Photo by Alicia Christin Gerald / Unsplash

Loss Aversion Definition

Definition

A propensity in behavioural finance in which investors are so fearful about their losses that they focus on minimising or eliminating losses more instead of focusing on making gains is called loss aversion. The more a person faces losses, the more he is prone to loss aversion. According to some latest research, investors feel the pain of loss twice as much as they feel enjoyment from making gains.

According to neuroscientists, one part of our brain is called the amygdala, which processes anxiety and fear. Another part of the bran is called the insula, which reacts to disgust. The expectation of loss activates the amygdala and insula, which create strong negative emotions leading to loss aversion.

In behavioral economics, it is a phenomenon in which a potential loss is perceived by individuals as psychologically and emotionally more severe than a potential gain. The pain of losing $500 is more severe than the gain of the same amount.

Examples

The following are some examples of loss aversion:

Investing in Low Return

Investors prefer to invest in low-return, guaranteed investments as compared to more promising investments that contain relatively higher risk.

Free Trial Periods

Companies can benefit from loss aversion by offering free trial periods. Once a consumer uses a product, they become more willing to purchase the same product they used. For example, a supermarket used the strategy of providing a free month- long trial period of free delivery. When consumers get used to this free service of providing groceries at the door, they don’t want to give up this opportunity, so they willingly pay premiums.

Explanation

Cognitive Bias

Nobody in this world wants to lose money. The fear of realising a loss can trigger an investor to hold on to a certain investment for a long time in the expectation of getting some gain after holding a stock too long, a cognitive bias also known as the disposition effect.

Behavioural Economics

Behavioural economics also claims that it is clear that humans are bound by loss aversion. Some psychological studies also state that the pain of losing is twice as much as the pleasure of gaining profit.

Loss Psychology

Loss psychology may be a main cause of the asymmetric volatility phenomenon that occurs in the stock market, where equity market volatility is higher in the declining market as compared to other markets.

