Planes lined up at the airport.

Price Discrimination and the Airline Industry: Economic Effects of Tiered Pricing Models

We have previously examined dynamic pricing strategies used by the airline industry. The amount you pay for an air ticket varies widely, based on factors such as the amount of luggage you choose to take, the time and date of your flight, and how full the flight is at the time of booking. In this post, we’re looking at examples of first-degree and third-degree price discrimination that airlines use and the economic effects of their tiered pricing models.

What is Price Discrimination?

If you go to the supermarket, you will generally see a price tag for each item sitting on the shelf. While there may be some variation in what customers pay depending on whether they have a loyalty card, in most cases everyone will pay the stated price when they get to the checkout.

However, that isn’t how things work in all industries. Often prices are more personalised, varying considerably for particular individuals and groups. The airline industry works like this. There is no set price for flying between London and New York, for instance. The amount any prospective passenger pays for a flight differs based on a range of factors.

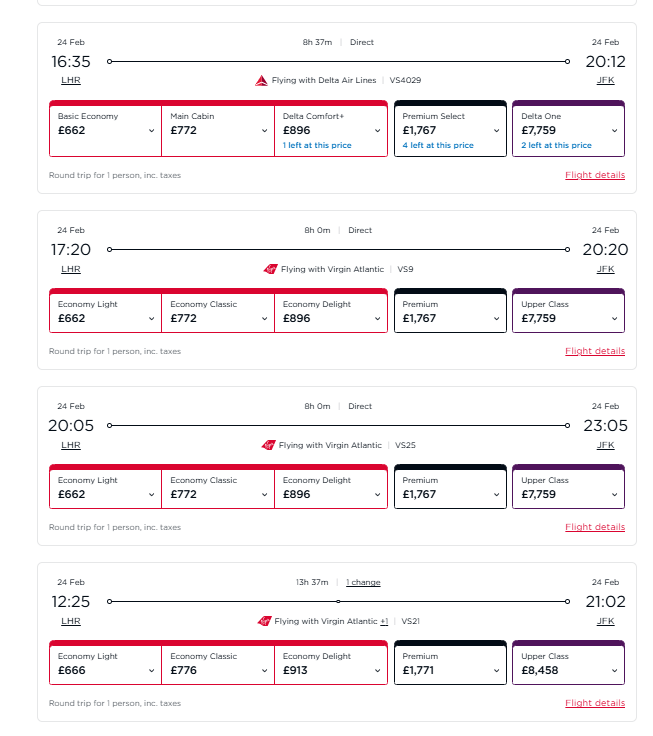

The Virgin Airways website screenshot above shows four flights on one day (there are more if you scroll down the page). Depending on seat availability and desired level of comfort, the airfares Virgin Atlantic offers range from £662 to £8,458. You could pick up a flight on another day that week for as little as £369. The minimum airfares quoted over one upcoming week range from £369 to £1009. The “prices” of these flights change yet again if you opt to pay with air points, rather than money.

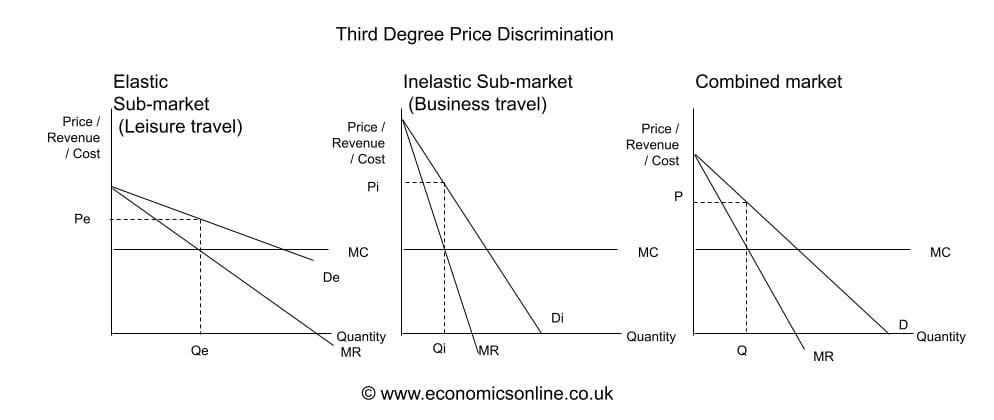

Firms use price discrimination to maximise profits from different types of customers, with differing demand elasticities. They know that passengers with inelastic demand are still likely to book flights, even at higher prices. Potential passengers with elastic demand, however, need more coercion to book a flight. Airlines, therefore, create sub-markets for different types of customers, knowing that those consumers in a relatively inelastic sub-market will pay a higher price than those in a relatively elastic sub-market.

