Photo by Maria Lupan / Unsplash

Theory of Absolute Advantage

Theory of Absolute Advantage

Statement

A country has an absolute advantage in the production of that good, which it can produce in greater quantity with the same quantity of resources than another country.

Origin

The Theory of Absolute Advantage is one of the earliest economic theories that explains the benefits of specialisation and international trade between countries. It was proposed by Adam Smith, the father of modern economics, in 1776 in his seminal work, "The Wealth of Nations." The theory of absolute advantage is based on the idea that countries can benefit from trade if they specialise in producing goods or services in which they have an absolute advantage over other countries.

The Purpose of the Theory of Absolute Advantage

The purpose of the theory of absolute advantage is to demonstrate the benefits of specialisation and international trade between countries. By specialising in the production of goods and services in which they have an absolute advantage, countries can increase their output through better resource allocation. This, in turn, can lead to economic growth and higher living standards.

Assumptions

The theory of absolute advantage is based on some assumptions, which are given below.

- There are only two countries in the world (Countries A and B).

- Both countries can only produce two goods. (Chairs and tables).

- The same resources are used to produce both goods.

- Both countries have different factor endowment in terms of the quality of their resources.

- Resources are homogeneous within a country. For example, all the workers in a country have the same skills, qualifications, productivity, and motivation.

- The factors of production or inputs (such as labor and capital) are not mobile between countries.

- There is constant opportunity cost. (We assume a straight-line production possibility frontier.)

- There is no transportation cost.

- There is free trade between trading countries. It means that there are no trade barriers for international trade.

- There is barter trade.

Data Example

Let’s use a data example to better understand the concept of absolute advantage.

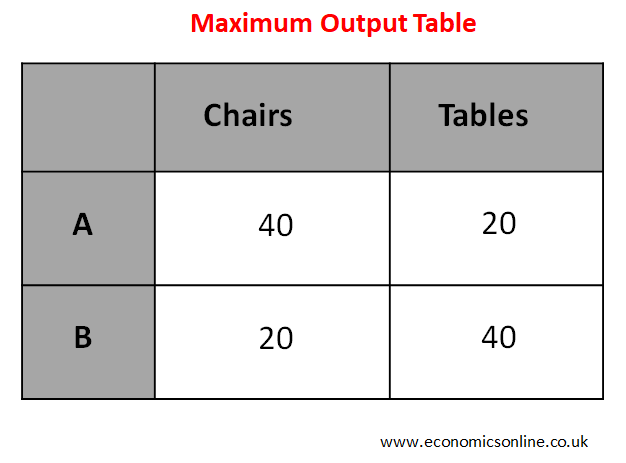

Consider the following maximum output table.

According to the above table, by using all the resources,

Country A can produce 40 chairs or 20 tables and country B can produce 20 chairs or 40 tables.

Suppose that each of the countries A and B has 10 workers. Then, In country A, 10 workers can produce 40 chairs or 20 tables and each worker can produce 4 chairs or 2 tables. While in country B, 10 workers can produce 20 chairs or 40 tables and each worker can produce 2 chairs or 4 tables.

Now let's consider different cases of resource allocation.

Case 1: Self-Sufficiency Output

Suppose that both countries are self-sufficient. Both countries produce chairs and tables according to their own needs. Suppose that both countries use half of their workers for the production of chairs and half for the production of tables. In country A, 5 workers will produce 20 chairs, and 5 workers will produce 10 tables. While in country B, 5 workers will produce 10 chairs, and 5 workers will produce 20 tables.

Following table shows self-sufficiency output in this scenario.

TWO is the total world output produced by both countries. For example, the total world output of chairs is 30 which is the sum of the outputs of country A (20) and country B (10).

Case 2: Output after Specialisation before International Trade

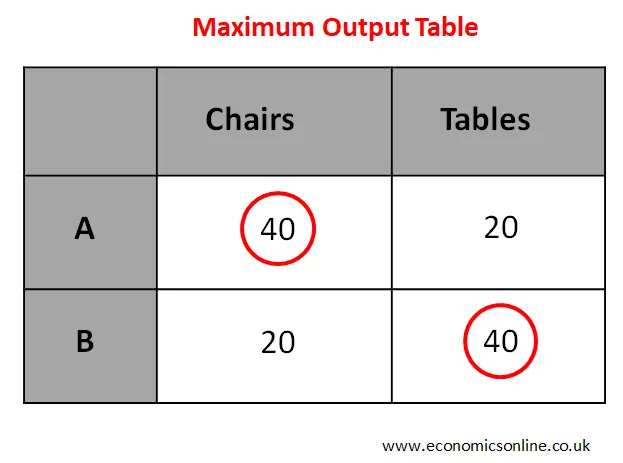

The specialisation decision will be made on the basis of absolute advantage. The specialisation decision will be made by using the maximum output table.

