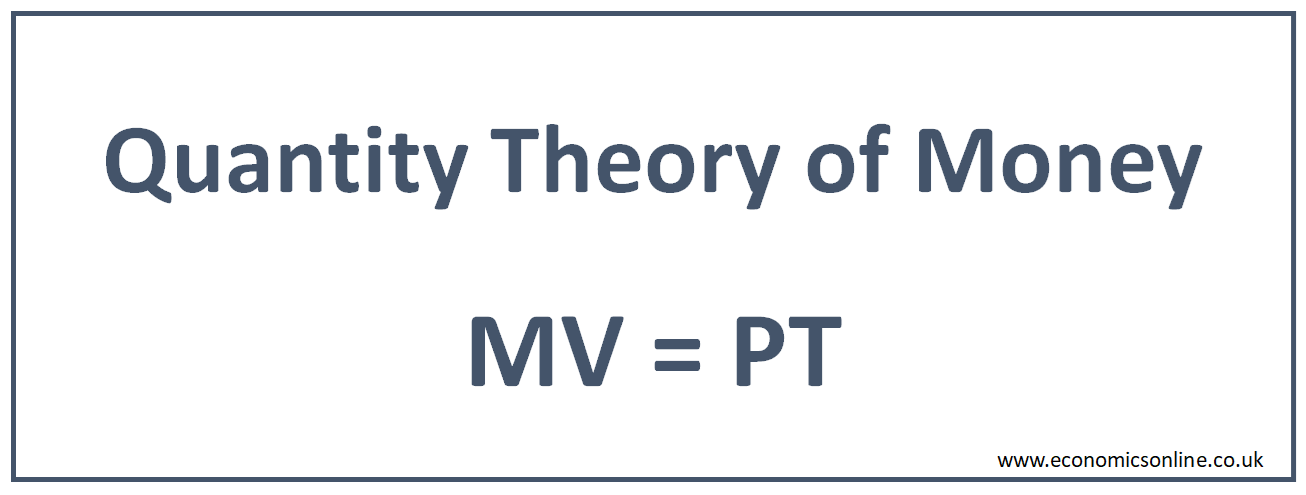

The Quantity Theory of Money

The quantity theory of money is at the backend of the concept of monetarism. The quantity theory says that the main cause of inflation is an increase in the money supply. According to this quantity theory, the value of money or its purchasing power depends on the quantity of money in circulation and there is a positive or direct relationship between money supply and inflation. The quantity theory of money can be expressed in the form of the following Fisher equation of exchange, which is given below.

MV = PT

The equation is named after the American economist Irving Fisher who formulated it to explain the quantity theory of money.

In this equation:

M = Money supply - the total quantity of money in the economy

V = Velocity of money circulation– the number of times money changes hands

P = The general price level of goods and services in the economy or the average price level

T = Total volume of transactions

In the short run, V and T are constant, which means a direct relationship between M and P.

When money supply (M) increases, the general price level (P) also increases leading to inflation. When money supply (M) decreased, the general price level (P) also increase leading to slowing down of inflation or even deflation.

