Photo by Vitaly Taranov / Unsplash

Why Americans Are Living Paycheck to Paycheck: The Financial Reality Behind Low Savings

As Jean Chatzky, the famous personal finance guru, once quipped, “Knowing where you stand in your quest to accumulate enough money for retirement is an incredibly important part of the planning process.”

But for some people, retirement is still a far-fetched idea.

While chasing the American dream, many have gotten lost in consumerism and amassed substantial financial burdens that only seem to increase with time.

According to the latest studies, around one-third of working Americans are living paycheck to paycheck today. And it is not just the low-income groups that struggle to meet their financial commitments. Those in the middle and high-income categories in the US are finding it just as hard to get by with their monthly salaries.

Why Are So Many Americans Still Living Paycheck to Paycheck?

So, what are the real reasons behind the financial struggles of most Americans? The answers might surprise you.

Lack of Financial Planning

This is often the number one factor that keeps people from achieving financial freedom. Consumerist habits, a desire to keep up with the Joneses, and the wide availability of credit have led many to take up lifestyles they can hardly afford.

Remember, bigger houses in expensive neighborhoods, luxury cars, the latest tech gadgets, and regular vacations all come at a cost and usually spread across a long period.

If you don’t watch out, they can accumulate into huge sums, well above your monthly income. When there is little to no financial planning, this is the unfortunate scenario most Americans are bound to face.

Rising Expenses

Over time, it is natural for your regular expenses to increase. For instance, when you decide to get married and have kids, you will eventually need to move into a bigger place as your family expands. A larger house means higher mortgages, bills, insurance, and maintenance costs.

That’s not all; Some may have to support elderly family members or could have unexpected medical bills that are not covered by insurance.

The bottom line is, monthly expenses can rise as you go through different stages of your life. And this could have a significant impact on your ability to save.

High Inflation and Interest Rates

Inflation and interest rates could be a double-edged sword that can sever your dreams of achieving financial freedom.

When inflation rises, the cost of food and other living expenses take a sharp turn up, making regular goods and services unaffordable. To curb this situation, the Federal Reserve typically responds by increasing interest rates. This makes borrowing more expensive.

Using high-interest instruments like credit cards can become deadly in such an environment. Even low-interest loans like mortgages can get you into trouble if you are not on a fixed-rate arrangement.

Debt Burdens

Borrowings of a person usually grows with age, peaking around the ages 40 and 49. Mortgages, student and vehicle loans, credit card debt, and personal loans can all add up, increasing the monthly amount you owe.

Based on 2023 Federal Student Aid data, 43.2 million people in the US had outstanding federal student loans alone, amounting to $1.60 trillion in total.

And as of the first quarter of 2024, Americans were $17.69 trillion in debt. For many people, this is a massive burden they will likely have to shoulder for years, if not decades.

How Can You Achieve Financial Security?

Is it possible to attain financial freedom for someone living paycheck to paycheck? Definitely, with the following steps.

Set Financial Goals

What does financial freedom look like to you? The answer to this question will be different for each person.

To understand yours, review what is important to you and what you would like to achieve in the near future and long term. Then, convert them into financial goals. But make sure they are SMART—specific, measurable, achievable, realistic, and time-bound.

Manage Your Expenses

Budgeting is the keyword here. Yearly and monthly budgets allow you to gain a realistic idea about your total income and plan expenses within your means.

It also makes it easier to categorize expenses into essentials and non-essentials so you can know exactly what to prioritize and where you must cut down.

Start Saving

The importance of saving, even a few dollars a month, cannot be stressed enough. An emergency fund, for instance, will give you that extra peace of mind, letting you sleep at night without worrying about unplanned events.

The easiest way to save is by automating it. You can also speak to your employer about automatic deductions to a retirement fund.

Pay Off Your Debt

When it comes to settling debt, prioritize credit cards and other high-interest borrowings. Low-interest ones like mortgages and student loans should be next.

Keep a tab on payment deadlines and ensure all debt owed during the month is paid off on time. This is important for maintaining a good credit rating, which will influence your ability to obtain better rates and terms in the future.

Increase Your Income

If you are constantly struggling to make ends meet, then you need to find ways to raise your monthly earnings.

This may mean negotiating a pay rise with your employer, finding employment elsewhere at a higher salary, or getting a second job. Also, consider renting a spare room, investing in dividend-paying stock, and other passive income streams.

Make Smart Choices

The truth is, life is full of choices. Bad choices can increase your financial burden, while good ones help relieve you of it.