Country A can produce more quantity of chairs; hence, country A has an absolute advantage in the production of chairs.

Country B can produce more quantity of tables; hence, country B has an absolute advantage in the production of tables.

Country A has an absolute advantage in the production of chairs. So, country A should specialise in the production of chairs.

Country B has an absolute advantage in the production of tables. So, country B should specialise in the production of tables.

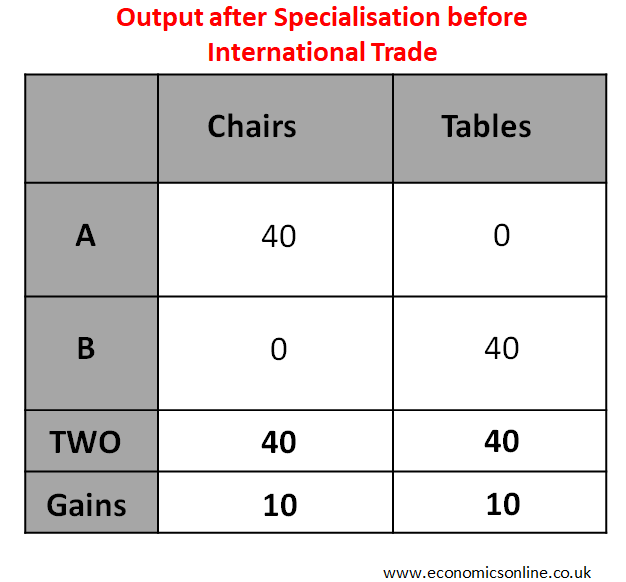

The following table shows output after specialisation.

It can be noted from above two cases, that the total world output (TWO) is increased due to specialisation. But the problem is that country A does not have tables and country B does not have chairs. This problem can be solved through international trade.

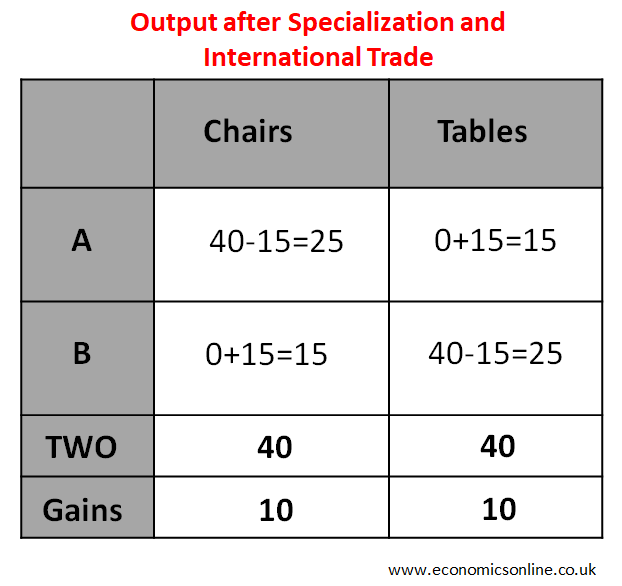

Case 3: Output after Specialisation and International Trade

In order to do international trade, countries have to deciode the barter exchange rate.

The barter exchange rate is the rate at which one country’s goods can be exchanged with another country’s goods. It is also called the barter terms of trade. The following points are important.

