An image of a steel mill.

Factor Market: A Comprehensive Guide

Introduction

In economics, the word ‘market’ refers to the collection of buyers and sellers of a product, a factor of production, or a currency. Markets play a significant role in efficient resource allocation through price mechanisms. In this article, we will explain the concept of the factor market in detail.

What is a Factor Market?

A factor market refers to the collection of buyers and sellers of a factor of production. In a factor market, the buying and selling of factors of production takes place. Buyers of factors are firms that generate their demand, while households and firms selling them generate their supply. The interaction of demand and supply determines the price and quantity of a given factor of production. Factor market is also called input market or resource market.

The Factors of Production

In economic terms, factors refer to the factors of production, which are essential inputs or resources needed for producing goods and services. These factors can be broadly categorised into three main types:

Land

Land means all the natural resources which can be used in producing goods and services. Land doesn't merely refer to open fields or terrain but includes all natural resources like minerals, water bodies, fish, farms, trees, natural gas, and many more.

Labour

Labour means the human effort put into the production process. It includes both the physical and mental services provided by workers.

Capital

Capital means man-made resources that can be used in production. It includes machinery, equipment, buildings, and any other physical assets. It is also called physical capital.

The Flow of a Factor Market

The relationship between buyers and sellers refers to the flow of the market. In a factor market, the flow of factors between buyers and sellers occurs in the following ways:

Firms hire workers or labourers for work and pay them wages for their work or labour. This is done in the labor market.

When a firm purchases capital goods, such as machines for manufacturing, from other firms in the marketplace; this is done in the capital market.

Similarly, natural resources are bought and sold in the land market.

Types of Factor Markets

There are three types of factor markets based on the types of factors, which are explained below:

Land Market

A land market refers to a place where the buying and selling of natural resources take place.

For example, a fruit juice manufacturer buying fruits from a farmer deals in the land market.

Similarly, a company may acquire land for a new manufacturing facility or buy mineral resources for production from the land market.

Labour Market

The labour market refers to a place where the buying and selling of labour (human effort) take place. In the labour market, the services of workers are bought and sold. In the labour market, workers are hired by firms, and then they get paid by firms for their work in the form of wages.

Capital Market

The capital market refers to a place where the buying and selling of capital goods take place.

For example, firms buy capital goods such as machinery for producing goods and services, or banks buy ATMs, computers, printers, etc., known as capital goods.

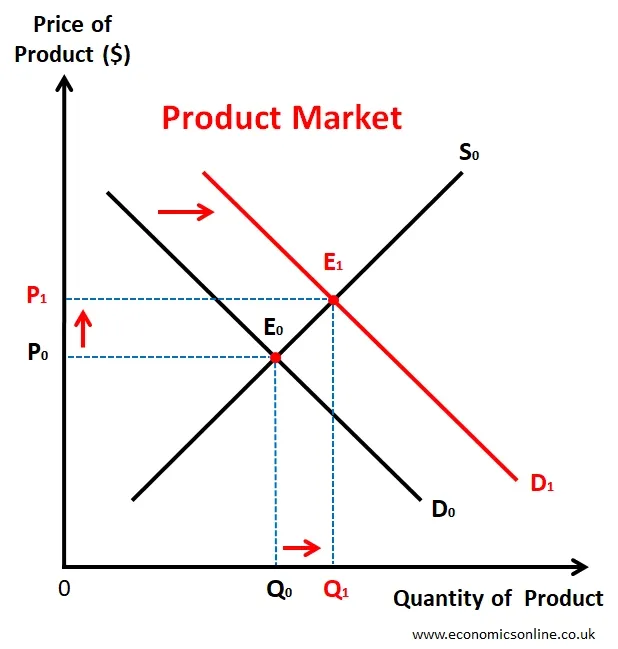

Product Market

In the product market, the forces of demand for and supply of a product determine the product's price and the quantity traded according to the price mechanism. It is also called the output market. Here, the product is bought for its intrinsic use, and the demand is direct. The following diagram illustrates this.

In the above graph, the initial equilibrium is at point E0. The rightward shift of the demand curve from D0 to D1 leads to an increase in the price of product from P0 to P1 and an increase in quantity traded from Q0 to Q1.

