A photo of a chess board with pawns on it.

Case Study in First Mover Advantage: Domain Ownership

What is the First Mover Advantage?

The first mover advantage refers to the competitive advantage gained by a firm, by being a pioneer in the market. In other words, the first movers gain a competitive edge by being the first in the market. They gain strong brand recognition and customer loyalty before the entry of competitors. They also benefit from the additional time to make their products better and attract customers before other firms, leading to a high market share. In terms of online presence, first movers enjoy a major advantage - a high domain authority (essentially a website credibility score that can be used by an online authority score checker).

The competitors enter the market after the first mover and try to follow the same path as the first mover in order to gain success. However, by that time, the first mover had already established a strong market share and a loyal customer base in the market, which competitors could not achieve.

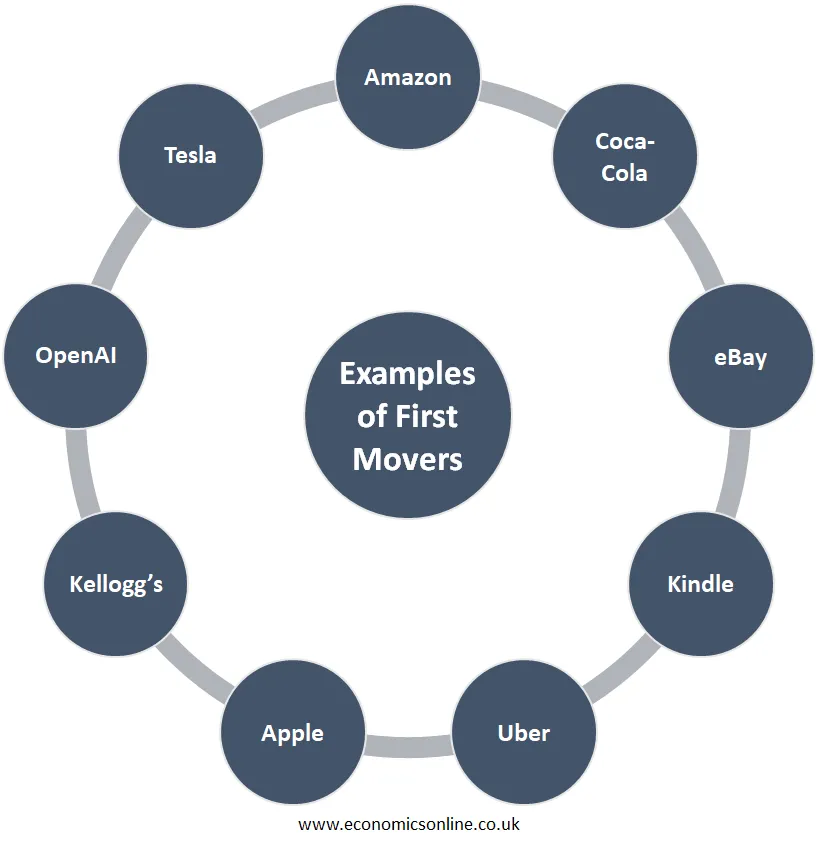

Examples of the First Movers

The following are some examples of first-movers advantages:

Amazon

Amazon is a good example of a successful first-mover due to its effective strategy of early market entry. Amazon launched its online bookstore in 1995 and was the first mover in the online book-selling market. Being far ahead of other firms selling books through brick-and-mortar stores, Amazon successfully attracted customers from Barnes & Noble and Borders, who were not seeing the potential of e-commerce at that time. Borders closed in 2011, sixteen years after becoming a public limited company, while Barnes & Noble witnesses a consistent fall in the value of their shares, revenue and profits. Amazon negatively affects the physical stores of Barnes & Noble by providing fast shipping, and offering low prices, which enables Amazon to hold a large market share.

Coca-Cola

Coca-Cola (Coke) is another example of a business that gained first mover advantage successfully. Even though, Coca-Cola was not the first fizzy drink in the market, other brands such as Vernors and Dr. Pepper started earlier, however, when Coca-Cola was introduced to the market in 1886, it immediately gained the largest market share, making it a first mover. In fact, the first mover advantage doesn’t necessarily mean that the first company has the advantage; it means the first company to capture the largest share in the market. Pepsi was launched in the market in 1898, which was not accepted that much. At that time, Coca-Cola was selling tonnes of gallons per year in competition with Pepsi.

