Photo by micheile henderson / Unsplash

Automatic Stabilisers

Definition

Automatic stabilisers are the taxes and government spending that change automatically, without any deliberate government action, to offset the fluctuations in a country’s real GDP. Automatic stabilisers are also called non-discretionary fiscal policy because they work through their normal operations without additional and timely authorisation by the government or policymakers.

These stabilisers work automatically to offset economic changes as the economy moves through different phases of the business cycle and help attain economic stability without the use of deliberate discretionary fiscal policy measures. They act as the shock absorbers to smooth out economic recessions and overheating booms. For example, during an economic recession, when unemployment is rising, tax revenue automatically falls and state welfare benefits rise to get the economy out of recession. Fiscal policies comprise discretionary fiscal policy and automatic stabilisers.

Discretionary Fiscal Policy

The discretionary fiscal policy occurs when the federal government implements a new law to specifically change the tax rates and government spending levels in order to influence aggregate demand in an economy.

Components of Automatic Stabilisers

There are two main components of automatic stabilisers, which are taxes and government spending, which have stabilising impact on the overall economy.

Taxes

Some taxes have a stabilising effect as they move accordingly with the economic growth. For example, during recessions, personal and corporate income tax collections decrease along with income and profits, and payroll tax collections decrease with wages and employment decreases.

Government Spending

Government spending on some transfer programmes is also dependent on the overall state of the economy. When the unemployment rate increases, spending on unemployment insurance also increases. During recessions, spending on anti-poverty programmes, such as SNAP and Medicaid, increases because, at times of bad economy, people are more eligible.

Workings of Automatic Stabilisers

Progressive taxes and unemployment benefits are two types of automatic stabilisers. Their workings are explained below.