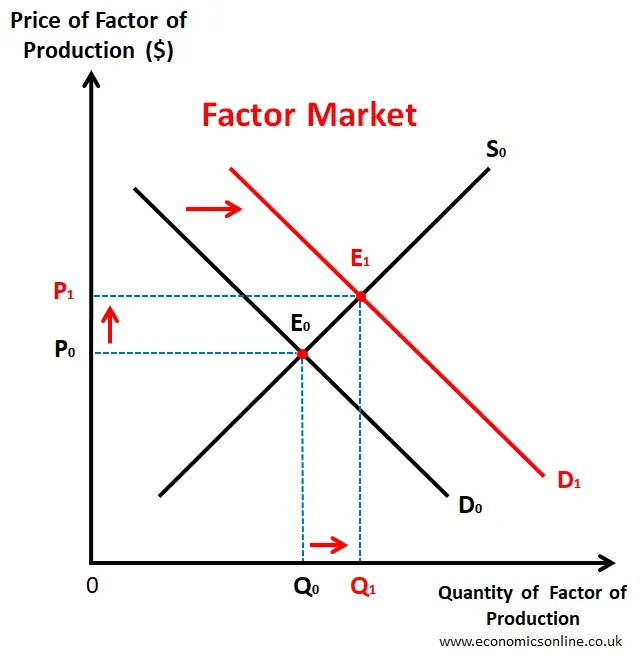

Factor Pricing

In the factor market, the forces of demand for and supply of a factor of production determine its price (factor pricing) and the quantity traded according to the price mechanism. Here, the factors are bought by firms to produce goods and services; hence, the demand for factors of production is called a derived demand.

For example, an increase in the demand for shoes in a shoe-making factory means the labor demand in that factory will increase.

The following diagram illustrates the determination of factor pricing.

In the above graph, the rightward shift of the demand curve from D0 to D1 leads to an increase in the price of the factor of production from P0 to P1 and an increase in quantity traded from Q0 to Q1.

For example, if there is an increase in the demand for labour in the labour market (without any shift in the labor supply curve), the wage rate (price of labor) will go up, and more workers will be hired (increased quantity of labor).

Factor Market vs. Product Market

The following table shows the main points of difference between the factor market and the product market.

Relationship between Factor Market and Product Market

There is a strong and two-way relationship between the factor and product markets. Let us explain the following two scenarios.

