Photo by Mathieu Turle / Unsplash

Real vs. Nominal in Economics

Introduction

In economics, the difference between real and nominal values plays an important role in understanding the true dynamics of monetary transactions. The difference between these two concepts is essential for everyone interested in understanding economics.

Defining Real and Nominal

Real Values

Real values refer to the values calculated by using base-year prices, which are adjusted for inflation. Real values provide a more accurate representation of purchasing power over time.

Nominal Values

Nominal values refer to the values calculated by using current-year prices that are not adjusted for inflation. Nominal values represent the raw values of income or output without making adjustments for inflation.

The Role of Inflation

Inflation refers to an increase in the general price level of goods and services in an economy over a period of time. It is a crucial factor that necessitates the use of real values in economics. Nominal values can be deceptive because they may appear to show growth when, in reality, the increase is merely a result of inflation. Real values, adjusted for inflation, allow for a better understanding of economic indicators and trends. The price index is used to calculate the rate of inflation.

Price Index

The price index refers to a number that is used to calculate the changes in the price level of goods and services over a period of time. Normally, a basket of goods is used as a sample to calculate the price index. Some price indices are the Consumer Price Index (CPI), the Retail Price Index (RPI), and the GDP Deflator.

Calculations of Real and Nominal Values

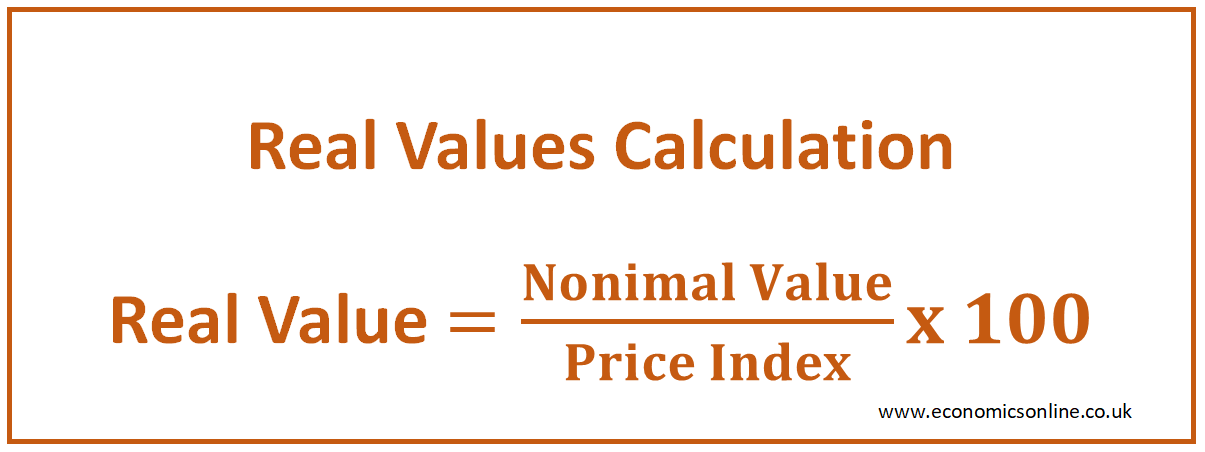

Real Values Calculation

To calculate real values, economists use a base year as a reference point. The formula involves dividing the nominal value by the price index and multiplying the result by 100.

Real Value = (Nominal Value/Price Index) × 100

Nominal Values Calculation

Nominal values are straightforward; they are simply the current market prices or raw data without any adjustment for inflation.

Examples of Real and Nominal Values

Nominal GDP vs. Real GDP

GDP stands for gross domestic product. GDP refers to the market value of all final goods and services produced within a country in one year.

Nominal GDP refers to the total market value of all final goods and services produced within a country in one year without adjusting for inflation. While nominal GDP is easier to calculate, it may not accurately reflect changes in economic output if inflation is present.

Real GDP refers to a measure of a country's output that is adjusted for inflation. It provides a more accurate representation of the actual growth in the economy by accounting for changes in the price level over time. Economists use a base year as a reference point to adjust nominal GDP for inflation.

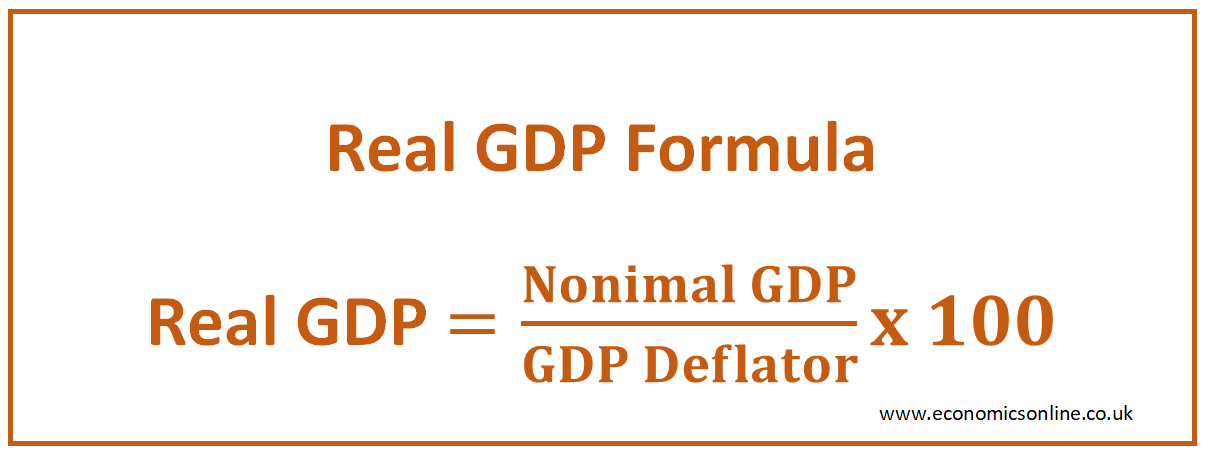

Calculating Real GDP from Nominal GDP

The following formula is used to calculate real GDP from nominal GDP.

