An image of a balance with two boxes of different sizes.

Money Illusion

What is Money Illusion?

Money illusion refers to the tendency of people to view their income and wealth in nominal terms instead of real terms. In other words, money illusion, or price illusion, is a mental perception or a cognitive bias in which people view their income and wealth without taking into account the effect of inflation on the value of money. Due to money illusion, people wrongly perceive that their income or accumulated wealth is worth the same or even increased as compared to the previous year, which can lead to wrong decision-making. In any illusion, people perceive things in a way that is different from reality. Similarly, in money illusion, people make decisions based on the nominal value of money, which is different from the real value of money.

Origin of the term Money Illusion

Talking about the origin of the term money illusion, this term was coined by American economist Irving Fisher and popularised by British economist John Maynard Keynes.

Nominal Terms vs. Real Terms

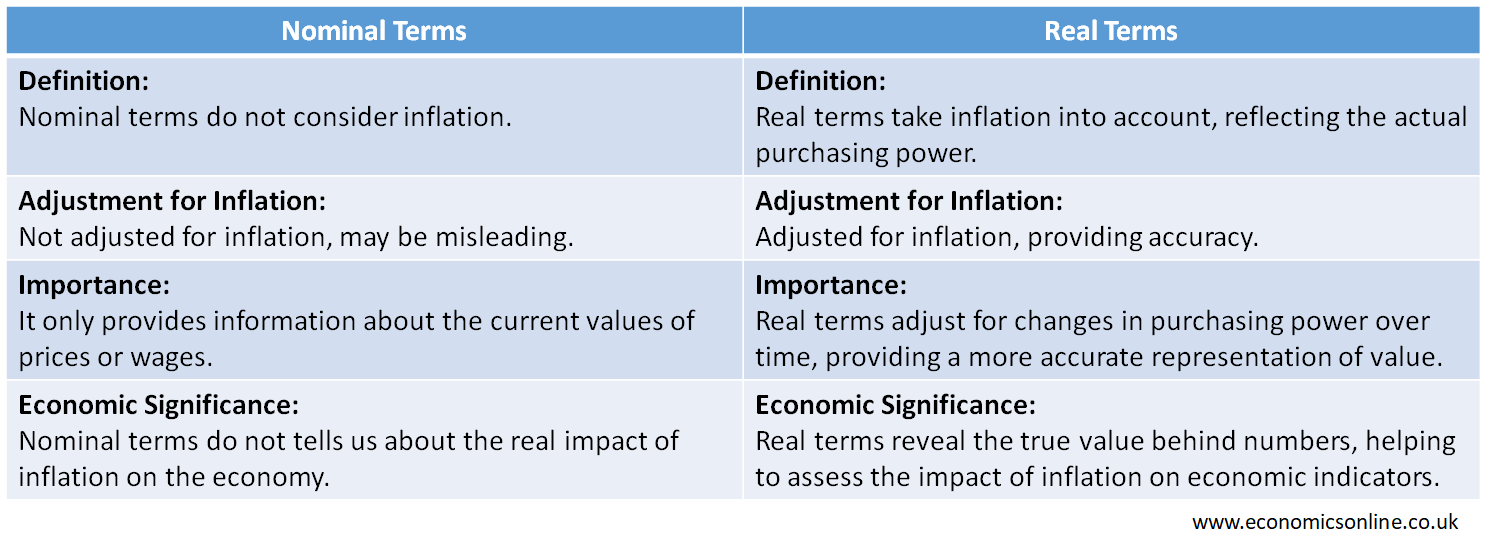

A nominal term is the one that consists of values without the adjustment of inflation. A real term is the one that consists of values adjusted for inflation. Both terms are important in understanding the concept of money illusion. The following table illustrates the main points of difference between nominal terms and real terms.

Inflation and the Value of Money

Inflation is an increase in the general price level of goods and services over a period of time. The value, or purchasing power, of money decreases with inflation. Suppose that Mr. A has $100 in his pocket. The value or purchasing power of this $100 is the number of units of a product that can be bought with this amount of money. Due to inflation, the purchasing power of this $100 decreases as fewer units of the same product can be bought with this amount. Suppose that the price of a soft drink is $2 in the year 2022. Mr. A can buy 50 bottles of the soft drink by using $100. Now, suppose that the price of the same soft drink is increased to $4 in 2023. Now, Mr. A is able to buy only 25 bottles of the same soft drink. The purchasing power of $100 is decreased from 50 bottles to 25 bottles of the same soft drink in one year. Money illusion occurs when people ignore this fall in the value of money and perceive that it is the same $100 with the same value. However, in reality, the value of money has been halved due to inflation.

