An image of an arrow and coins.

How to Stop Inflation?

Inflation Definition

A sustained increase in the general price level of goods and services in an economy over time is called inflation. It is measured by using price indices such as the consumer price index (CPI) or retail price index (RPI).

During inflation, the increase in the general price level will reduce the purchasing power or value of money. It means people can buy fewer goods and services with the same amount of money during inflation.

The economists consider a high rate of inflation bad for the economy due to its harmful effects. That is why governments aim to achieve a low rate of inflation in the economy.

Causes of Inflation

The following are the major causes of inflation:

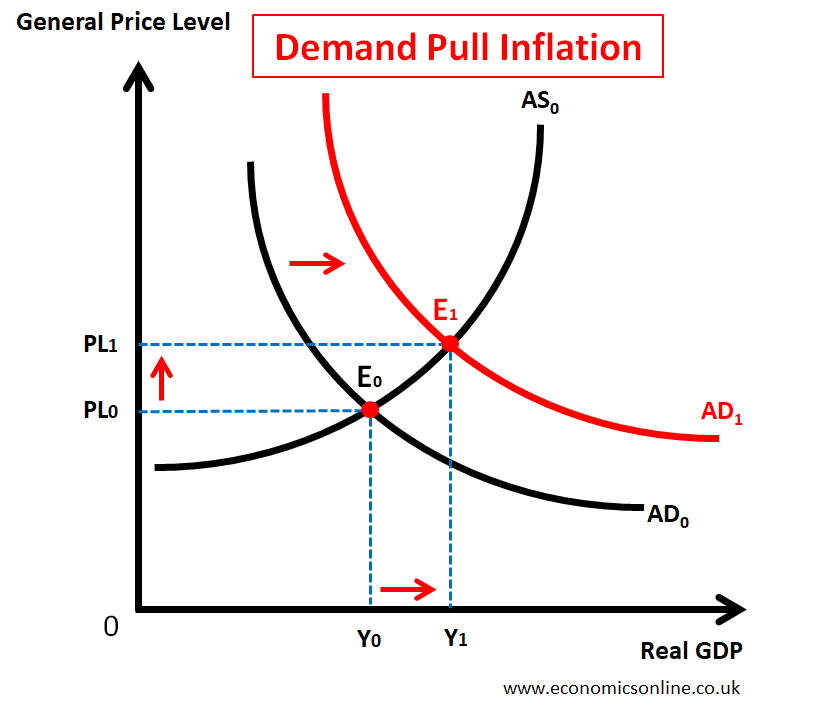

Demand Pull Inflation

Inflation caused by an increase in aggregate demand in an economy is called demand-pull inflation. Aggregate demand (AD) may increase due to an increase in consumption, investment, government spending, or net exports. Due to an increase in the aggregate demand for goods and services, the general price level goes up, which is called demand-pull inflation.

Demand-pull inflation is illustrated by the following graph:

In the above graph, real GDP is taken on the horizontal axis (x-axis) and the general price level on the vertical axis (y-axis). This graph shows the rise in aggregate demand from AD0 to AD1, causing the general price level to increase from PL0 to PL1, which indicates inflation. The real GDP also increases from Y0 to Y1, which indicates economic growth and a fall in unemployment.

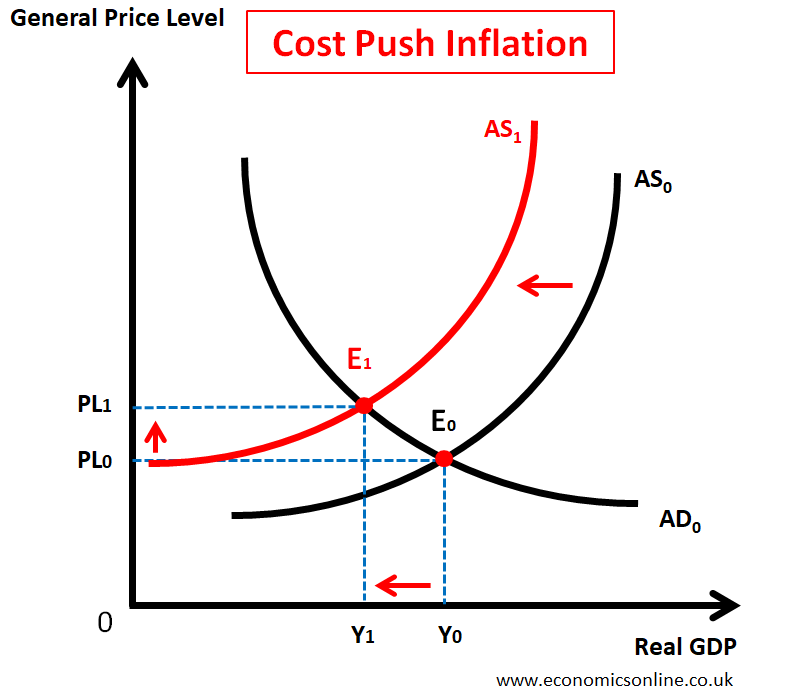

Cost Push Inflation

Inflation caused by an increase in the cost of production is called cost-push inflation.

