Ample Reserves vs. Limited Reserves

Introduction

In the subject of economics, the concept of reserves is considered very important in maintaining financial stability in an economy. Reserves, whether ample or limited, play a significant role while using monetray policy tools in meeting economic and financial challenges in an economy.

Before diving deep into this topic, let’s understand some basics first.

Basic Terms

Reserves

Reserves refer to the funds held by central banks to support financial stability and meet obligations.

They can include currency, deposits, and assets used for interventions and monetary policy.

Federal Reserve Bank

The Federal Reserve Bank, often referred to as the Fed, is the central banking system of the United States.

It is responsible for conducting monetary policy, supervising and regulating banks, and maintaining financial stability.

The Federal Reserve's main objectives include promoting maximum employment, stable prices, and moderate long-term interest rates.

The Reserve Market Graph

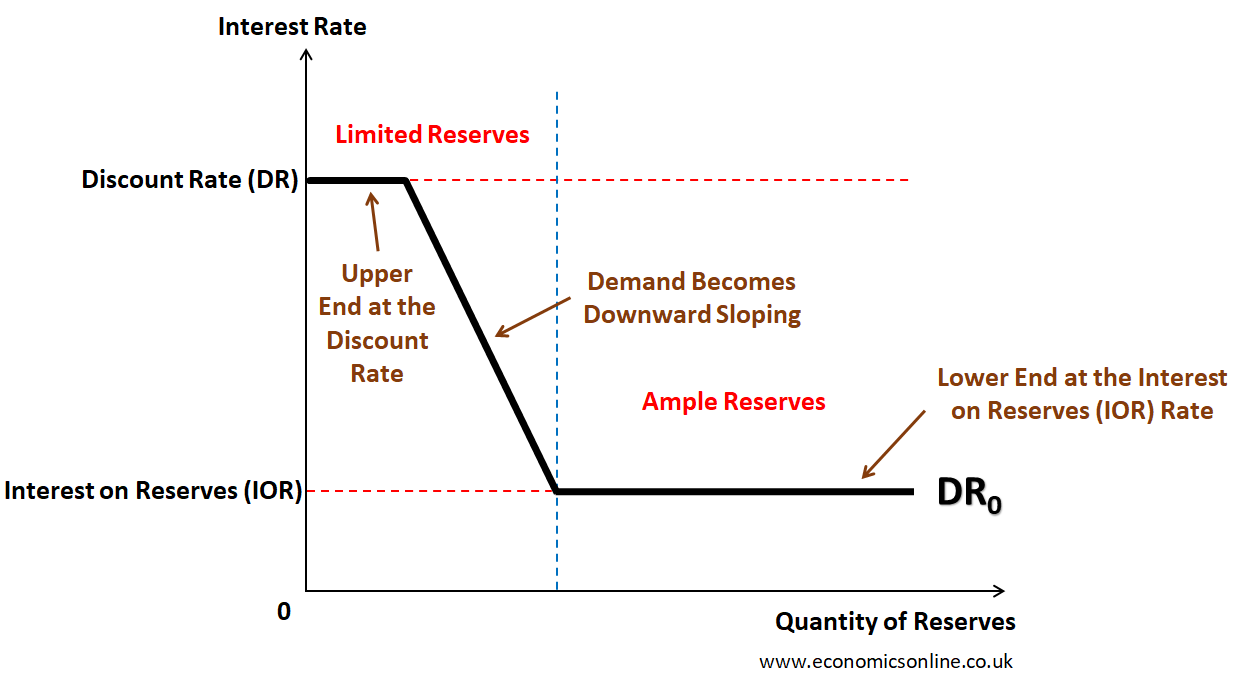

The reserve market graph shows the supply and demand for reserves in the banking system. The horizontal axis (X-axis) shows the quantity of reserves. The vertical axis (X-axis) represents the interest rate. The graph is used to determine the Federal Funds Rate (FFR) or the policy rate (PR), which is the interest rate charged between banks for overnight loans. This graph also helps us understand how changes in monetary policy and market conditions affect the supply and demand for reserves in the money market. We use the demand for reserves (DR) and the supply of reserves (SR) to determine the FFR as an equilibrium interest rate.

Demand for Reserves (DR)

The demand for reserves is represented by the downward-sloping demand curve (DR), as shown in the diagram below.