Understanding Money Illusion

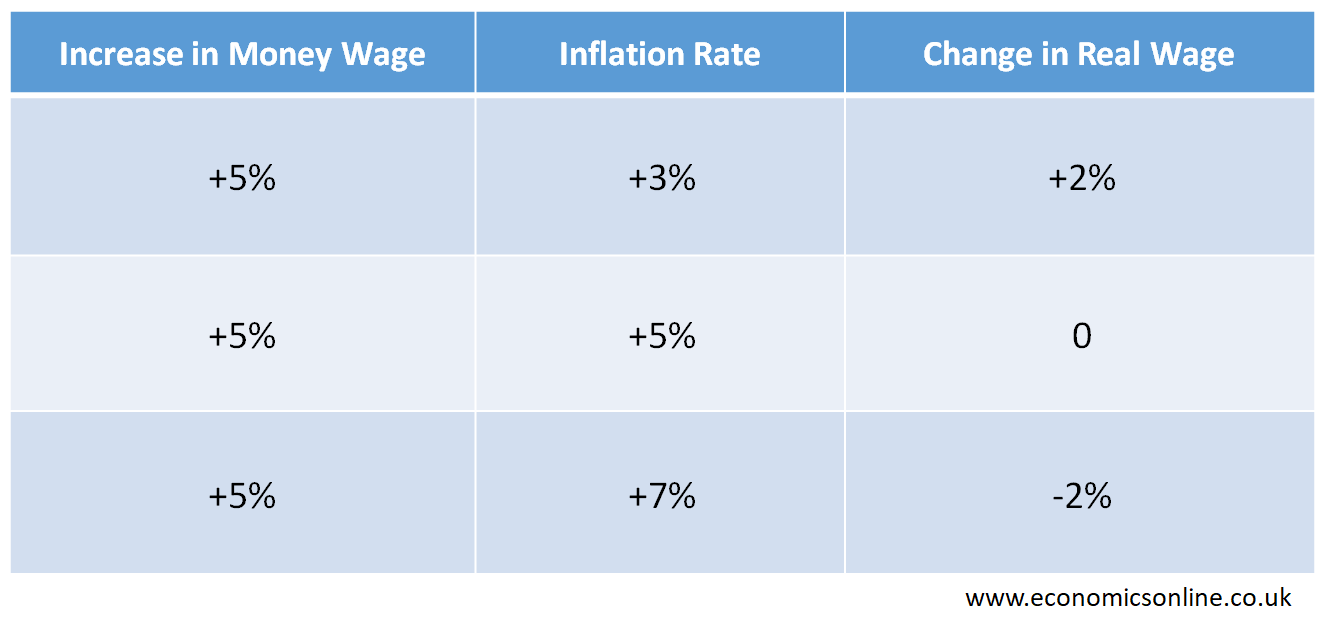

Let’s understand money illusion with another example. Assume an employee gets an increment in his money wage (nominal salary or nominal income) by 5%, as shown in the following table.

In the above table, the change in real wage is calculated by subtracting the rate of inflation from the rate of increase in money wage. Now, whether the real wage of the employee is increased, stays the same, or decreases, it depends on the rate of inflation. When the rate of inflation is 3%, the real wage increases by 2%. When the rate of inflation is 5%, the real wage is not changed, and when the rate of inflation is 7%, the real wage is decreased by 2%. In money illusion, employees will ignore the rate of inflation and make spending decisions based on the 5% increase in the nominal wage. If the inflation rate is ignored, the employee will think that he has more income and can increase spending, but in reality, his real wage might have stayed the same or fallen. Even if the real wage is increased, its rate of increase is lower than the rate of increase of the nominal wage. Ignoring any changes in the real wage and making decisions on the basis of an increase in the nominal wage is called a money illusion.

Causes of Money Illusion

The following are some causes of money illusions:

Perception of Nominal Changes

Due to money illusion, people form false perceptions about changes in nominal prices or nominal wages, but the changes in real prices or real wages are different.

Lack of Economic Understanding

Lack of financial education and economic understanding can lead to money illusion because people are not aware of the effects of inflation on money, wages, and their accumulated wealth.

Psychological Factors

Psychological factors like cognitive biases can affect an individual’s perception of changes in the monetary value of goods or services. When people get more money, they perceive this as an increase in the real value of money. This cognitive bias may be due to a lack of information about the prices of goods and services, which causes a money illusion.

