Photo by Live Richer / Unsplash

Average Variable Costs in Economics

Average Variable Cost Definition

The variable cost per unit of a product or service is called the average variable cost (AVC). The average variable cost can be determined by dividing the total variable cost incurred in a certain time period by the number of units produced. The variable costs are the ones that change with the change in level of production. Some variable costs are raw materials, direct labour, and variable manufacturing overheads. The average variable cost is defined for a single unit of output produced. Here is the average variable cost formula:

Average Variable Cost = Total Variable Cost / Number of Units Produced

AVC = TVC / Q

Calculation Example

For example, an XYZ company produced 500 units of a certain product. The total variable cost of producing all 500 units is $2000. The average variable cost in this case will be calculated as follows:

Average Variable Cost = Total Variable Cost / Number of Units Produced

Average Variable Cost = $2000 / 500 = $4

Average Variable Cost Graph

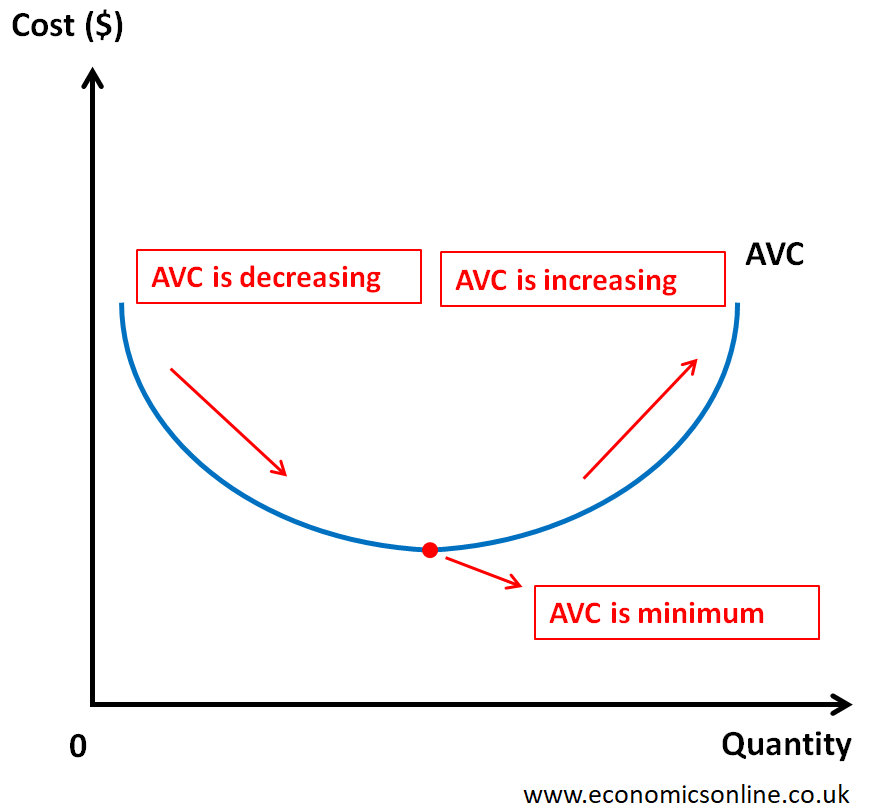

The following graph illustrates average variable cost:

In the above graph, the quantity is taken on the horizontal axis (x-axis) and the cost on the vertical axis (y-axis). The average variable cost curve tends to be U-shaped because of the law of diminishing returns. First, the AVC curve falls up to its minimum point and then starts to rise as the quantity is increased.

Features of Average Variable Cost

The following are the main features of average variable cost:

- Average variable cost is defined for a single unit of output.

- Average variable cost is different from marginal cost which is the additional cost of producing an additional unit of output.

- AVC is defined in the short-run only. In the long run, only average cost is defined.

- The graph of AVC is U-shaped.

- Initially, AVC decreases because of increasing returns according to law of diminishing marginal returns.

