Photo by Aaron Burden / Unsplash

Exponentially Rising Tuition Costs Suppress Economic Growth in the U.S.

Rising College Tuition in the U.S.: A Growing Economic Challenge

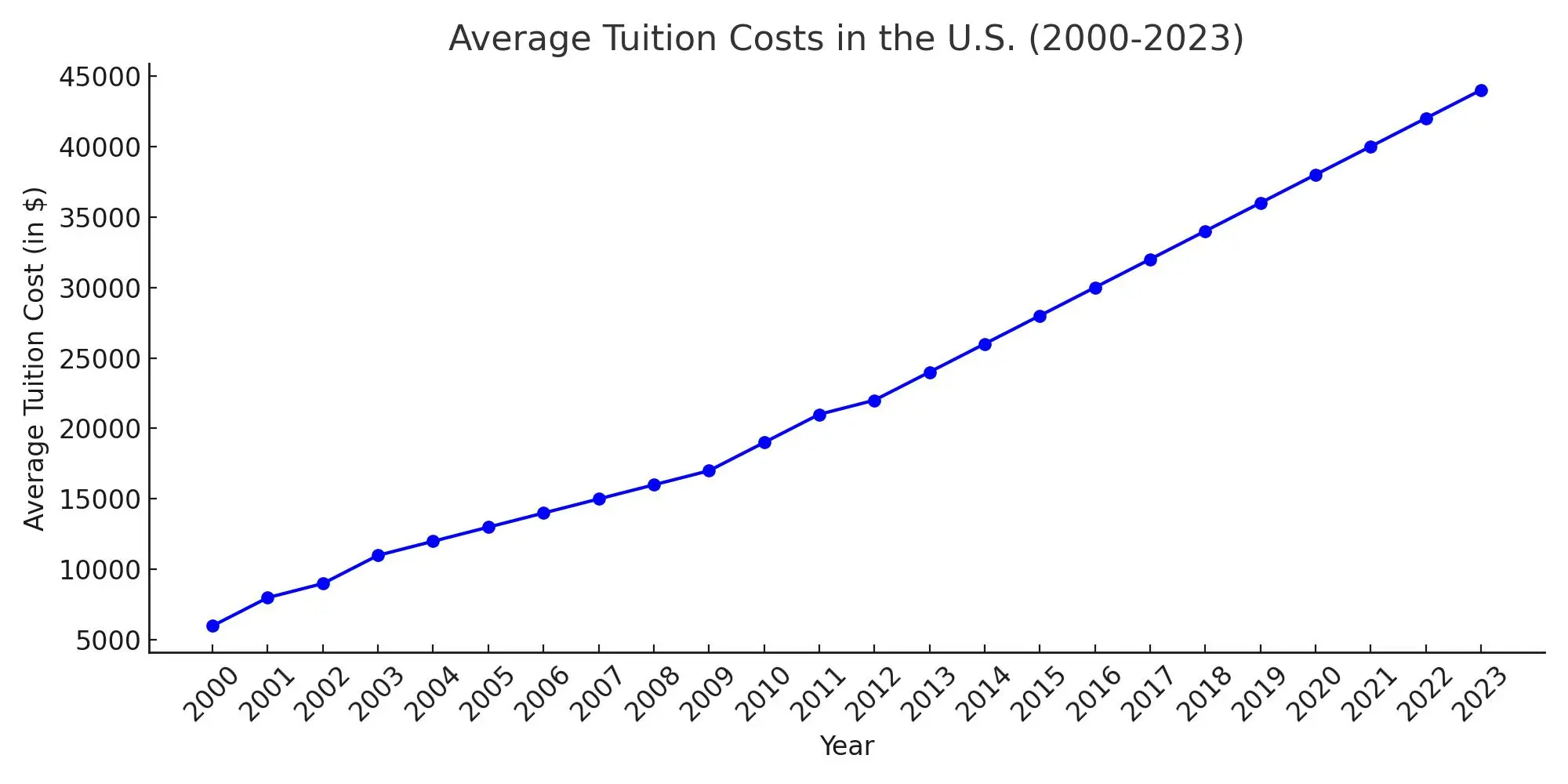

College tuition is accelerating at a fast rate in The United States despite being a developed country. Fare is on the rise in the past twenty years whereby further education has moved up by over three times since the beginning of the new millennium. A heavy load is upon students and parents due to this huge difference leading to consequences at macro-economic levels. Consequently, soaring college charges threaten more than just personal fiscal health; they impede broader economic expansion through decreased job placement rates, enhanced social classes movement and restricted economic prospects.