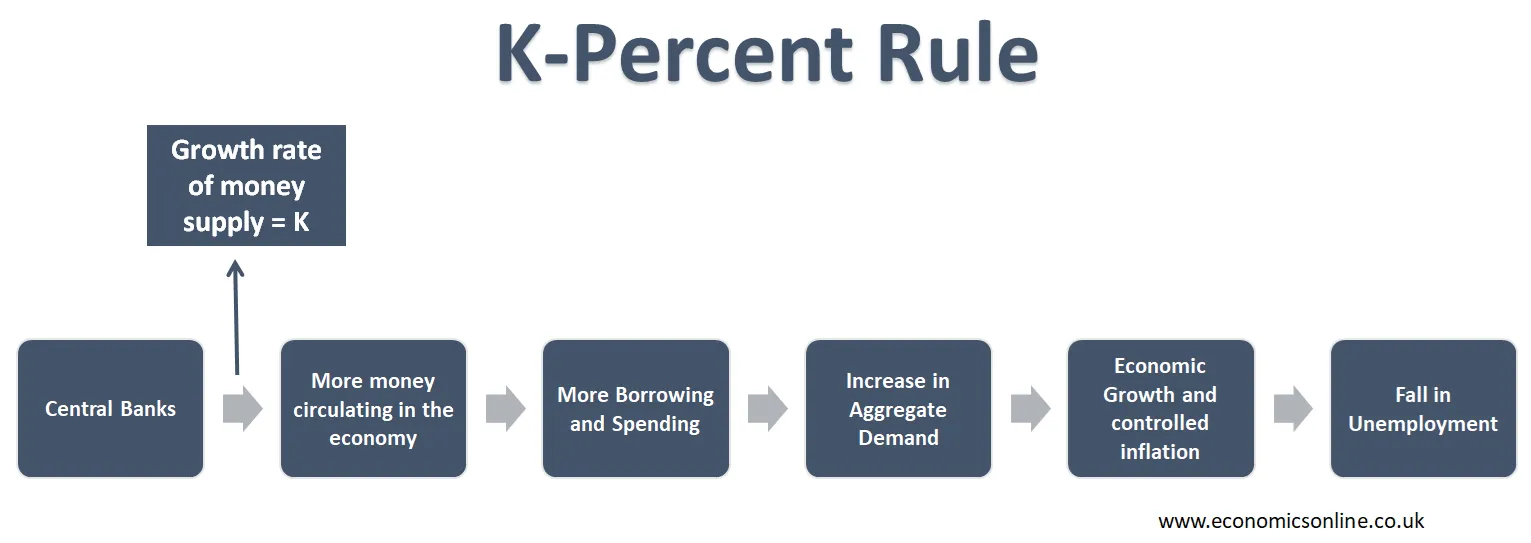

K-Percent Rule

Friedman introduced a fixed growth rate called the k-percent rule in his book, "A Monetary History of the United States 1867–1960." According to this rule, the growth rate should be at a constant annual rate, which is connected to the growth of nominal GDP (nominal gross domestic product). In this way, the money supply will grow expectedly, and businesses will be able to forecast changes to the money supply and plan accordingly every year, which helps economic growth to increase at fixed rates and is used to keep inflation levels relatively low.

Milton Friedman, an American economist and a Nobel laureate from the University of Chicago, argued, based on the quantity theory of money, that the government should keep the flow of the money supply steady and expand it a little each year in order to achieve economic growth. He also argued that the main cause of the Great Depression, in 1930s, was poor monetary policy. Friedman thought that monetary policy should be used to target growth rates by controlling the money supply.