- Finally, AVC increases because of decreasing returns according to law of diminishing marginal returns.

- The minimum point of AVC is where it cuts the marginal cost (MC) curve.

Total Variable Cost

Those costs that change with the change in the output of the production process are called total variable costs. Cost of direct material, direct labour and variable manufacturing overheads are the main examples of variable costs. It can be calculated by subtracting total fixed costs from all costs incurred.

Total Variable Cost = Total Cost - Total Fixed Cost

Total Cost (TC)

All types of costs, including variable or fixed, that are incurred in a production process are called total costs. Total cost is the sum of total fixed cost (FC) and total variable cost (VC).

Total Cost = Total Fixed Cost + Total Variable Cost

Fixed Cost

Fixed costs are those that remain constant and does not change with increasing quantity of output. Rent, insurance, fixed salaries, and interest rates are examples of fixed costs.

Approach to Calculate Average Variable Cost

The following are two main approaches that are used to calculate the average variable cost:

Division Method

In the division method, the average variable cost can be calculated by dividing the total variable cost incurred by the total quantity of output produced in a given time.

Average Variable Cost = Total Variable Cost / Number of Unit Produced

The following are the three main steps that are used in the division method:

Units Produced

The first step is to calculate and identify the total number of units produced in a given period of time.

Total Variable Cost

The second step is to calculate the variable cost (VC) incurred to produce those units.

Division Process

The third step is to put all the values in the formula and divide the total variable cost by the number of units produced and we get the value of the average variable cost.

Subtraction Method

In the subtraction method, the average variable cost can be calculated by subtracting the average fixed cost from the average total cost.

Average Variable Cost = Average Total Cost - Average Fixed Cost

The following are the three main steps that are used in the subtraction method:

Average Total Cost (ATC)

The first step is to identify the average total cost, which can be calculated by dividing the total cost by the number of units produced.

Average Total Cost = Total cost / Number of Units Produced

Average Fixed Cost (AFC)

The second step is to identify the average fixed cost, which can be calculated by dividing the total fixed cost incurred by the number of units produced.

Average Fixed Cost = Fixed Cost / Number of Units Produced

Subtraction Process

The third step is to subtract both values from each other, and then we can get the value of the average variable cost.

Average Variable Cost = Average Total Cost - Average Fixed Cost

Importance of Average Variable Cost

The following points explain the importance of average variable cost:

Costing

Costing is the process of determining the cost of producing a product. Contribution costing or variable costing, is a costing method in which AVC is considered as the product cost and is also called the contribution cost of the product.

Pricing

In marketing, there is a pricing technique which is called contribution cost pricing. In this pricing method, price of the product is determined by adding some mark-up into the average variable cost of the product.

Unit Contribution

Unit contribution is the difference between price of a product and its average variable cost.

Unit Contribution = Price – Average Variable Cost

Before reaching breakeven output, unit contribution covers the fixed cost. After the breakeven point, unit contribution increases the profit for the business.

Production Decision

AVC is used in short run continuity decision of production in a business. In economics, firms should continue production in the short run if average revenue or price is greater than or equal to average variable cost. The firms should stop production in the short run if average revenue or price is less than the average variable cost.

Break-even Point

The average variable cost is an important figure in calculating the break-even point, which is the number of units for which there is no profit or loss. The formula for breakeven point is:

Breakeven Point = Fixed Cost / (Price – Average Variable Cost)

Efficiency

Cost control and efficiency are important for all businesses. Dividing the costs into fixed and variable parts helps a business in terms of cost control. Variable costs are more flexible and easy to control as compared to fixed costs, which have to be paid even if no production is done.

Conclusion

In conclusion, average variable cost is the total variable cost divided by the number of units produced. Average variable cost is an important figure for any business and is used in making various decisions such as pricing, production, breakeven and costing. Calculating average variable costs also helps businesses become more efficient and profitable.