Austrian School of Economics

Introduction

An economic school of thought that originated during the late 19th century in Vienna with the works of Carl Menger, an economist who lived from 1840-1921, is called the Austrian school of economics. This school of thought is also known as the Vienna school, causal realist economics, or psychological school.

Historical Background

The Austrian school is distinguished by its belief that the actions of the broad economy are simply the sum of smaller individual actions and decisions, contrasted with the Chicago school and some other theories that seem to suspect the future from the historical arguments, often using wide statistical and numerical aggregates. Those economists who follow and prosper the ideas of the Austrian school today belong to different parts of the world. There is no specific attachment of these ideas to the country of Austria, and the Austrian school is called so because of its historical origin. For the last 90 years, no economist has become a leading name in the field of economics from the University of Vienna or any other Autrain university.

Carl Menger

The Austrian school tracked its roots from the late 19th century Austria and from the work of Carl Menger’s Principles of Economics. He, along with other economists, like William Stanely Jevons from Britain and Leon Walras from France, assisted in the Marginalist Revolution in economics. They emphasised that economic decision-making is performed over particular quantities of goods, the units of which provide some additional benefit (or cost), and that economic analysis must focus on these additional units and their linked benefits and costs. The contributions of Carl Menger to the theory of marginal utility mainly focused on the subjective value of economic goods and the ordinal or stratified nature of how people or individuals assign values to multiple goods. He also originated a market-based theory of the origin and function of money as a way of exchange to ease trade.

Eugen von Bohm-Bawerk

After Carl Menger, Eugen von Böhm-Bawerk continued this economic school by stressing the importance of time in economic activity and explaining the fact that all economic activities take place over a specific period of time. His work developed theories of production, interest, and capital. He also developed these theories in part to support his wide-ranging critiques of Marxist economic theories.

Ludwig von Mises

Ludwig von Mises, a student of Eugen von Bohm-Bawerk, then later combined the economic theories of both Carl Menger and Bohm-Bawerk with the ideas of a Swedish Knut Wicksell on money, interest rates, and credit in order to construct the Austrian Business Cycle Theory (ABCT). The mid-twentieth-century Austrian economist Ludwig von Mises is also famous for his work with his colleague Friedrich Hayek in debating the possibility of rational economic planning by socialist government.

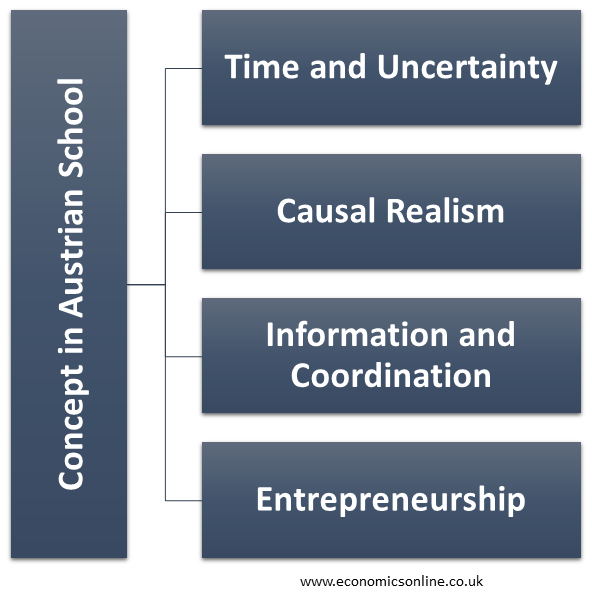

Concept in Austrian School of Economics

The following are some unique concepts that help to differentiate and define the Austrian school:

Time and Uncertainty

All economic activity happens in and through time, and it is aligned towards an inherently uncertain future. According to the school, the supply and demand curves are not static and intersect at stable points of equilibrium; instead, both supplying and demanding quantities of goods are actions that consumers and producers in the market are involved in, and the trade or exchange process coordinates the actions of both producers and consumers. The value of money is simply based on its future expected value, and the interest rates refer to the price of time in terms of money. Businesses and individuals bear risk and uncertainty as they combine economic resources in productive processes over time in the hope that it will provide them with a certain expected future return.

Causal Realism

The Austrian school states the economy as a wide and complex network of cause-and-effect relationships guided by purposeful human interactions and actions, which happen in real-time and space. It also involves particular, real economic goods in separate quantities as the objects of action. This school does not perceive the economy as a mathematically solvable problem of optimisation or a sum of statistical aggregates faithfully modelled econometrically.

Information and Coordination

In the Austrian school, prices are considered signals that summarise the competing values of different users of economic goods, the predictions of future preferences for economic goods, and the comparative scarcity of the economic resources. This type of price system provides the rational means in economic calculation about what goods should be produced, when and where goods should be produced, and how they are distributed among consumers, and aims to withdraw or replace it with central economic planning, which will damage the economy.

