FDI

Foreign Direct Investment (FDI)

FDI refers to the flow of capital between countries. According to the United Nations Conference for Trade and Development (UNCTAD), FDI is ‘investment made to acquire lasting interest in enterprises operating outside of the economy of the investor.’*

FDI is distinguished from ‘portfolio‘ investment in that, as well as being ‘lasting’, it means that the investor has control over the assets invested in. A single flow of capital between two countries is described as outward for the investing country and inward for the recipient country. FDI is undertaken by both private sector firms and governments.

FDI associated with cross-border mergers and aquisions can be horizontal – where the firms are at the same stage of production; vertical – where firms are at different stages of production; and conglomerate – where firms are in different industries.

*Source: UNCTAD.ORG : https://www.unctad.org

The growth of FDI has accompanied the rise of globalisation.

According to the World Investment Report, FDI flows in 2013 increased to $1.45 trillion, with developing countries increasing their share of inflows to (a record level of) 54 per cent, with Asia now ahead of both the EU and USA.

The benefits of investing abroad

Investing overseas can generate many benefits to multinational organisations, including:

- Transport costs can be reduced by locating manufacturing plant within a consuming country. This is especially important for bulk increasing products, such as motor vehicles.

- Inward investors gain easier access to a country’s markets, especially where the product can be made with local ingredients. For example, it makes clear commercial sense for McDonalds to establish local restaurants that use local ingredients, rather than export ingredients from the USA. In addition, investing firms gain access to a range of resources, including cheap or skilled labour and local knowledge and expertise.

- Firms that build factories and plant in other territories can exploit of economies of scope, such as spreading fixed management costs between territories, or where plant in one territory can be used to produce output for many territories.

- Firms based outside one trading bloc can avoid barriers to trade such as tariffs and quotas, as in the case of Japanese car producers, such as Toyota and Nissan, locating in the EU.

Investment income

Outward investment can lead to increased overseas investment income for a country, including:

- Profits from overseas subsidiaries.

- Dividends from owning shares in overseas firms.

- Interest payments, from lending abroad, such as lending by UK banks.

FDI in the balance of payments accounts appears in two ways:

- The initial outflow of FDI is entered as an outflow (debit) on the capital account

- The resulting investment income is entered as an inflow (credit) on the current account.

Inward investment

Countries receiving inward investment gain in a number of ways, including:

- An increase in GDP, initially through the FDI itself, but this will be followed by a positive multiplier effect on the receiving economy so that the final increase in national income is greater than the initial injection of FDI.

- The creation of jobs.

- An increase in productive capacity, which can be illustrated by a shift to the right in the Aggregate Supply (AS) or the Production Possibility Frontier (PPF).

- Producers have access to the latest technology from abroad.

- Less need to import because goods are produced in the domestic economy.

- The positive effect on the country’s capital account – FDI represents an inflow (credit) on the capital account.

- FDI is a way of compensating for the lack of domestic investment, and can help ‘kick-start’ the process of economic development.

The UK is a leading investor abroad, and a principal beneficiary of inward investment. The UK consistently receives over 20% of all inward investment into the EU.

There are over 18,000 different investors into the UK, with1.8m people directly supported by inward investment. Overseas firms account for approximately 40% of the top 100 UK exporters.

The volatility of FDI

Like domestic investment, FDI flows exhibit high levels of volatility. Investment requires a stable economic environment and changes in the economic cycle, currency fluctuations, and changes in business confidence create uncertainty, which is a general deterrent to international investment.

Fluctuations in monetary conditions

Changes in monetary conditions in an investor or recipient country can affect investment decisions. Tighter policy will tend to inhibit investment, while looser policy will encourage it. However, fears of inflation might act as a check against FDI if monetary expansion is seen as reckless.

Changes in the economic cycle

Sustained economic growth in an economy is likely to encourage FDI, while recession will deter it. The impact of the financial crisis on FDI flows can clearly be seen in the above chart.

Expectations

Poor expectations can arise for a number of reasons, especially resulting from worries about the overall state of the economy in which the investment will take place. Rising budget deficits are also likely to be a cause for concern for the investing country.

Changes in business regulation

Tighter domestic regulations will deter FDI, while looser regulation will encourage it. The World Bank uses an index to rank countries in terms of the ease of doing business in each country. The index uses several criteria, including how long it takes to start up a business, amount of documentation required, and how much time is taken up dealing with tax administration. In 2009, the top five countries regarded as the easiest to do business in were Singapore, Hong Kong, New Zealand, the UK and USA.

Changes in the level of business taxes

Changes in business taxes, such as the UK’s corporation tax, can attract or repel FDI. During the 2000’s, low business taxes in Ireland encouraged inward investment from many large US corporations, including Apple, Microsoft, and Adobe. In fact, US investment in Ireland during 2009 stood at $166 billion – more than US investment in China, India, Russia and Brazil combined.

(Source: US Department of State – https://www.state.gov/r/pa/ei/bgn/3180.htm#econ)

Wages

Changes in relative wage rates and in the level of the minimum wage also have an impact on FDI flows. In Eastern Europe, for example, countries such as Poland, the Czech Republic, and Slovakia have increasingly taken advantage of their low labour costs to attract FDI.

Incentives

Inducements and incentives by host countries can encourage FDI.

Government

Changes of government and political instability can have a significant impact on overseas investment decisions.

Better alternatives

Better investment prospects elsewhere are likely to reduce flows into an economy. During the 2000’s, emerging economies like China, India and Eastern Europe were beginning to become extremely attractive to global investors. This trend has clearly continued, with China representing considerable investment opportunities, and receiving the most investment inflows.

The effects of the financial crisis

FDI suffered a considerable fall during 2008 as a result of the financial crisis. General uncertainty, and the need to retain liquidity, meant that many large investors cancelled investment projects abroad. This affected all investing countries, but notably the USA, where outward investment to the rest of the world fell by 41%.

(Source: Unctad)

The effects of FDI on Sterling

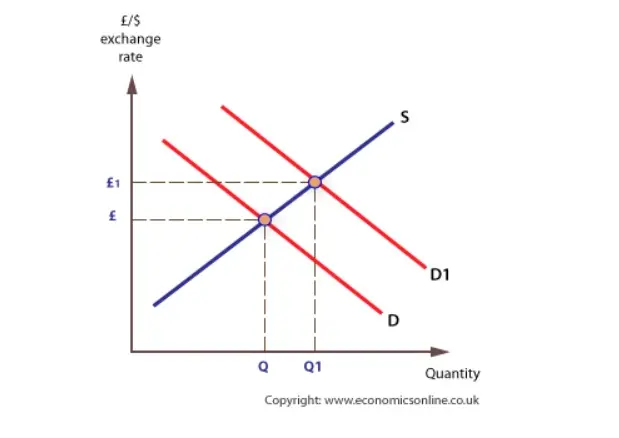

The effect of overseas investment on an economy is to raise demand for its currency and push up its value – its exchange rate.

This will have both positive and negative effects on an economy, such as the UK. The higher value of a currency is beneficial for domestic inflation as foreign products require less currency, and are, therefore, cheaper when paid for in domestic currency.

An increase in FDI

An increase in FDI will increase the demand for the currency of the receiving country, and raise its exchange rate.

In addition, an increase in a country’s currency will lead to an improvement in its terms of trade, which are the ratio of export to import prices. (See: Terms of Trade).

However, a higher currency reduces competitiveness and exports may fall, worsening the balance of payments. Even so, the positive value of FDI to the balance of payments is probably likely to be more significant than any increase in the exchange rate that would follow.