This curve shows the quantity of reserves that banks are willing to hold at various FFR values. The upper part of the demand curve is at the Discount Rate (DR), which is the interest rate charged by the central bank on the loans. The downward sloping part of the demand curve shows that when the interest rate on reserves decreases, the quantity of reserves demanded by banks increases. The lower part of the demand curve is at the interest on reserves (IOR) which the central bank pays banks on their reserves. DR and IOR provide a target range for Fed Funds Rate (FFR) to fluctuate.

Supply of Reserves (SR)

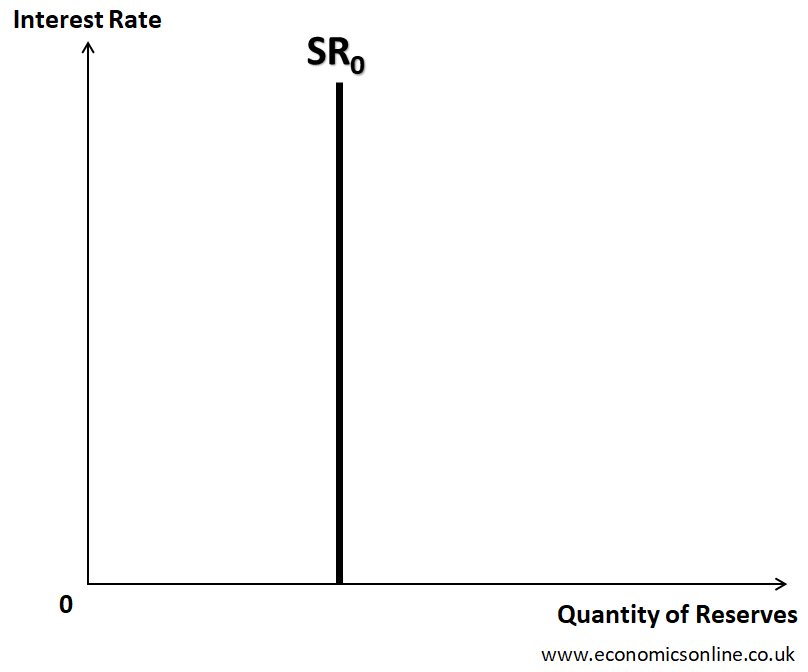

The supply of reserves is represented by the vertical supply curve, as shown below.

This curve shows the quantity of reserves that the central bank is willing to supply at various interest rates. This supply curve is vertical because only the central bank can supply reserves, and its decision is not influenced by the interest rate or FFR.

The Equilibrium Interest Rate

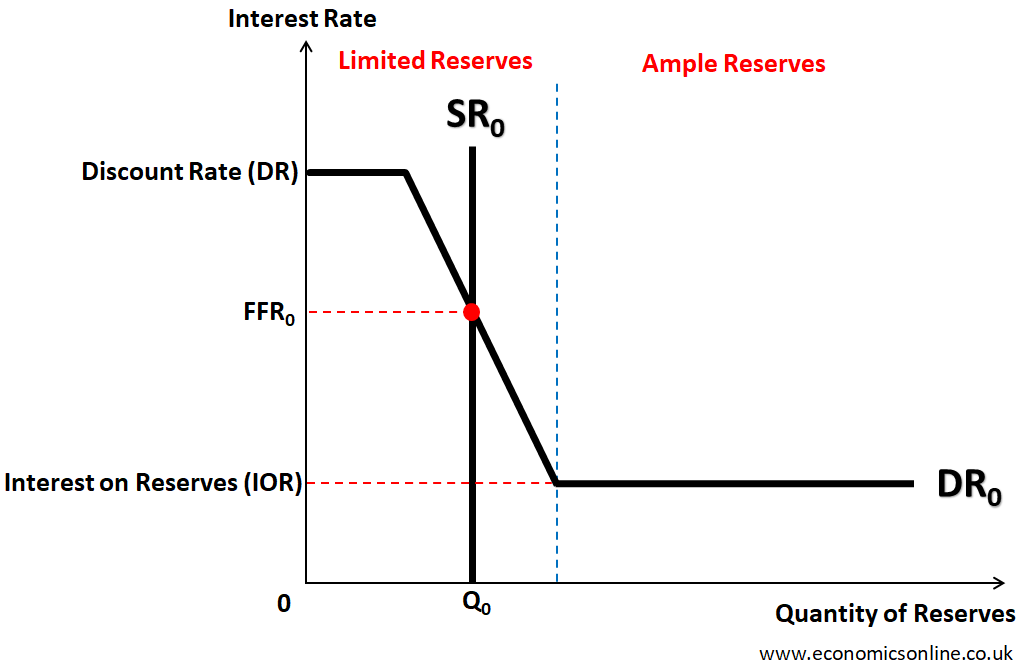

The equilibrium interest rate, or FFR is determined through the interaction of the demand for reserves (DR) and supply of reserves (SR) as shown below.