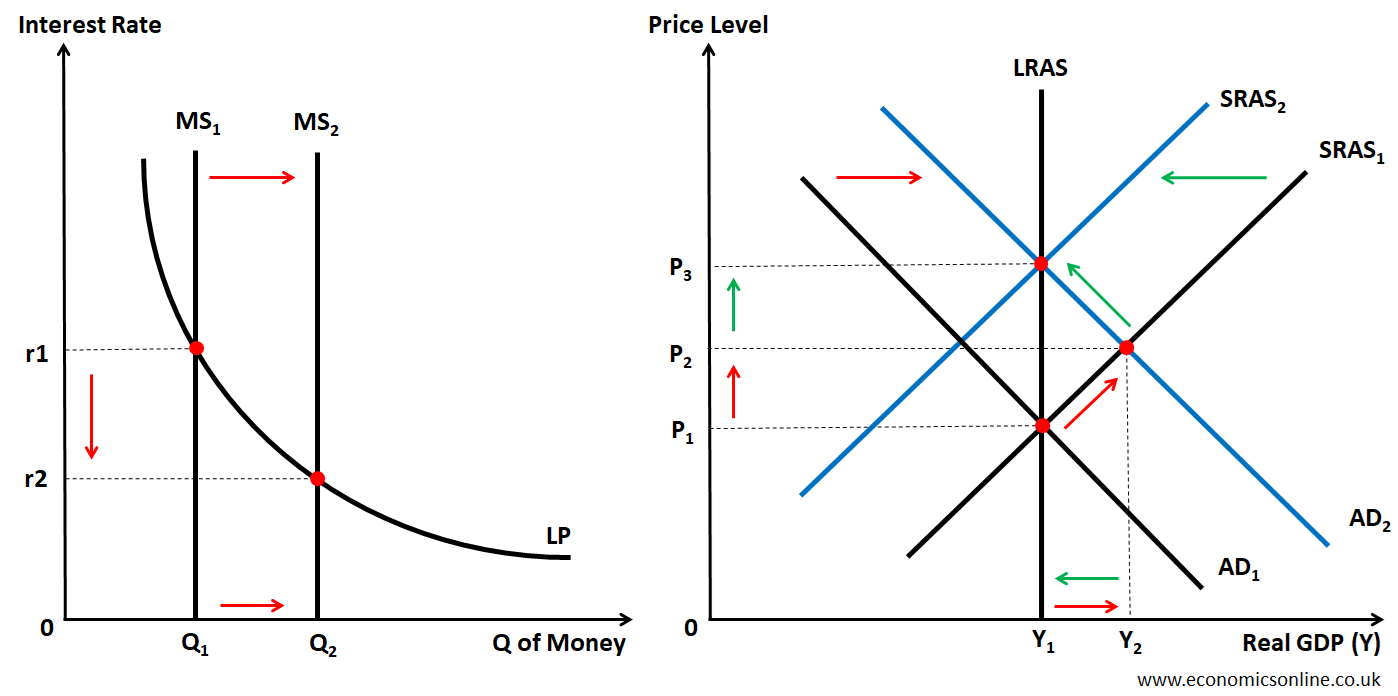

Workings of Monetarism

The following graphs illustrate the workings of monetarism.

In this graph on the left, an increase in money supply from MS1 to MS2, is causing the interest rate to fall from r1 to r2. This increase in money supply affects the macroeconomy as illustrated by the graph on the right. The initial macroeconomic equilibrium is at the point of intersection of AD1 and SRAS1. The price level is P1 and the real GDP is Y1. The LRAS is a vertical straight line, as suggested by monetarists. Due to an increase in the money supply, individuals and firms increase consumption and investment, leading to a rise in aggregate demand from AD1 to AD2. The general price level is increased from P1 to P2 causing inflation. The real GDP is increased from Y1 to Y2. Monetarists say that this happens only in short run due to the money illusion where people make decisions based on their nominal income. In the long run, workers will bid up wages due to inflation and this increases the production cost for firms, leading to a fall in short run aggregate supply form SRAS1 to SRAS2. The real GDP will come back to Y1 at the natural rate of unemployment and the general price level will further increase from P2 to P3. Monetarists believe that an increase in money supply will increase real GDP in the short-run but has no effect on the real GDP in the long-run. In the long run, any increase in money supply will only cause inflation. Hence inflation is a monetary phenomenon, which should be controlled by controlling the money supply.

