A graph illustrating an upward Euro trend.

Irrational Exuberance Meaning

Definition

When investors’ enthusiasm drives the prices of an asset higher as compared to the asset’s fundamentals, this is called irrational exuberance. It also refers to the optimism shown by investors without choosing rational thinking, which causes an unexpected increase in asset prices. This increase in the asset price will not have a correlation with its intrinsic market value.

Historical Background

The irrational exuberance was first popularised by former Fed chairman Alan Greenspan in his speech of 1996, which was known as “The Challenge of Central Banking in a Democratic Society.” In his speech, he gave us information from the beginning of the dot-com bubble in the 1990s, which was a textbook example of irrational exuberance. On the day of the speech, the crashed Tokyo market showcased how various markets reacted to this news.

Example

The late 1990s dot-com bubble is an example of irrational exuberance. On December 5, 1996, Fed Chair Alan Greenspan warned the markets about their irrational exuberance. But he did not impose stronger monetary policies until the spring of 2000. But at that time, banks and brokerages used the excess liquidity reserved by the Fed in advance of the Y2K bug to invest in internet stocks. As circumstances have gone out of his control, he has no choice except to burst the bubble.

Another example of irrational exuberance is the stock market, in which psychology plays an important role in stock market investment decisions. These decisions have supported various biases against rational thinking and explained the difference between theory and practice. In the stock market, the exuberance fluctuations are not limited to the stocks but also related to consumer discretionary stocks, such as Amazon, Netflix, Daraz, etc.

The Reddit Rebellion is also an example of irrational exuberance movements, which mainly focus on buying stocks that are shorted by professional traders and holding those stocks for a significant period of time instead of selling them, which will result in an uptrend.

The Book: Irrational Exuberance

A book authored by Robert Shiller in 2000 was also named “Irrational Exuberance.” Robert Shiller was a famous economist, and in his book, he demonstrated the stock market boom that lasted from 1982 through the dot-com years. He also represents 12 important factors that contributed to this boom and suggests policy changes in order to manage the irrational exuberance. The second edition of this book was published in 2005. In this edition, he warned about the housing bubble burst, which occurred three years after his prediction and led to the Great Recession.