The Pepsi Company bankrupted twice and was then rebranded in the 1950s. In order to remain competitive, Pepsi collaborated with Frito Lay in the 1960s, which provided Pepsi with a massive market share in the food industry, a huge increase in stocks, and a large inventory to compete. But at that time, Coke reached $1 billion in sales, which Pepsi was unable to do.

eBay

The online auction company, eBay, was founded in 1995. It managed to survive the dot-com bubble and remarkably withstand Amazon’s online auction spinoff, known as Amazon Auction. The acquisitions of other companies, like PayPal, iBazar, and Skype, helped eBay maintain market dominance and relevancy in 2014. eBay is still one of the largest online auction sites, with approximately 138 million active buyers in the second quarter of 2022.

Kindle

Amazon introduced an e-reader known as the Kindle, in 2007 to beat Barnes & Noble. Then Barnes & Noble introduced a competitor, Nook, in 2009, but it was too late. Nook generated a business of $933 million per year, but reports said that it only earned $146 million. Within only two years, Kindle’s brand loyalty decreased the market share of Barnes & Noble and continued to decline.

Uber

Uber was introduced in 2009. Although Uber was not the first ride sharing company, it became the largest and most successful due to its high-quality services. Then, in 2012, Lyft was a strong competitor to Uber. 2016 was a tough year for Uber due to the death of its founder and CEO, the scandal of 2016, and the campaign ‘Delete Uber’. However, the market share of Uber did not decrease much. In the US ridesharing market, Uber has a market share of 74%, compared to 30% share of Lyft.

Apple

In 2007, when Apple introduced the first iPhone, they completely changed the mobile phone market, and it was done for the good of consumers. Then HTC (High Tech Computer Corporation) became the first to manufacture Android phones in 2008. According to the Consumer Intelligence Research Partners report, Apple’s iOS has a loyalty rate of 90% as compared to its competitor Samsung’s loyalty rate of 70%, which is lower than Apple’s. This loyalty rate helps Apple maintain its originality and consumer preference for smartphones in the market.

Kellogg’s

James Caleb Jackson was the one who created a graham flour dough breakfast cereal in 1863, which was known as granula. He was the first mover in the market but didn’t capture enough consumers. Then surgeon John Harvey Kellogg created a similar version called granola. Then he and his brother introduced cornflakes, added sugar, and started mass marketing. Their brand took off and they gained the first mover advantage.

Post and Quaker Oats also created similar cereals, but they didn’t attract as many consumers as Kellogg’s. After World War II, many companies, such as Tony the Tiger, Frosted Flakes, and other late entrants struggled to become famous cereal brands. In 2000, the acquisition of Kashi allowed Kellogg’s to maintain its status as a natural and organic food brand.

OpenAI

OpenAI launched ChatGPT, a generative AI chatbot, in November 2022 and gained the first mover advantage by becoming the fastest product to get one million users in five days. Google responded by launching Bard, but struggled. OPenAI’s ChatGPT is still dominating the market for generative chatbots.

Tesla

Tesla gained the first mover advantage in electric vehicles (EVs) when it launched its first electric sedan, Model S, in 2012. At that time, Tesla was far ahead of its traditional competitors in terms of technology and vehicle performance. Tesla has dominated the EV market in many countries and regions of the world.

Competitors and the First Mover

First movers have enough time to grab the attention of their consumers, establish brand loyalty and brand name recognition before their competitors arrive in the market. New entrants are mostly the industry leaders because no one is there to compete with them. In this way, they also have a larger market share. But competitors are also very clever. They used the existing products by making changes for improvement and offer the new variants at lower prices, to satisfy customer needs. But being a first mover, businesses have an advantage in terms of costs, collaborative learning, and modern technology. By having intellectual property rights, such as copyrights and patents, the first movers keep their competitors away from having an advantage over their original products.

