Shell gas station at night.

The 1973 Oil Crisis and Shell's Scenario Planning

The 1973 Oil Crisis and Shell’s Response

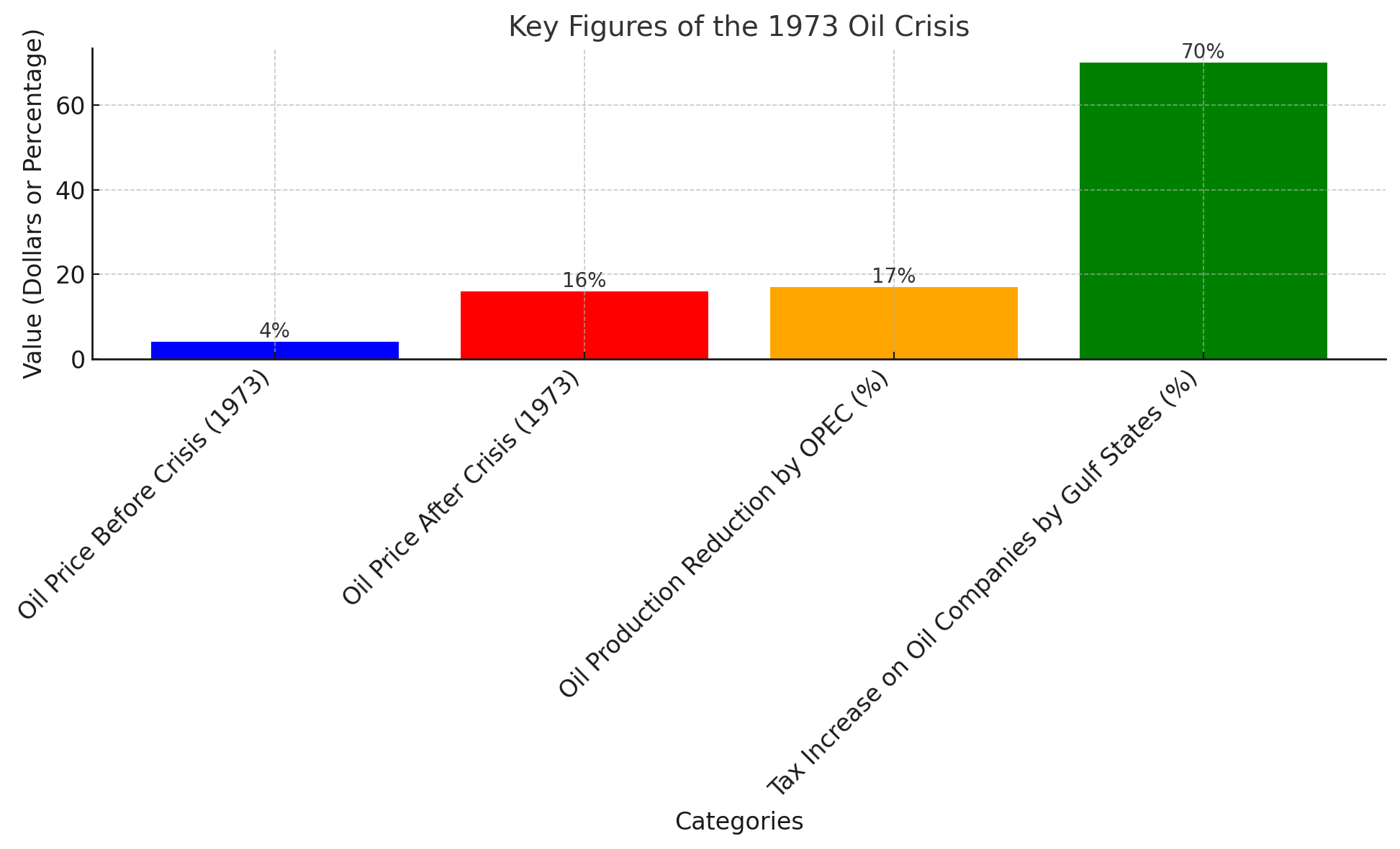

The 1973 oil crisis was a major event that changed the global oil market. It was caused by geopolitical tensions after the Yom Kippur War. The Gulf States and OPEC reduced oil production, raised oil prices by 17%, and increased taxes on oil companies by 70%. Consequently, oil prices soared from $4 to $16 a barrel. The western economies were faced with the brunt of three decades' steady growth by now brought low with diminished purchasing power, economies shrinking to a few husks, and soaring levels of unemployment.

Key Figures of the 1973 Oil Crisis

The graph below illustrates the significant changes in oil prices, production reductions, and tax increases during the crisis:

Shell, in the midst of this lugubrious chaos, stood out as being better prepared than most, simply because it shouldered a sharper vision into the future.

Early Planning at Shell

Shell started its Group Planning department in 1959 to predict future trends using methods based on past data. In 1965, it introduced a computerized forecasting tool called the Unified Planning Machinery (UPM) to project financial outcomes based on oil consumption growth. But by the early 1970s, these methods were no longer enough. People in the oil industry were starting to question whether growth could continue forever. Reports like the Meadows Report, which talked about the "limits to growth," and projections from BP showed that OPEC might limit supply in the future.

Moving to Scenario Planning

In 1965, Shell began working on "Long Range Studies" under the guidance of Jimmy Davidson and Ted Newland. Drawing on the ideas of the Hudson Institute, the team created alternative futures, considering political, economic, and cultural factors. These models offered a challenge to the idea of the endless increase: they entailed two futures, one in which international cooperation and free trade were realized, the second one in which it would not happen and the states would prefer protectionism and conflict. Such scenarios delivered insight into which of those factors predicted and which of them were uncertain by Shell, along with the highlighting of the increasing power of the oil-producing Gulf States.

Scenarios as a Way to Change Thinking

When Pierre Wack took over Shell’s forecast planning, the focus shifted from forecasting to changing how managers thought about the future. The plans weren’t meant to predict exactly what would happen but instead to help decision-makers think more broadly and challenge their assumptions. This approach encouraged Shell’s leaders to think about uncertainties and prepare for unexpected disruptions.

Getting Ready for the Oil Crisis

In the 1970s, Shell’s forecast team created two types of scenarios. Type A scenarios looked at the technical limits of oil extraction and how shortages might happen. Such situations were more probable than improbable, yet discomforting to think about. Type B scenarios predicted a more hopeful future but were less realistic. These exercises helped Shell in changing strategies and preparing better for seismic changes.

For example, this led Shell to specialize primarily in light fuels which were harder to replace rather than heavy fuels which had substitutes. With an effectual use of scenario insights, refinery coordinator Jan Choufoer succeeded in advocating for an upgrading policy which meant increased cracking capacity converting heavy into light fuels. This then opened Shell into a new oil pricing shock and consequent big profits from the crisis.

The Legacy of Scenario Planning

Shell’s use of scenario planning showed that the value of this method wasn’t about predicting the future but about changing how people think and plan. By using hypotheses in their strategies, Shell became more flexible and better at handling risks and disruptions. This approach helped the company stay ahead in uncertain times and is still considered an important tool for dealing with change. It shows how businesses can be successful by preparing for a range of possible futures.