An image of a spiral staircase.

The Circular Flow Diagram

Introduction

Have you ever wondered how our economy works? How do millions of people and businesses in an economy interact with and influence one another? If so, you are not alone. Understanding the workings of the whole economy is not challenging. The economists have developed a model to visually understand the workings of the whole economy in a simplified way. This model is called the circular flow of national income and is an important topic in macroeconomics. In this article, we will explain this model with diagrams.

Circular Flow of Income

The circular flow of income is a model that shows the way factors of production, goods and services, and money circulate in an economy. It is a continuous or circular loop of the flow of inputs, outputs, and money in an economy.

Assumptions

The circular flow of national income has the following assumptions:

- Households own all the factors of production.

- Savings are done in banks.

- There is only a direct tax.

- All of the firms’ output is sold.

Circular Flow Diagram

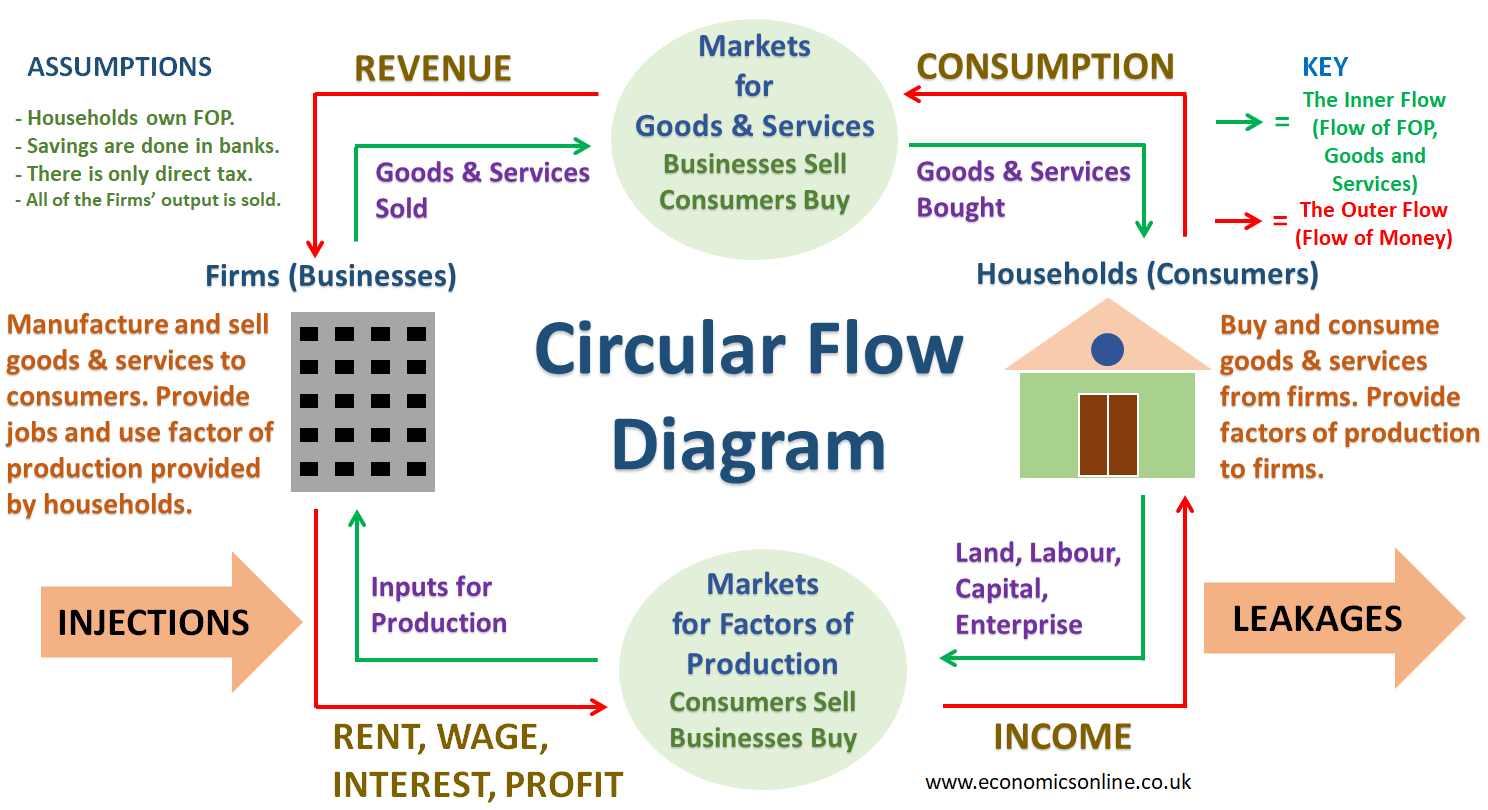

A visual presentation of the circular flow of income in an economy is called a circular flow diagram. This diagram illustrates the flow of factors of production, outputs, and money in an economy. The circular flow diagram is given below.