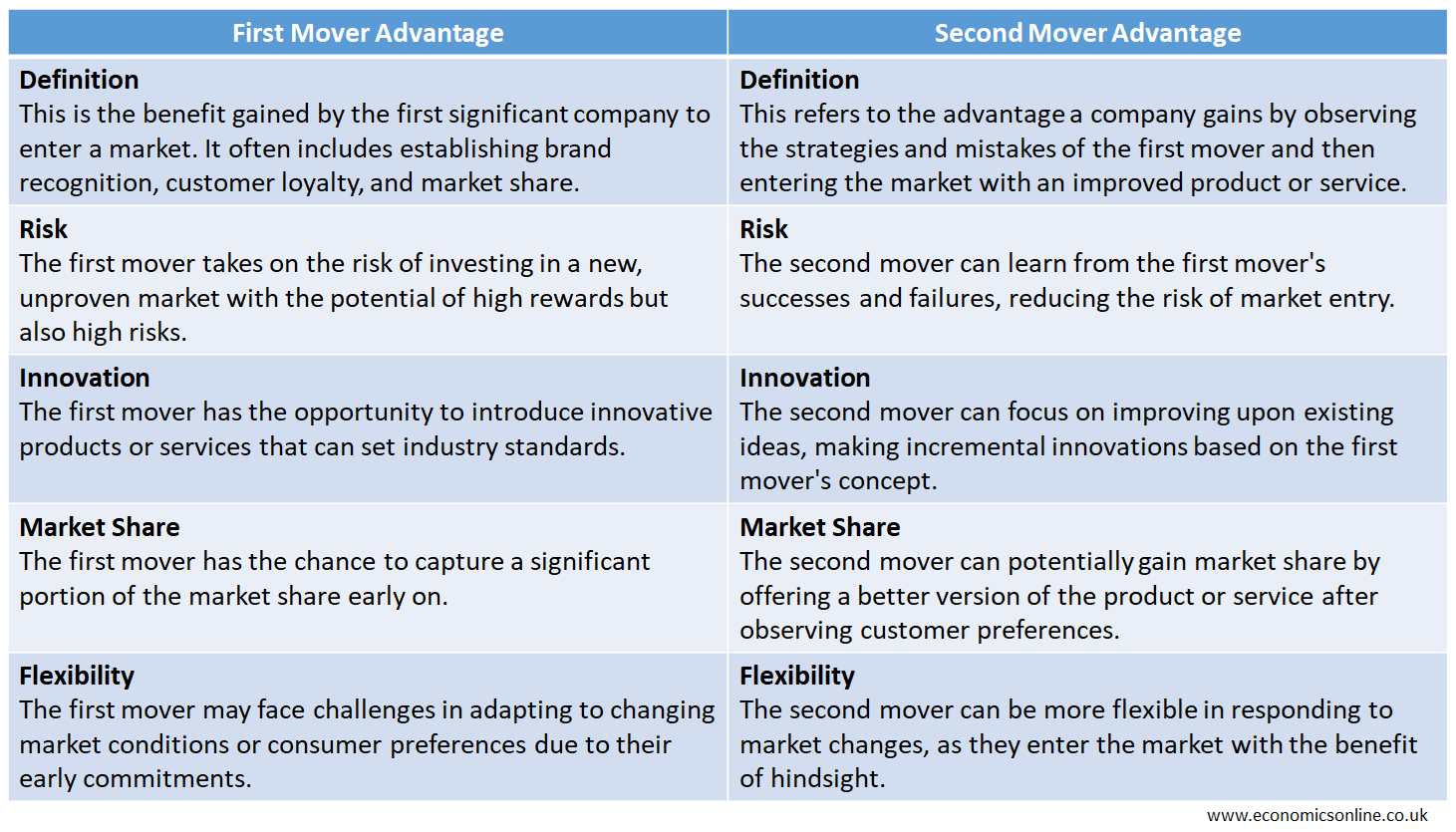

Differences between the First Mover Advantage and the Second Mover Advantage

The following table contains the main points of difference between the first mover advantage and the second mover advantage.