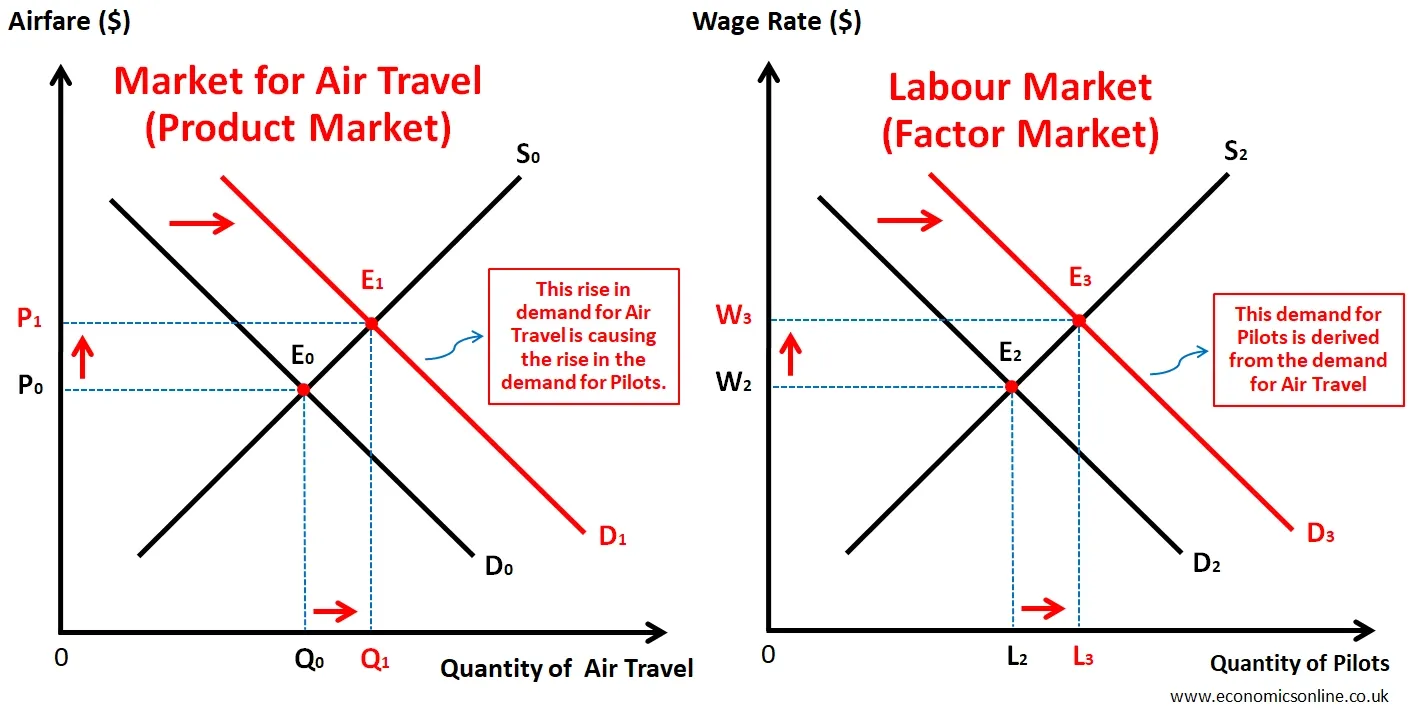

Scenario 1: Air Travel and Pilots

An increase in the demand for air travel (product market) will lead to a rise in the demand for pilots (factor market). The following diagrams illustrate this.

In the above diagrams, an increase in the demand for air travel is causing a rise in the demand for pilots in the labour market.