Prospect Theory

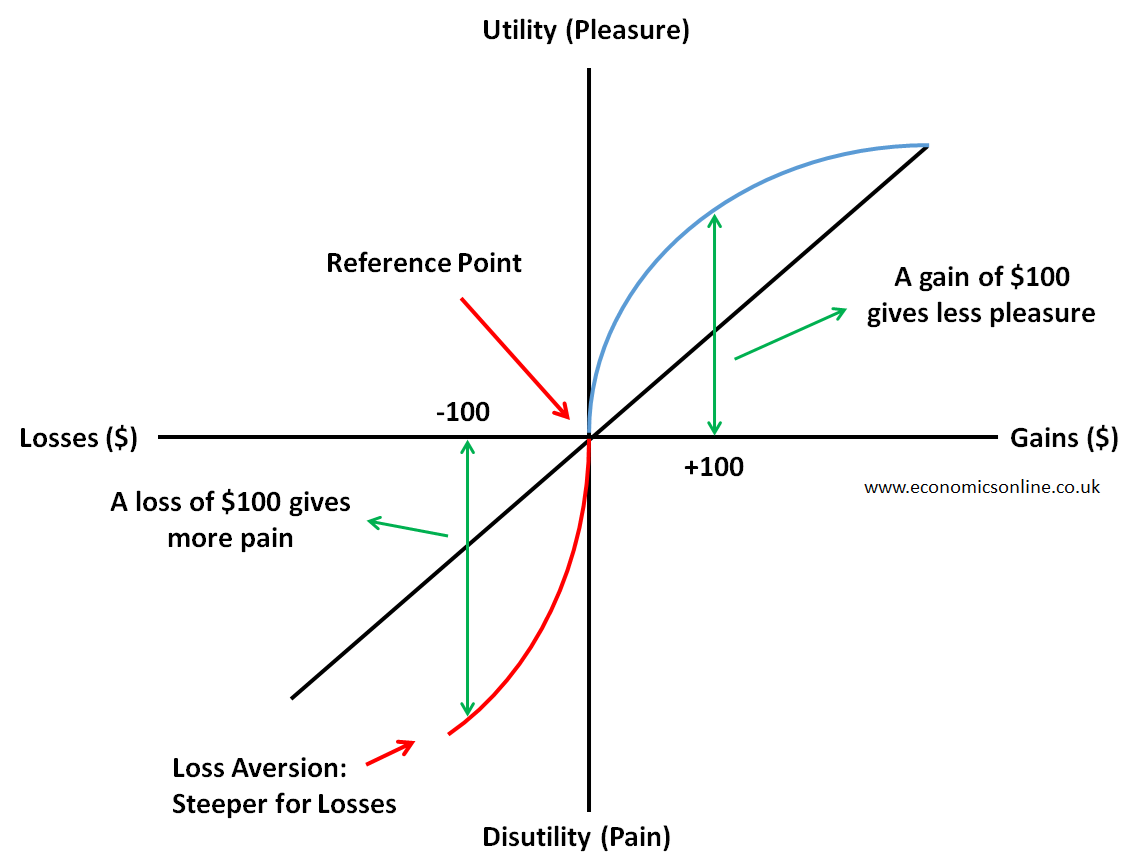

According to the prospect theory, people prefer avoiding losses to acquiring gains. This level of loss aversion is so strong that it can cause a negative bias. In these types of situations, investors focus more on bad news than on good news, which causes them to miss out on bull markets and panic when markets sell off.

In this graph, the loss aversion curve is steeper than the gain curve. This is because individuals feel more pain from loss as compared to the pleasure of gains. A gain of $100 gives less pleasure, while a loss of $100 gives more pain.

Historical Background

The cognitive mathematical psychologist Amos Tversky was the one who first identified the concept of loss aversion with his associate and Nobel Prize winner Daniel Kahneman. The concept was first identified in 1979 in a paper on subjective probability, but it was described in 1992 when criticising the idea behind this bias: individuals act differently in response to positive and negative changes. He and his associate explained that the losses are twice as powerful as the gains. This is the basic concept of prospect theory.

Strategies to Avoid Losses

The following are some strategies that explain how businesses and individuals can minimise their risk and exposure to losses:

Hedging

The hedging technique is used to minimise losses. In order to hedge an existing investment, investors make another investment that is inversely correlated with the first investment. In this way, investors reduce their exposure to losses.

Guaranteed Rate of Return

Investors should invest in products or investments that have a guaranteed rate of return, such as insurance products.

Government Bonds

Investors should invest in government bonds because they have fewer chances of becoming abandoned.

Low Price Volatility

Investors should purchase those investments that have relatively low price volatility as compared to other risky investments.

Consciously Remain Aware

Investors should consciously remain aware of their loss aversion, as it is a potential weakness for their investing decisions.

Strong Balance Sheet

Investors should invest in companies or stocks that have strong balance sheets and cash flow. Perform due diligence or rational analysis to make sure the investment is profitable or not. Only invest in those investments that have the guaranteed potential to gain profits.