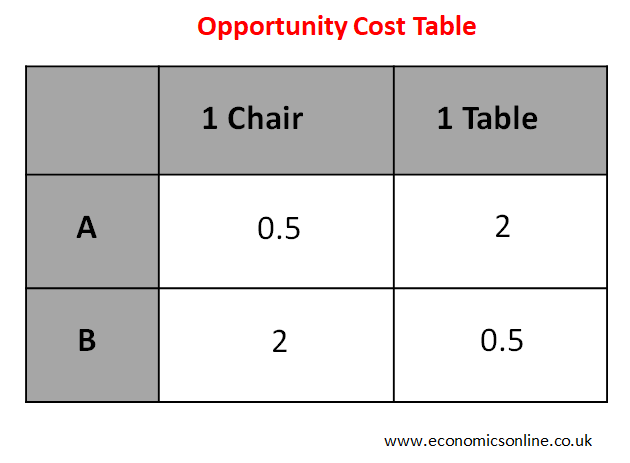

- The opportunity cost table is used to decide the barter exchange rate.

- The barter exchange rate must lie between opportunity cost ratios.

Here is the opportunity cost table.

For country A, the opportunity cost of making 1 chair = 0.5 tables

For country B, the opportunity cost of making 1 chair = 2 tables

Let us take the barter exchange rate as 1 chair = 1 table

Suppose that country A has exported 15 chairs and imported 15 tables

The barter exchange rate is 1 chair = 1 table. So, 15 chairs = 15 tables

For country A, Exports =15 chairs and Imports =15 tables

For country B, Exports =15 tables and Imports =15 chairs

The output after international trade is shown in the table below.

Gains from Specialisation and International Trade

- Country A’s output is increased by 5 chairs and 5 tables.

- Country B’s output is increased by 5 chairs and 5 tables.

- Total world output is increased by 10 chairs and 10 tables.

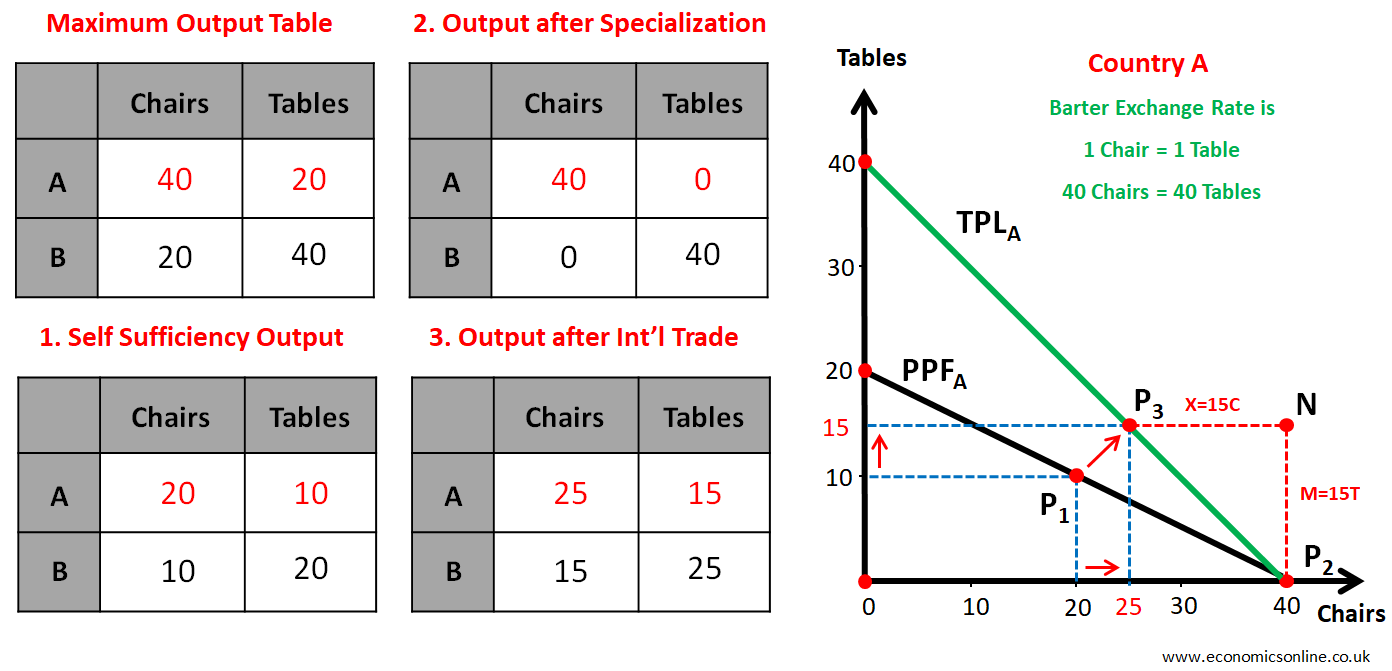

Diagrams of the Theory of Absolute Advantage

Diagram for Country A

The following diagram shows all above cases of resource allocation in country A.