Understanding Ample Reserves

What are Ample Reserves?

Ample reserves refer to a situation where the central bank has an abundant amount of excess reserves, meaning it has reserves that are more than what are considered necessary for immediate financial stability.

The central bank can adjust interest rates, reserve requirements, and conduct open market operations to manage the money supply and control inflation. Having ample reserves can also give banks more flexibility in lending and support economic growth.

Key Characteristics of Ample Reserves

Some key characteristics of ample reserves are given below.

Financial Security

Abundant reserves imply that the central bank has surplus reserves available beyond what is required by regulations. This provides security for the economy against any economic shocks.

Policy Flexibility

With excess reserves, banks have greater flexibility when using monetary policy tools to stabilise the economy. For instance, banks can easily change their lending to support economic growth, as they have sufficient funds available for lending purposes.

Economic Stability

Ample reserves can be deployed to stabilise exchange rates, prevent currency devaluations, or provide liquidity to the financial system, reducing the risk of severe economic downturns and financial instability.

Disadvantages of Ample Reserves

The main disadvantages of ample reserves are given below.

Reduced Lending Incentives

With excess reserves, banks may be less motivated to lend money, which could limit access to credit for individuals and businesses.

Lower Interest Rates

Excess reserves can lead to lower interest rates, which may negatively impact savers and investors who rely on interest income.

Potential Economic Slowdown

If banks are not actively lending, it could slow down economic growth and investment in the economy.

Inefficient Allocation of Resources

Excessive reserves may result in a misallocation of resources, as funds may not be utilised for productive investments.

Opportunity Cost

Holding excessive reserves could mean missed opportunities for banks to invest in profitable ventures or support economic development.

Policy Tools in Ample Reserves

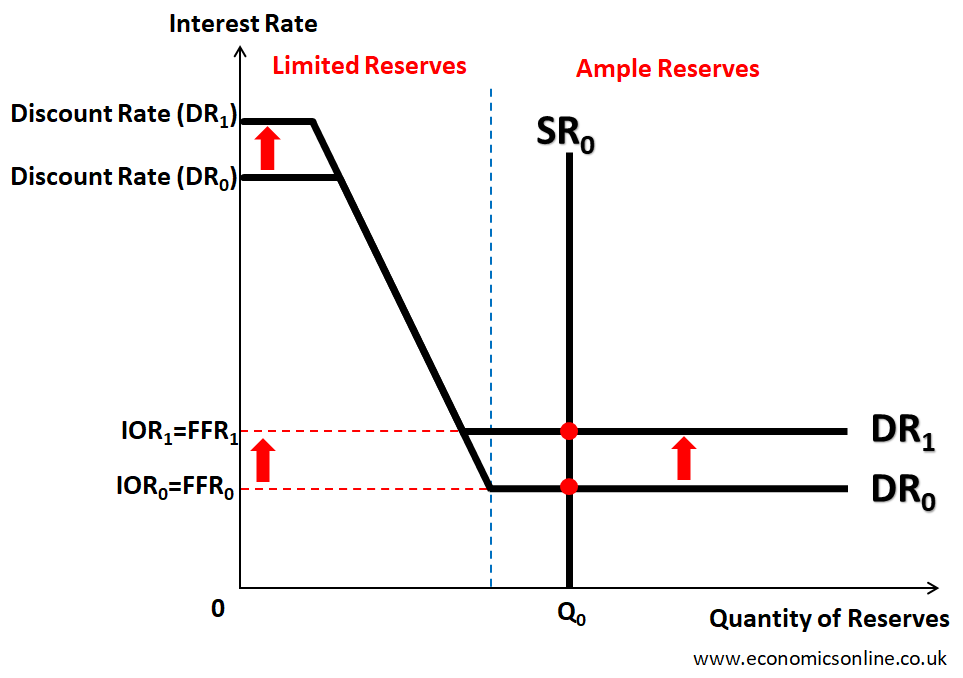

In case of ample-reserves framework, the central bank can change the interest rate as a monetary policy tool to achieve economic stability.

Adjusting Interest Rates

With ample reserves, the central bank can increase or decrease interest rates by changing the discount rates (DR) and the interest on reserves (IOR).

The central bank can increase DR and IOR to increase the interest rate, as shown in the figure below.

