Photo by Jakub Żerdzicki / Unsplash

Core CPI vs CPI

Introduction

Inflation is an increase in the general price level of goods and services in an economy over a period of time. Price index is a number which is used to measure the rate of inflation. There are many different types of price indices, including consumer price index (CPI), retail price index (RPI), and retail price index excluding interest rate (RPIX). These price indices are calculated by using the same process; however, they serve different purposes and measure inflation in different ways. In this article, we will explain core CPI and CPI in detail.

Consumer Price Index (CPI)

CPI is a price index that is used to measure the change in the general price level of goods and services over time, by observing the prices of those items which are consumed by an average household. CPI is a widely used measure of inflation in many countries. Just like any other price index, CPI is calculated by using a basket of goods, which represents a sample of those goods and services which are bought by an average household. In the U.S., the Bureau of Labor Statistics (BLS) measures the CPI, and it is released in the middle of each month with a publication lag of one month.

Headline-CPI

The headline CPI provides information about all goods or services present in the report of the U.S. Bureau of Labour Statistics. It also represents the average inflation rate across the country, which is also called headline inflation.

Core CPI

It excludes food and energy prices because they are highly volatile as compared to the other products present in the CPI’s basket of goods. Both food and energy sectors can be affected by weather, geopolitics, and international prices. That is why many economists prefer to exclude food and energy prices from the calculations to have a more consistent view on price inflation.

CPI and Economy

An economy’s growth can be seen by simply looking at rates at which prices are increasing or decreasing. Many economists at the Federal Reserve observe inflation rates of about 2% year over year. If the inflation rate is increasing too fast and too high, it means that the economy is overheating. But if prices are decreasing, it means that the economy is slowing down. CPI is used to get an overall picture of a country’s economy.

Core Inflation

The change in the general price level of goods and services, except food and energy, is called core inflation. The core inflation rate is an indicator of underlying long-term inflation. Core inflation does not include the components or items from the food and energy sectors in calculating inflation because the price of these items is highly volatile. The core consumer price index (core CPI) is used as a measure of core inflation.

Reasons for Exclusion of Food and Energy Prices

The following are some of the main reasons why food and energy prices are excluded from the calculations of core CPI:

High Volatility

Food and energy prices are excluded from the calculations because they have highly volatile prices that fluctuate quickly. These prices fluctuate mainly due to supply-side reasons like cost of production, weather conditions and international factors. Food and energy are both essential, which means that their demand is not affected even in case of an increase in their prices. For example, gas prices usually increase with the increase in oil prices, but people still need to fill their tanks to drive their cars. Another example is that people do not stop buying grocery items just because their price is high. These are basic living necessities.

Commodity Prices

Another reason for exclusion is that oil and gas are commodities and traded by traders on exchanges where they can buy and sell them. Food is also a commodity and is also traded along with wheat, corn, cotton, etc. The postulation of energy and food commodities can lead to high volatility in their prices, which can cause high ups and downs in inflation rates. For example, a drought can cause a high increase in the prices of corn and wheat. The effect of the inflation is for a short period of time, and the situation returns to normal when all the factors correct themselves, then the market returns to a balanced state. That is why food and energy sectors are excluded from the calculations of core inflation.

