Photo by Kenny Eliason / Unsplash

What does Hysteresis do?

Hysteresis

In economics, an economic event that persists even after the factors causing that event have been eliminated or removed is called hysteresis. In other words, the dependence of the state of a system on its history or past is called hysteresis. It means that the past or history of an event affects its present state, making it a lagging event. For example, after a recession (past), the rate of unemployment usually starts to increase (present) regardless of growth in the economy or the end of a recession, making unemployment a lagging event.

Examples

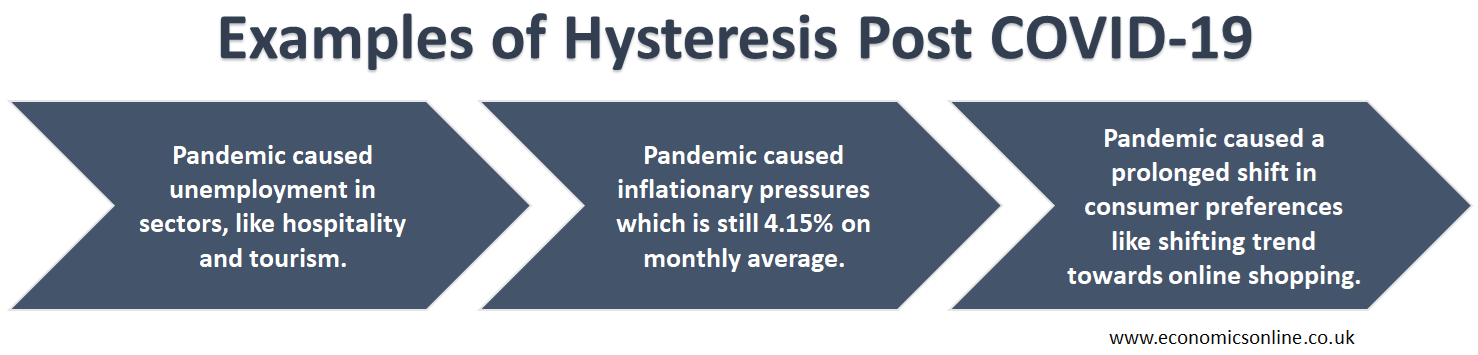

In the modern economy, COVID-19 is the most wonderful example of hysteresis. The Biden Administration has ended the public health emergency status of this crisis on May 11, 2023. However, most of the economic responses taken during the pandemic are still being felt into 2024. COVID-19 had caused many job losses, especially in sectors such as hospitality and travel that were badly affected by lockdowns. According to the Bureau of Labour Statistics, it is projected that the hospitality and leisure industry will only employ over 16 million individuals by 2031, as compared to 16.6 million individuals employed in 2019. The delayed effect of COVID-19 on unemployment events in 2024 is an example of hysteresis.

The COVID-19 pandemic also caused inflationary pressures. For example, the disruptions in the supply chain had caused an increase in the cost of goods, and these cost increases have been shifted to the consumers in the form of high prices of affected goods. Regardless of mitigating rate raises and monetary policy, the average monthly rate of inflation in 2023, which was 4.1%, was still the third highest average of the period.

Another example related to the pandemic COVID-19 is consumer preference. Due to health restrictions, there were so many hurdles bestowed on in-person shopping or consumption. As a result, many Americans shifted to online shopping. After the pandemic, many of those hurdles have been removed, but it has been noticed that the post-pandemic behaviour of consumers has changed. This can be referred to as hysteresis because, as the hurdles were removed and market conditions were largely where they were pre-pandemic, consumers had not yet returned to what the trend was before.

Historical Background

The term hysteresis was originated by a Scottish physicist and engineer, named Sir James Alfred Ewing, to refer to systems, fields, and organisations that have memory. In other words, the outcomes of some inputs are accomplished with a delay or certain time lag. For example, iron maintains some magnetisation after it has been exposed to or removed from a magnetic field. Hysteresis also originates from a Greek word, which means a time lag or delay.

Explanation

In economics, hysteresis occurs when a single disturbance affects the whole economy. The main reasons for hysteresis change depending upon the provoking events. That said, the preservance of the market depression after the event that has technically passed is most commonly credited to changes in attitudes or behaviour of the market participants after the event. For example, after a market crash, investors may be hesitant to reinvest cash on hand due to their current losses. This hesitation or reluctance translates to a longer period of depressed stock prices due to the hesitant attitudes of investors instead of market fundamentals.

