Adverse Selection in Insurance

What is Adverse Selection?

Adverse selection refers to the tendency of people or firms to select unsuitable products or customers due to asymmetric information, leading to market failure. It is also called anti-selection or negative selection. This term is most commonly used in insurance, economics and risk management.

Important Terms

Let’s define some important terms to better understand the concept of adverse selection.

Market Failure

Market failure occurs when the free markets, without any government intervention, fail to allocate resources in socially desirable way. When market failure occurs, there may be under-allocation, over-allocation or wrong allocation of resources. Adverse selection is also a type of market failure due to asymmetric information.

Information Failure

Information failure refers to market failure that occurs due to asymmetric information or a lack of information. Adverse selection is a type of information failure.

Asymmetric Information

Asymmetric information refers to a situation where two parties in a transaction have different levels of information, leading to market failure. In simple words, asymmetric information is a situation where one party has more information than the other party. This can lead to a number of problems, including undesired results due to adverse selection.

Adverse Selection in Insurance

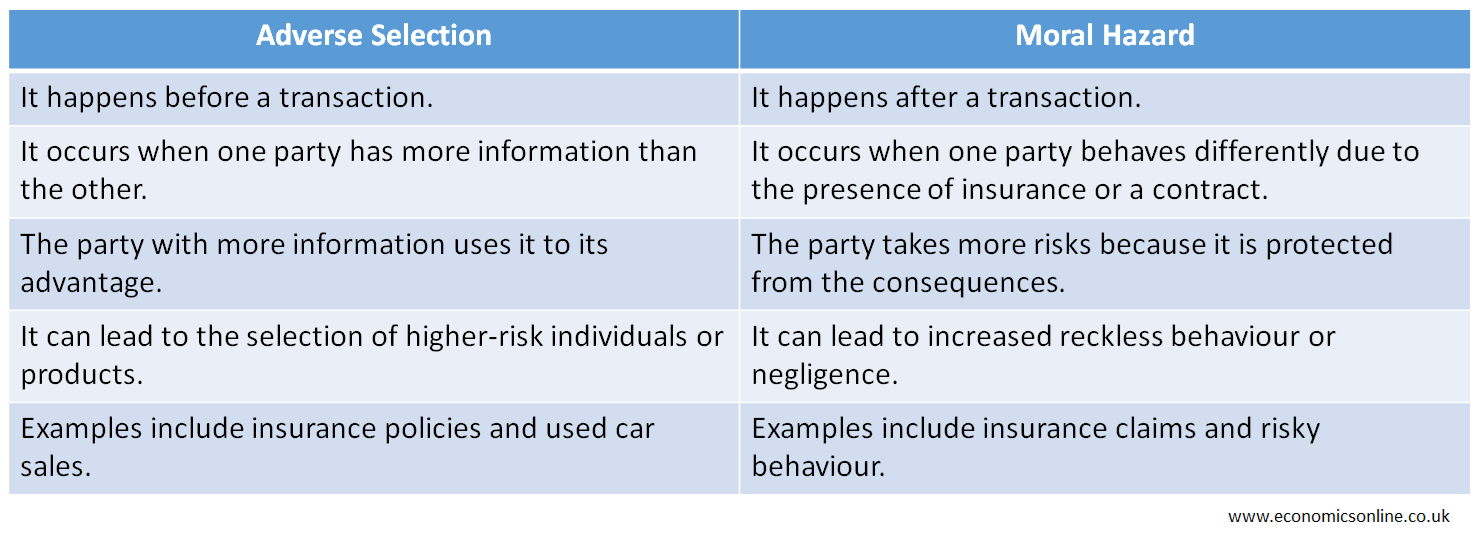

Adverse selection, a commonly used term in insurance, is one of the two main types of market failure in the insurance market. The other is a moral hazard.