Firms may experience an increase in production costs due to expensive materials, expensive fuel, higher rents and electricity bills, or higher wages in the labor market. When production costs increase, firms may increase the prices of their goods and services, and that is called cost-push inflation.

Cost-push inflation is illustrated by the following graph.

The above graph shows the fall in aggregate supply from AS0 to AS1 due to an increase in the cost of production. This fall in aggregate supply is causing the general price level to increase from PL0 to PL1, which indicates inflation. The real GDP is also falling from Y0 to Y1, which indicates economic decline and a rise in unemployment.

Why to Stop Inflation?

Governments want to control a high inflation rate because it is harmful for the economy in many ways. Some of these harmful effects are given below:

- Money loses its value due to inflation. During high inflation, value of money falls rapidly.

- During inflation, lenders receive their loans back in low value money, while borrows gain.

- People with the fixed income lose the most due to fall in their real income.

- Workers with low bargaining power also suffer due to fall in their real wages.

- Firms also face higher costs during inflation. These costs may include menu costs, show-leather costs, and higher production costs.

- Inflation also creates uncertainty in the economy, making future planning difficult for individuals and firms.

- Higher inflation can cause a fall in exports, which may affect the balance of payments negatively by driving it towards a deficit.

- Inflation may also cause the depreciation of a country’s currency.

- During inflation, people may indulge in non-productive activities such as hoarding and speculation instead of productive ones.

How to Stop Inflation?

The government can use macroeconomic policies to stop or control inflation. To stop demand-pull inflation, the government may use demand-side policies such as contractionary fiscal policy and contractionary monetary policy. To stop cost-push inflation, the government may use supply-side policies.

Policies to Stop Inflation

The following policies are used by the government to stop inflation:

Contractionary Fiscal Policy

In this policy, the government can implement fiscal restraint to overcome inflationary pressures and reduce aggregate demand for goods and services by increasing taxes, decreasing government spending, and aiming for budget surpluses. Some aspects of this contractionary fiscal policy are given below.

Government Spending Control

Governments can reduce their spending to control inflationary pressures or to prevent the economy from overheating by decreasing aggregate demand.

Taxation Policies

The government should increase tax rates or implement updated taxation policies, which will prevent wasteful use of income and reduce aggregate demand through reduced consumption and investment.

Budget Surplus

Governments should aim for a budget surplus by increasing government revenue and reducing expenses and spending; this will stabilise prices and control inflationary pressures.

Contractionary Monetary Policy

In this policy, governments, with the help of central banks (such as federal reserve or FED), can implement tight monetary measures to overcome inflationary pressures by using higher interest rates, reducing the money supply, and increasing reserve requirements. Some aspects of this contractionary fiscal policy are given below.

Interest Rates Adjustments

The central bank can discourage borrowing and spending by raising interest rates; this will help reduce aggregate demand and control inflation.

Money Supply Management

Central banks can reduce the availability of funds in the economy by managing the money supply. This money supply management prevents liquidity and overcomes inflationary pressures.

Reserve Requirements

Central banks have the authority to adjust reserve requirements for commercial or other banks; this will influence the amount of money that can be lent out and help control inflation.

Open Market Operations

The central bank can buy or sell government securities in the open market to manage its operations and influence interest rate increases. This will help reduce inflationary pressures in the economy.

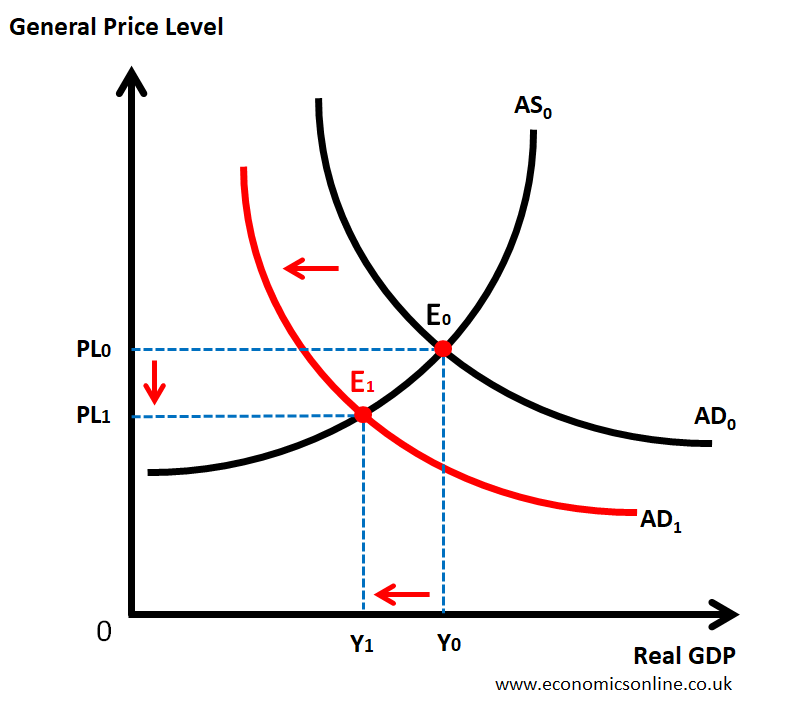

Graph of Demand Side Policies

The above demand side policies may be effective in controlling demand pull inflation; however, it may cause unemployment and a slowing down of economic growth. The effects of these policies are shown by the following diagram.