First-Degree vs. Third-Degree Price Discrimination

In setting up viable sub-markets, airlines (and other traders) use two general types of price discrimination:

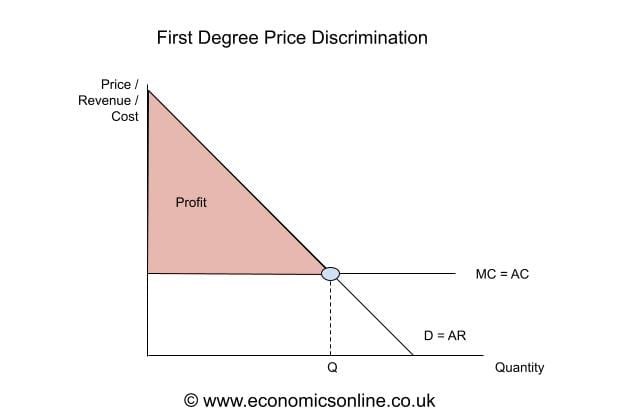

- First-Degree Price Discrimination – this occurs when a business aims to charge the maximum price for each unit sold. To achieve this the business creates personalized prices for its customers, using some form of formula to establish the most lucrative price that will earn it maximum profit, without a customer refusing to make a deal and looking elsewhere.

- Third-Degree Price Discrimination – this price discrimination is more general. Here, a business groups its customers into groups and sets a price for each tier.

Airlines still predominantly use third-degree price discrimination. For example, Virgin Atlantic has five main pricing tiers for its cross-Atlantic travel (Economy Light, Economy Classic, Economy Delight, Premium, and Upper Class).

They then quote prices for each flight, based on a range of other factors, such as the day and time of flight, and the time left until departure. They know, for instance, that businesspeople tend to have a fairly inelastic demand for air travel – they will generally make a trip, regardless of the price if it’s necessary for work. Consumers, however, have a more elastic demand for flights. If prices go too high for their budget, they will opt for a different way to travel or simply cancel their leisure travel.

You might notice that flights over the next few days typically cost more than flights further ahead. This is because airlines consider that people booking at the last minute are more likely to pay whatever price they are given. They typically consider their flight urgent.

The airlines strongly encourage flyers to use their loyalty programmes. For example, Delta Air Lines offers SkyMiles, where travellers earn air miles for travelling on Delta. They redeem their SkyMiles when they purchase flights. You can earn up to 5 miles per dollar on eligible Delta flight purchases and an extra 3 miles per dollar on other Delta purchases. With some airlines, travellers can use their air points as a virtual currency when buying flights (e.g. you could pay for a $200 flight with either cash or the equivalent value of air points). Other airlines allocate a certain number of seats that regular customers can exchange for their loyalty plan points.

What are the Economic Effects of Tiered Pricing Models in the Airline Industry?

As we’ve seen, the airlines use a mix of first-degree price discrimination (the more personalized prices it offers customers depending on when they’re booking) and third-degree price discrimination (the distinct tiers they offer different groups of consumers).

While it is hard to graphically demonstrate the combined effects, economists can show the effects separately. For example, if the airlines were able to perfectly utilise first-degree price discrimination, the market would look like:

In this ideal situation (from the airlines’ point of view), they would get all the surplus.

In the case of third-degree price discrimination, the airlines charge different prices for elastic and inelastic flyers.

As a result of the airlines being able to charge different prices to different customers, the airlines can extract more of the consumer surplus than they would otherwise be able to. However, they are not yet in a position to totally customize their pricing, so can’t get the full amount of surplus that they could with complete first-degree pricing discrimination (and perfect knowledge of their potential customers).