Photo by micheile henderson / Unsplash

Expansionary Fiscal Stance

What is Fiscal Stance?

Fiscal stance refers to the macroeconomic policy or strategy of a government to change tax rates and government spending in order to influence the economy. It can be an expansionary or a contractionary fiscal stance. The purpose of using fiscal stance or fiscal policy is to achieve macroeconomic objectives and economic stability.

Types of Fiscal Stance

The following are types of fiscal policy or fiscal stance:

Expansionary Fiscal Stance

Expansionary fiscal stance refers to the macroeconomic policy of government to decrease tax rates and to increase government spending in order to achieve macroeconomic objectives of economic growth and low unemployment. It is also called expansionary fiscal policy, inflationary fiscal policy, fiscal expansion, or a loose fiscal policy.

In other words, when a government has tax revenue that is lower than government spending, we say that the government is taking an expansionary fiscal stance. In this case, the government is operating a budget deficit, which means that tax revenue is less than government spending.

As a part of the general perception of Keynesian economics, expansionary fiscal stance is used during economic downfalls and recessions to maintain economic cycles. Moreover, it is also appropriate when the economy is experiencing a liquidity trap and monetary stance becomes ineffective.

Contractionary Fiscal Stance

The contractionary fiscal stance is also called the deflationary fiscal stance, contractionary fiscal policy, or fiscal consolidation. When the government has less spending as compared to tax revenue, the fiscal stance is a deflationary stance. In this contractionary policy, the government reduces aggregate demand by increasing tax rates or cutting its spending. In this case, the government is operating a budget surplus, which means that the tax revenue is greater than the government spending.

The Purpose of Expansionary Fiscal Stance

The purpose of using an expansionary fiscal stance is to stimulate economic growth to healthy economic levels, which is necessary during the contractionary period of the business cycle or trade cycle. As a demand-side policy, the expansionary fiscal stance increases aggregate demand to boost economic growth and employment in the country.

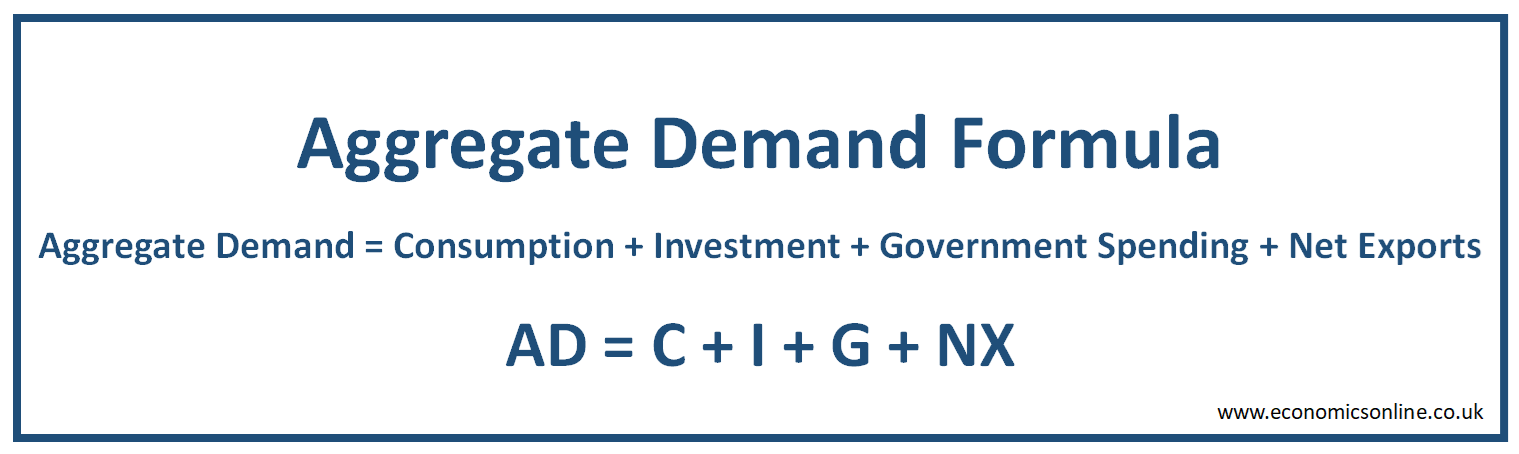

Aggregate demand (AD) is the total demand of goods and services in an economy by all four sectors of economy. Here is the formula for calculating aggregate demand:

Fiscal Policy Tools

Tax rates and government spending are the two tools which government can use in case of fiscal policy. In case of expansionary fiscal policy, the following changes will be made in these tools:

Decreasing Tax Rates

The government will decrease tax rates, which will increase the disposable income of individuals and after-tax profit of firms. As a result, households increase spending and firms increase investment.

Increasing Government Spending

Government spending is a component of aggregate demand. Increasing government spending on infrastructure, defense and public projects will boost aggregate demand.