Case 1: Self-Sufficiency Output

Point P1 (20, 10) shows self-sufficiency output.

Case 2: Output after Specialisation before International Trade

Point P2 (40, 0) shows output after specialisation before international trade.

Case 3: Output after Specialisation and International Trade

Barter exchange rate is 1 chair = 1 table. So, 40 chairs = 40 tables (This is used to draw the trade possibility line, TPL). And 15 chairs = 15 tables.

Point P3 (25, 15) shows output after international trade.

For Country A , Exports = 15 Chairs Imports = 15 Tables

Country A's Gains from Specialisation and International Trade

- Country A’s output is increased by 5 chairs and 5 tables

- Country A’s output is above PPF, which shows a decrease in scarcity, an increase in output and economic growth.

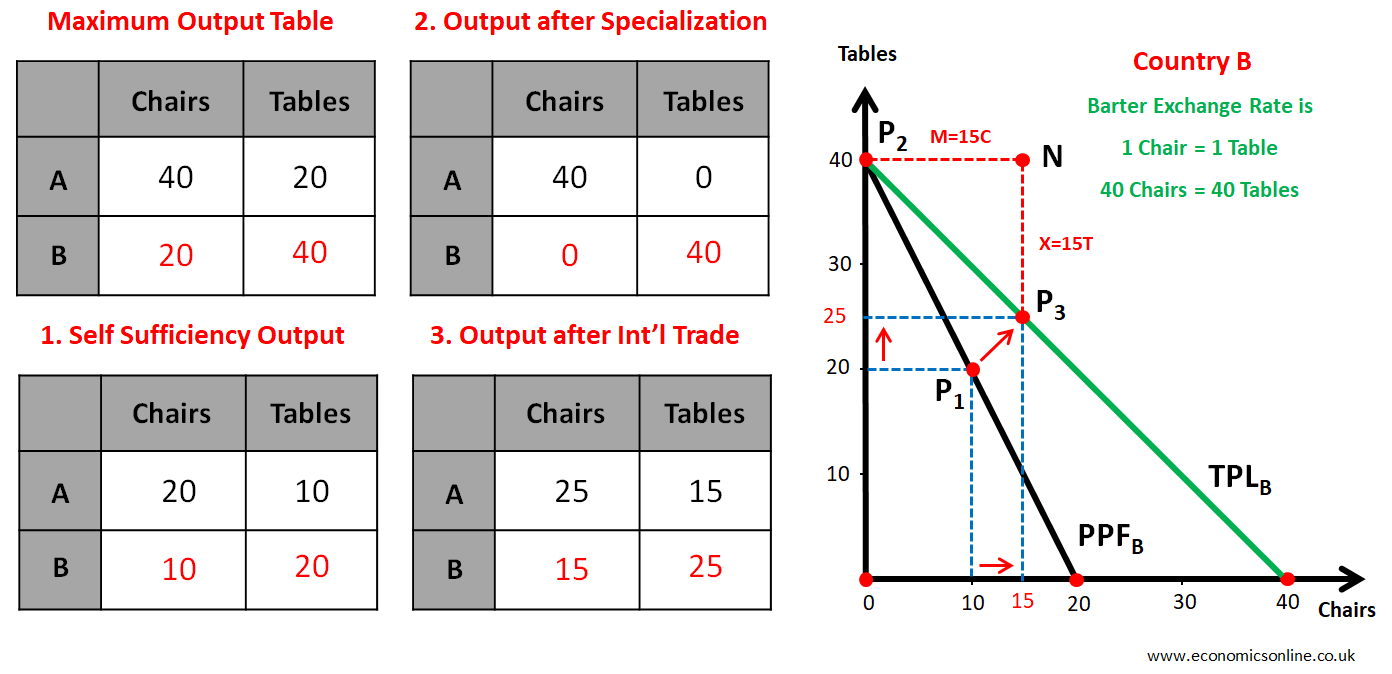

Diagram for Country B

The following diagram shows all above cases of resource allocation in country B.

