The Law of Unintended Consequences

What is the Law of Unintended Consequences?

Statement

The law of unintended consequences states that the actions taken by economic decision makers with a specific objective in mind can lead to unexpected outcomes. In other words, economic policies used by the government in order to achieve economic objectives may have unexpected outcomes along with the intended ones. These unintended effects can be negative or even catastrophic.

Explanation

Unintended consequences of economic actions occur because the complex systems, factors, and forces that make up the economy are difficult to predict by economists and decision makers and can produce unexpected results.

Economics agents and policymakers often take decisions with the best of intentions, hoping to achieve positive and desirable outcomes for society. However, these actions can have unanticipated outcomes, which the economists regard as the unintended consequences.

The concept of unintended consequences has been present since the time of Adam Smith, but it gained prominence in the 20th century due to the work of sociologist Robert K. Merton. According to Merton's theory, the unintended consequences of purposeful actions can often be unanticipated. Unfortunately, in some cases, these consequences can have a perverse effect that goes against the original intention, ultimately exacerbating the problem.

Examples of Unintended Consequences

There are many examples of unintended consequences. We shall explain a few of them below.

Price Ceiling

One example of unintended consequences is the effective price ceiling or maximum price used by the government to control prices in different markets. The price ceiling is the maximum legal price that can be charged for a product. It is illegal to charge a price higher than the price ceiling. Hence, the market price must not exceed the price ceiling. A price ceiling is called effective if it is set by the government below the prevailing market price. Governments use price ceilings for controlling:

- Prices of staple (routine) food, such as bread, rice and cooking oil

- Rents in certain types of housing

- Services provided by utilities, such as water, gas and electricity

- Transport fares especially where a subsidy is being paid.

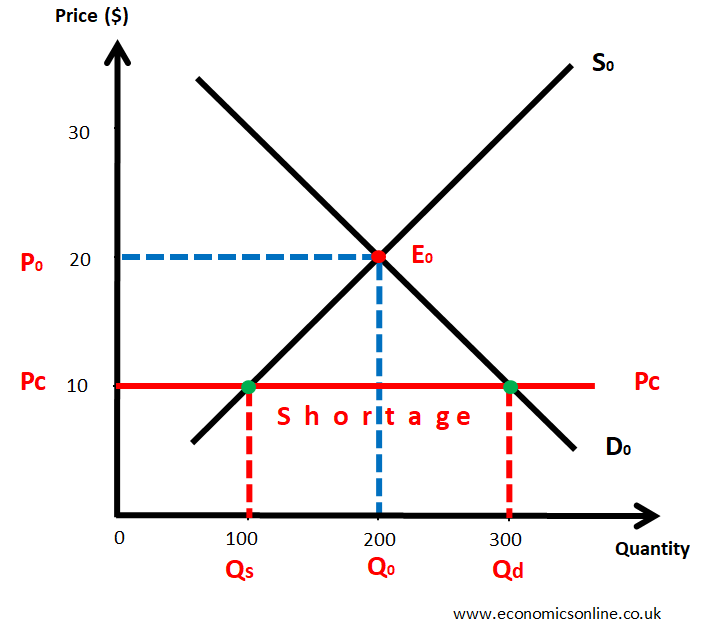

The following diagram illustrates the effects of an effective price ceiling along with its unintended consequences.

In this diagram, equilibrium Price = P0 = $20, Price Ceiling = Pc = $10

Here, the price ceiling is set below equilibrium price, so it is effective. Sellers cannot charge the price of $20 because it is higher than the price ceiling of $10. As a result, a market shortage will be created. The intended outcome is that the price cannot go higher than $10. Hence, customers are protected from being exploited by sellers by charging high prices. The unintended consequences are that shortage will be created in the market, leading to waiting line and the emergence of black markets.

Minimum Wage Law

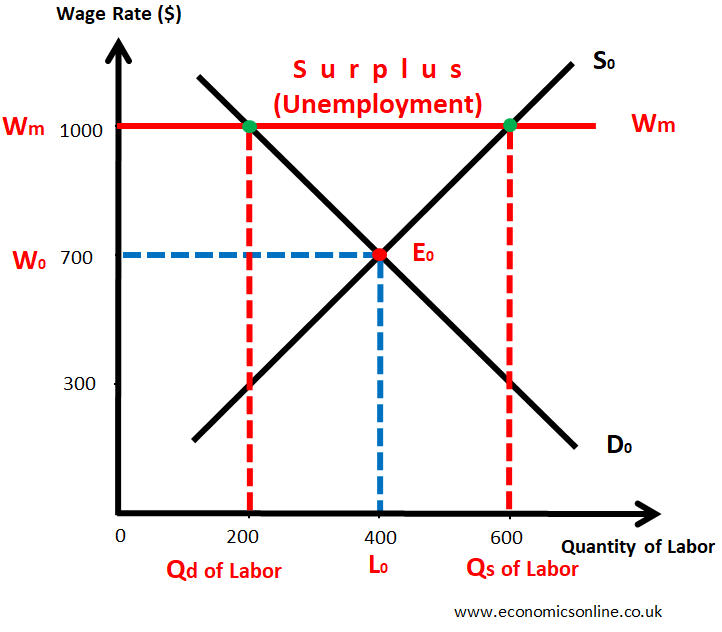

Another example of unintended consequences is the minimum wage law. While this law is used to increase wages and reduce poverty, it can have the unintended consequence of increasing unemployment. This is because employers may choose to reduce the number of employees or hours worked in order to offset the higher labor costs. This is illustrated by the following diagram.

In this diagram, equilibrium wage rate = W0 = $700, Minimum Wage = Wm = $1000

Firms have to pay $1000 to workers instead of $700. This will increase the wage rate of workers, which is the intended outcome. Due to the increase in labour cost, firms will hire less number of workers, which will lead to unemployment. This is the unintended consequence.

Some other sources of unanticipated consequences are described below:

Environmental Regulations

Governments use environmental regulations to protect the environment, but they can have the unintended consequence of increasing costs for businesses and consumers.

Taxation

Tax is the major source of revenue for most governments. Yet, taxation can have unintended consequences, such as discouraging work or incentivizing tax evasion.

Expansionary Fiscal and Monetary Policies

Expansionary Fiscal and monetary policies are used by governments to achieve macroeconomic objectives of economic growth and low unemployment. But, they can have unintended consequences, such as inflation, which can have negative impacts on the economy.

Minimising Unintended Consequences

While it may be impossible to completely eliminate unintended consequences, there are several steps that decision makers can take to minimise their impact:

Conducting Comprehensive Analysis

Before using any economic policy, decision makers should conduct a comprehensive analysis of its potential impact. This should include an assessment of both the intended and unintended consequences of the decision.

Using Market-Based Approach

One way to reduce the risk of unintended consequences is to use a market-based approach. Rather than implementing laws, governments can create incentives that encourage individuals and businesses to make decisions that align with the desired outcomes.

Monitor and Adjust Policies

Decision makers should regularly observe and monitor the impact of their policies and adjust them as needed. This can help identify any unintended consequences early on and make changes to mitigate their impact.

Conclusion

Unintended consequences are a common occurrence in economic decision making, and can have significant impacts on individuals, firms, and the economy as a whole. While it may be impossible to completely avoid unintended consequences, policymakers can take steps to mitigate their impact by conducting comprehensive analyses, using a market-based approach, and regularly observing and adjusting policies as needed. By doing this, decision makers can create economic policies that achieve their intended outcomes while minimizing the likelihood of unintended consequences.