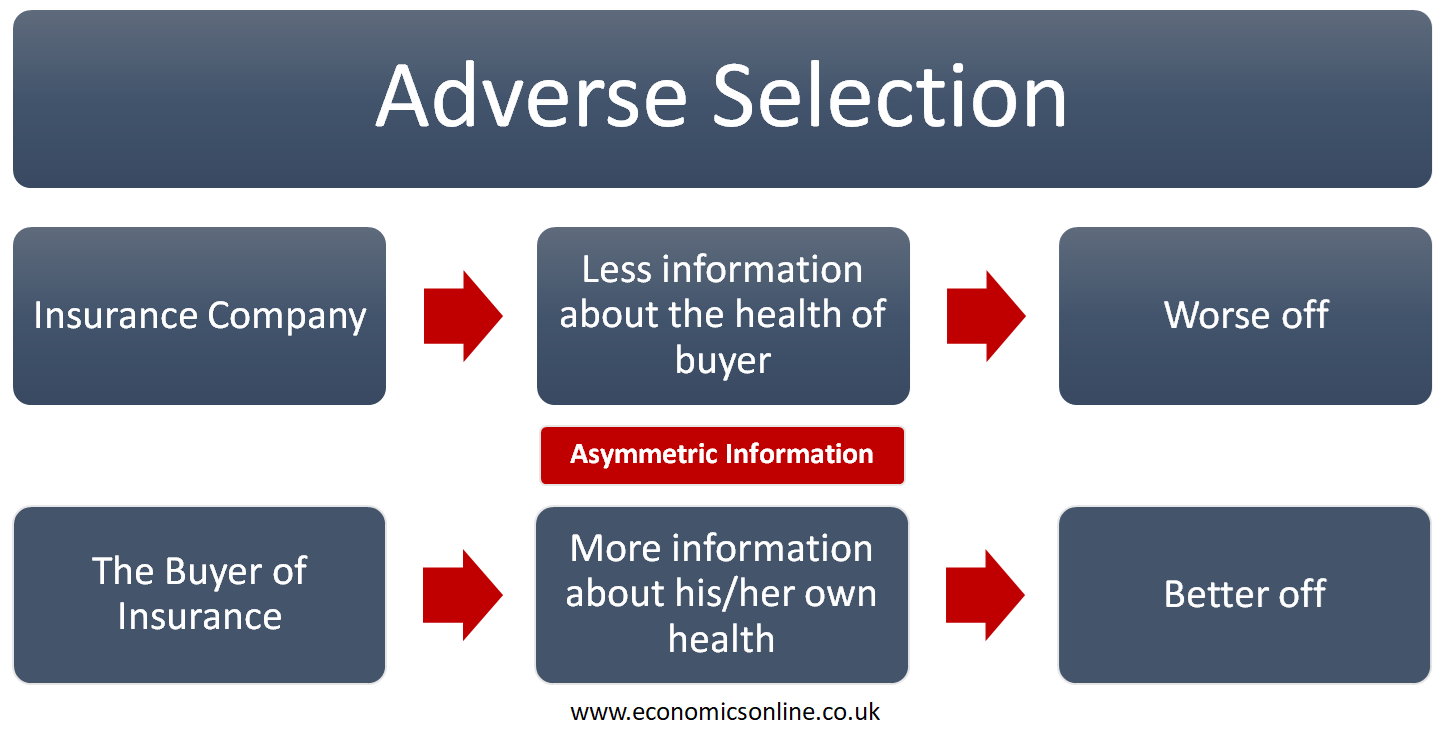

Adverse selection occurs when there is asymmetric information between the insurance company and the buyer of insurance.

