Photo by Alexander Schimmeck / Unsplash

American National Debt

Introduction

Debt is the amount of loan borrowed by one party from other parties, and it has to be paid back along with interest at some future date. Individuals and households borrow money to fund their expensive purchases, such as cars and houses. Firms take on debts for making investments. Governments also take loans to finance their budget deficits.

National Debt

National debt is the amount of money borrowed by a country from different creditors. It is also termed as government debt, federal debt, or public debt. In simple words, national debt is the amount of money that is owed by the federal government and is used to cover the outstanding balance of financial expenses incurred over time.

The national debt of America is the total financial liabilities that the federal government has to pay to its creditors. America has always carried national debt, and most of the presidents only added to it. Therefore, total national debt has been increasing, especially since 2008. The reasons for this increase are the combination of increased government spending and a failure to increase taxes by the United States government. On November 20, 2024, the current U.S. national debt is over $35.96 trillion.

Explanation

The federal government is the one who borrows money to cover the financial obligations or outstanding expenses, and that borrowed money continued to accumulate with time. The funds for federal spending are mainly produced by collecting taxes from individuals and firms. Then the federal government spends this collected money on programs like healthcare, social security, infrastructure, education, and national defence. The government has to borrow money in case the spending of the government exceeds its revenue.

Let’s understand this with a simple example. Suppose that the revenue of the government in a particular fiscal year is $1500 while its spending on various projects is $1800. The difference between these two figures is $300 and is called a budget deficit. This deficit will be financed by the government by borrowing $300 from different creditors, and this will become part of the national debt.

Budget Surplus

Budget surplus is the positive difference between tax revenue and government spending and occurs when the government spends less than the collected tax revenue.

Budget Deficit

Budget deficit is the negative difference between tax revenue and government spending and occurs when the government spends more than the collected tax revenue.

U.S. Treasury

In order to pay for the budget deficit, the U.S. Treasury takes loans by issuing debt instruments such as bonds and Treasury bills (T-bills). These can be purchased by financial institutions and investors, such as insurers, banks, the Federal Reserve, and other foreign central banks.

Treasury Securities

The national debt, which is usually referred to as the federal, government, and public debt, is made up of borrowing along with the interest liable to be paid to the investors who purchased Treasury securities.

The Expanding National Debt

It is said that the U.S. has carried debt since it was founded. Another fact is that the U.S. has accumulated over $75 million in debt during the period of the Revolutionary War, and this loan rises to $2 billion by the end of the Civil War in 1865. Many major political and economic events spark an increase in the amount of national debt. Some other events are the wars in Afghanistan and Iraq, the great recession, the Great Depression 2008-2009, and the pandemic COVID-19. During the wars in Afghanistan and Iraq, the military spending reached a record level of more than $600 billion.

The government spending on major relief measures during times of economic downturns, like the Great Depressions and the COVID-19, also increased the national debt. For example, during the recession of 2008, President Barack Obama’s American Recovery and Reinvestment Act (ARRA) was an $831 billion fiscal stimulus that was aimed to restore jobs during the recession.

Spending also increased by 50% during the President Donald Trump era (2019-2021), mainly due to tax cuts and COVID-19 relief measures. These types of moves, including increased government spending and decreased levels of tax revenue due to high levels of unemployment, have led to a sharp increase in the national debt of the country.

Those spending decisions that are made in the president’s office also affect the national debt level. A president’s actions to direct government spending towards healthcare, national defence, education, and fiscal stimulus packages can also increase the level of debt. These economic decisions are justified as they may be made due to unfavourable conditions, like war, recessions, and pandemics.

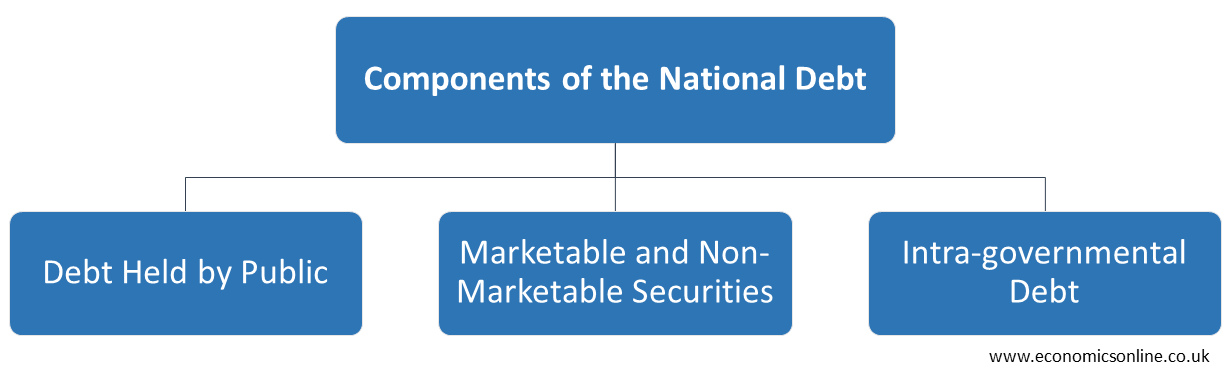

Components of the National Debt

The following are the main parts or components of the national debt:

Debt Held by Public

The U.S. federal debt is mainly held by its general public (American public), funded by U.S. banks, foreign governments, and investors. The part of publicly held debt does not include the U.S. debt held by the federal government or intragovernmental debt. The debt held by the public consists of individuals, corporations, Federal Reserve banks, state or local governments, foreign governments and investors, or any other entities outside the U.S. government.

