The College of Medicine of the Philippines building, showcasing modern architecture and a vibrant academic environment.

The Causes and Effects of Exponentially Increasing College Tuition Rates in the United States

The Rising Cost of College Education in the United States

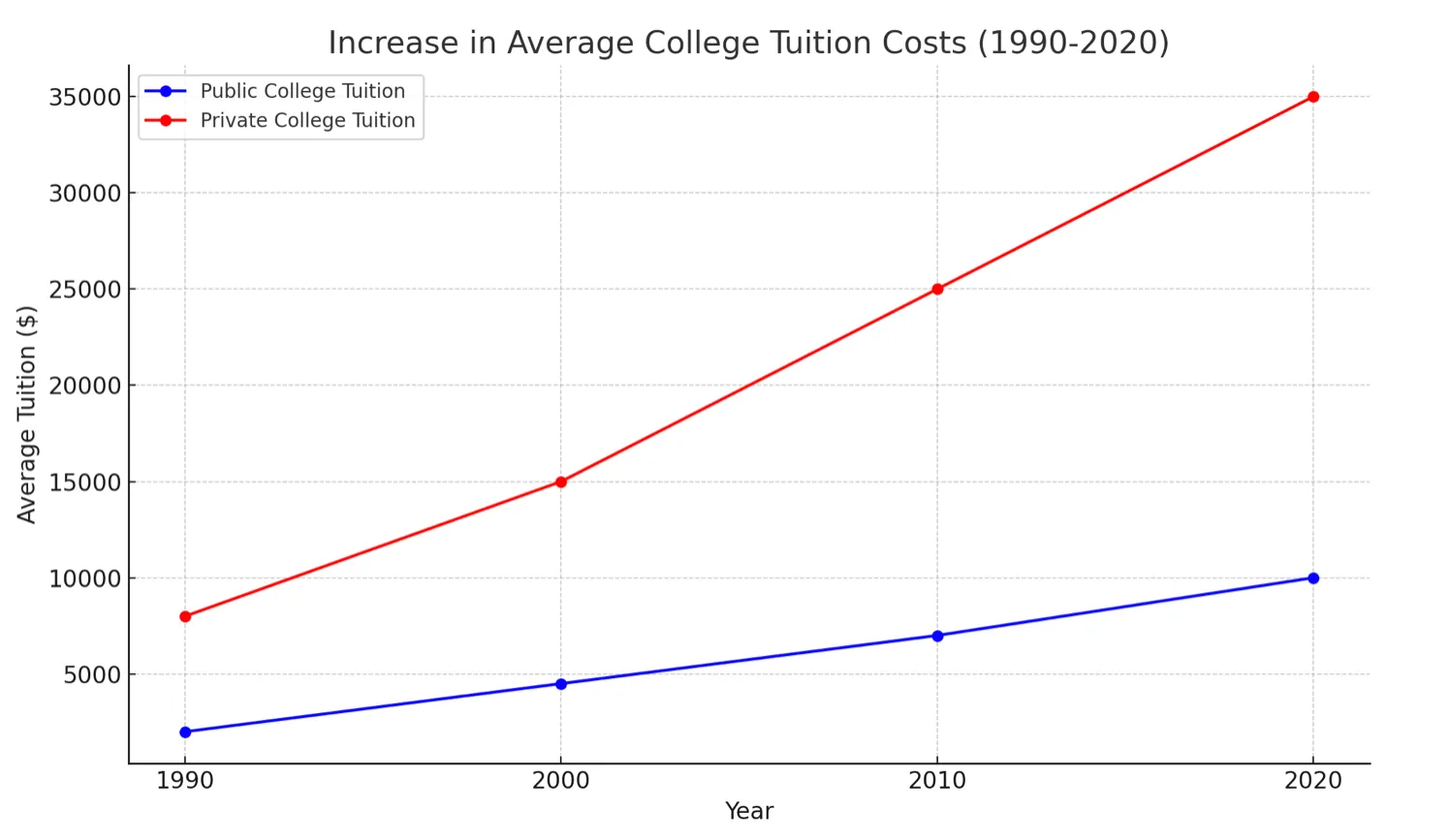

Higher education in the United States has become notably more costly over the last few decades with tuition fees propelling the surge. In the last 30 years, mean yearly expenditure on public four-year university tuition and other costs has risen by more than three times. Similar increases have occurred in private institutions. There was a real rise of 213% in students’ average funding outlays in state university four-year colleges from 1990 to 2020. As a result, this growing concern about whether students are being priced out of higher learning or if there are any ways around impediments manifests itself through such indicators as affordability, accessibility, and how much money families will be left with at the end of it all. An article dedicated to analyzing leading tuition escalation causes, as well as its extensive consequences at their personal levels, is what we are going to delve into in this paper.