The central bank can decrease DR and IOR to decrease the interest rate.

Open Market Operations

In open market operations, the central bank controls the money supply by buying or selling government securities in the open market. To increase the money supply, the central bank injects money into the economy by buying securities. Conversely, to decrease the money supply, the central bank reduces the money supply by selling securities.

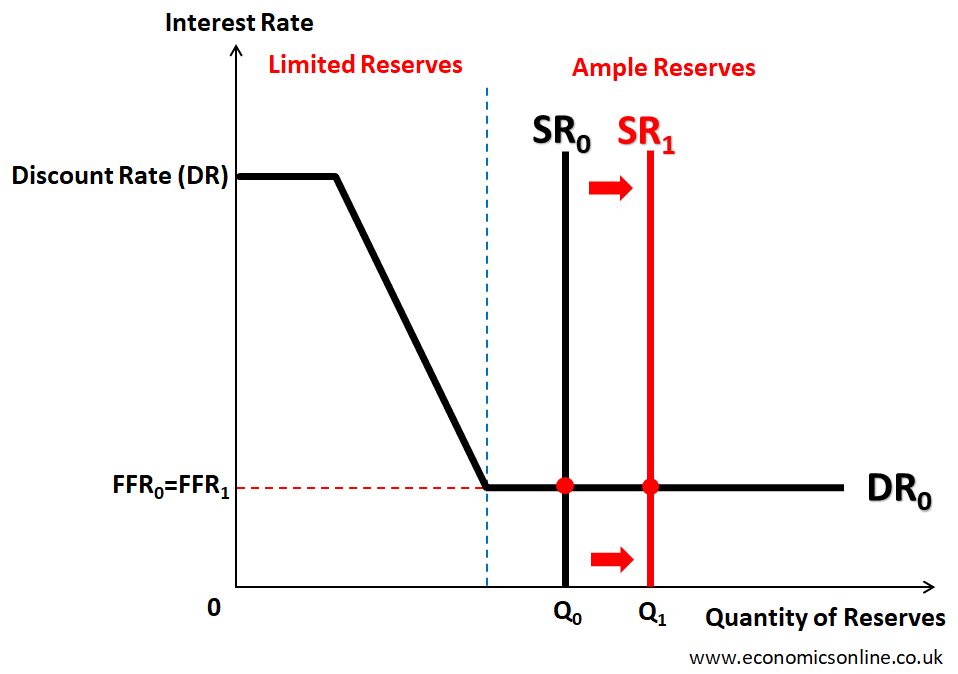

In case of ample reserves, open market operations have no effect on the interest rate. This is shown in the diagram below.

Understanding Limited Reserves

What are Limited Reserves?

Limited reserves refer to a situation where the central bank has the minimum amount of reserves required to meet its immediate obligations.

Limited reserves can limit the extent to which a central bank can engage in activities such as open market operations or quantitative easing.

This can impact the effectiveness of traditional monetary policy tools for stimulating the economy or managing inflation.

Key Characteristics of Limited Reserves

Some key characteristics of limited reserves are given below.

Reduced Financial Security

Limited reserves imply that the central bank has only a minimal amount of assets to cover its immediate financial obligations. There is little to no surplus beyond what is necessary to maintain basic financial stability. This lack of a safety net leaves the country vulnerable to economic shocks.

Reduced Policy Flexibility

Limited reserves can reduce the flexibility of using monetary policy tools to respond effectively to economic challenges. With fewer resources at their disposal, governments and central banks may have to use policy tools in restrictive ways.

Reduced Economic Stability

Countries with limited reserves are more susceptible to external economic shocks. Exchange rate volatility, commodity price spikes, or sudden shifts in investor sentiment can have a disproportionate impact on their financial stability, potentially leading to currency crises or financial instability.

Disadvantages of Limited Reserves

Some disadvantages of limited reserves are given below.

Restricted Liquidity

Limited reserves can hinder banks' ability to provide funds for customer withdrawals, potentially leading to liquidity shortages and financial instability.

Increased Risk of Bank Runs

Insufficient reserves can heighten the risk of bank runs, where customers rush to withdraw their funds, causing panic and potentially triggering a collapse of the banking system.

Reduced Lending Capacity

With scarcity of reserves, banks may have less capital available for lending, which can restrict access to credit for businesses and individuals, potentially slowing down economic growth.

Weakened Monetary Policy Effectiveness

In a scarce reserves system, the central bank's ability to influence interest rates and control inflation through monetary policy may be constrained due to limited reserves.

