Balance of Payments Problems and Policies

Balance of payments problems

Trade in goods and services typically forms the largest part of an economy’s current account. The current account also includes primary and secondary income flows. Primary income refers to international payments to factors of production, such as investment income and compensation to employees. Secondary income includes transfer payments flowing between countries, such as personal remittances, pension payments and overseas’s aid.

With the exception of 1997, the UK has recorded a trade deficit in goods and services in every year since 1987.The UK’s current account deficit reached a peak of £84.9 bn in 2014. The deficit tends to follow a cyclical pattern, as shown in the chart.

UK Current Account 2008 – 2018

The trade balance

The balance of trade refers to trade in goods and services between one country and the rest of the world.

Recent figures

Is a current account deficit a problem?

A deficit can be a problem under certain circumstances, including the following:

- It is a persistent deficit that does not self-correct over time.

- The deficit forms a large share of GDP.

- There are no compensating inflows of investment income or inward capital account flows.

- The central bank has low reserves.

- The economy has a poor record of repaying debt.

Economic growth and trade

In the UK, there is a strong connection between a growing economy and trade deficits. Soon after the economy went into recession in 1990, the trade deficit began to fall quickly. However, as the economy came out of recession and into a period of strong growth from 1993, the trade deficit began to rise quickly, and continued to rise through the next 15 years. The recent recession, which started in late 2008, quickly reduced the deficit.

Causes of a current account deficit

There are several possible causes of a persistent current account deficit, including the following:

Excessive growth

If the economy grows too quickly and rises above its own trend rate, which in the UK is around 2.5%, then domestic output (AS) may not be able to cope with domestic aggregate demand. When national income rises above its trend rate it is likely that income elasticity of demand for luxury imports such as motor cars is relatively high, so that imports rise relative to exports.

De-industrialisation

An increasing trade deficit may be a symptom of long-term de-industrialisation. The UK started to lose its manufacturing base in the 1970s, and this process has continued over the last 30 years.

Trade with the EU

Trade with the EU indicates that, at least in terms of trade in goods, the UK is a net importer with a peristent and widening trade deficit with the rest of the EU.

High export prices

High export prices will occur if a country’s inflation is higher than its competitors, or if its currency is over-valued which will reduce its price competitiveness.

Non-price competitiveness

Non-price factors can discourage exports, such as poorly designed products, poor marketing or a worsening reputation for reliability.

Low levels of investment in human capital

This involves a lack of investment in education and training, which reduces skill levels relative to competitor countries and forces countries to produce low value exports.

Poor productivity

An economy might not be producing enough from its scarce factors of production. Labour productivity, which is defined as output per worker, plays an important role in a country’s competitiveness and trade performance, and the UK has suffered from poor productivity. The productivity gap is the gap between the UK’s relatively poor productivity performance and that of the UK’s leading competitors.

Low levels of investment in real capital

This could be caused by excessive long-term interest rates, or low levels of research and development.

Low levels of investment in human capital

This involves a lack of investment in education and training, which reduce skill levels relative to competitor countries and force countries to produce low value exports.

The rise of alternative global suppliers

While the UK has slowly deindustrialised, emerging economies like China and India have increased their share of world trade, with their firms benefitting from access to new technology and from economies of scale. This has reduced the likelihood of smaller UK manufacturers selling abroad, while at the same time increased the likelihood of UK households and firms importing from these economies.

Policies to reduce a deficit

There are four basic strategies for dealing with a persistent deficit.

Deflating demand

Deflating demand means deliberately reducing consumer spending, or reducing its rate of growth, through fiscal contraction, such as raising direct taxes, or by monetary contraction, such as raising interest rates or reducing the availability of credit.

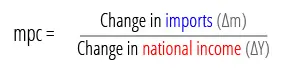

As a by-product of this, imports are also likely to fall, hence deflating demand is said to work by a process called expenditure reduction. This policy targets general household spending, and given that imports are dependent on spending, then imports will fall as spending falls. The connection between spending and imports is called the marginal propensity to import, which is expressed as:

Evaluation:

The main criticism of deflationary policy is that, as spending-power must fall, personal incomes and standards of living will also fall, and this can trigger demand deficient unemployment. However, different deflationary policies may result in different effects. For example, raising interest rates may work more quickly than raising tax rates.

For the above reasons, deflation is a politically unpopular policy option. Voters are much more likely to be concerned with recession and unemployment than with a balance of payments deficit, hence politicians are unlikely to prioritise the reduction of a deficit.

It is also difficult to predict the precise effect of a fall in spending on imports, which requires an accurate calculation of the marginal propensity to import.