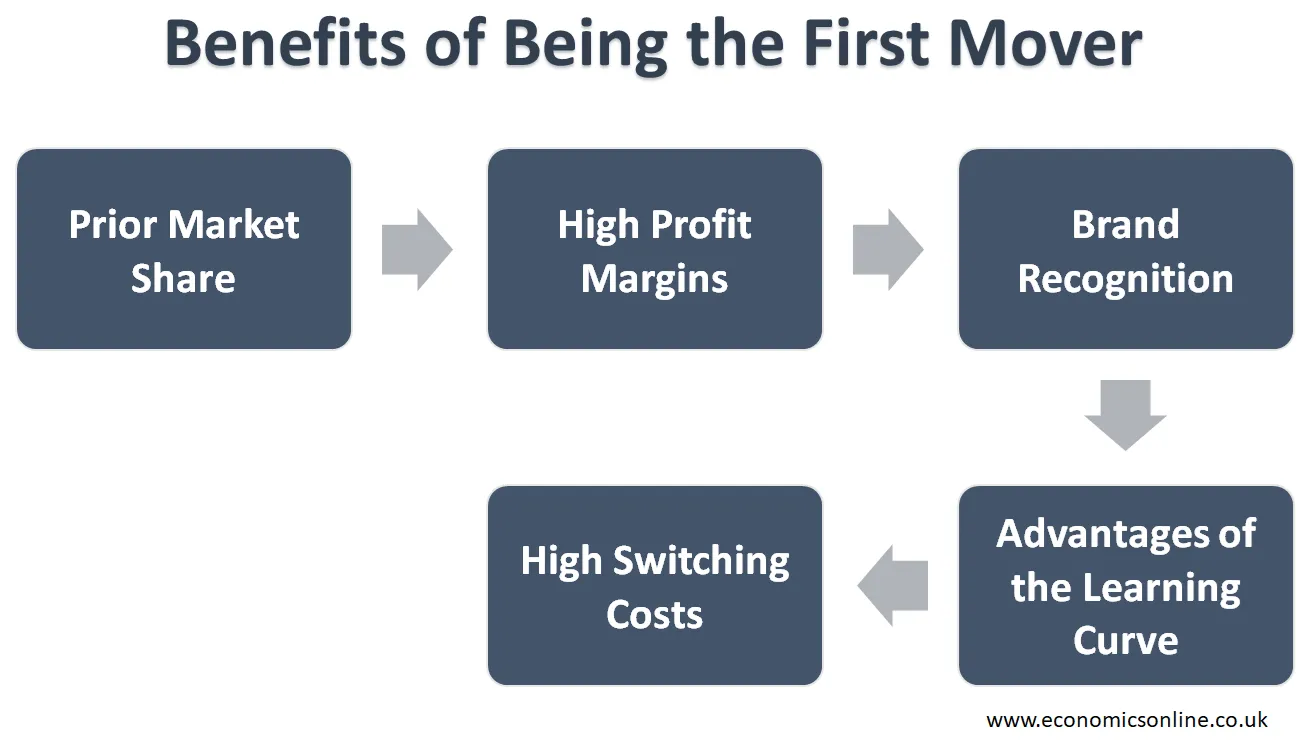

Benefits of Being the First Mover

The following are some benefits of being a first mover:

Prior Market Share

As a first-mover, a firm can set standards for new entrants in the market and establish itself as a dominant market player. This step makes it hard for new competitors to enter the market in the near future.

High Profit Margins

Being a first mover, a firm has the advantage of setting premium prices and keeping the profit margins high. Being a first-mover, charging high prices is possible because of the absence of competition in the market, which leads to significantly high profit margins.

Brand Recognition

As first-movers, businesses have the advantage of having brand name recognition and also providing awareness to their customers about their product. They have enough time to stabilise their business in the market, as there is no competition for them.

Advantages of the Learning Curve

Being first-movers, businesses have time to learn from their shortcomings as they move forward from their competitors, who are not yet in the field. Businesses can easily improve their products and observe consumer needs in order to become consumers’ favourites. They can also make strategies to attract customers’ attention and brand loyalty before competition starts and remain dominant in the industry. The learning curve also provides economies of scale for those who relate to tech-based products or manufacturing products to maintain a cost-efficient strategy to manufacture and deliver products.

