An image of a coin in a hand with a risk meter.

Credit Default Swap (CDS)

Definition

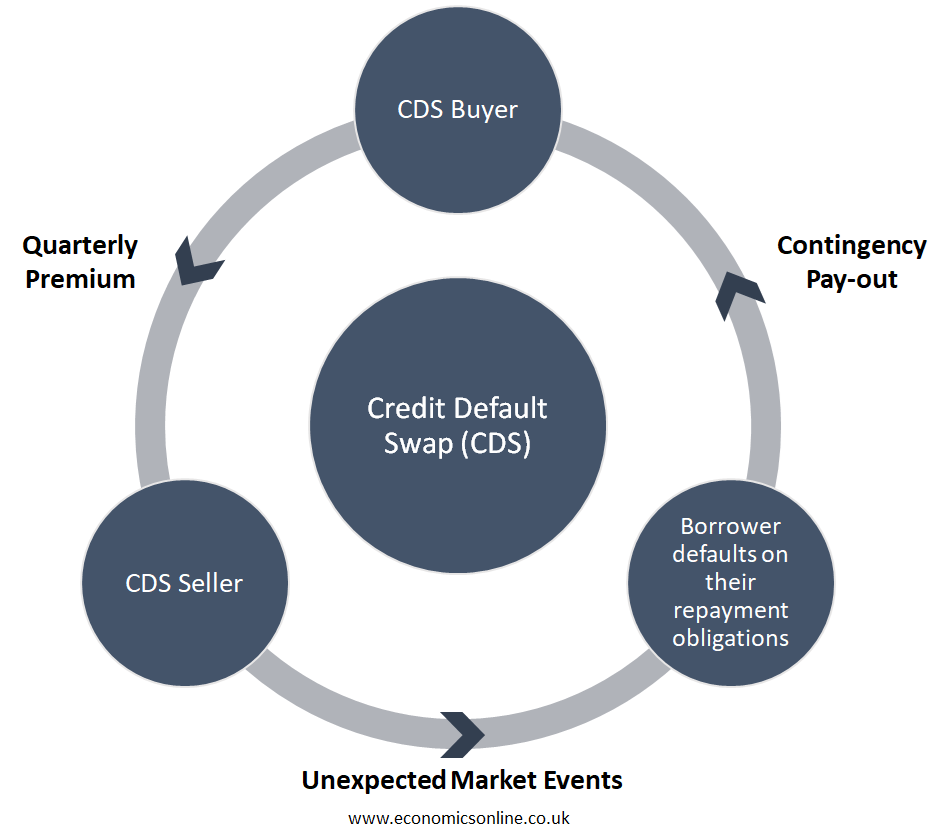

A form of financial derivative in which investors or shareholders swap their credit risk with another investor is called a credit default swap (CDS). In CDS, the lenders buy CDS contracts from other investors to shift their obligations when borrowers default. Some credit default swap contracts are maintained through a premium payment, which is similar to the regular premiums that are due on an insurance policy. If a lender is worried about borrower defaults on a loan payment, then he uses CDS contracts to swap the risk of credit default.

Explanation

A CDS is a financial derivative contract that swaps or off-sets the credit exposure of fixed-income products. CDS consists of bonds and other forms of debt securities, which are derivatives of loans sold to investors. For example, a company may sell a bond to an investor with a face value of $200 and a maturity of ten years. The company agreed to pay $200 after ten years of maturity, along with regular interest payments throughout the bond’s life. Because the debt issuer can’t guarantee that he will be able to repay the bond premium, investors find it risky. The debt buyers can purchase a CDS contract to transfer or swap the risk to another investor, who agrees to pay the debt when the debt issuer becomes a credit default on its liabilities.

Debt securities have a longer maturity period, which makes it hard for investors to estimate the risk associated with an investment. That is why a mortgage has a maturity of thirty years. It can’t be assumed that the borrower will be able to pay the debt for this long. Due to these reasons, CDS contracts are an easy and popular way to manage the risk. The CDS’s buyer continues to pay the CDS’s seller until the maturity date or expiration date. In return, CDS’s seller promises to repay all the interest payments as well as the security’s value that had been paid from the time of selling to the maturity date if there is a credit event.

Sectors of the Credit Default Swap Market

The following are the sectors of a credit default swap market:

Single-Credit CDS

The single-credit CDS consists of bank credits, corporates, and sovereigns.

Multi-Credit CDS

The multi-credit CDS consists of a custom portfolio of credits agreed upon by the seller and the buyer.

Credit Events and Credit Default Swap

An event that triggers the buyer of the credit default swap to manage the contract is called a credit event. Credit events happen when CDS is purchased and are also part of the contract. A majority of single-credit CDSs are traded with the following credit events as initiators:

Reference Entity Default

A credit event where an issuing entity defaults due to certain reasons instead of failure to pay is known as the reference entity default.

Failure to Pay

When a credit event happens, the buyer of the contract fails to meet its obligations.

Liability Acceleration

It occurs when an issuer of a CDS contract is willing to pay the debt payment earlier than decided in the contract.

Repudiation

Repudiation is the conflict over the contract’s validity.

Moratorium

A moratorium is the suspension of a contract until the issues that led to the suspension are resolved.

Reconstructing Liabilities

It is also a CDS initiator, which occurs when the underlying loans are reconstructed.

Government Intervention

It happens when actions taken by the government can affect the CDS contract.

Maturity Terms of a CDS

CDS do not need to cover the investment for its lifetime when CDS are purchased to provide insurance on an investment. For example, if an investor is in a ten-year maturity bond and, after two years, he realises that the issuer is in credit trouble. The bond owner buys a CDS with a five-year maturity term that is supposed to protect the investment until the bondholder believes that the risk is diminished in the seventh year.