Understanding the Circular Flow Diagram

In the above circular flow diagram, two main sectors of the economy are shown. These are households and business firms. Households own all the factors of production and provide those factors of production to firms. Firms use these factors of production to produce output in the form of goods and services. Households earn their income from the factors of production that they provide to firms. This income can be in the form of rent, wages, interest, and profit. Households spend money on buying the output (goods and services) produced by firms. Firms also provide employment when they hire labour provided by households. All the factors of production are traded in the factor markets, such as the land market, labour market, and capital market. Goods and services are bought and sold in the product markets.

Types of Circular Flow

The following are two main types of circular flow:

The Inner Flow

The inner flow is the flow of real variables. These real variables are the inputs (factors of production) and the outputs (goods and services). The inner circle is clockwise and is represented by green arrows in the above circular flow diagram.

The inner flow starts with the households that provide factors of production to firms through the factor markets. When firms get these factors of production, they use them to produce goods and services. These goods and services are sold by firms to households through the product markets.

The Outer Flow

The outer flow is the flow of money. This money can be in the form of the income and spending of households and firms. The outer circle is anticlockwise and is represented by red arrows in the above diagram.

The outer flow starts from the firms that pay rewards for the factors of production to the households in the form of rent, wages, interest, and profit. For households, these rewards are their income. This income is spent by households in the form of consumption and becomes the revenue of firms.

Types of Markets in the Circular Flow Diagram

Markets are important elements in the circular flow of income. The two types of markets are explained below.

Product Market

The collection of buyers and sellers of goods and services is called the product market. There are two sides of the product market. On the supply side, there are firms that sell products, while on the demand side, there are households that buy those products.

Factor Market

The collection of buyers and sellers of factors of production (land, natural resources, raw materials, labour, capital) is called the factor market. The land market, the labour market, and the capital market are examples of factor markets. There are two sides of the factor market. On the supply side, there are households that sell factors of production, while on the demand side, there are firms that buy those factors of production.

Sectors of Economy in the Circular Flow Diagram

The simple model of the circular flow shows two sectors of the economy: households and firms. The extended model also includes the government and the foreign sector. These sectors of the economy are explained below.

Households

Households are the individuals who buy goods and services for their personal use. Their spending on buying goods and services is called consumption. Households are the owners of factors of production, provide these resources to business firms, and receive income in the form of rent, wage, interest, and profit. Households are the sellers of factors of production and the buyers of goods and services. In the basic two sector circular-flow model, we assume that households spend all of their income without saving any money. In the extended models, households also use their income for savings, tax payments, and buying imports. These are called leakages, which are explained in the later part of this article.

Firms

Firms are businesses that produce and sell goods and services by using factors of production. Firms are the buyers of factors of production and the sellers of goods and services. Firms are involved in investment, which is their spending on buying capital goods. Firms also create employment or jobs when they hire labour.

Government

The government sector is composed of government owned institutes that regulate the economy. The government receives taxes from individuals and firms. The government is also involved in spending money on public goods and many other projects. This is called government spending. Taxes are leakages, and government spending on the economy is an injection. The leakages and injections are explained in the later part of this article.

Foreign Sector

The foreign sector is composed of the households, firms, and governments of foreign countries. A country is involved in the foreign sector through imports and exports. Imports are leakages, and exports are injections.

Activities of the Sectors of Economy

The following are the economic activities of the sectors of the economy:

Production

Production means making goods and services by using factors of production. Production of goods and services is the activity of the firm's sector.

