An image of a person under the burden of loan.

Leverage Ratios Explained

Introduction

Different stakeholders are interested in the activities of business firms. These stakeholders include owners, managers, employees, investors, banks, suppliers, customers, and pressure groups. These parties need financial information to make various decisions. Business firms produce various financial statements (income statement, balance sheet, and cash flow statement) to provide information to these stakeholders. Accounting ratios give further financial information to these stakeholders so that they can make quality decisions. In this article, we will discuss leverage ratios.

What are Leverage Ratios?

Leverage means the extent to which a business firm is financed by loans. Leverage ratios are accounting ratios that are used to measure the extent to which a business firm is financed by loans and the ability of a business to pay interest. These ratios are also called gearing ratios or financial leverage ratios. Leverage ratios help companies manage their financial risks and provide strategies to meet their debt burden. Financial investors and shareholders use leverage ratios to assess the financial health of companies.

Common Leverage Ratios

There are many leverage ratios, but, the most common leverage ratios are given below.

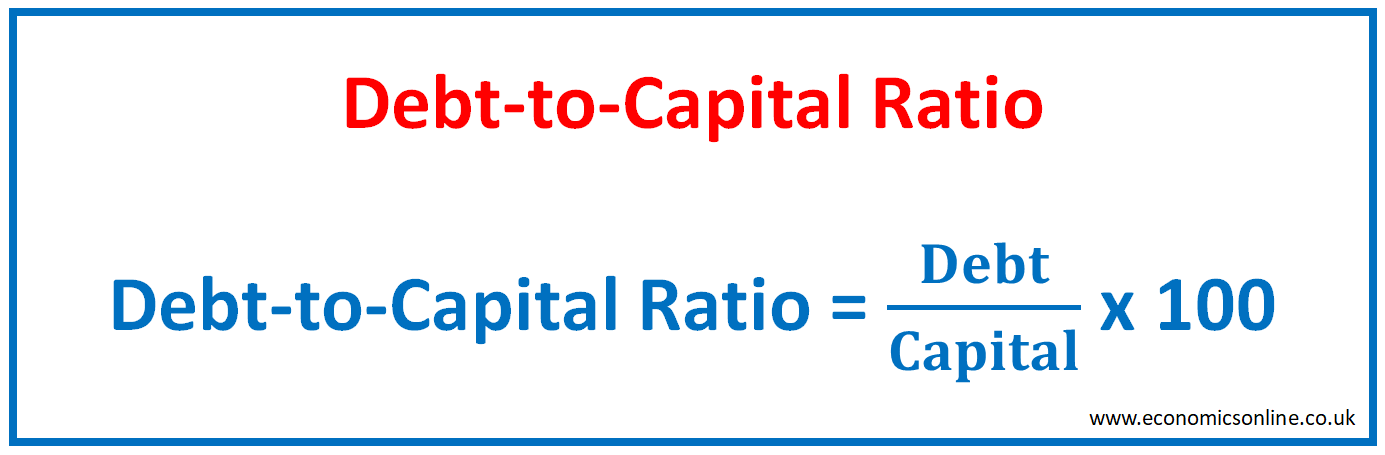

Debt-to-Capital Ratio

A type of financial leverage ratio that compares the total amount of a company's debt to the total capital employed is known as the debt-to-capital ratio. This ratio tells us about the company’s capital structure and the portion of financing that directly comes from debt. Here is the formula to calculate the debt-to-capital ratio.

Debt-to-Capital Ratio = (Debt / Capital) x 100

Now let’s take an example to understand the debt-to-capital ratio.

Suppose that a car manufacturing company has a total debt of $30m and the total capital employed in the business is $50m. It means that total shareholders' equity is $20m. The debt-to-capital ratio is calculated as follows.

Debt-to-Capital Ratio = (Debt / Capital) x 100 = ($30m / $50m) x 100 = 60%

The interpretation of this 60% is that out of every $100 capital invested in the car manufacturing company, $60 has come from long-term debt or a loan. If the debt-to-capital ratio is above 50%, the business is said to have high leverage.