Types of Hysteresis

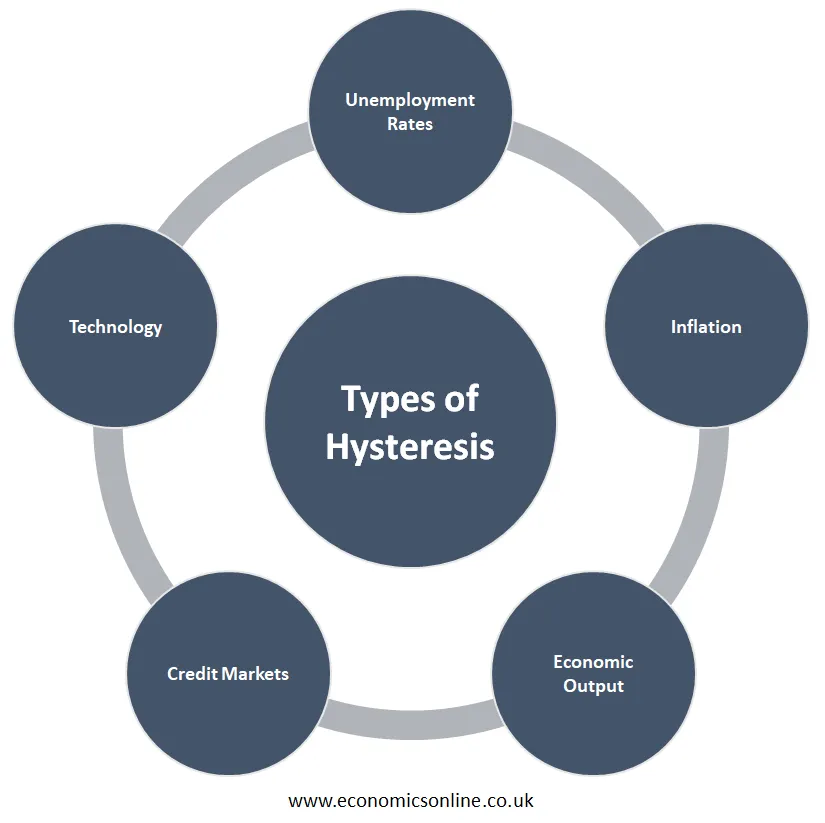

The following are some types of hysteresis:

Unemployment Rates

A major type of hysteresis is the delayed effects of unemployment rates. In this case, the unemployment rate can continue to increase even after the economic conditions start recovering. The current unemployment rate refers to the number of people in an economy who are seeking opportunities for work but can’t find any, calculated as a percentage of the size of workforce.

Cyclic unemployment increases when a recession happens, as the economy experiences negative GDP growth rates. The cyclic unemployment increases when a country’s economy performs poorly and falls when the economy is in the expansion phase.

It is also expected that when an economy re-enters in its expansionary phase, businesses will start hiring their unemployed labour. In this way, the economy’s unemployment rate would start moving towards its normal or natural unemployment rate until the cyclic unemployment becomes zero. This is an ideal situation that economies facing recession manifest to attain.

However, hysteresis states that when the unemployment rate increases, most people adjust to a lower standard of living. After they become used to this lower standard of living, they may not be as motivated to attain the previously desired higher living standard. Additionally, as more people become unemployed, it becomes socially acceptable to remain unemployed even after the labour market returns to normal; some unemployed people may not be concerned about returning to the workforce.

Inflation

Inflation hysteresis occurs when prolonged periods of either low or high inflation construct expectations for the future. A high inflation in past leads to a high inflation in present and future due to the expectation of high inflation and vice versa. For example, when inflation remained consistently low, it can become a belief that this trend will continue. Inflation hysteresis can lead to ongoing expectations of low inflation and can make it difficult for central banks struggling to maintain price stability. Central banks may fully rely on people’s expectations of future inflation and guide their policy decisions accordingly. In inflation hysteresis, where expectations become fixed, it becomes difficult for central banks to implement effective monetary policies.

Economic Output

Economic output hysteresis can occur in the aftermaths of an economic downturn or recession. When businesses perform their investment activities during a recession, it is eventually a decline in productivity and investment. Therefore, it results in a reduction in the real GDP of the overall economy. The consequences of this reduced productivity can last even after the recessionary period. In practical terms, this means that even when the economy starts recovering, it may struggle to attain the growth trajectory it maintained before the downturn or recession. That is why companies may be reluctant to commit long-term capital and be the first to launch a new product in the market.

Credit Markets

During financial downturns, the first response of any bank is to tighten the credit, as they mainly deal with increased risks and uncertainties. For example, banks are potentially reluctant by the experiences of the crisis and may remain risk-averse. They may be careful in their lending practices and conserving a persistent credit crisis even though it is not necessary.

Technology

In technology hysteresis, workers who were cyclically unemployed in recession may lack skills to operate the latest machines, which will become a reason for their unemployment when the economy starts recovering. As a result, the loss of job skills will cause a change of workers from the cyclic unemployment phase to the structural unemployment category. An increase in structural unemployment will cause a rise in the rate of natural unemployment.

Ways to Overcome Hysteresis

The following are two main ways to overcome hysteresis:

Expansionary Monetary Policies

Those economies that are experiencing a hysteresis or recession in which the natural rate of unemployment continues to increase usually use an economic stimulus to fight the resulting cyclic unemployment. Central banks introduced expansionary monetary policies, like Federal Reserves, which can consist of lowering interest rates to make loans cheaper and help boost the economy of a country. An expansionary fiscal policy can also increase government spending in those regions, areas, or industries that are mostly affected by natural unemployment due to recession or any economic shock.

Job Training Programmes

Still, hysteresis is more than cyclic unemployment; it can last long after the economy has recovered. In case of long-term issues, like lack of job skills in workers due to job displacement by technological advancement, the job training programmes can be helpful to overcome hysteresis.

Structural Reforms

Another way to overcome hysteresis is to use preventive structural reforms by predicting potential sources of hysteresis and implementing changes in order to stimulate the flexibility and elasticity of the economy. Regulatory adjustments, labour market reforms, and initiatives encouraging innovation can overcome the impact of economic shocks. However, there is usually a greater risk associated with long-term policies instead of short-term strategies.

Hysteresis in Other Fields

Hysteresis can also be present in the following sectors:

Financial Sector

In financial markets, hysteresis has multiple forms, such as credit market hysteresis, manufacturing output, and investor sentiment towards inflation.

Banking Sector

Hysteresis in the banking sector, which arises from financial crises, can lead to constant cautious lending practices even after the crisis diminishes. This continuing judgement in lending may cause an extended credit squeeze, making it difficult for consumers and businesses to get loans.

Conclusion

In conclusion, hysteresis refers to the lasting impact of past economic events on the current state of economy. Hysteresis underlines how disruptions and shocks, like economic recessions, can lead to consistent effects that can influence the behaviour of economic agents, including consumers, producers, and workers, leading to the extension of past events over a prolonged period.