During Strong Economic Growth

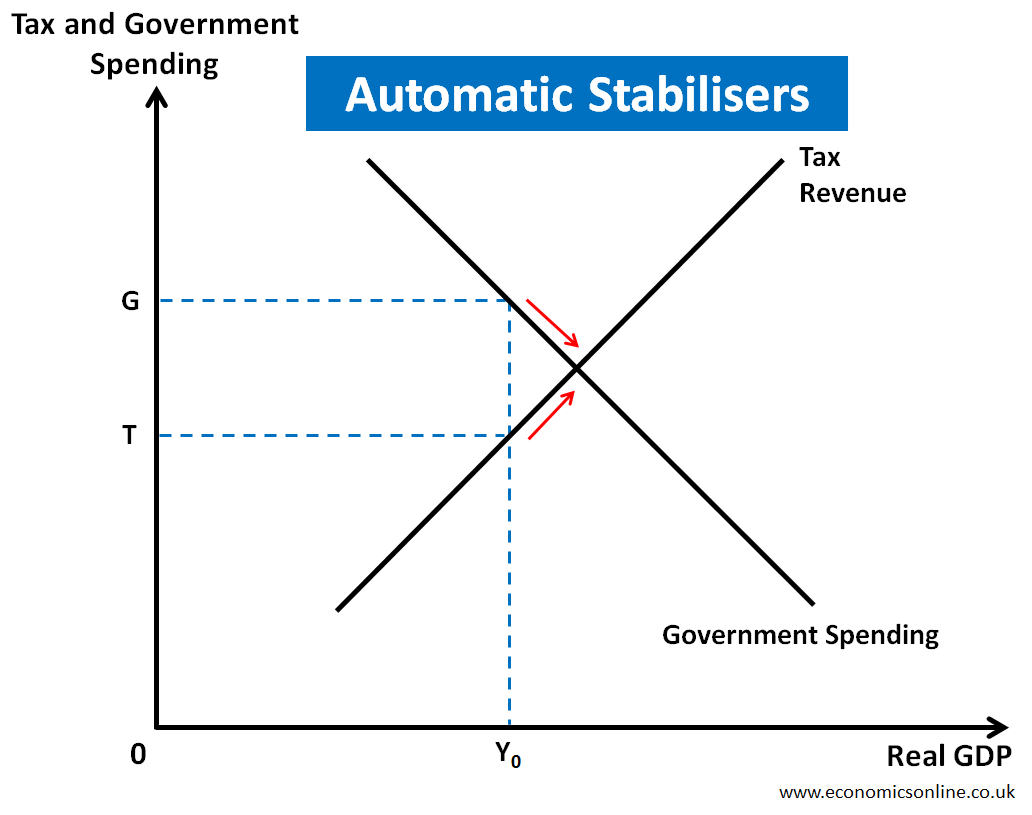

During times of rapid economic growth or an economic boom, the tax revenues will increase with the increase in households’ real incomes and corporate profits. At the same time, unemployment is declining. As more people are at work and need less state financial support, then government welfare spending will reduce. In this way, government finances improve, including a falling budget deficit or possible fiscal surplus. Therefore, fiscal policy is extracting incomes out of the circular flow, and automatic stabilisers help normalise the economic boom. This is illustrated by the following graph:

In the above graph, when real GDP increases from Y0, government spending on unemployment benefits decreases as more people are on jobs, while tax revenue increases automatically due to higher incomes of people and firms. These stabilisers offset the negative effects of high economic growth.

During an Economic Recession

During recessions, employment and real output shrink when real incomes decrease, people pay less taxes, either direct or indirect, and company tax payments also reduce. But government welfare spending like universal credit rises. Both will increase the budget deficit, which leads to the economy getting out of recession.

Further Explanation

Automatic stabilisers are specifically designed to counter negative economic shocks and recessions; however, they can also be intended to “cool off” an expanding economy or to tackle inflation. By their normal operations, these policies extract more money out of the economy in the form of taxes during periods of rapid growth and higher incomes. Automatic stabilisers put more money back into the economy in terms of government spending or tax refunds when economic activity slows down and incomes decrease. The purpose behind this is to protect the economy from economic challenges in the business cycle.

They can include the use of a progressive taxation structure under which the percentage of income that is collected in the form of taxes is higher when incomes are high. But due to inflation, this amount decreases when income decreases, causing job losses and lowering investments. For example, based on the current tiered structure, if individual taxpayers earn high incomes, their additional income can be subjected to higher tax rates. But if they earn low income or have low wages, they will remain in the lower tax tier as indicated by their earned income.

Similarly, unemployment insurance transfer payments decline when the economy is in an expansionary phase as there are fewer unemployed people filling claims. These payments rise when the economy faces a recession, due to which unemployment is high. When a person becomes unemployed, which makes them eligible for unemployment insurance, they only need to file to claim the benefits. The amount of benefits offered is controlled by multiple national and state regulations and standards, requiring no intervention by larger government entities beyond application processing.

Automatic Stabilisers and Fiscal Policy

When an economy is facing recessions, the automatic stabilisers may by design result in high budget deficits. This feature of fiscal policy is a tool of Keynesian economics that uses taxes and government spending to reinforce aggregate demand during economic downturns in an economy.

By extracting less money out of private businesses and households in taxes and providing them more money in the form of payments and tax refunds, fiscal policy is used to encourage them to increase, not decrease, their investment and consumption spending. The primary goal of fiscal policy is to help prevent economic mishaps from increasing.

Effectiveness of Automatic Stabilisers

The overall impact depends on whether a government allows automatic stabilisers to operate fully or not, and it does not introduce fiscal severity measures, like real spending cuts during recessions or economic slowdowns.

Also, impact depends on the marginal propensity to save and spend of those households whose real income is enhanced by welfare during a recession.

Impact also depends on the relative abundance of the welfare system, like unemployment support and base levels of payment for universal credit, but some governments have restricted total welfare payments.

Child Tax Credit

Another form of government spending used to support working families is the child tax credit (CTC). In 2021, the CTC underwent some changes that qualifying families will get credit on a monthly basis or as monthly payments transfer directly to their bank accounts. The child tax credit is also an expanded amount ranging from $2000 per child to $3600 per child under the age limit of 6. It is less for the children that are older than this. The CTC was introduced by President Joe Biden’s American Rescue Plan. It is also hoped that the CTC will reduce child poverty and support families in America because the CTC acts like a grant that is automatically extended to households. The child tax credit is also considered a new fiscal policy that is related to a universal basic income policy, but it has also been criticised in the past. The CTC’s intention is to help families manage their monthly bills for things such as food and clothing by sending money out monthly rather than sending a lump sum as part of a person’s tax refund.