Entrepreneurship

In the case of the Austrian School, entrepreneurship also plays an important role. The entrepreneur or businessman refers to himself as an active agent in the economy who typically uses the information or knowledge available from prices and interest rates to coordinate the economic plans, practices judgements of expected future prices and conditions to select among the multiple alternative economic plans, and tolerates the risk of an uncertain future by taking subsequent responsibility for the future success or failure of the selected action plan. The entrepreneurial view of the Austrian school of economics not only embraces innovators and inventors but also encompasses all sorts of business owners and investors.

Austrian Business Cycle Theory

The theory of the American business cycle incorporates perceptions from the capital theory of the Austrian school—money, credit, and interest—and price theory to explain the periodic cycles of boom and recession that classify modern economies and stimulate the field of macroeconomics. The Austrian business cycle theory (ABCT) is a quite popular but somehow misinterpreted part of Austrian school.

According to this theory, the success and failure of the economy totally depends on coordinating the availability of the right type of resources in the right amounts at the right time because the productive structure of the economy comprises of multiple processes that happen over variable amounts of time and need the use of different complementary capital and labour inputs at different points in time.

For the Austrian economists, an economic recession is an honestly painful remedial process made inevitable by the miscoordination of the boom. The scope, depth, and length of the recession can entirely depend on the size of the initial expansionary economic policy and on any attempts to comfort the recession in ways that support unproductive investments or prevent financial, labour, and capital markets from adjusting.

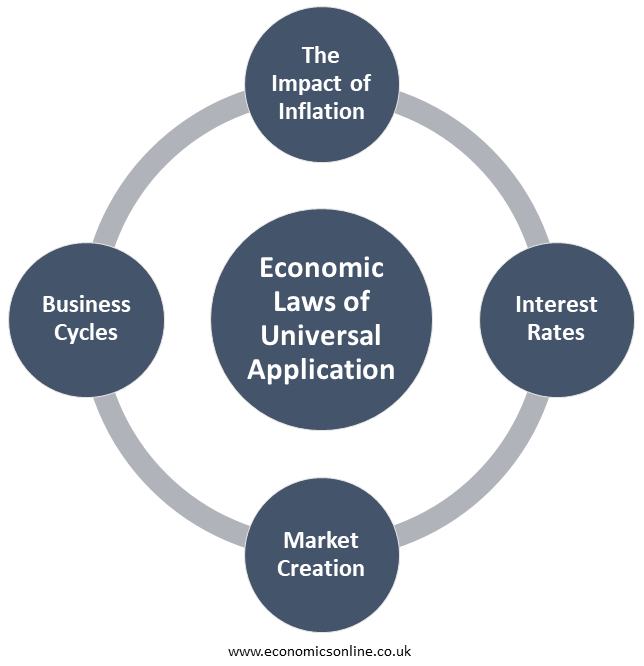

Economic Laws of Universal Application

The Austrian school of economics is based on the logic of prior thinking, which is something a person can do on his/her own without fully relying on the outside world, in order to discover economic laws of universal application. However, other schools of economics, such as the New Keynesians, neoclassical schools, and others, use statistical data and mathematical models to justify their point.

The Impact of Inflation

This school believes that any increase in the money supply can lead to inflation if it is not supported by the rise in the production of goods and services in the economy. It is also a fact that the prices of all goods or services do not change simultaneously. Prices of some goods may change quicker than other goods, leading to a huge change in the relative prices of goods. For instance, if the government is injecting money into the economy by simply purchasing corn, the prices of corn would probably rise as compared to other consumer goods, leading to a succession of price distortions.

Interest Rates

On the determination of interest rates, the classical view of capital states that interest rates are determined by the supply and demand of capital in the market. On the other hand, the Austrian school says that the interest rates are determined by the subjective decisions of the individuals and firms to spend money now or in the future.

Market Creation

The Austrian theory considers the market mechanism as a process, not an outcome of a design. People or individuals create markets with their intentions to comfort their lives, not by any deliberate decision. For example, if some non-professional people, having no knowledge of economics, start living on a deserted island, then their interactions to ease their lives would result in the creation of markets.

Business Cycles

The Austrian school argues that business cycles and their phases are the results of the distortion in interest rates due to the attempts of the government to control the money supply. The misallocation of capital occurs when interest rates are kept artificially high or low through the intervention of government, eventually leading to a recession in the economy. Also, the short-term business investments cause a downfall in the real investments, and as a result, the unemployment rate increases.

Conclusion

In conclusion, the economic theory of the Austrian school has taken economics somehow away from the statistical and numerical complexity of mainstream economics. There are also considerable differences with other schools of economics; however, by providing unique understanding into some of the most complex economic problems, the Austrian school of economics has gained a permanent place in the field of economic theory.