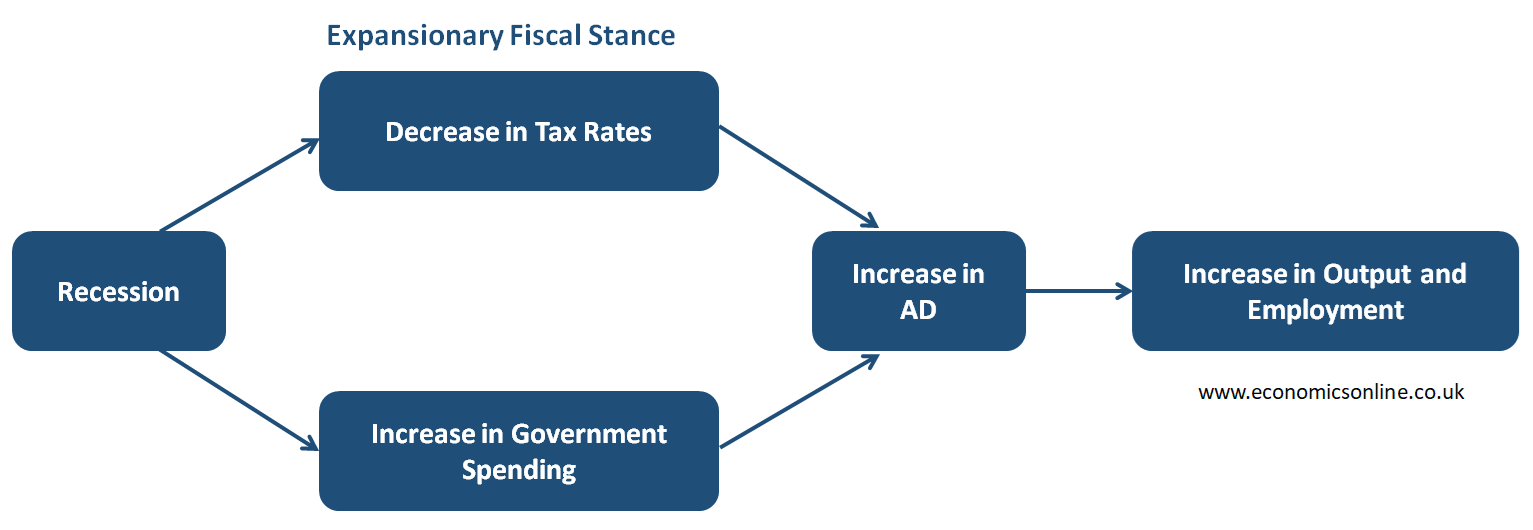

The Workings of Expansionary Fiscal Stance

Let’s understand the workings of expansionary fiscal stance.

Effects of a Decrease in Tax Rates

Tax is the revenue of the government that is received from people and firms. When a government decreases income tax rates, the disposable income of consumers is increased, which leads to an increase in spending by households on goods and services due to an increase in their purchasing power. This consumer spending is called consumption (C) and is a major component of aggregate demand. An increase in consumption increases aggregate demand. Similarly, a decrease in corporation tax will increase after-tax profits of firms. This can encourage firms to increase investment (I), which is also another component of aggregate demand. The increased investment boosts aggregate demand. An increase in investment by investors, an injection into the economy, can lead to the multiplier effect, which is when the increase in national income is greater than the initial increase in injection.

Effects of an Increase in Government Spending

Government spending (G) is the spending of government on public projects. In an expansionary fiscal policy, government increases it’s spending on public goods, merit goods and infrastructure projects to boost aggregate demand and economic activity in the country. For example, if the government starts a new infrastructure project, many jobs will be created along with an increase in the demand for materials. This will increase economic activity in the economy. Various sectors of economy, such as construction, technology, and public services, will see a boost in their demand. As government spending is a component of aggregate demand, any increase in government spending will increase aggregate demand.

The multiplier effect will also play an important role here. Government spending is an injection in to the economy and through the multiplier effect, the increase in national income will be much bigger than the increase in government spending.

