Photo by nima hatami / Unsplash

Herding Psychology and Economics

Definition

A process of decision-making in which people, instead of relying on their own independent analysis, make decisions based on other’s actions is called herd behaviour. Herd behaviour happens when individuals act collectively in a group instead of being centralised. This phenomenon is common in many economic and financial sectors, driven by many social and psychological factors. It is also used to explain how group behaviour affects the individual decision-makers.

Examples of Herd Behaviour in Economics and Finance

The following are some examples of how herd behaviour exhibits in behavioral economics and finance:

Financial Markets

Herd behaviour can create asset bubbles or speculative bubbles in the financial markets. Herd behaviour can occur when a group of people (investors) start buying a particular asset, for example, stocks from the stock markets, cryptocurrency, property, etc., due to positive price movements or hype, and other people follow the same track without completely analysing the true value of an asset. Due to this hype, prices further increase, creating bubbles that burst when market conditions shift. For example, Dotcom bubbled in 1999-2000, when share prices to earnings dramatically rose above long-term average earning ratios. But then market conditions changed and prices crashed.

Bank Runs

Herd behaviour can also cause bank runs in the commercial banking sector. When depositors start withdrawing their funds from banks due to the fear of their instability, others also follow the same behaviour due to the fear of losing their money. This huge withdrawal can cause liquidity problems, and eventually banks will possibly collapse.

Investment Decisions

Investment decisions can also be affected by herd behaviour. Individual investors follow the investment decisions of successful investors because they believe that these people have some superior knowledge or investment strategies without knowing the current market conditions. This can cause herding when individual investors start investing in particular stocks or specific investment strategies without knowing that either it will align with the individual’s risk profile or long-term financial goals.

Economic Policy

Herd behaviour can also be seen in the economic policies of different countries. If a country’s government implements certain economic policies, other countries also implement the same economic policies in their countries without knowing the potential risk or economic conditions associated with their countries.

Consumer Behaviour

Herd behaviour can also influence consumer behaviour. When a particular brand or products become popular and become a social trend, other individuals start buying from the same brand or same product to be part of this trend without knowing whether they need the product or not. Similarly, fashions trends are also the examples of herd behaviour.

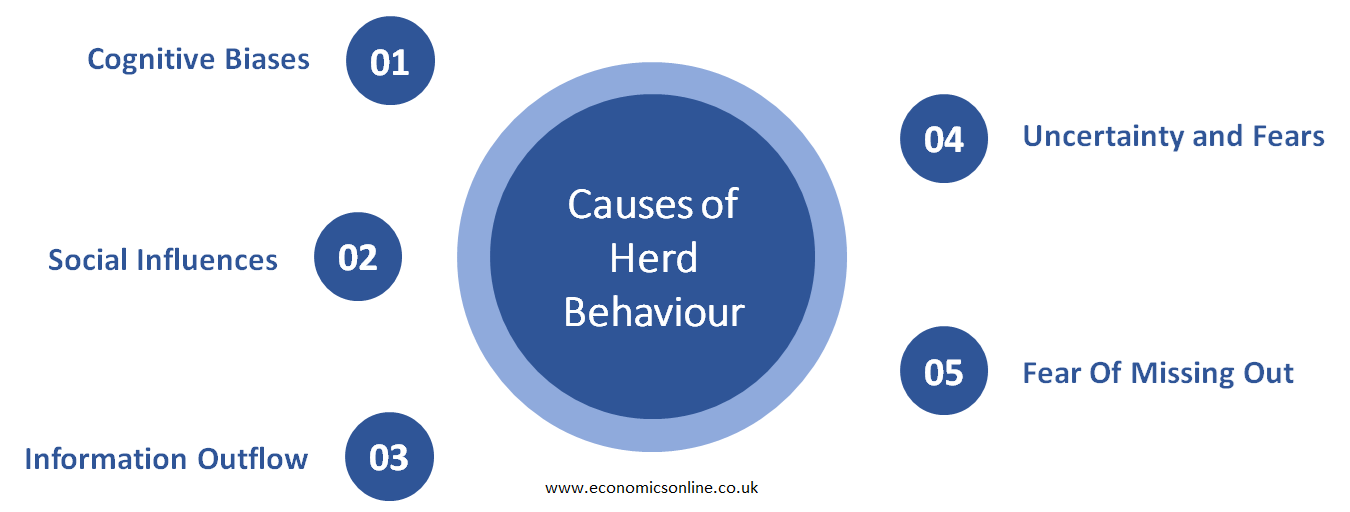

Causes of Herd Behaviour

The following are some main causes of herd behaviour:

Cognitive Biases

Herd behaviour can cause cognitive or behavioural biases. For example, people feel FOMO (fear of missing out) or have the desire for conformity due to herding.