Vulnerability to Economic Shocks

When reserves are limited, banks may be more susceptible to economic downturns or financial crises, as they have less of a buffer to absorb losses and maintain stability.

Policy Tools in Limited Reserves

In case of limited reserves, the following policy tools can be used by the central bank to achieve economic stability; yet, their use is limited by the amount of reserves held by the central bank.

Open Market Operations

As stated earlier, the open market operations refer to the buying and selling of government securities, such as bonds, by the central bank in the open market. The central bank buys securities to increase the money supply. The central bank sells securities to decrease the money supply. Open market operations are a tool used by central banks to influence short-term interest rates and manage liquidity in the banking system. These operations are done through financial markets by The Federal Open Market Committee (FOMC) of the Federal Reserve.

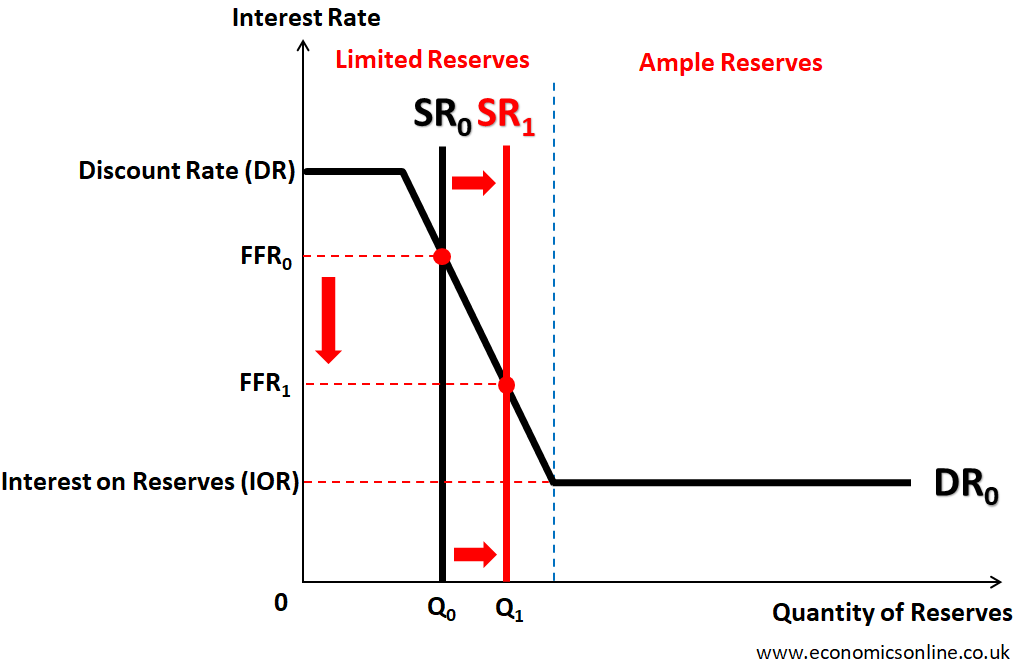

The following figure illustrates the effect of buying securities to increase the money supply. The supply of reserves will increase from SR0 to SR1, and the interest rate will decrease from FFR0 to FFR1.

Similarly central bank can decrease money supply to set FFR at a higher rate.

Reserve Requirement

In a limited reserve system, the reserve requirement refers to the percentage of deposits that banks are required to hold as reserves. This policy helps ensure that banks have enough required reserves in the form of funds to meet withdrawal demands while also influencing the amount of money available for lending and economic activity. When banks need extra funds, they can get them from the federal funds market.

For example, the central bank may make it mandatory that commercial banks must hold 10% of their deposits as bank’s reserves. This ensures that banks have a buffer to meet customer withdrawal requests while controlling the amount of money available for lending and economic activities.

Discount Rate

In a limited reserve system, the discount rate refers to the interest rate at which commercial banks and other financial institutions can borrow funds directly from the central bank. By adjusting the discount rate, the central bank can influence the cost of borrowing, which in turn affects lending rates and overall economic activity.

An example of the discount rate in a scarce reserve system is when the central bank lowers the discount rate from 5% to 3%. This encourages commercial banks to borrow more funds at a lower cost, stimulating lending and economic growth.

Quantitative Easing (QE)

Quantitative Easing (QE) is an unconventional monetary policy tool used by central banks when traditional measures are insufficient. In QE, the central bank purchases long-term government bonds or other financial assets from the market. This injection of money into the economy aims to lower long-term interest rates, stimulate borrowing and investment, and support economic growth. QE is typically used during periods of economic downturn or when interest rates are already low, as a way to provide additional monetary stimulus.