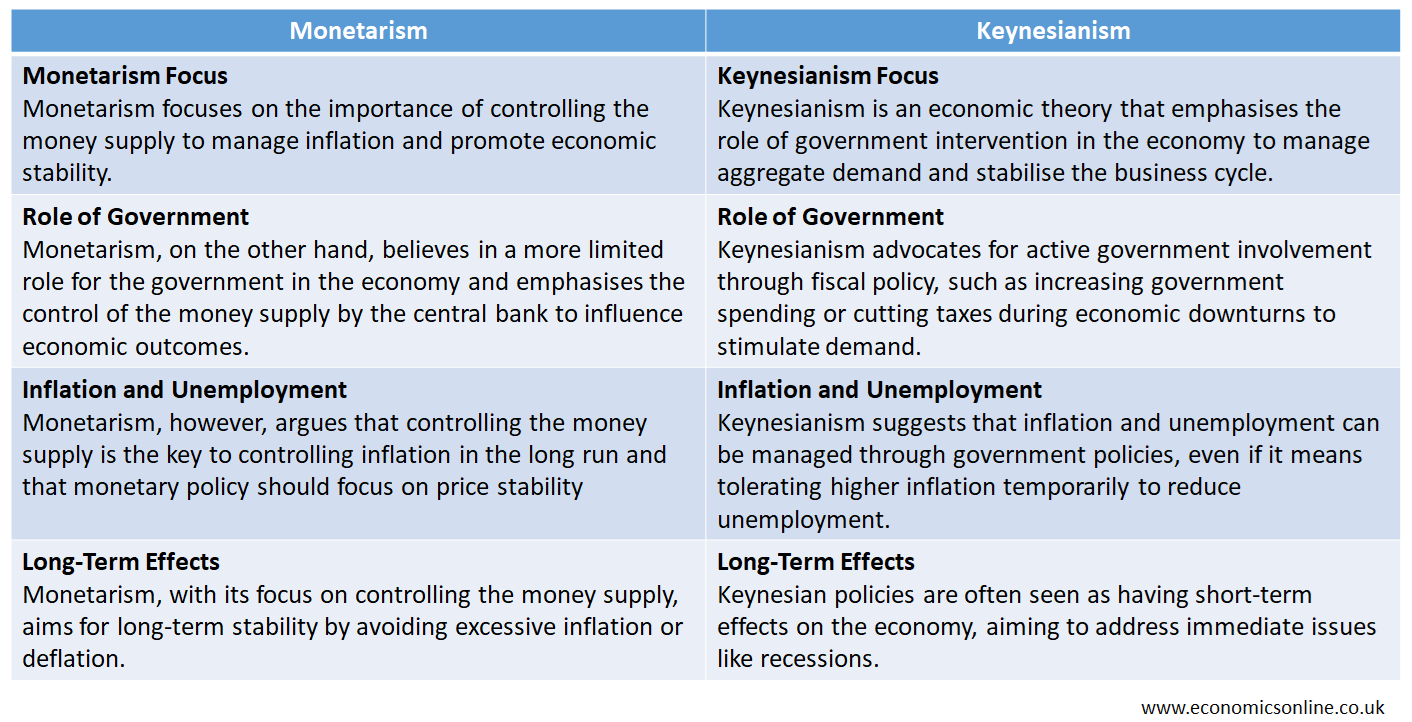

Differences between Monetarism and Keynesianism

The following table contains the main points of difference between monetarism and Keynesianism schools of thought.

Key Ideas of Monetarism

The following are some key ideas of monetarism:

Importance of Money Supply

The monetarist explained that the money supply is very important in determining economic growth and price stability. They also argued that changes in the money supply affect inflation, interest rates, and economic growth.

Long-Term Relationship

Monetarists have faith that money and prices are in a positive relationship for the long term. They also argued that an increase in the money supply will cause inflation, and a decrease in the money supply will cause deflation. So money and prices are related in the long term.

Focus on Controlling the Money Supply

Some monetarists favour the idea that monetary policy should focus on controlling the money supply instead of stabilising the economy or managing business cycles. They say that inflation is the mother of all the macroeconomic problems in an economy and it can be managed, in the long run, by controlling the total amount of money supply in circulation,

Conclusion

The theory of monetarism is a school of thought in economics which says that inflation is caused by an increase in money supply and that monetary policy should focus on managing inflation by controlling the money supply. Milton Friedman was the one who populated the monetarism theory, which gained importance in the late 20th century. Monetarism can be easily distinguished from Keynesianism, which focuses mainly on the use of fiscal policy to manage the economy.