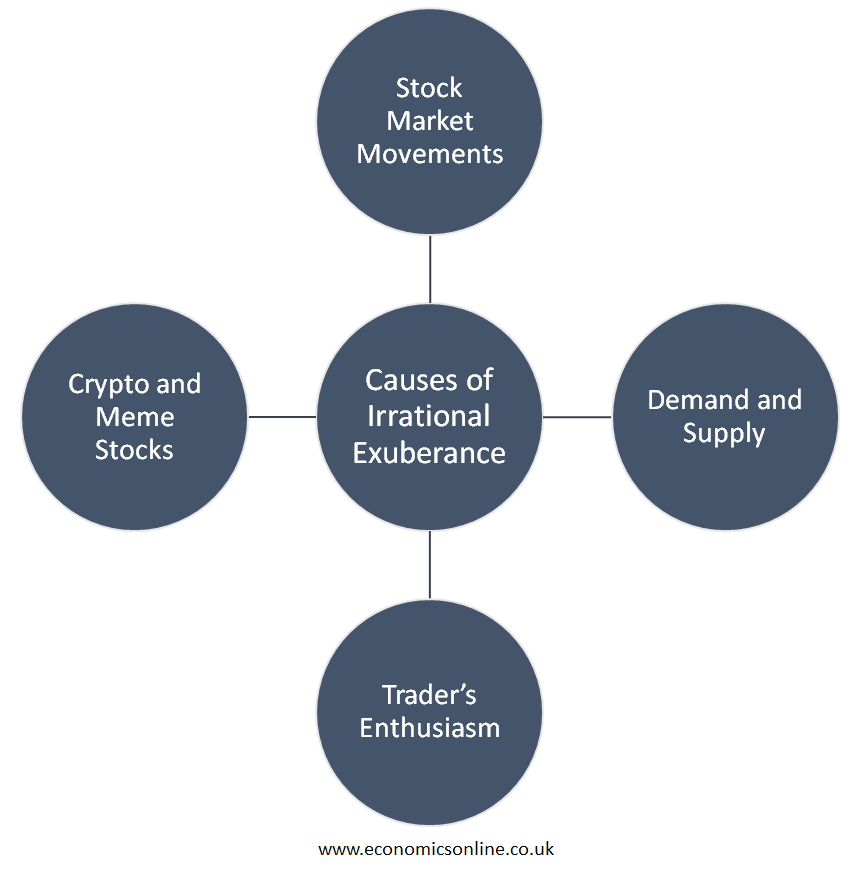

Causes of Irrational Exuberance

The following are some causes of irrational exuberance:

Stock Market Movements

The stock market movements are directly dependent on the traders behaviour. These traders buy and sell stocks in order to get high profits regardless of price fluctuations.

Demand and Supply

The demand and supply for a particular stock or asset are used to determine their market value or intrinsic value. But sometimes, the market value of these assets can feel exaggerated due to irrational exuberance among traders.

Trader’s Enthusiasm

Irrational exuberance is a state of frenzy and states the trader’s enthusiasm for a particular stock or asset is more positive, which can be fundamentally justified.

Cryptocurrencies and Meme Stocks

A single piece of news or new investment opportunities can trigger the investor’s enthusiasm, just like in the case of cryptocurrencies and meme stocks, for example, GameStop and AMC.

Factors Affecting Irrational Exuberance

The following are some factors affecting irrational exuberance:

Price Effects

The investors believed that the prices would remain high for a long period of time, but that is not true because there is exuberance present in the market. The exuberance effect becomes stronger if prices keep on rising. Professional investors can overcome this kind of unjustified optimism as compared to unprofessional investors. But professional investors are also not able to completely resist this exuberance.

Intrinsic Values

When the prices do not match their strong fundamentals or are not in line with intrinsic values, the speculative bubble bursts. Then there is a panic situation in the market due to exuberance movements, and the investors’ decisions attract other investors.

Recession

Investors sell their assets even at low prices compared to their original worth. This practice disrupts the market and also spreads this effect to other financial markets, which may lead to an acute recession.

Earnings

The high valuation time period does not have a long-term positive impact on investors or market stability. Small factors, like negative earnings in a quarter and a slight change in the lawsuit news, can cause the prices to fall.

Limitations of Irrational Exuberance

The irrational exuberance is an example of how human psychology affects the financial markets, and also a widespread economic optimism.

Positive Feedback Loop

When investors start believing that the rise in prices in the past predicts the future, they start to act like there is no uncertainty in the market, which creates a positive feedback loop of higher prices.

Panic Selling

It is also believed that it creates fake scenarios that give rise to bubbles in asset prices. But when the bubble bursts, investors rush to panic sell; sometimes they sell their assets below the value of their actual worth. The panic can also shift to other asset classes and cause a recession. The investors who bought stocks because they believed they were high-priced are the ones who are overconfident about the Bull Run and assume it will last longer.

Monetary Policy

The question raised by Alan Greenspan was whether the central bank should address the irrational exuberance or not by imposing strong monetary policies. He also believed that the central bank should increase interest rates if they noticed that a speculative bubble was starting to take shape.

Conclusion

In the end, irrational exuberance is the optimism or enthusiasm of investors without rational thinking, causing an unjustified increase in asset prices. Alan Greenspan was the one who explained this market phenomenon in his 1996 speech. Irrational exuberance can be caused by factors such as the positive feedback loop, panic selling, and not implementing strong monetary policies. The stock market movements are also a major cause of irrational exuberance because trader behaviour determines market conditions as they buy and sell stocks to get high prices regardless of the price fluctuation. The concept of irrational exuberance is an example of how human psychology affects financial market structures.