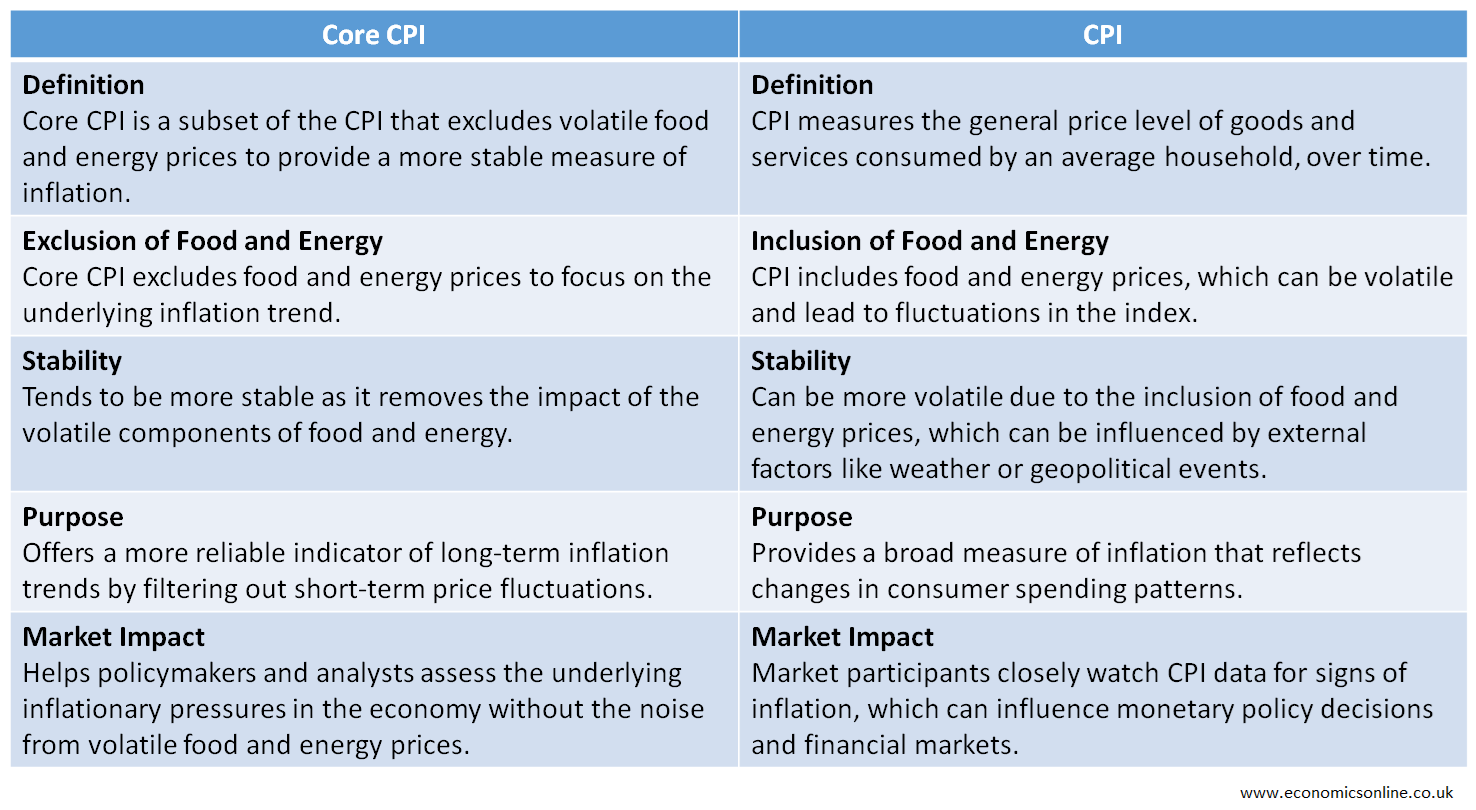

Differences between Core CPI and CPI

The following table contains the main points of difference between core CPI and CPI.

Measurement of Core CPI and CPI

Both the core CPI and CPI are used to measure the overall inflation in a country’s economy. In order to calculate both of them or any other price index, the following steps are undertaken:

Step 1

The first step is to decide the basket of goods, which is a sample of goods and services for which the prices will be observed. Different price indices have different baskets of goods and this is the primary difference between various price indices. For example, for core CPI, the basket of goods does not contain food and energy items, while these are included in CPI.

Step 2

The next step is to decide the base year, which is a year with which the prices will be compared.

Step 3

The third step is to carry out the expenditure survey in order to find expenditure weights that are based on the expenditure patterns of households. Each item in the basket of goods is assigned a weight based on the percentage of spending on that item.

Step 4

In this step, prices are observed for all the items in the basket of goods for base year and current year. Then, a simple index is calculated for each item.

Step 5

In this step, the weight of each item is multiplied by the index of that item to calculate the weighted index.

Step 6

This step is involved in calculating the price index by using the aggregates of weighted index and weights. In this step, the value of CPI, or core CPI, is obtained.

Step 7

In the last step, the rate of inflation, or core inflation, is calculated by using the price index calculated in step 7.

CPI calculations include all the items along with food and energy prices, but Core CPI does not include food and energy prices in its calculations. Government statistical agencies regularly publish both indicators on a monthly basis. Both are equally important for monitoring inflation and implementing relevant economic policies.

Importance of Core Inflation

Core inflation is important because it explains the relationship between the price of goods or services and the level of consumer income. If prices of goods or services keep increasing but consumer income does not increase, due to this, consumers have less purchasing power. Inflation reduces the value of money or income as compared to the prices of goods or services. The measurement of core inflation through core CPI helps policymakers design suitable policies to achieve a target rate of inflation.

Policy Implications of Core CPI

The core CPI has its own policy implications. In the case of CPI, monetary authorities more frequently change interest rates based on inflation trends. For example, in 2008, there was a rise in energy prices that caused a cost push inflation of 5%. After a few months, the world faced a great recession. This means that CPI provides misleading or false impressions of underlying inflationary pressures. If the government uses strict monetary policy due to temporary food and energy inflation, it can have the potential to slow down the economy of that country. When there is a huge downswing of food and energy prices, the strict monetary policy can become slack, which causes future underlying inflation. Indexing of Core CPI does not link to pensions because it provides increased benefits to pensioners less than their cost of living.

Conclusion

In conclusion, the consumer price index (CPI) is the most critical indicator of pricing pressures in a country’s economy and also provides an overall report about inflation. Forex traders focus on monitoring CPI, as it can cause major changes in the monetary policies of the central bank, which will either increase or decrease the strength of currency to purchase assets against rivals in the market. This will also have significant impacts on the earnings performance of many companies working in global markets.