Social Influences

Social influence can also cause herd behaviour, as many people are affected by the behaviour and choices of their relatives and start behaving and following them, leading to herding.

Information Outflow

Other people start believing that the earlier ones have some superior knowledge and information and following them, resulting in information cascade due to some initial actions of a few individuals.

Uncertainty and Fears

In times of crises or uncertainty, people prefer to be on the safe side and start believing that the decision of a large group is more correct than individual decisions.

Fear of Missing Out (FOMO)

It is a major cause in social settings. For example, if a person sees other people joining in a particular activity, they may fear missing out on fun and decide to join them too.

Historical Background

The concept of herd behaviour became popular in the 19th century by Western philosophers who assumed the herd was the reverse of individuality. A famous Danish philosopher, Soren Kierkegaard, preferred individuals over the “crowd.” Another concept by Friedrich Nietzsche also became famous. According to him, the concept of greatness relies on being noble, being able to be different, standing alone, and preferring to live independently. Wilfred Trotter was the one who published “Instincts of the Herd in Peace and War,” which became a classic in the domain of social psychology and gained credit by popularising the term “herd behaviour.”

Gustave Le Bon

He was a French intellectual and was known for his work on crowd psychology, especially his text of 1895, “The Crowd: A Study of the Popular Mind,” in which he wrote that an individual in a crowd is like a grain of sand which the wind can stir up at will.”

Wilfred Trotter

He was a British neurosurgeon who studied the instinctive behaviour of the herd of sheep and wolf packs. His research led him to the formulation of “herd instinct” before publishing the “Instincts of the Herd in Peace and War” in 1914.

Solomon Asch

He was a famous psychologist and well-known for his work on conformity. In 1915, his study became an iconic example of how group pressures affects the individual's opinions and decision-making power.

Consequences of Herd Behaviour

The following are some of the major consequences of herd behaviour:

Inefficient Allocation of Resources

When individuals start following the behavior of others, they may not make decisions based on the fundamentals of an asset or a company. They follow the crowd, which leads them to inefficient allocation of resources. For example, if some investors start investing in a particular industry, others also start investing in the same industry, resulting in an overinvestment, and the investment decision may not be the correct one.

Lack of Innovation

Herd behaviour can also affect innovation in many industries. When individuals prefer to follow the crowd and not make independent decisions, it will result in a lack of innovation or fewer people interested in investing in new technology, products, or services, which also causes a lack of diversity in the marketplace and also hinders economic growth.

Missed Opportunities

When individuals are too busy following each other’s actions, they may miss out on some profitable investment opportunities. For example, if a group of people is investing in a particular stock, others will also invest in the same stock, neglecting the other stocks, which can be undervalued and have strong growth potential.

Case Studies on Herd Behaviour

The following are some main case studies conducted to understand herd behaviour:

Online Book Sales

Yi-Fen Chen of Christian University in Taiwan conducted a case study. This case study explained that herd behaviour is also present in the online book sales. He also provided evidence about the study that supported his claim that socially informative influences, like ratings and sales volumes, affect consumer decision-making processes.

Shortage of Toilet Paper

During the time of COVID-19, people unpredictably started buying toilet paper, resulting in a shortage of toilet paper in the market. For example, in Canada, in March 2020, the demand for toilet paper increased dramatically by 250%, due to which many stores had faced shortages of toilet paper. This is due to herd behaviour and bandwagon effect because when people see others buying toilet papers, they also decide to buy toilet paper and follow the herd.

Types of Herd Behaviour

There are many types in order to understand the concept of herd behaviour:

Rational Herding

A type of herd behaviour in which people follow others because they think that following their actions can also be in their favour is called rational herding. For example, if a group of investors starts investing in a particular stock, others will also invest in the same stock by believing that it will also provide financial gain to them.