Real GDP = (Nominal GDP/GDP Deflator) × 100

For example, if a country's nominal GDP is $100 billion and the GDP deflator is 125, the real GDP would be $80 billion.

Real GDP = ($100 billion / 125) x 100 = $80 billion.

Nominal GDP is calculated by using current-year prices, while real GDP is calculated by using base-year prices. An increase in real GDP indicates economic growth in a country.

Nominal Interest Rate vs. Real Interest Rate

Nominal interest rate is the rate quoted by lenders on loans to borrowers without making adjustment for inflation, while real interest rate is the interest rate after making adjustment for inflation.

Calculating Real Interest Rate from Nominal Interest Rate

Mathematically, real interest rate is calculated by subtracting the rate of inflation from the nominal interest rate.

Real Interest Rate = Nominal Interest Rate – Inflation Rate

For example, if the nominal interest rate is 12% and the rate of inflation is 3%, then the real interest rate will be 9%. The difference between the nominal rate and real rate is the rate of inflation.

Real Interest Rate = 12% - 3% = 9%

Nominal Income vs. Real Income

Nominal income refers to the income of a person expressed in terms of money, while the real income refers to the income of a person in terms of purchasing power. Real income gives the quantity of a product which money income can buy.

Calculating Real Income from Nominal Income

The following formula is used to calculate real income from nominal income.

Real Income = Nominal Income/Price

For example, if the nominal income or nominal wage or salary of a person is $800 and the price of a product is $10, then the real income or real wage will be

Real Income = $800/$10 = 80 units of the product.

It means the purchasing power of nominal income of $800 is 80 units of the product.

Now if the nominal income is increased by 20% from $800 to $960 and the rare if inflation is 5%, the increase in real income will be of 15%.

Advantages and Disadvantages of Real and Nominal Values

Advantages of Real Values

- Real values provide a more accurate representation of economic performance.

- Real values facilitate meaningful comparisons across time periods.

- Real values are needed for policy planning and decision-making.

Disadvantages of Real Values

- Real values need historical data for inflation adjustments.

- Real values are difficult to calculate as compared to nominal values.

Advantages of Nominal Values

- Nominal values are simple to understand and calculate.

- Nominal values can be used for short-term analysis.

Disadvantages of Nominal Values

- Nominal values can be misleading due to inflation effects.

- Nominal values have a limited use in providing a true reflection of economic trends.

Comparing Real and Nominal Values

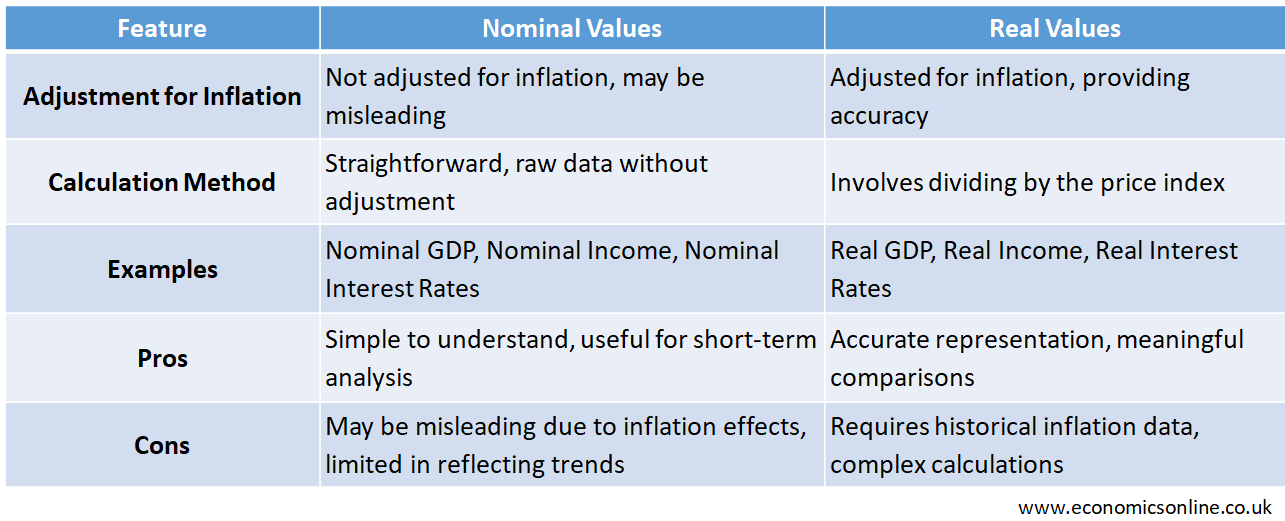

The following table contains the main points of difference between nominal values and real values.

Conclusion

In economics, distinguishing between real measurements and nominal measurements is important for understanding economic statistics and making better economic decisions. Whether analysing GDP, interest rates, or income, understanding the effect of inflation and calculating real values help in avoiding mistakes that occur due to inflationary noise.