High Switching Costs

When a strong brand is build, it becomes difficult for customers to switch to other products due to high cost of switching. For customers who are habitual of Apple’s ecosystem, may find it difficult to switch to other alternatives.

Drawbacks of Being the First Mover

The following are some first-mover disadvantages:

Uncertain Market Demand

Being a first-movers, maintaining and correctly estimating market demand for their product or service is quite challenging and very uncertain. So, overestimating demand for their product or service may leave businesses with a huge inventory, which may lead to massive financial losses. In order to become successful, businesses should correctly estimate the market demand and supply of newly introduced products or services.

Follower Businesses

Follower businesses are the ones that only capitalise on the success of their competitors because it is not easy to reinvent something which is already successful, to become competitive. Follower businesses showcase their products or services at low prices in order to attract more consumers and also make changes to the original products or services as a differentiator. This behaviour may negatively impact the original founders and lowers their profits.

High Research and Development Costs

Being a first-mover is quite expensive because in order to invent something new, there is a need to research and develop a reliable product. So, it needs high R&D costs, even when the results are not guaranteed. This expense is too much for new entrepreneurs.

First Mover Advantage in Internet Markets

The first mover advantage arises in a firm that gains the opportunity to be a first-mover. The followings are the main types of mechanisms that are used to sustain a first-mover advantage in internet markets:

Proprietary Technology

Observers state that the transparency of Internet business methods makes replication by competitors easier. The most important method for keeping technological advancements proprietary is secrecy, which is virtually impossible in different parts of the internet environment. Some of the internet market pioneers have developed advanced technologies and reduced the impact of the learning curve just to suppress their competition. But when there is a lack of patents and intellectual property rights, it is impossible to sustain such an environment for a long period of time.

Patents provide protection for innovation against competitors or replication by firms and are considered an indicator of the innovative activity of firms. Internet patents are less expensive as compared to other technology-oriented industries. Patents on business activities are controversial, and it becomes questionable how they can withstand future challenges. For example, Amazon’s patent on one-click ordering and Priceline’s patent on reverse auction services.

Preemption of Scarce Resources

Early studies state that early entrants in the market can be able to preempt scarce resources of different types, for example, physical assets, geographic positions, and positions in customer perpetual space.

Physical assets are insignificant for many internet companies, but digital resources may be. For example, having a valuable domain ownership or access to premium digital resources may be important.

The preemption of geographical position is an effective technique for small brick-and-mortar companies but irrelevant for Internet firms. That is why, the Web is considered more valuable, as it provides its own form of real estate, the domain ownership, rather than others.

The preemption of positions in customer perpetual space is important in many internet companies. Early market entrants such as Yahoo, Amazon, eBay, etc. invest heavy amounts to enhance customer recognition of their brands. These companies also expand their product lines to retain their initial positions.

Customer Switching Costs

First-movers enjoy more opportunities as compared to their followers to attract more customers through switching costs. This is also known as stickiness or lock-in. In the case of software products that require huge initial levels investments by buyers, switching costs arise from the fixed nature of basic investments to maintain compatibility between rivals. Switching costs are also evolving from time to time as buyers gain experience from sellers’ new products and sellers’ from buyers’ tastes. For example, Amazon’s reputation for reliability is increasing as many customers are willing to pay a premium in order to reduce the risk of fraud, delay, and loss associated with a purchase from an unknown seller at low prices.

Network Effects

The network effect is more important in new technology- and communications-related industries than in other types of market spaces in the economy. The network effect helps many firms enter the internet market, but many of them failed to understand the structural conditions needed to support large network effects.

The network effect happens when the value of a product or service to a given user increases with the increase in the number of other users. The network effect is also known as network externalities or demand-side economies of scale.

Conclusion

In conclusion, being a first-mover can be a source of competitive advantage in the market due to early entry. First movers have a better chance of establishing brand loyalty, brand name recognition, and also understanding consumer preferences because they have no rival or competitor at that time. They have much time to learn from their shortcomings and actively dominate the industry.