Informational Herding

A type of herd behaviour in which individual investors follow the path of other investors or groups of people because individuals believe that the majority is correct is called informational herding. For example, if a group of people starts running in a particular direction, others also follow them believing that they have some additional information that they don’t have.

Mimetic Herding

A type of herd behaviour in which individuals follow the actions of others because they find it appropriate and acceptable in society is called mimetic herding. For example, if people start following some fashion trends, others also follow them because they feel that by doing the same actions they can also fit in with the trend.

Panic Herding

A type of herd mentality in which individuals follow the actions of others because they are in fear or in a state of panic is called panic herding. For example, if some people are running without any reason, others will also start running with them, feeling that they are in danger.

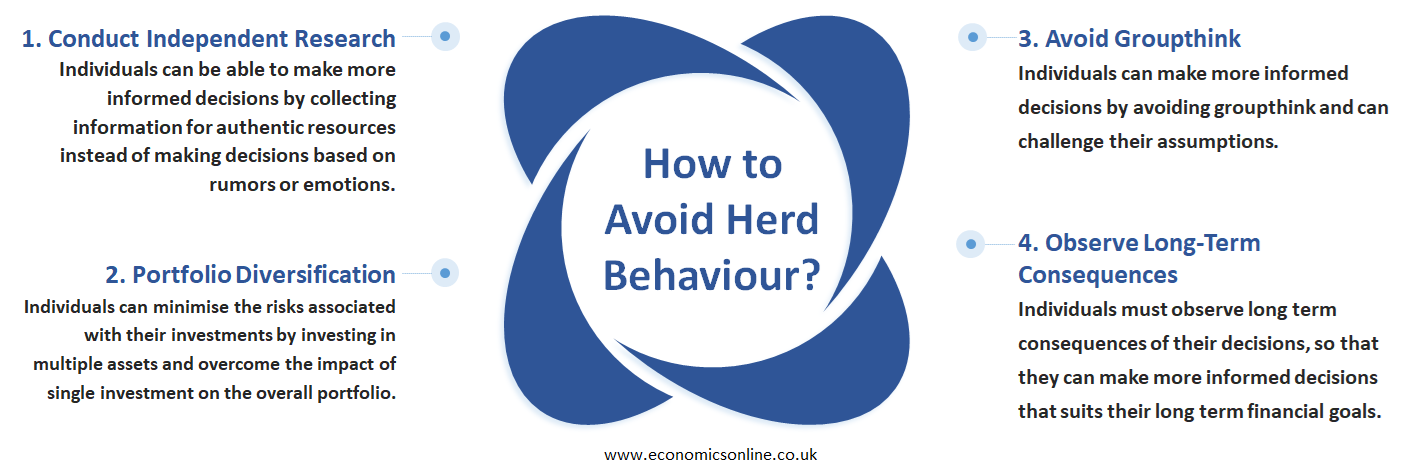

How to Avoid Herd Behaviour?

Herd behaviour should be minimised, or there must be certain ways to avoid herd behaviour because people start making irrational decisions and following a large group of people without knowing the outcomes of their actions, which can cause major losses. The following are some ways to avoid herd behaviour:

Conduct Independent Research

It is important to conduct independent research because, in this way, individuals can understand the potential risks. Individuals can be able to make more informed decisions by collecting information for authentic resources instead of making decisions based on rumours or emotions.

Portfolio Diversification

By diversifying their portfolios, people can be able to reduce the risk of herd behaviour. Individuals can minimise the risks associated with their investments by investing in multiple assets and overcome the impact of a single investment on the overall portfolio.

Avoid Groupthink

Groupthink is a situation in which people follow the opinions, ideas and behavior of a group instead of individually analysing the facts and evaluating them. Individuals can make more informed decisions by avoiding groupthink and can challenging their assumptions.

Observe Long-Term Consequences

Individual investors should observe the consequences associated with their long-term financial goals because herding sometimes provides short-term financial gains along with long-term financial losses.

Conclusion

In conclusion, herd behaviour can cause increased volatility, market inefficiencies, and insignificant economic decision-making. In many cases, herd behaviour can cause systemic risks and financial instability in many countries. Policymakers, regulators, and investors should understand the herd behaviour so that the negative impact of herding can be overcome and people can be able to make more accurate decisions with their own understanding not following the herding.