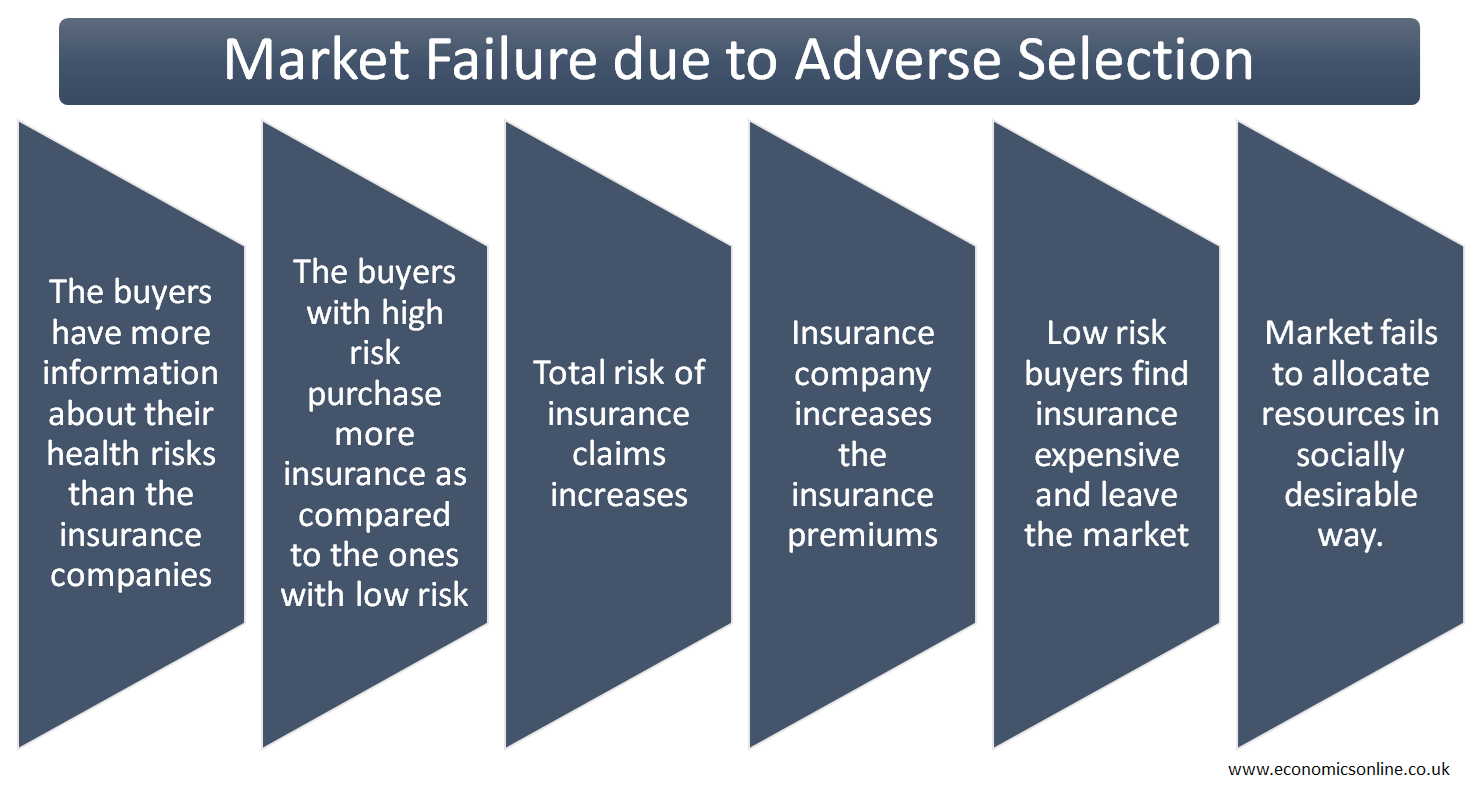

Insurance companies set their premiums according to the perceived risk of insuring a particular individual or group. A lower risk means a lower premium, while a higher risk means higher premiums. The problem of adverse selection occurs when a high-risk buyer of insurance is wrongly considered a low-risk buyer by the insurance company due to asymmetric information. The high risk buyer is given insurance at a low premium, leading to a disadvantage for the insurance company.

Let’s understand this situation with a simple example.

Suppose that there are two buyers of insurance, Mr. A and Mr. B, who want to take out a health insurance policy from the XYZ Insurance Company. Mr. A has a good health condition and is habitually going to the gym for exercise, while Mr. B has a poor health condition, high blood pressure, and a lazy lifestyle. Mr. A has a longer life expectancy, while Mr. B has a shorter life expectancy. Mr. A is a low-risk buyer of insurance, while Mr. A is a high-risk buyer.

Ideally, the insurance company should have all the information about the health conditions of both clients and offer insurance at a higher premium to Mr. B as compared to Mr. A. But, here comes the asymmetric information. Mr. B has more information about his own health conditions and medical history, while the insurance company has less information. By concealing or understating the information about his health conditions, Mr. B will be able to get insurance at a low premium, which may cost more to the life insurance company in future.

So, the insurance company has adversely selected Mr. B due to asymmetric information and has ended up insuring higher-risk individual at a lower monthly premium, which can result in high cost and financial loss for the company.

Due to the higher cost of insurance claims by high-risk sicker people, the insurance company will increase the insurance premiums, and fewer low-risk individuals will buy insurance in the health insurance market. This wrong allocation of resources can lead to the death spiral and hence a market failure.

Different Risk Classes for Policyholders

The policyholders are divided into three major risk classes by the insurance company:

Preferred

People who are in good health but have minor health issues are included in this class. These people are subject to paying low premium rates on the basis of their health conditions.

Standard

Those people who are in good health but have genetic health issues are bound to pay more premiums as compared to the preferred ones because their health issues and life expectancy hinder their ability to join the preferred category.