Causes of Rising College Tuition Rates

The factors contributing to rising tuition costs in the U.S. are complex and interconnected. Key drivers include decreased state funding for public colleges, rising administrative expenses, expanding student services, and increased reliance on student loans.

a. Declining State Funding for Higher Education

A major reason that has led to an increase in tuition is related to the lower support from the states towards their public universities and colleges. Traditionally, there had been significant allocations that went towards state coffers for them to keep costs down but now this does not happen anymore. Nonetheless, starting from 1980s with more emphasis being put after the global economic decline of 2008, there has been a gradual reduction in state funding for this sector. As a result of this development, universities have resorted to increasing the amount of money that they charge as fees so as to maintain their operations hence making learners’ parents bear much of the financial load.

b. Increasing Administrative Costs

Another reason for rising tuition is the growth in administrative expenses. Over the years, the number of administrative positions in colleges has increased significantly, outpacing enrollment growth. These positions, covering areas such as admissions, student services, human resources, and diversity programs, have led to what some call "administrative bloat." This trend has driven up operational costs, which are often passed on to students in the form of higher tuition.

c. Expansion of Student Services and Amenities

Many universities have invested heavily in expanding student services and building modern facilities to attract enrollment. Today’s campuses feature amenities like mental health counseling, career centers, tutoring programs, fitness centers, and luxurious dormitories. While these services enhance the college experience and support academic success, they also contribute significantly to tuition costs as institutions rely on student fees to fund them.

d. Increased Reliance on Student Loans and Federal Aid

The availability of federal student loans has also played a role in rising tuition costs. Studies suggest a correlation between student loan expansion and tuition increases. With federal loans widely available, colleges have less incentive to keep costs down, knowing that students can borrow to cover the expenses.

Effects of Rising College Tuition Rates

The impact of increasing college tuition reaches individuals, families, and society as a whole. It has led to higher student debt, reduced access to higher education for low-income students, and widened economic inequality.

a. Student Debt Crisis

The most immediate consequence of rising tuition is the surge in student borrowing. High tuition costs have pushed more students to rely on loans, leading to a national student loan debt of approximately $1.7 trillion in 2021. The average borrower owes around $30,000, but students attending private or out-of-state colleges often owe much more. This debt burden can delay homeownership, retirement savings, and entrepreneurship, hindering young adults’ financial independence and economic mobility.

b. Reduced Access to Higher Education

Rising tuition has made college less accessible, especially for low-income students. While financial aid programs like Pell Grants exist, they have not kept pace with tuition increases. Many low-income students and their families find college costs unaffordable, even with aid, leading some to rely heavily on loans or forgo college altogether. According to the National Center for Education Statistics, students from low-income families are less likely to enroll in college than their wealthier peers and are more likely to attend community colleges. This limits social mobility and perpetuates existing economic disparities.

c. Widening Social and Economic Inequality

The rising cost of college education has deepened economic and social divides. Higher education, traditionally a pathway to upward mobility, is increasingly accessible only to those who can afford it. Wealthier families are often able to cover tuition through savings or qualify for substantial financial aid at prestigious institutions, while low-income students face difficult choices, such as accumulating large debts or settling for less prestigious schools. This economic divide restricts social mobility and reinforces class barriers.

d. Long-Term Economic Implications

The long-term effects of rising tuition on the U.S. economy are significant. High student debt levels may reduce demand for housing and discourage entrepreneurship, limiting economic growth. Additionally, if fewer people can afford college, the supply of skilled labor in critical fields like healthcare, technology, and education could decline, weakening the country’s economic competitiveness and innovation capacity.

Conclusion

American colleges and universities have increased tuition fees steeply over the last few decades. This is because there has been less government funding, higher administrative costs, student services have increased and finally, education loans are readily available countrywide. The direct result of this unnecessarily high cost to the students or their families is that it affects their quality of life as well as economic standards for everyone in general. If we really want to reduce student borrowing rates, improve accessibility for individuals who desire to advance higher learning when they are still young as well supporting societal equality between various classes within America; thus addressing expensive college educations becomes crucial. A pressing need exists for reforms aimed at making sure that this dream has not become impossible for most people nowadays who are from poor backgrounds thus destroying their chances of attaining any level worth achieving in academics.