For instance, instead of browsing social media, spend your time on building your financial knowledge. Forgo the latest iPhone and put that money into an investment that could yield a steady return. If you look around carefully, there are many other ways to make your money stretch further and improve your financial standing.

Summing Up

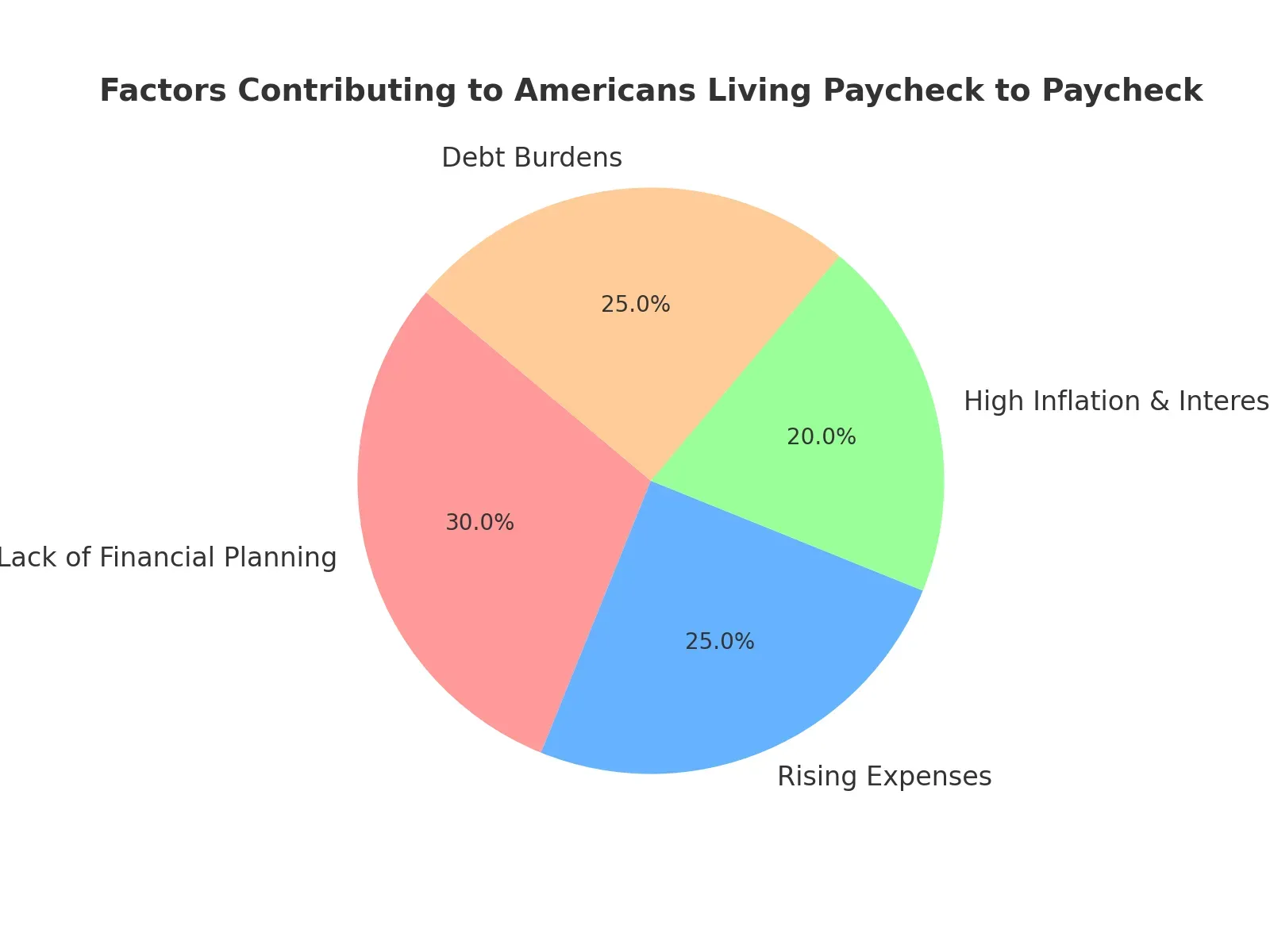

For many Americans living paycheck to paycheck, achieving financial freedom is a distant dream. While a lack of financial knowledge and planning is often at the root of their troubles, there are other factors like rising expenses, high inflation and interest rates, and accumulated debt that contribute to it.

If this sounds familiar to you, it is important to know that building wealth and attaining financial security is still possible despite your current financial worries.

For this, you must determine and set your financial goals, start budgeting to manage your expenses, and get into the habit of saving regularly. Paying off debt, finding ways to increase your income, and making smart lifestyle choices is just as essential.