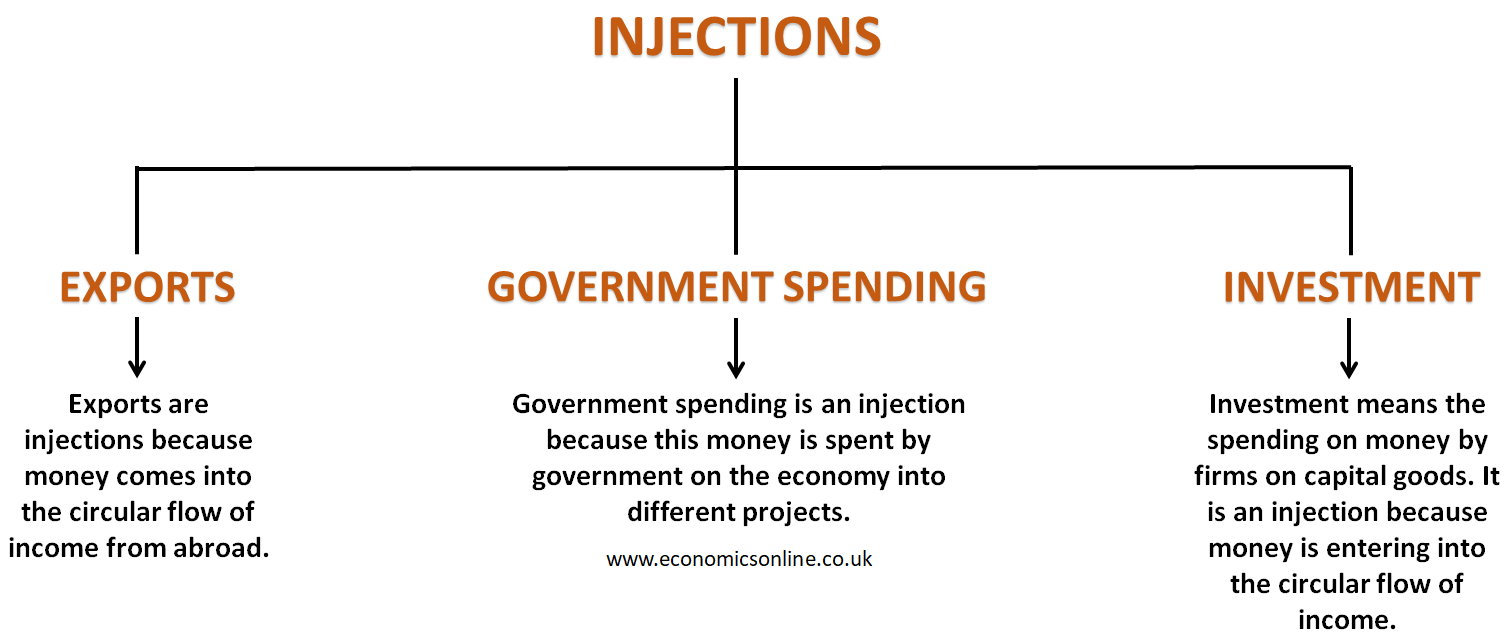

Investment (I)

Investment (I) is the spending of firms on buying capital goods. Investment is an injection and is the activity of the firm's sector.

Consumption (C)

Consumption (C) is the spending of households on buying goods and services for personal use. Consumption is the activity of the household sector.

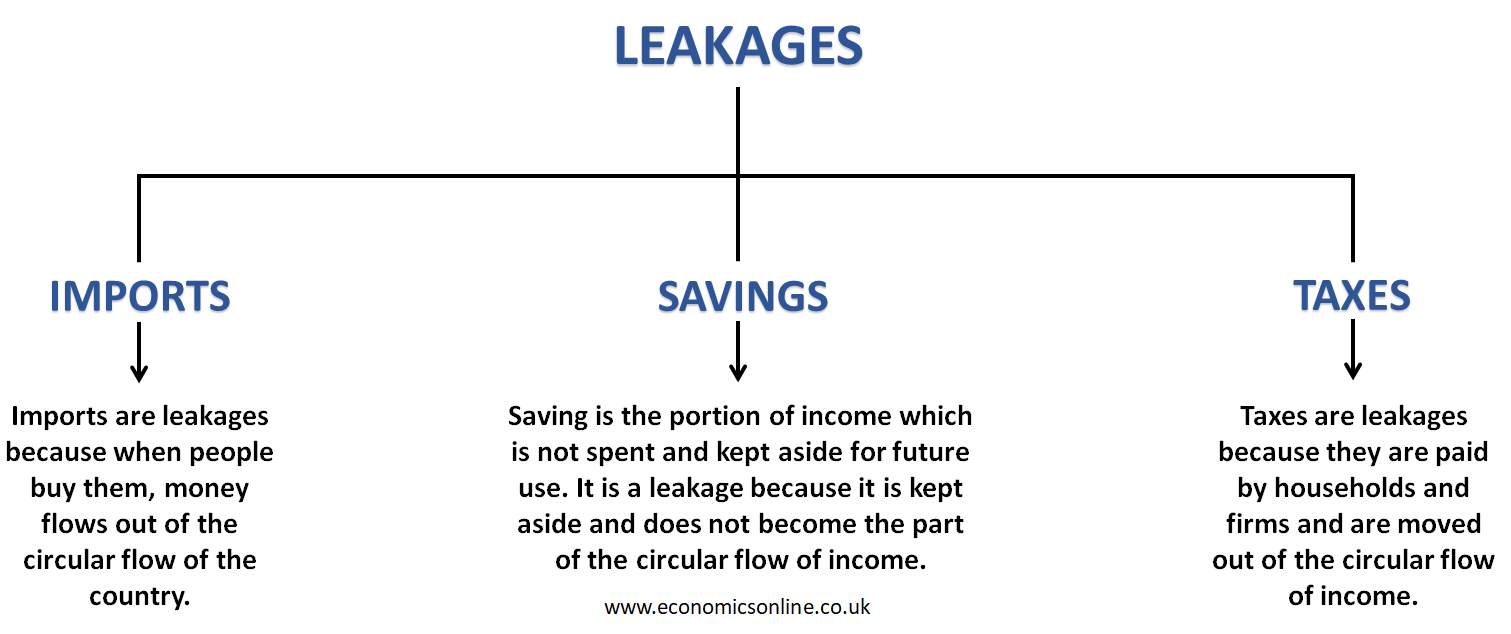

Saving (S)