Habituation in Past Prices

People become habitual about prices or wages as they are not changed for a specific period of time. People have the perception that nominal changes are real changes, but in reality, this is not true. People struggle to adjust their finances according to recent economic conditions due to price stickiness or wage stickiness.

Influence of Marketing and Advertising

Nowadays, the majority of individuals are highly influenced by marketing and advertising strategies through social media platforms. They tend to make decisions under the influence of marketing campaigns and ignore changes in inflation. This causes a money illusion.

Social Comparisons

Comparing the social statuses of each other can lead to a money illusion as people compare nominal values of things instead of real monetary values.

Behavioral Economics

Behavioural economics says that people don’t always act rationally. This lack of rationality is attributed to factors such as emotions and mental conditions that can cause money illusions, as people make false perceptions of money based on their emotions or mental state.

Framing Effect

People’s perceptions about money or changes in prices or wages can be affected by how information is presented to them (the framing effect).

Anchoring Bias

People stick to the prices that were in the past, causing a situation of money illusion as they have an anchoring bias in their behaviour to past prices rather than focusing on inflation and scarcity.

Impact of Money Illusion on Economic Behavior

The following are some of the major impacts of money illusions on economic behavior:

Influence on Spending Habits

Money illusion can influence the spending habits of individuals as they spend money focusing on nominal values of prices or wages rather than real values.

Perception of Wealth

When people see their wealth in nominal terms, they may have wrong perceptions about it. This can lead to wrong decisions about savings and investments.

Decision Making in Financial Matters

Money illusion negatively affects the decision-making power of individuals in their financial matters, such as spending, savings, investments, and many more. People randomly select an option, considering it a better option but not suitable for long-term benefits.

Money Illusion and the Phillips curve

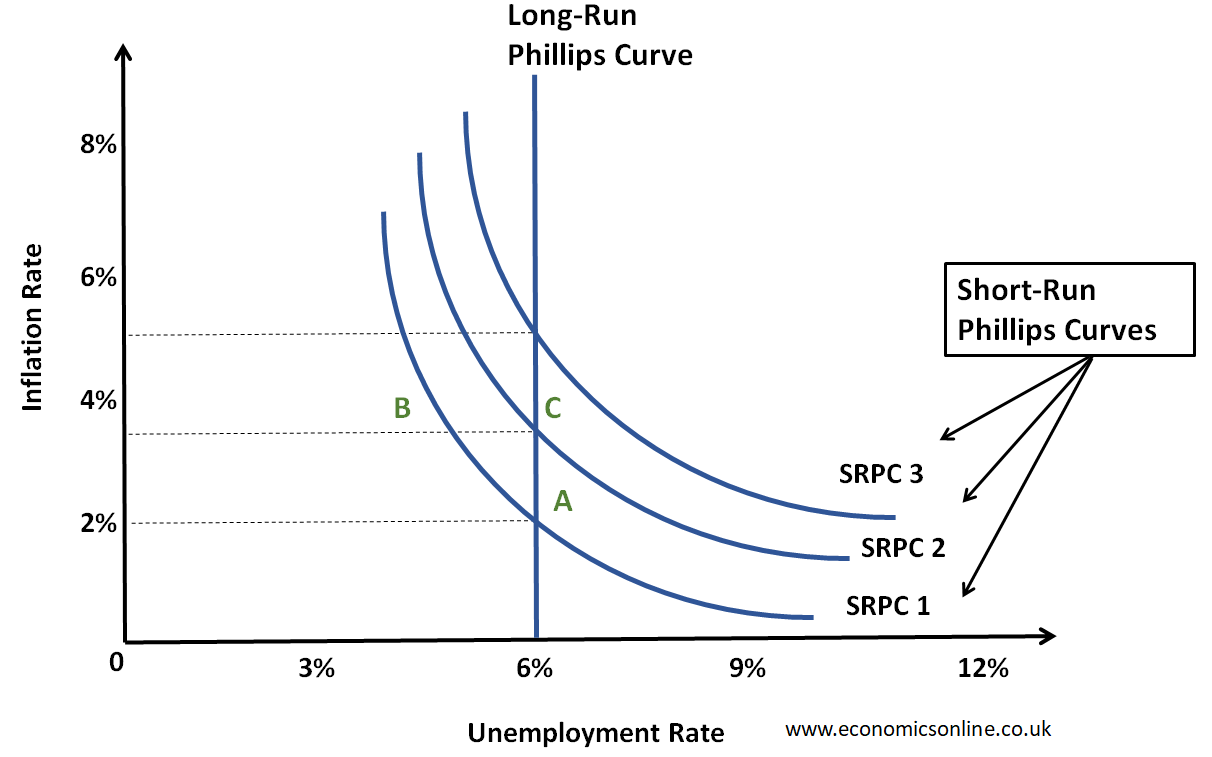

The relationship between inflation and unemployment can be explained with the help of the Philips curve. Let’s consider the following graph:.