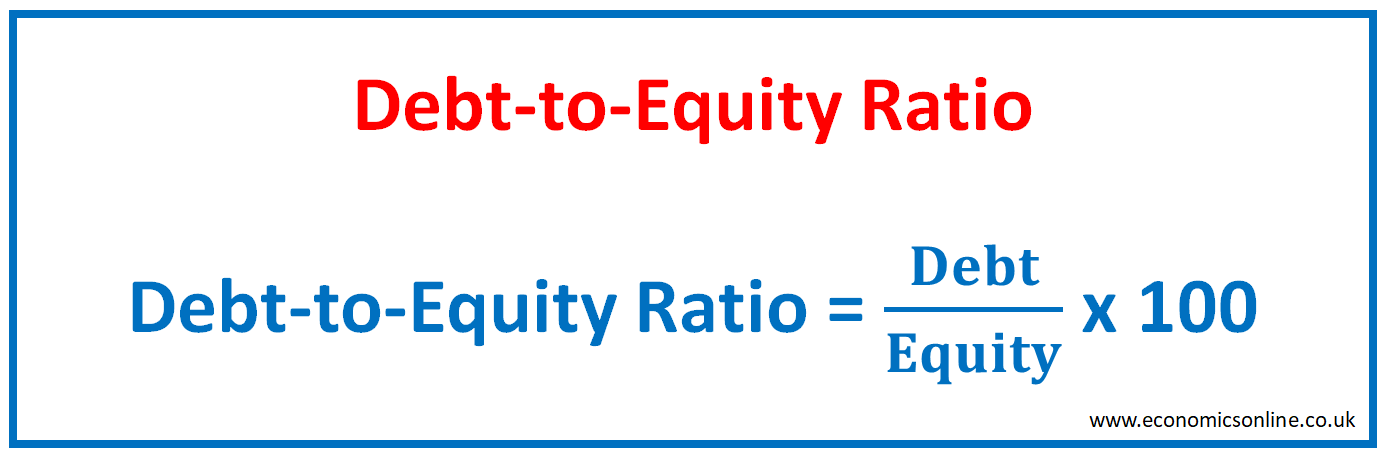

Debt-to-Equity Ratio

A type of leverage ratio that compares the total amount of debt of a company to the total equity of its owners or shareholders is known as the debt-to-equity ratio. This is an alternate leverage ratio. Here is the formula to calculate the debt-to-equity ratio.

Debt-to-Equity Ratio = (Debt / Equity) x 100

Now let’s use the above mentioned example of the car manufacturing company to calculate the debt-to-equity ratio.

Debt-to-Equity Ratio = (Debt / Equity) x 100 = ($30m / $20m) x 100 = 150%

The interpretation of this 150% is that, compared to every $100 investment coming from owner’s or shareholders equity, $150 has come from debt or a loan. If the debt-to-equity ratio is above 100%, the business is said to have high leverage.

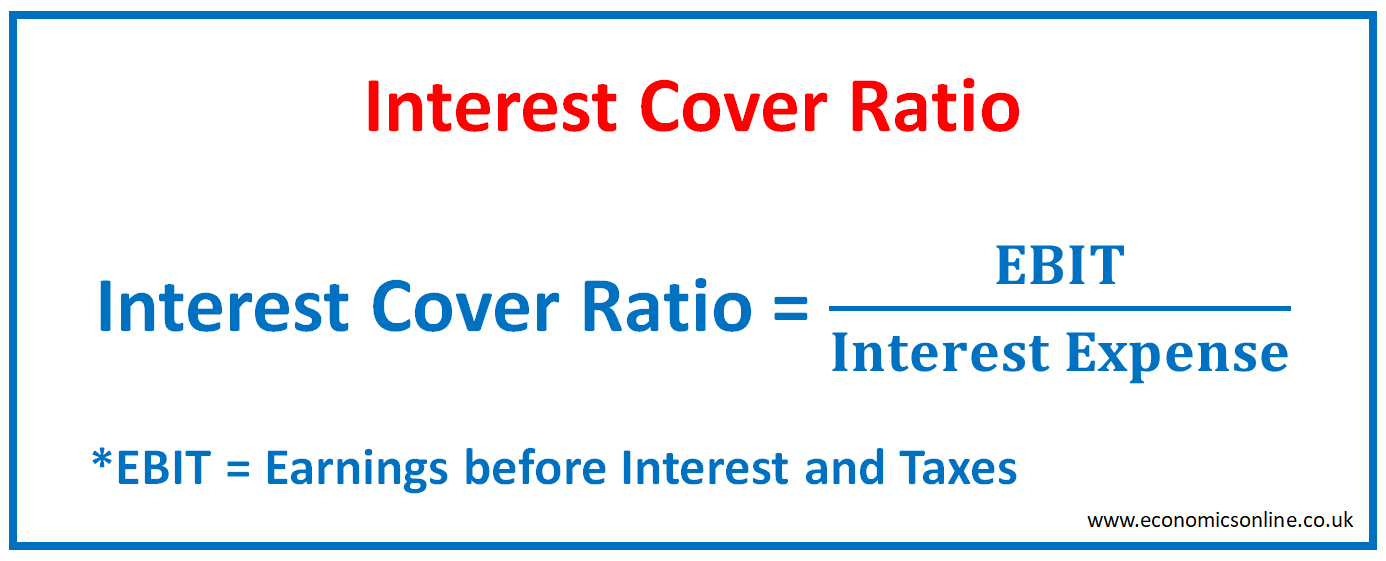

Interest Cover Ratio

A type of financial leverage ratio that explains the company’s ability to pay or cover its interest expenses with its operating income is known as the interest cover ratio or interest coverage ratio. This ratio measures the ability of a business firm to pay its interest expense and shows how easily a company can make its interest payments. Here is the formula to calculate the interest cover ratio.

Interest Cover Ratio = EBIT / Interest Expense

*EBIT = Earnings before Interest and Taxes

The interest cover ratio shows the number of times interest expenses could be paid out of EBIT.

Now let’s take an example to understand the interest cover ratio.

Suppose that a car manufacturing company has EBIT of $25m and the interest expense of $5m. The interest cover ratio calculations are shown below.