Marketable and Non-Marketable Securities

The marketable securities, such as Treasury bills, notes, bonds, and TIPS (Treasury Inflation-Protected Securities), can be traded on the secondary market, and their ownership can be transferred from one entity or person to another entity or person.

The non-marketable securities that consist of government account series, savings bonds, and state or local government series cannot be sold to any other investors.

Intra-governmental Debt

A type of debt held by the government itself is called intra-governmental debt. The intra-governmental debt is what one part of government is liable to pay the other part. This component of the public debt has not increased sharply over the past decades.

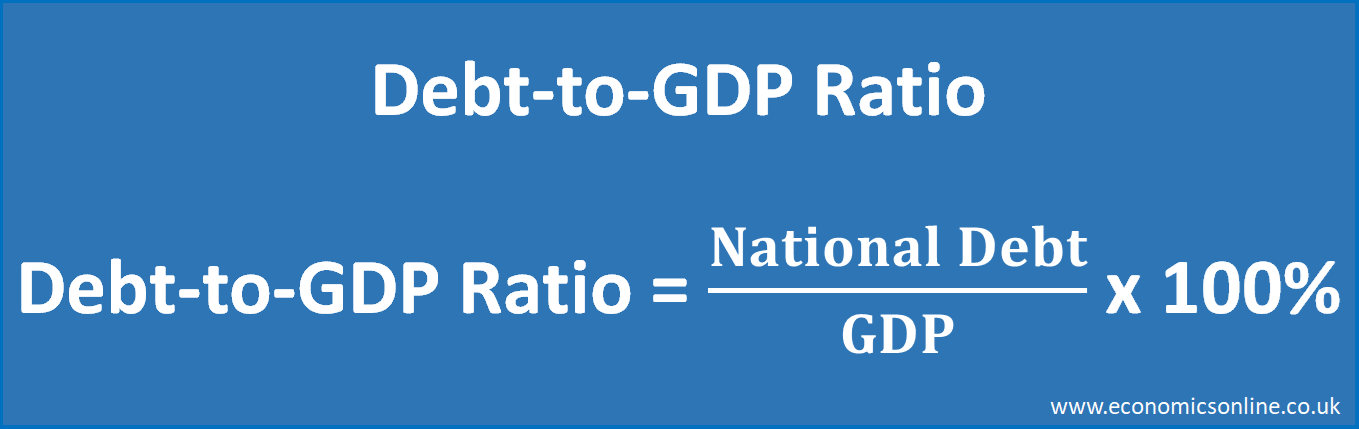

Debt-to-GDP Ratio

The public debt of a country expressed as a percentage of its gross domestic product (GDP) is called the debt-to-GDP ratio.

This ratio is expressed as a percentage and is used as a reliable indicator to evaluate a country’s economic situation because this ratio compares what a country is liable to pay with what it produces. In other words, it shows a country’s ability to repay its debt obligations. A higher value of the debt-to-GDP ratio indicates a lower ability of a country to repay its debt, due to which a country can be at a risk of default. This default is concerning to the investors as it could create a financial panic in both domestic and international markets.

According to a World Bank’s study, a country whose debt-to-GDP ratio is greater than 77% and is experiencing it for a prolonged period can face a significant slowdown of economic growth. For instance, from April-June 2024, the U.S. debt-to-GDP ratio was approximately 121.57%, and this ratio has been above 77% since 2009 due to the financial crises started in 2007.

The Debt Ceiling

The debt ceiling is the maximum amount of money that the government of a country is allowed to borrow by issuing debt instruments. It is also called a debt limit. When the debt reaches its ceiling, the Treasury must find another way to pay their liabilities. For example, if the federal government reaches its debt limit and that debt limit is not rising, this means that there is a high probability or risk that the U.S. will default on its debt. This is an alarming situation for investors because this could have serious consequences for both national and global markets. In order to overcome the risk of default, the debt ceiling needs to be increased by Congress, and it has been done many times.

For example, U.S. Treasury Secretary Janet Yellen said that the American government has reached its debt ceiling in January 2023. Yellen also said that the U.S. government should need to take extraordinary measures to avoid a sovereign default, which could probably come in mid-2023 if the debt ceiling is not raised.

Managing the National Debt

The Bureau of Fiscal Services is a government department that provides services of accounting and reporting regarding national debt to the government and also manages all the receipts and payments. A main role of these fiscal services is to keep records and report the national debt. The federal government also pays interest costs on borrowed money. The amount of interest payment depends on the total public debt and the rates of interest of different debt instruments. When FOMC (Federal Open Market Committee) increased the target range for the federal funds rate (fed rate), holding debt became more expensive for the governments also. In 2022 and 2023, the Federal Reserve continuously increased the benchmark interest rates to stabilise high inflation. According to the Peter G. Peterson Foundation, the interest expenses of the U.S. government could go over $1 trillion in this decade.

Conclusion

In conclusion, the national debt is the total amount of debt money a country is liable to pay its creditors. The government spends money on social programs, like healthcare, national defence, and education, which eventually accumulates debt due to borrowing or funding to cover the outstanding balance of expenses incurred over years. Some major economic and political events, like wars, recessions, and pandemics, mainly affect government spending.