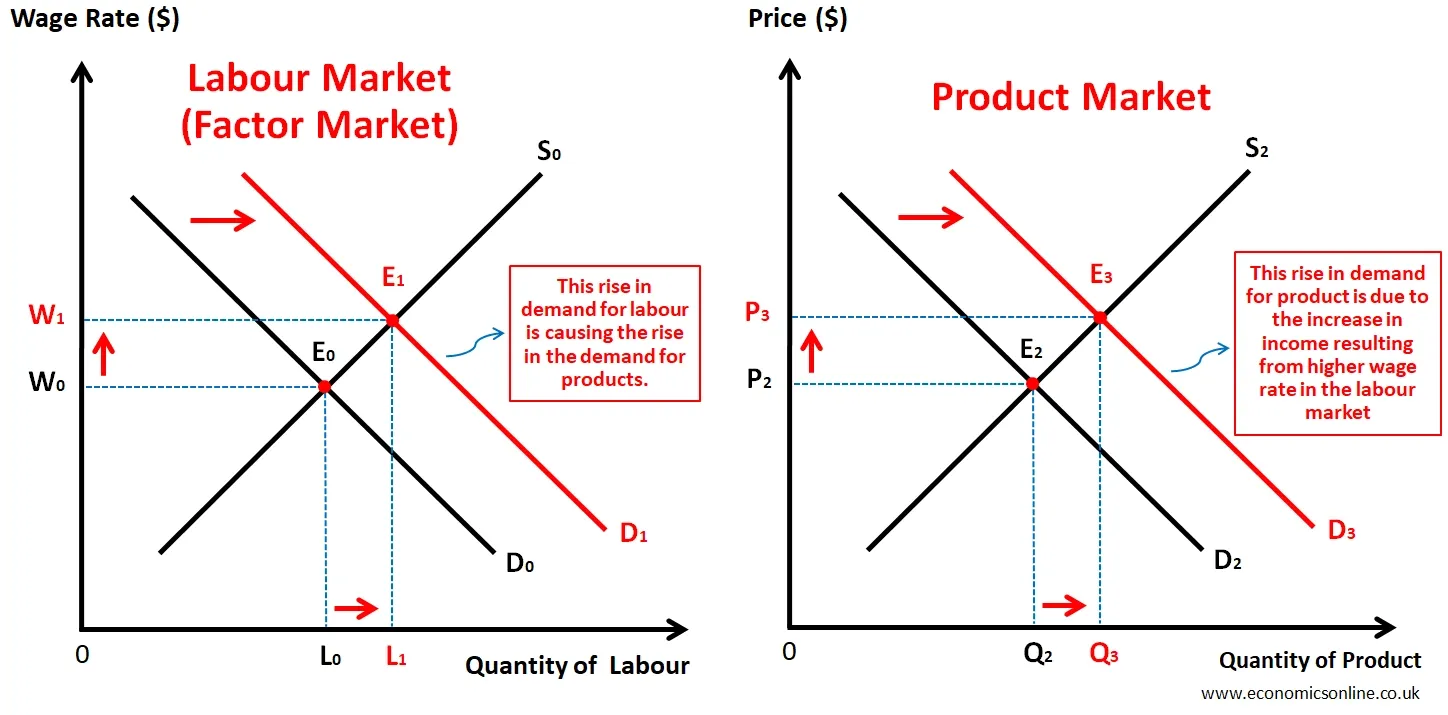

Scenario 2: A Rise in the Demand for Labour leads to a Rise in the Demand for Products

Any rise in the demand for labour in the labour market (factor market) may lead to a rise in their wage rate. This will increase workers' income, and they may buy more goods and services. As a result, the demand for goods and services in the product market will increase. The following diagrams illustrate this.

Determinants of Demand for Factors of Production

The following are some major determinants of the demand for factors in the factor market.

Factor Price

The price of a factor (land, labour, and capital) is a string determinant of its demand because factor price is cost for firms. For example, if the price of capital increases, firms may shift to hiring more labour; hence the demand for capital will decrease.

Productivity

The effectiveness of a resource's contribution to the manufacturing process is known as its productivity. A higher productivity of a factor of production means its higher demand. For example, to increase production, firms hire workers with higher productivity.

Prices of other Factors

The price of other factors affects the demand for a particular factor. For example, if the price of capital goods decreases, firms may substitute labour with capital, leading to a fall in demand for labour.

Demand for Final Goods or Services

The demand for factors is a derived demand, which means it is derived from the demand for goods and services that those factors produce. An increase in the demand for goods and services will lead to a rise in the demand for factors of production to produce more goods and services.

Determinants of Supply of Factors of Production

The following are some major determinants of the supply of factors production in the factor market.

Resource Availability

The availability of factors, such as land, labour, and capital, is a fundamental determinant of supply. If a particular resource is scarce, the supply of that factor will be limited. Conversely, an abundance of a resource can increase its supply in the factor market.

Population and Labour Force

In the case of labour, the size and composition of the population and labor force can be an important determinant of labour supply. For example, an increase in labor force size can increase labour supply.

Technological Advancements

Technological progress and innovation can increase the supply of capital through the availability of modern machines.

Government Policies

Government policies, such as labor laws, immigration policies, and tax incentives, can significantly affect the supply of factors. For example, immigration policies encouraging foreign labor inflow can increase the supply of labour in the market.

Factor Market Imperfection

Imperfections exist in the product markets, such as the market structures of monopolies, oligopolies, and monopolistic competition. These imperfections lead to market failure and inefficient resource allocation. Perfect competition, though, is an exception.

Similarly, imperfections exist in the factor market. For example, in the labour market, there may be monopsony (one buyer of labour), oligopsony (a few firms buying labour), trade union (one seller of labour), and bilateral monopoly (one buyer and one seller of labour).

These imperfections in the factor market create inefficiencies and hinder the efficient allocation of resources.

Conclusion

In conclusion, the factor market is where buying and selling of factors take place. These factor markets differ from the product market, even though both work through price mechanisms. Unlike the product market, the demand for factors of production is a derived demand. Moreover, in a product market, mainly individuals buy products along with some firms involved; however, in the factor market, the firms buy labour and not the individuals. An understanding of the factor market can help firms determine the changes in the prices of factors of production and make their production decisions accordingly.