Interest Cover Ratio = EBIT / Interest Expense = $25m / $5m = 5 times

The interpretation of 5 times is that the interest expense can be paid 5 times out of the earnings before interest and tax. A higher interest cover ratio means that the interest expense can be paid more easily.

Other Types of Leverage Ratios

The following are some other types of leverage ratios:

Debt-to-Assets Ratio

A type of financial leverage ratio that measures the percentage of a company’s total assets that are financed by debt is known as the debt-to-assets ratio. This ratio provides information about a company’s financial structure and its dependence on debt financing. Here is the formula to calculate the debt-to-assets ratio.

Debt-to-Assets Ratio = (Debt / Assets) x 100

Asset-to-Equity Ratio

This ratio compares the total assets of a business with its total equity. Here is the formula to calculate the asset-to-equity ratio.

Asset-to-Equity Ratio = (Total Assets / Total Equity) x 100

A high asset-to-equity ratio indicates high leverage in the business.

Operating Leverage Ratio

Operating leverage ratio refers to the ratio between a company’s fixed costs and variable costs, which are used to manage its operations. If the fixed costs (FC) of a business firm are higher than the variable costs (VC), the business is said to have high operating leverage. Here is the formula to calculate the operating leverage ratio.

Operating Leverage Ratio = % Change in Operating Income / % Change in Revenue

Companies with a high operating leverage ratio, have higher fixed costs as compared to variable costs and are considered capital intensive. In such business firms, a small change in sales will bring about a large change in operating income.

Financial Leverage

As explained above, financial leverage means the proportion of loans or debts in the total capital of a business. A high level of financial leverage means that a business relies more on loans to finance its operations as compared to the owner’s equity. This can increase return on equity (ROE) and earnings per share (EPS) provided that the earnings of the business are greater than the interest on loans.

Combined Leverage

Combined leverage consists of both operating and financial leverage. Stakeholders may use combined leverage to assess the financial position of a business and make better decisions.

Bank Leverage

Bank leverage is the amount of money banks can advance as loans to borrowers as compared to the cash reserves held as capital in their vaults. For example, if a bank has a leverage ratio of 5%, it can lend $20 as a loan against every $1 kept as a reserve. A low leverage ratio means that the bank can lend more money for every $1 held as reserve, and in this case, the bank can make more profits.

Significance of Leverage Ratios

The following points explain the importance of leverage ratios:

Assessing Financial Risk

The financial leverage ratio is used to assess the worth of a company’s financial risk by estimating the value of debt compared to the company’s equity or assets. A high company’s leverage means that there is greater financial risk, which indicates that the business has a higher burden of debt.

Determining Solvency

Investors and shareholders can evaluate the potential of a company to meet its debt obligations by measuring its leverage ratio. A low level of solvency means that the relevant company is less dependent on debt financing, as indicated by a low leverage ratio.

Evaluating Capital Structure

The leverage ratio is used to evaluate the capital structure of a company. This capital structure shows the total portion of debt and equity that is used for financing the business. The leverage ratio helps to maintain a balance between debt and equity in a company.

Comparing Performance

By comparing the leverage ratios of different companies and businesses, we can evaluate their financial position. The leverage ratio helps to indicate the amount of debt and equity companies use to perform their operations.

Making Informed Investment Decisions

With the help of leverage ratios, investors can make informed investment decisions. This will help to evaluate the high return or increased volatility that is associated with the leverage ratios.

Industries with Elevated Leverage Ratios

Industries have high leverage ratios because they have a high value of borrowed debt, which is used to perform their financing operations. They have a large portion of debt as compared to equity in their capital structure, which means that these industries rely entirely on debt funds to operate their financial activities as opposed to relying on their own equity. Businesses in industries like real estate, utilities, telecommunications, etc., have a high leverage ratio because of the capital-incentive nature of their operations.

Is High Leverage Risky?

A business with high leverage has proportionately more debt obligations as compared to the owner’s equity. Such businesses are considered risky and have a higher burden of interest expenses. Such businesses also find it difficult to get further loans in cases of need. Such businesses also have a higher risk of default and bankruptcy. Moreover, a business with high leverage is more volatile, if there is an increase in the interest rate.

Leverage and Bank Loans

Banks use leverage ratios to estimate the amount of debt the borrower firm has already borrowed as compared to equity. Banks have a higher willingness to give loans to businesses with low leverage ratios.

Leverage Ratios in Loan Covenants

The loan covenants are special financial measures that the borrower must maintain as a rule of their loan agreement. These terms and conditions are set by the lenders to ensure that borrowers are strong enough to meet their financial liabilities. Leverage ratios in loan covenants can evaluate the borrower’s ability to pay back loan payments along with interest payments. If someone is unable to repay the debt, they can sue that person, impose penalties on him, and offer no loans in the future.

Conclusion

In conclusion, the leverage ratio is one of the financial metrics that can be used as a tool to identify the financial position of a company to fulfil its debt and other financial obligations. Investors and stakeholders use the financial leverage ratio to make investment decisions. They can easily get the desired information related to their investments. Financial leverage is beneficial in many industries to check the capital structure and the financial risk of their respective companies.