Tuition Inflation

Since the early 2000s, tuition costs at both public and private institutions have skyrocketed. In 1989, a four-year college degree cost approximately $26,902 (about $52,892 adjusted for inflation). However, by 2018, that same degree would cost around $104,480—a fourfold increase. While general inflation during this period was around 236%, college tuition far outpaced it, increasing by more than 120%. Today, young professionals enter the workforce burdened by unsustainable student loan debt, which creates long-term financial stress and slows economic mobility.

Postponing Major Life Decisions

One of the most important consequences of the increase in tuition fees is postponement by young adults of some of the major life milestones. Millennials and Generation Z are putting off getting married, owning houses, as well as starting families because they cannot afford it according to one source that quoted these events. For instance, the first time buyer’s average age increased from 29 years old back in 1981 to 34 years old today compared to how it used to be previously. Again, while marriage used to take place at the age 23 and 21 for men and women respectively some time back in the early 1970s (;30; 28) now this figure is higher than before.

Postponing significant life events have an impact on the economy. It is essential to note that owning a house increases demand in property markets and encourages consumer expenditure. Therefore, if young people choose to buy their first homes later or postpone starting families they weaken consumer spending growth leading to less economic productivity in general. Furthermore, research reveals that individuals who get married or buy houses at a later age tend to save less money over time which affects their personal financial security as well as hurting national economies.

Moreover, women may experience disparities in professional advancement and income when they decide to delay having children. Apparently it takes many years for them to catch up with men in our days by earning less on average than men at any given time period due largely because they have their kids later than men do, among other things. Also, such a situation would exacerbate the salary inequality that exists between men and women on the grounds of the concomitant costs that come with studying at school when one does not have a scholarship.

Social Factors and Workforce Implications

Increasing tuition fees do not affect all students equally. Accordingly, this has led to a decrease in the number of male students enrolled in universities. The rise in college tuition costs has forced many males to forego pursuing higher studies with potential adverse impacts on their capacity to compete for higher paying jobs in future within the economy. This may consequently result in skill shortages particularly in stem related sectors within the industry if young men show less interest towards it.

In addition, extreme tuition rates may engender economic stagnation as non-degree holders earn lower wages thus contributing minimally towards overall growth in economy. Consequently, choosing to avoid college because of expensive prices can lessen future incomes and thus chances to get out of middle-income circles making one end up in a more unequal labor market that offers little in terms of well remunerated skilled labour opportunism.

Higher Education as a Business

A major driver of rising tuition costs is the increasing commercialization of higher education. Many universities now operate more like businesses, prioritizing budgetary expansion over the academic and civic development of students. The growth in administrative staff, expansion of campus facilities, and investment in luxury amenities have all contributed to the soaring costs of higher education, while the quality of education has remained relatively unchanged.

Additionally, the easy availability of student loans has created what some economists call a "tuition bubble." With government-backed loans widely accessible, universities face little pressure to keep tuition affordable. This has led to a cycle where colleges continue to raise tuition, knowing that students can borrow to cover the costs, ultimately driving up student debt and contributing to long-term financial hardship for graduates.

Economic Consequences

The rising cost of education has far-reaching consequences for the U.S. economy. Higher education is crucial for developing a skilled workforce, which is essential for economic growth. However, as fewer students can afford college, the pool of skilled labor shrinks, particularly in high-demand fields like technology, healthcare, and engineering.

The burden of student loan debt also stifles entrepreneurship and innovation. Many potential entrepreneurs are unable to start businesses because they are tied down by loan repayments. With much of their income going toward debt servicing, they have less disposable income to invest in new ventures, which hinders economic growth and job creation.

Moreover, high levels of student debt reduce overall consumer spending, as graduates are forced to delay major purchases such as homes, cars, and other goods. This reduction in spending negatively impacts industries reliant on consumer demand and slows down economic recovery and expansion.

Conclusion

The rising cost of college tuition over the past 20 years has created significant financial challenges for students, delayed major life events, and widened social disparities. While higher education remains a critical pathway to economic mobility, the escalating costs have placed it out of reach for many, resulting in long-term negative effects on the U.S. economy. Without meaningful reform, the country risks perpetuating economic inequality, slowing innovation, and hindering the development of a skilled workforce.

To address these issues, policymakers and educational institutions must reassess the current higher education system. Solutions may include increasing funding for public universities, expanding financial aid, and reducing the administrative costs that drive up tuition. A more affordable, accessible higher education system would benefit not only individual students but also the broader economy, fostering greater social mobility and ensuring long-term economic growth.