Substandard

People who have serious health issues such as cancer, have had heart surgeries, or have had kidney transplants are bound to pay a high premium as compared to the average ones. High-risk individuals are involved in the substandard category due to their hobbies, lifestyle, and chronic health issues.

Sources of Information for Insurers

The following are some sources through which an insurer can collect information about a policyholder:

Initial Application

The first source to collect information about a person is when the buyer fills out a form consisting of basic information, including age, gender, nationality, health, job, and lifestyle.

Premedical Examination

Another source is a premedical examination. The insurance company sent an agent to the home or office of the buyer to examine him/her thoroughly. For example, if the buyer had not mentioned the exact weight or a habit of smoking, the premedical exam will identify them.

Doctor’s Statement

After the premedical exam, the doctor’s statement is another source of information about the health conditions of the buyer. The doctor’s statement after a thorough medical examination gives a lot of information to the insurance company which is then used to avoid the possibility of adverse selection.

Prescription List

The prescription list of the buyer is also used as a source to collect correct information in order to minimise adverse selection in the insurance sector. The insurer can check your prescription list to see what kind of drugs the buyer is taking and what are the associated health risks.

Ways to Overcome Adverse Selection in the Insurance Sector

The following are some ways that an insurance company can use to overcome adverse selection:

Grouping High-Risk Individuals

The insurance companies can overcome the adverse selection by grouping high-risk individuals in the same category and charging them high premium rates to fulfill their future claims or coverage. The insurance companies can charge high rates from these clients on the basis of their ages, lifestyle risks, weight, and health conditions.

These factors are used to estimate a person’s life expectancy, and the amount the company is prepared to pay the claims.

Minimising Asymmetries

Another way to overcome adverse selection in the insurance sector is to minimise asymmetric information between the insurance company and the policyholders. The insurance companies can use multiple sources to get as much information as possible about the client. This will reduce the information asymmetry and the chance of adverse selection.

Providing Warranties and Guarantees

Another way to minimise adverse selection between buyers and sellers is to provide warranties and guarantees for a certain period of time so that consumers can use the product free of risk for a specific period of time and be able to return the bought product if it has any issues within the offered period. This method is particularly useful to minimise the adverse selection in the used car market.

How Insurance Companies Protect Themselves

The following are three main actions that insurance companies used to protect themselves from adverse selection:

Identify Risk Factors

The first action is to identify the risk factors associated with the policyholders, such as their high-risk lifestyle, hobbies, and chronic health issues. By identifying risk factors, companies can manage the client’s risk level associated with them.

Verify Applications

Another action is to carefully verify the submitted applications to qualify for a certain policy product. A well-functioning system is used to verify the information provided by the clients.

Cap Payouts

The third action is to put limits on the coverage associated with the insurance industry as an aggregate limit of liability. This measure puts a cap on the total financial risk or payouts of the insurance company. Insurance companies used standard measures and strategies to overcome adverse selection from the market.

Differences between Adverse Selection and Moral Hazard

Adverse selection and moral hazard are two main types of market failure due to asymmetric information. The following table contains the main points of difference between adverse selection and moral hazard.

Other Examples of Adverse Selection

Used Car Market

Another common example of adverse selection is the used car market. There is information asymmetry between the buyer and seller of used cars. Normally, the seller has more information about the car history and its condition, as compared to the buyer. There may also be some hidden defects which only the seller knows. This asymmetric information leads to the adverse selection for the buyer who will pay more than the actual worth of the car leading to wrong allocation of resource. On the other hand, the seller will gain profit from the sale of car.

Medical Services

When a patient goes to a doctor, there is asymmetric information between them. The doctor, as an expert, has more information about the disease as compared to the patient. This can lead to information failure, where the patient may incur a higher cost of unnecessary medical test and expensive medicines due to lack of information.

Capital Markets

The capital markets are also subject to adverse selection. Some companies offer equity to their investors as compared to profits. The company managers know the hidden risks that are associated with the company, but the outside investors are unaware of these risks. This asymmetry of information then leads to an adverse selection situation.

Conclusion

In conclusion, adverse selection is present in the insurance sector because there is an asymmetry of information between the insurance company and the high-risk policyholders. This asymmetry of information can increase the financial risks of the insurance companies in the form of high policy claims by the policyholders. The adverse selection can be minimised if both the parties, involved in a transaction, have the same amount of information.