In the above graph, the unemployment rate is taken on the horizontal axis (x-axis) and the inflation rate is taken on the vertical axis (y-axis). The constant vertical curve is the long-run Phillips curve, which explains that there is no impact of inflation on unemployment in the long run. The initial equilibrium is at point A, with an inflation rate of 2% and an unemployment rate of 6%. Now suppose that the government has increased the money supply as part of an expansionary monetary policy. The unemployment rate will decrease and inflation will increase from point A to point B due to money illusion. But in the long run, when people realise a higher inflation and get out of the money illusion, they will ask for wage increases, which will increase unemployment again from point B to point C.

Money Illusion and Expectations

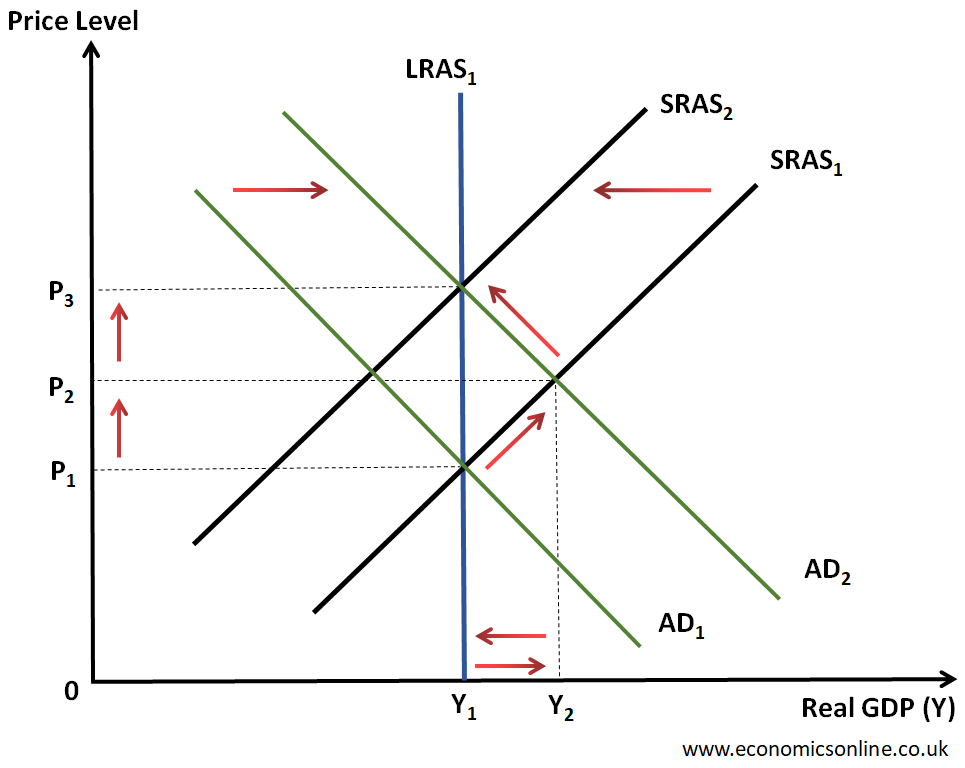

Neo classical economists, such as Milton Friedman, believed that people suffer from money illusion in the short run only. This is illustrated by the following diagram.

In this graph, we have real GDP (Y) on the x-axis and the price level on the y-axis. The vertical curve is the long-run aggregate supply curve, which shows that changes in money supply have no impact on real output in the long run. Money illusion has an impact only in the short run. When the money supply is increased, people increase their spending due to money illusion, which shifts the aggregate demand curve from AD1 to AD2. This also creates inflation. When people realise inflation and get out of the money illusion, they ask for a wage increase, leading to a fall in short run aggregate supply. So the real output increases only in the short run but not in the long run.

Conclusion

In conclusion, money illusion is an economic theory that explains people’s perceptions along with the reality of the economic world. Understanding of money illusion helps people become aware of the economic changes in the country. It also helps people avoid making false perceptions about changes in the real world and, hence, make better financial decisions.