The above graph shows the fall in aggregate demand as a result of using contractionary fiscal policy or contractionary monetary policy. The fall in aggregate demand from AD0 to AD1, will put a downward pressure on price level and it will decrease from PL0 to PL1, and inflation will be controlled.

However, the real GDP will also fall from Y0 to Y1, and the unemployment will increase. These are the side effects of using contractionary demand-side policies.

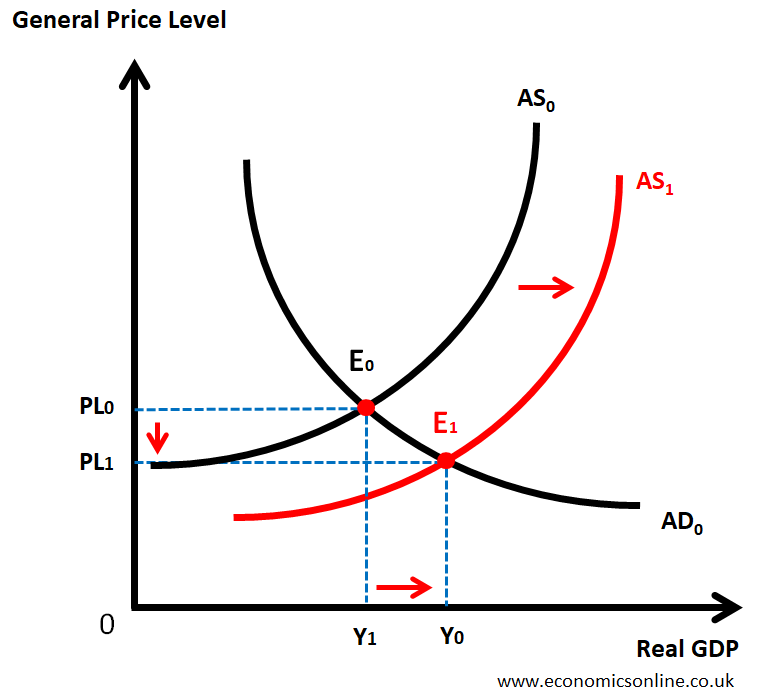

Supply-Side Policies

The government can implement policies to increase productivity, promote competitiveness, and reduce product costs. Government can also use privatisation and subsidies as supply side policies. These policies will help to overcome inflationary pressures by increasing aggregate supply of goods and services. The supply side policies are particularly effective in controlling cost push inflation.

The effects of using supply side policies are shown by the following graph.

The above graph shows a rise in aggregate supply from AS0 to AS1 as a result of using the supply side policies. The general price will decrease level from PL0 to PL1 and inflation will be controlled. Moreover, the real GDP will also increase from Y0 to Y1 leading to economic growth and a fall in unemployment.

The Role of Government

In addition to the above mentioned demand side and supply side policies, government can also take the following measures to stop inflation.

Price Controls

The government imposes price control policies on necessary goods or services to prevent excessive increases in prices during inflationary pressures.

Coordination and Communication

The government needs to coordinate its monetary and fiscal policies and communicate its strategies to maintain public confidence and economic stability and reduce inflationary pressures.

Exchange Rate Policy

The government manages to maintain its exchange rates to promote import and export price levels, through which inflation can be controlled.

Economic Diversification

The government can focus on diversifying its economy to reduce inflationary pressures and reliance on specific sectors prone to seasonal fluctuations.

Education and Training

The government can educate people and invest in training programs to equip workers with skills that are in demand year-round; this will reduce prices and seasonal unemployment.

Why is it Challenging to Stop Inflation?

Controlling inflation can be challenging due to several reasons:

One reason is that inflation can be driven by both internal and external factors; that’s why it is difficult to control inflation only through domestic policies.

There is a time lag between the implementation of macroeconomic policies and their effects to take place; this also makes it challenging to control inflation.

Unexpected events, like changes in global commodity prices, pandemics, commodity shortages, climate change, supply chain issues, can also affect inflation.

The inflation takes time to overcome due to certain factors, such as the severity of the inflation, the effectiveness of monetary and fiscal policies, and the overall economic conditions of the country.

Conclusion

In conclusion, inflation is a sustained increase in the general price level of goods and services in an economy. A higher rate of inflation is bad for the economy and government aim to stop this rapid inflation. Government can use a combination of monetary and fiscal policies to stop inflation. Governments can control their spending, interest rates, and budget surpluses and central banks can raise interest rates to decrease aggregate demand for goods or services by managing the money supply. These monetary and fiscal measures are used to control inflationary pressures and promote price stability in an economy.