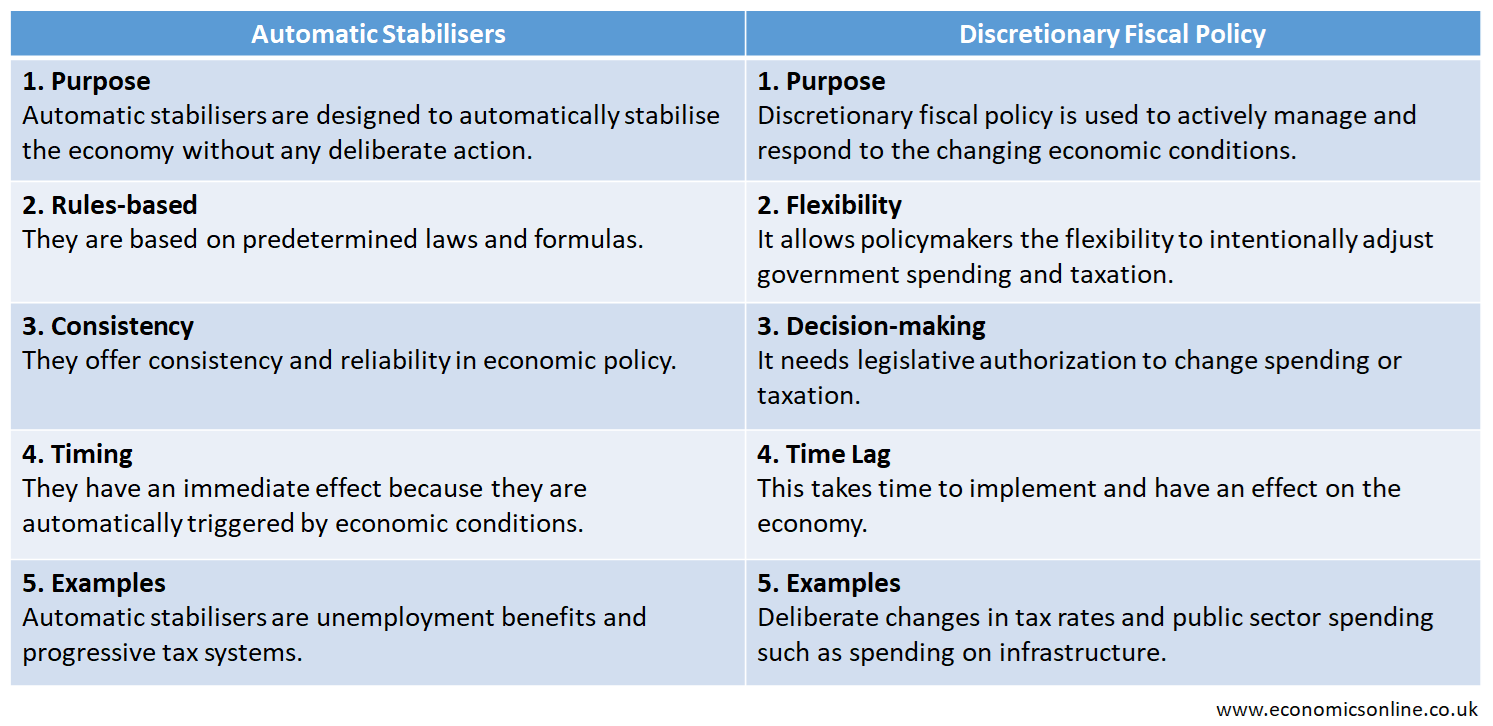

Automatic Stabilisers and Discretionary Fiscal Policy

The following table contains the main points of difference between automatic stabilisers and discretionary fiscal policy:

Conclusion

In conclusion, automatic stabilisers are referred to as the first line of defence that can turn severe negative economic trends across the country. Therefore, governments shift to other types of fiscal policy programmes to properly address the lasting and intense recessions and to target specific regions, politically favoured groups, and industries in order to get extra economic relief for society.