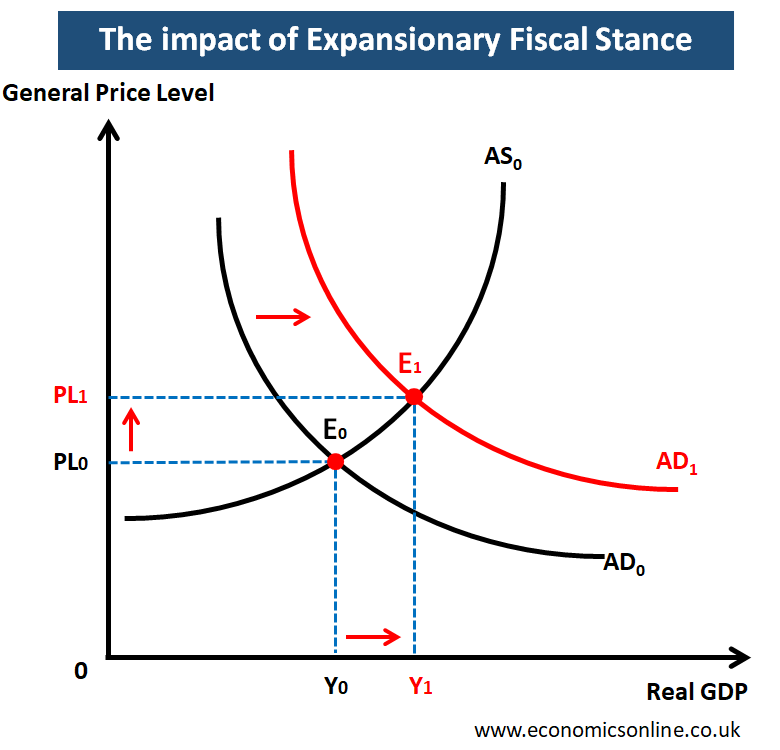

The combined effects of tax cuts and increased government spending are illustrated in the following diagram:

In the above graph, the real GDP (Y) is on the horizontal axis (x-axis), and the general price level is on the vertical axis (y-axis). The initial macroeconomic equilibrium is at E0, where the initial aggregate demand curve (AD0) is intersecting with aggregate supply curve (AS0). The price level is PL0 and the real GDP is Y0.

Due to expansionary fiscal stance, the aggregate demand is increased from AD0 to AD1. This happens because the first three components of aggregate demand are increased due to tax cuts and an increased spending of government. The new macroeconomic equilibrium is at E1 where the new aggregate demand curve (AD1) is intersecting with aggregate supply curve (AS0). The new price level is PL1 and the new real GDP is Y1.

Effect on Economic Growth

The expansionary fiscal policy will result in economic growth which is its intended macroeconomic objective. In the above graph, an increase in the real GDP from Y0 to Y1 indicates GDP growth or economic growth.

Effect on Unemployment

This expansionary policy will also result in a fall in unemployment provided that the economy is not operating at the full employment level of output or potential GDP. In the above graph, an increase in the real GDP from Y0 to Y1 shows a fall in unemployment rates in the country.

Effect on Inflation

The above graph also illustrates an increase in the general price level from PL0 to PL1 which means demand-pull inflation. This is the negative effect of expansionary fiscal policy.

Measuring the Fiscal Stance

The following are some ways to measure the fiscal stance:

Actual Budget Deficit and Surplus

An important measure of the fiscal stance is knowing the actual position of the government budget. When government spending is greater than taxes, it represents an expansionary stance as a deficit, but when government spending is less than taxes, there is a surplus, showing a deflationary stance.

Cyclical Deficit

In the recession, automatic stabilisers are activated automatically by reducing taxes and increasing spending on unemployment benefits. The effects of these automatic stabilizers have to be excluded in order to see what the government is doing in terms of discretionary fiscal policy.

The Primary Fiscal Deficit

The primary fiscal balance ignores the interest payments on past debts. It is an indicator of the current fiscal efforts of the government because it excludes the interest payment on the debts which were taken in the past years.

Role of Government in Fiscal Stance

During recessions, according to the Keynesian concept, the government should impose fiscal expansions when there is low demand, high unemployment, and high private sector savings in order to run a budget deficit smoothly and provide demand stimulus.

When the economy is stuck in a liquidity trap, there is a need for expansionary fiscal policy because, when interest rates are near zero, it is difficult to boost demand by using monetary policy.

During times of high borrowing and high inflation, the government shifts its fiscal stance in order to reduce budget deficits.

The Side Effects of Expansionary Fiscal Stance

The following are the side effects of expansionary fiscal stance:

Demand-Pull Inflation

Expansionary fiscal stance or any other expansionary demand-side policy will create demand-pull inflation. The extent, to which it creates inflation in the economy, depends on the elasticity of aggregate supply. The demand-pull inflation will be high in case of a vertical aggregate supply which happens when the economy is operating at full employment level of output.

Negative Effect on Balance of Payments

Another side-effect of expansionary fiscal stance is the worsening of the balance of payments. This happens because a reduction in tax rates means consumers have more disposable income. This leads to a higher spending by consumers on domestic as well as imported goods. As a result, imports are increased. Moreover, the exporting firms will find it easy to sell to domestic people due to their high disposable incomes. As a result, exports may decrease. The increase in imports and a fall in exports will negatively affect the balance of payment of the country.

Conclusion

In conclusion, the government uses an expansionary fiscal stance by decreasing the tax rates and increasing the government spending. This is used in economic downturn in order to boost aggregate demand. The effective use of fiscal policy depends on economic conditions in a country, however, the expansionary fiscal stance should ensure economic growth and stability in the short-run as well as in the long-run.