Comparative Analysis of Ample Reserves and Limited Reserves

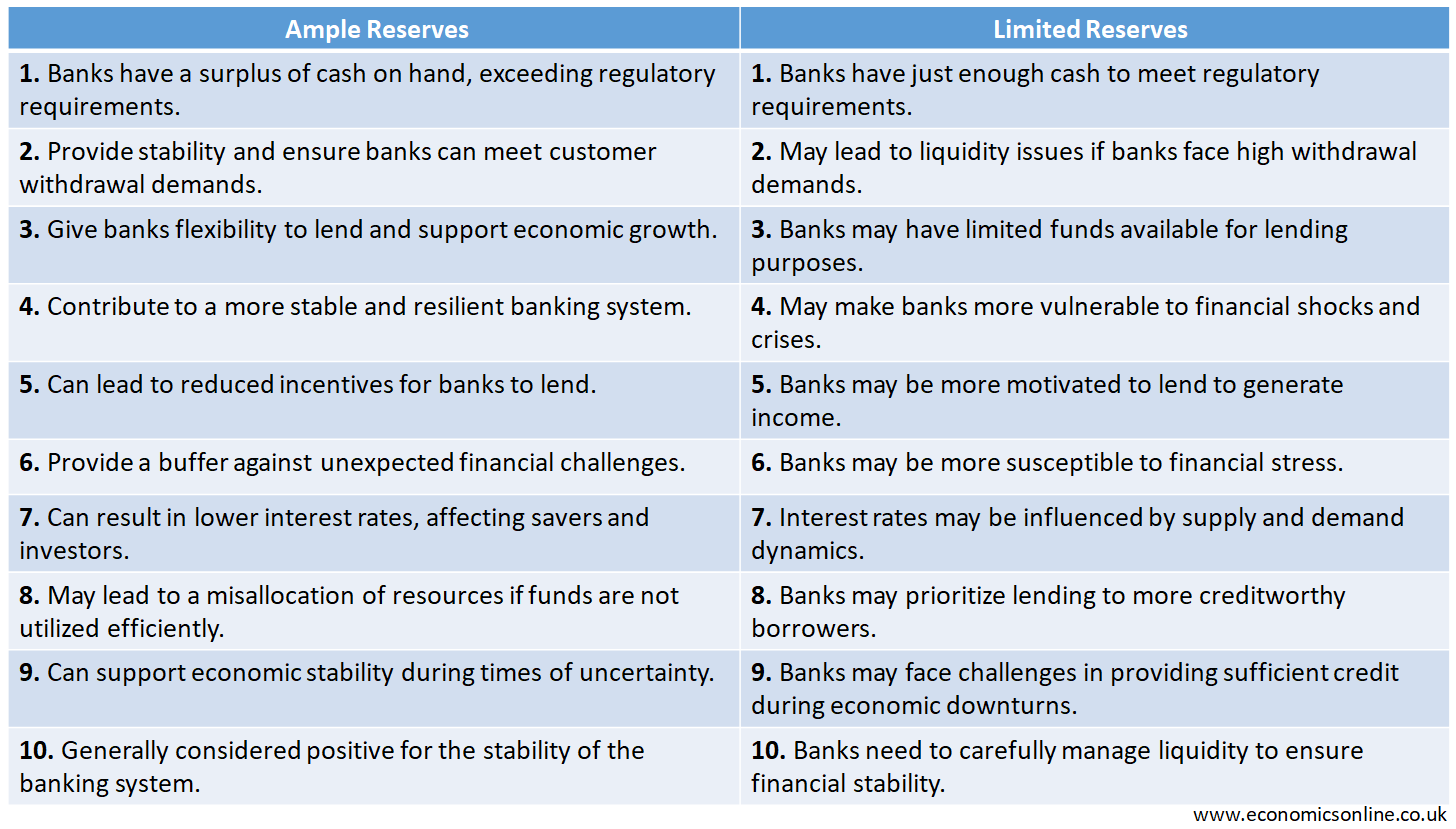

The following table summarises the key points of comparison between ample reserves and limited reserves.

Conclusion

In conclusion, ample reserves in the banking system can support lending and economic growth, while limited reserves may constrain lending and impact economic activity. The availability of reserves is influenced by the central bank's monetary policy decisions. It is important for central banks to strike a balance between ensuring sufficient reserves for financial stability and promoting economic growth through lending.