Case 1: Self-Sufficiency Output

Point P1 (10, 20) shows self-sufficiency output.

Case 2: Output after Specialisation before International Trade

Point P2 (0, 40) shows output after specialisation before international trade

Case 3: Output after Specialisation and International Trade

Barter exchange rate is 1 chair = 1 table. So, 40 chairs = 40 tables (This is used to draw the trade possibility line, TPL). And 15 chairs = 15 tables.

Point P3 (15, 25) shows output after international trade.

For Country B, Imports = 15 Chairs Exports = 15 Tables

Country B's Gains from Specialisation and International Trade

- Country B’s output is increased by 5 chairs and 5 tables.

- Country B’s output is above PPF, which shows a decrease in scarcity.

Problem with the Theory of Absolute Advantage

It does not explain the possibility of specialisation and international trade if one country has an absolute advantage in both goods.

Limitations of the Theory of Absolute Advantage

While the theory of absolute advantage provides a useful framework for understanding the benefits of specialisation and international trade, it has several limitations, including:

The theory assumes that there are only two countries and two goods produced, and that all resources are homogeneous within a country, which is an unrealistic oversimplification of the real world.

The theory assumes that all factors of production are fixed and cannot be increased or decreased. In reality, factors of production are not fixed and can be increased or decreased through investment and innovation.

The theory does not account for the impact of government policies, such as subsidies and taxation, on trade.

The theory does not account for the impact of technological change on trade.

The theory assumes free trade without trade restrictions. In reality, there may be tariffs, quotas, and other trade restrictions between countries.

The theory assumes a constant opportunity cost, but in reality, the opportunity cost may not be constant, especially if resources are not homogeneous or if the production process becomes more complex.

The theory assumes barter trade, but in reality, most international trade is conducted through monetary exchange.

The theory assumes no transportation costs, which can have a significant impact on trade patterns.

Real-world Examples of the Theory of Absolute Advantage

Here are some real-world examples of the theory of absolute advantage in action:

Saudi Arabia and Oil Production

Saudi Arabia has an absolute advantage in oil production due to its abundant oil reserves and low cost of production. As a result, it specialises in oil production and exports oil to other countries that do not have an absolute advantage in oil production.

Japan and Electronics Manufacturing

Japan has an absolute advantage in electronics manufacturing due to its highly skilled workforce and advanced technology. As a result, it specialises in electronics manufacturing and exports electronic products to other countries.

China and Textile Production

China has an absolute advantage in textile production due to its low labour costs and large workforce. As a result, it specialises in textile production and exports textiles to other countries.

New Zealand and Agriculture

New Zealand has an absolute advantage in agriculture due to its favourable climate and abundant natural resources. As a result, it specialises in agriculture and exports agricultural products to other countries.

Zambia and Copper Production

Zambia has an absolute advantage in copper production due to its abundant copper reserves and low cost of production. As a result, it specialises in copper production and exports copper to other countries. In fact, copper is Zambia's main export, accounting for over 70% of the country's total export earnings.

These examples illustrate how countries can benefit from specialising in the production of goods in which they have an absolute advantage, and then trading with other countries to obtain goods in which they do not have an absolute advantage.

Theory of Absolute Advantage vs. Theory of Comparative Advantage

The theory of comparative advantage, developed by David Ricardo in the early 18th century, is another important economic theory that explains the benefits of international trade. The key differences between the theory of absolute advantage and the theory of comparative advantage are that the idea of absolute advantage focuses on productivity and efficiency, while the theory of comparative advantage focuses on opportunity costs. The theory of comparative advantage suggests that countries should specialise in producing goods and services for which they have a lower opportunity cost of production than other countries. This means that a country should produce the goods and services in which it is relatively more efficient, even if it is not absolutely efficient in producing them. Despite these differences, both Smith's theory of absolute advantage and Ricardo's theory of comparative advantage justify the benefits of specialisation and international trade.

Conclusion

In conclusion, the theory of absolute advantage provides a useful framework for understanding the benefits of international trade between countries. By specialising in the production of goods and services in which they have an absolute advantage, countries can increase their productivity and efficiency and reduce their production costs. However, the theory has several limitations and assumptions that must be considered, and it should be compared with other economic theories, such as the theory of comparative advantage, for a more complete understanding of the benefits of international trade.