Saving (S) is the portion of household income that is not spent but kept aside for future use. Saving is a leakage and is the activity of the household sector.

Tax (T)

Tax (T) is the revenue of the government that is received from people and firms. Tax is a leakage and is the activity of the government sector.

Government Spending (G)

Government spending (G) is the spending of the government on public projects. Government spending is an injection and is the activity of the government sector.

Imports (M)

Imports (M) are the value of the goods and services bought by the people of a country from the foreign sector. The money spent on imports is leakage and is an activity of the foreign sector.

Exports (X)

Exports (X) are the value of the goods and services sold by the people of a country to the foreign sector. The money earned from exports is an injection and is an activity of the foreign sector. Net exports (NX) is the difference between the value of exports and the value of imports.

Leakages and Injections in Circular Flow Diagram

Leakages or Withdrawals (W)

A leakage or withdrawal (W) is the money taken out of the circular flow of income. The following diagram illustrates the three types of leakages.

Injections (J)

An injection (J) is the money added to the circular flow of income. The following diagram illustrates the three types of injections.

National Income Equilibrium

The national income is said to be in equilibrium when the value of the national income stays constant and there is no tendency to change. The circular flow model can be used to study national income equilibrium. When leakages are equal to injections, the national income is said to be in equilibrium.

Types of Circular Flow Diagrams

The following are different versions of the circular flow model, which are explained below:

Two-Sector Model

This is the simplest representation of circular flow of income. In this simple circular flow model, only two sectors are considered, i.e., households and firms. This economy will be considered as a free market closed economy because of the absence of the government and the foreign sectors. The only leakage is the savings and the only injection is the investment.

Three-Sector Model

This is the expanded circular flow model. In this model, three sectors of economy are considered, i.e., households, firms and the government. This economy will be considered as a mixed closed economy because of the absence of the foreign sector. The leakages are the savings and taxes while the injections are the investment and government spending.

Four-Sector Model

This is the fullest representation of the circular flow of income. In this model, four sectors of economy are considered, i.e., households, firms and the government and the foreign sector. This economy will be considered as a mixed open economy. The leakages are the savings and taxes and imports while the injections are the investment and government spending and exports.

Importance of Circular Flow Diagram

The following points explain the importance of the circular flow model:

Understanding the Economy

The circular flow model is important in understanding the state of a country’s economy. It presents a clear and simplified picture of complex sectors working in an economic cycle. This diagram illustrates each and every sector, like households, firms, government and foreign sectors, and how they are connected with each other.

Identifying Relationships and Inter-dependencies

The circular flow model, along with providing a simplified picture of how the economy works, also provides the relationship, interdependence and interconnection of multiple sectors in an economy. Households are connected with firms through factor and product markets. Government is connected to households and firms through taxes and government spending. Foreign sector is connected through imports and exports.

Analyzing Economic Activity

Another important point of the circular flow model is that we can analyse the economic activities of a country. A circular flow diagram is an easy and simple presentation of the workings of economic activities such as production, consumption, investment, saving, taxes, imports and exports.

Assessing Income Distribution

The circular flow model makes it easier to assess the income distribution among all the sectors working in an economic cycle. The income distribution starts with households, as they provide factors of production to businesses, and then businesses pay rewards for factors of production (factor income) to the households. Households spend money on buying goods and services. Money is also devotes for savings, taxes and imports. This is how money circulates in an economic cycle.

Limitations of a Circular Flow Diagram

The following are some limitations of the circular flow model:

Simplified Representation

The simplified representation is the major drawback of this concept. This diagram is based on some strict assumptions which limit is usefulness to some extent.

Lack of Dynamic Analysis

The concept of the circular flow of money is a static model. It lacks the dynamic analysis of a country’s economy. Nothing is static in economics; everything is changing within seconds. Ups and downs occur in an economy within short periods of time.

Conclusion

In conclusion, a circular flow diagram is a concept for a basic understanding of the concept of economy and how it works. This concept is useful in understanding the relationship between households, firms, the government and the foreign sector. The concept of circular flow of income is a basic and useful concept in macroeconomics; however, it has some limitations which limit is usefulness to some extent.