An image of human brain inside a bulb as a analogy of bounded rationality.

Bounded Rationality

What is the Bounded Rationality?

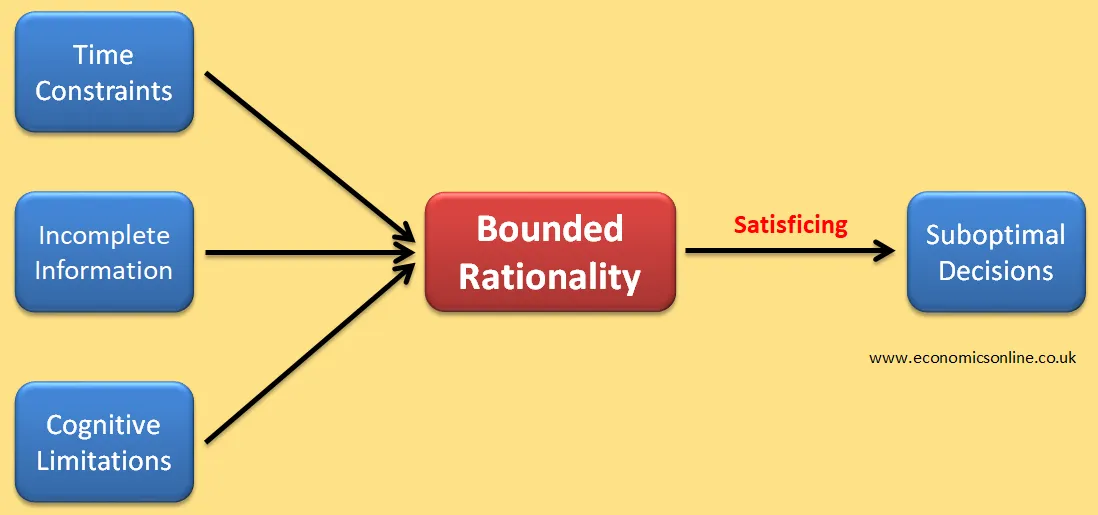

Bounded rationality refers to the idea that people are not perfect decision-makers and that their rationality is restricted by limited information, cognitive abilities, and time constraints.

In simple words, people may try to behave rationally while making decisions, but their ability to do so is bounded or restricted; therefore, even with the best intentions, people end up "satisficing," or accepting sub-optimal outcomes instead of the best possible outcomes.

Bounded rationality is an important concept in behavioural economics and is particularly useful in understanding human behaviour in real-life situations.

Behavioural Economics

Behavioural economics is the branch of economics that studies the choices people make in real life, under the influence of psychological, social, and emotional factors.

Traditional Economics vs. Behavioural Economics

Traditional neoclassical economics assumes that people are rational, well-informed, and always seek to maximise satisfaction (self-interest); hence, they choose the best possible outcomes that will maximise their total utility according to the utility theory. On the other hand, behavioural economics challenges these assumptions and recognises that people have bounded rationality, imperfect or incomplete information, and are often subject to cognitive biases and heuristics while making decisions. So they make suboptimal decisions that just make them happy (satisficing) instead of perfect ones that will maximise their satisfaction. That is why behavioual economists call human beings "satisficers" instead of "homo economicus" or perfectly rational.

In other words, behavioral economics relaxes the assumptions of classical economics and looks at the way people actually behave. Human beings are subject to emotions and impulses, which can result in ‘errors’ and biases in decision-making.

Unlike traditional economic theories, which view individuals as rational, well-informed, utility maximisers and perfect decision-makers, the advocates of behavioural economics believed that economic agents are not fully ‘rational’ decision-makers; instead, they were affected by psychological biases and social and emotional factors.

Origin of the Bounded Rationality

The term "bounded rationality" was coined by Nobel Prize-winning economist Herbert Simon in the 1950s. Simon argued that human decision-making is bound by cognitive limitations that prevent people from making perfectly rational decisions.

According to Simon, people have limited information-processing capacity, limited time and resources, and limited abilities to reason and calculate probabilities. As a result, they rely on heuristics, or mental shortcuts, to make decisions that are "good enough" rather than optimal. The work of Simon has contributed significantly in understanding human behaviour outside the scope of rational choice theory of traditional economics.

Understanding Bounded Rationality

Traditional economics assumes that people are rational utility-maximisers maximizers with perfect information. This means that people have all the information they need about all the options when a decision is to be made and are not influenced by emotional, social (social norms), or psychological factors. So people gather all the information about all the options, weigh up all the costs and benefits of all those options, and then make a utility-maximising decision.

However, behaviour economics assumes that people have bounded rationality and face the following constraints while making decisions:

Time Constraint

People often have limited time to make decisions. This means that they may not have the opportunity to gather all the information needed to make an optimal decision or to consider all available options. In response, people often use mental shortcuts to simplify the decision-making process and arrive at a satisfactory decision within the time available. They put their preferences aside to get a reward sooner due to short-term temptations.

Incomplete Information

People often have limited access to information when making decisions. This can lead to uncertainty and ambiguity, and decision-makers may have to make assumptions or fill in gaps in their knowledge. In such situations, people may depend on heuristics or mental models to make decisions, rather than trying to obtain all the information that would be needed for a completely rational decision.

Cognitive Limitations

Bounded rationality model also recognises that people have limited cognitive abilities. This means that people also have limited information-processing capacity in terms of evaluating all the pros and cons of the options. Instead, they may rely on heuristics to simplify the decision-making process.

Even if people have all the time, information, and mental ability, they lack the self-discipline to act rationally. For instance, a smoker may have all the information about the harmful effects of smoking cigarettes, but due to addiction, he/she may lack the self-discipline to give it up. This is called bounded self-control.

Hence, the concept of bounded rationality says that people do the best they can with the information and resources available to them, but they are not always completely rational in their decision-making.

Implications of Bounded Rationality

Bounded rationality has several important implications for economics and decision-making.

First, it suggests that people are not always rational decision-makers, and that their choices may be influenced by biases, emotions, and cognitive limitations.

Second, it suggests that people may not always be able to make the best decisions, even when given all the information available to them.

Finally, it suggests that decision-making processes should take into account the limitations of human cognition and emotions, and be designed to help people make better decisions.

Examples of Bounded Rationality

Bounded rationality can be seen in many areas of life, from personal finance to healthcare to politics.

Health Insurance

One example of bounded rationality is the way people make decisions about health insurance. Studies have shown that people tend to choose plans that are not always the most cost-effective, due to a lack of understanding of the complex insurance system.

Investment Decisions

Another example is the way people choose investments. Investors may rely on past performance or the advice of friends or family members. They may also be swayed by emotions and biases, such as fear of loss or overconfidence in their abilities, rather than making decisions based on a rational analysis of the risks and potential rewards.

Eating Out

Another example of bounded rationality is when people decide where to eat. People may use heuristics such as going to a restaurant they have been to before or choosing a place that is close by (availability bias). This simplifies the decision-making process but may result in missing out on other options that could be better.

Conclusion

Bounded rationality is an important concept in economics and decision-making. It suggests that humans are not always rational decision-makers and that their choices are influenced by a variety of cognitive and emotional factors. By understanding the limitations of human behavior, cognition, and emotions, decision-making processes can be designed to help people make better decisions.