Ways to Reduce Loss Aversion

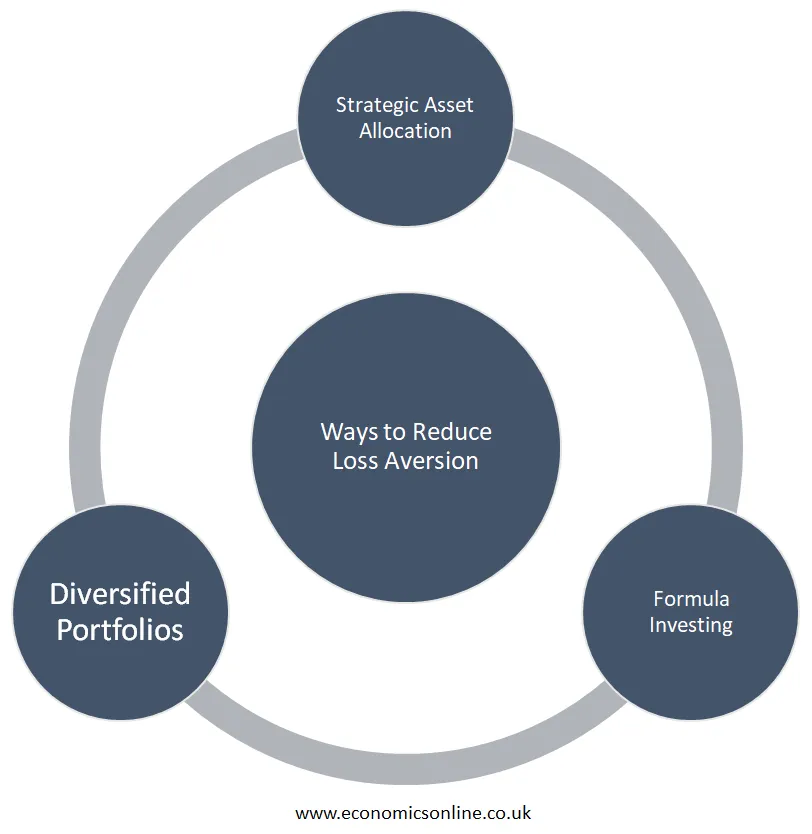

The following are some ways to reduce loss aversion:

Strategic Asset Allocation

A way to avoid psychological traps of loss aversion is to follow a strategic asset allocation strategy. Instead of trying to perfectly time market sentiments and being annoyed by letting their competitors run, investors are suggested to revise and rebalance their portfolios from time to time according to a certain methodology.

Formula Investing

It is another form of strategic investing. With the help of constant ratio plans, aggressive and conservative portfolios can be set at a fixed ratio. In order to maintain the target weight of a stock or bond, the portfolio is periodically rebalanced. This can be done by selling outperforming assets and buying underperforming ones. This can create pro-cyclic momentum for investing.

Diversified Portfolios

Another way to tackle loss aversion is to build a diversified portfolio and use buying and holding strategies. Another way of investing is to use smart beta strategies, for example, equal weight portfolios, in order to avoid inefficiencies that dig into index investing due to reliance on market capitalization. Factor investing is also a widely used strategy for reducing market risk factors.

Causes of Loss Aversion

The following are the two main causes of loss aversion:

Individual Effects

Loss aversion can significantly affect a person’s decision-making process because, as humans, it is our natural tendency to overcome or avoid incurring losses in our course of action. But this fear prevents us from taking even well-calculated risks with potential profit gains. Loss aversion is related to how we spend and manage our money. Financial decisions have significant impacts on our lives, which mean that if we fail to make fair decisions with our finances, then our choices can be destructive and harmful. However, some wealthy people and powerful individuals are less loss averse. These powerful people find it easy to accept losses and are more success driven.

Systemic Effects

Loss aversion prevents corporations, individuals, and even countries from making decisions under complex challenges. Avoiding danger is a good practice, but it prevents us from making innovative solutions. For example, before COVID-19, Brazil was well known for its ground-breaking strategies for solving complex pandemic problems. Brazil also has unique tactics to overcome poverty and reduce insufficient funding as compared to wealthier countries.

Artificial Intelligence and Loss Aversion

Artificial intelligence is used to make better decisions. When a person approaches a dilemma, he prefers to evaluate his options with a tendency to overestimate losses and underestimate gains, but machine learning algorithms always approach the dilemmas in a productive way, as they used to make predictions based on statistical patterns. By using this method, it equally weighs both losses and gains, allowing the software to precisely calculate our net benefit from our choices. But it doesn’t mean that we completely rely on AI for every single analysis of decision; it can be helpful when we feel that loss aversion is affecting our decisions.

Conclusion

In conclusion, loss aversion is linked with a person both psychologically and emotionally. The pain of loss is twice as great as its equivalent gain. People exhibit different intensities of reactions to negative and positive changes. Amos Tversky and his associate Daniel Kahneman first proposed this concept when they were explaining the cognitive bias behaviour of human psychology and decision theory. Loss aversion can be mitigated by using multiple strategies, such as formula investing, strategic allocation of assets, and diversifying portfolios.