Settlement of CDS

A CDS contract can be settled physically or with cash, which is a historically common method when a credit event happens.

Physical Settlement

In a physical settlement, the seller gets an actual bond from the buyer.

Cash Settlement

Cash settlement, which is the most preferred method. In this method, the purpose of CDSs shifts from hedging to speculation, and the seller is responsible for repaying the buyer’s loss.

Uses of Credit Default Swap

The following are some uses of the credit default swap:

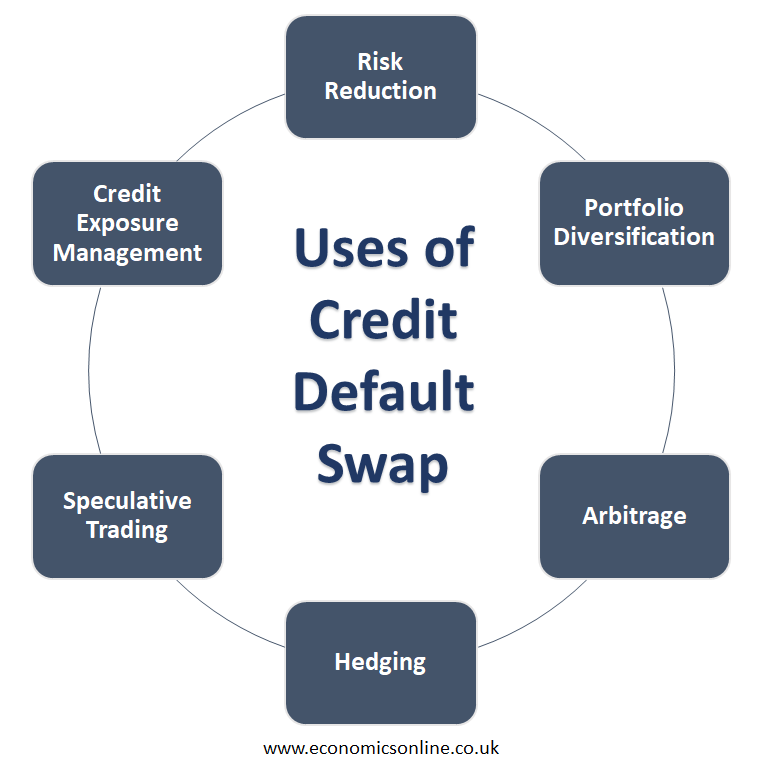

Risk Reduction

Managing and reducing credit risk is the primary use of CDSs. In order to reduce potential risk, the buyers purchase CDS to have protection against risks associated with those instruments. With the help of CDS, the default risk shifts to the seller. In this way, investors diversify their investment portfolios without risking default.

Portfolio Diversification

Banks and investors are those financial institutions that use CDSs to diversify their investment portfolios. They do not use risky individual bonds or loans; instead, they use credits in order to spread the risk.

Arbitrage

Arbitrage is used to purchase a particular security in one market and then sell it in another. In arbitrage, CDS are also used. For example, if an investor buys a security or a bond from one market, they can then buy a CDS on the same reference entity on the CDS market.

Hedging

Financial institutions, corporate entities, and banks use credit default swaps as a hedging tool to protect themselves from severe credit events. For example, a bondholder may purchase a CDS to hedge against the issuer’s default, which ensures that he will get compensation when default occurs.

Speculative Trading

CDS are also used by market participants for the purpose of speculative trading. They buy those CDS contracts on credits that they assume are undervalued or sell the CDS contracts on credits that are supposed to deteriorate.

Credit Exposure Management

In this context, the CDSs are used to manage credit default risk associated with financial institutions and investors. They reduce the credit default risk to a level they can afford and use it in their investment portfolio.

Characteristics of a CDS

The following are some characteristics of a credit default swap:

Counterparty Risk

A significant characteristic of a CDS is the counterparty risk, in which the CDS seller commits to paying payments in the event of default. If the seller fails to fulfil his liabilities, then buyers can’t get the protection payment he paid. For example, the 2008 financial crisis was a significant event of counterparty risk when many financial institutions failed to fulfil their CDS obligations.

Market Standardisation

The CDS contracts are highly liquid and standardised in the CDS market. With the help of market standardisation, investors can increase their market efficiency and transparency. They can also exchange these contracts with more suitable ones.

Regulatory Investigations

CDS faced regulatory investigations due to their role in the financial crisis of 2008. In order to reduce or minimise the potential risk of abuse in the CDS market, the government and regulatory institutions imposed measures or strategies to enhance transparency.

Impact on the Bond Market

The CDS can also influence the bond market when the CDS contracts for specific issuers become expensive, which can lead to high borrowing costs for the issuers in the bond market. The connection between CDS and the bond market explains the interconnectedness of financial instruments.

Complex Nature

The CDS contracts can be complex as they have different terms and conditions. CDS requires a deep understanding of bond markets and credit risks. Market participants and investors must carefully examine the terms and conditions of CDS contracts and their implications.

Role of Credit Default Swap

Credit default swaps played a role in credit crises such as the Great Recession. CDS were issued by Bear Sterns, Lehman Brothers, and American International Group (AIG) to the investors to protect them against defaults or credit losses if the mortgages that were securitized into mortgage-backed securities (MBS) defaulted.

Conclusion

In conclusion, credit default swap contracts are used by financial institutions to swap the credit default risk to another party. They were also used to reduce the risk of investing in mortgage-backed securities. The CDSs have some characteristics that are beneficial for investors who use them, such as counterparty risk, market standardisation, etc.