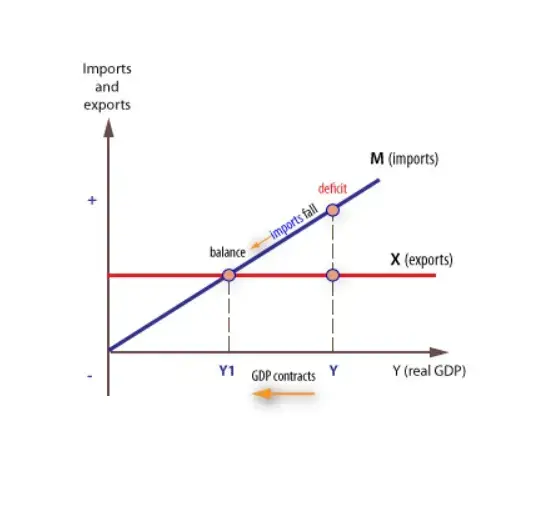

The cross diagram

The cross diagram can be used to illustrate how deflation works. The cross diagram shows the relationship between injections and withdrawals and national income, Y.

The export line is horizontal because it is determined by overseas GDP and not domestic GDP.

The import line is upward sloping, assuming a positive marginal propensity to import (mpm) this means that as income (Y) increases, imports (M) will increase. For example, if the mpm is 0.4, then a £1 increase in income leads to an increase in imports of 40p. The higher the mpm, the steeper the gradient of the import line. Deflating demand, therefore, reduces income and spending with income (Y) falling to Y1, so that imports (M) fall but exports (X) are left unaffected.

Devaluation

The second policy option to improve the current account is devaluation, which involves the deliberate reduction in the value of a country’s currency. It works by expenditure switching, which means that the policy encourages consumers to alter the distribution of their spending, rather than the total level of spending.

Achieving an equilibrium exchange rate

An ‘equilibrium’ exchange rate is the specific rate where export revenue and import spending are equal.

Equilibrium

At currency ‘£’, import spending equals export revenue, at Q1. At a higher actual rate, say at £1 imports now appear cheap in the UK, and spending increases to Qm, and exports appear expensive abroad, and fall to Qx. This opens up a trade gap (QX to QM).

Devaluation will stimulate export revenue and reduce import spending, hence closing the trade gap.

Fixed exchange rates

A fall in the exchange rate will, ceteris paribus, reduce export prices encouraging overseas consumers to switch to UK products. This is likely to lead to a rise in export demand. Devaluation will also lead to an increase in import prices, encouraging UK consumers to switch away from imports to domestically produced products. This will lead to a fall in import demand.

Evaluation

Devaluation relies on the assumption that the sum of price elasticity of demand for imports and exports is elastic (>1), the so-called Marshall-Lerner condition. However, this may not be satisfied in the short run, or even the longer run.

Devaluation may also trigger cost-push inflation, where a fall in the value of a currency will increase the price of imported goods, in terms of the domestic currency.

Devaluation could be interpreted as a hostile move against other countries and may lead to retaliation by competitors, so that no long term benefit is derived by the devaluing country.

Import and export elasticity

To understand the Marshall-Lerner condition, it is necessary to reconsider price elasticity of demand. It should be noted that imports and exports refer to the value of spending on imports and the value of revenue from exports. The value of these payments is derived from the prices of imports and exports multiplied by the quantity of imports and exports. For example, if country A sells 100 tonnes of steel to country B for A$1000 per tonne, export revenue earned by A is A$100,000. If we assume that the exchange rate of A$ against B$ is 4-1, then country B will have paid B$250 per tonne and spent B$25,000 in total. If the exchange rate of country A now falls to 5/1, the impact of this on A’s export revenue depends on how many tonnes it now sells at the cheaper rate. Country B will now only have to pay B$200 per tonne following devaluation, a fall from B$250, to B$200, of 20%. If demand is elastic, say (-) 2.0, then the 20% devaluation will lead to a 40% increase in demand, from 100 tonnes to 140 tonnes. The result is that payments from B to A rise from B$25,000 to (140 x 200) B$28,000. The Marshall-Lerner rule simply says that so long as the combined elasticities of demand for imports and exports are greater than 1, devaluation will improve the balance of payments on current account.

The cross diagram – showing devaluation

We can also use the cross diagram to illustrate the impact of devaluation.

Assuming the Marshall-Lerner condition:

- The export line will shift up, and:

- The import line will shift down.

- At the existing GDP (Y), the deficit will fall.

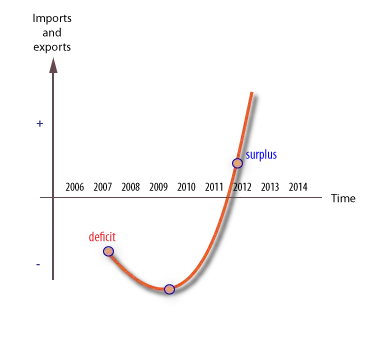

The J Curve

The J curve shows what can happen to a country’s balance of payments when it devalues its currency. If we assume the Marshall-Lerner condition is satisfied, devaluation will improve the balance of payments.

If the condition is not satisfied, devaluation will worsen the balance of payments.

The J-Curve effect exists because the condition is met in the long run but not the short run. In the short run, households and firms may not respond immediately to a change in price caused by a change in the exchange rate.

There are a number of reasons for this:

- Consumers may wait and see if the price rise is sustained.

- Businesses may find it difficult to switch to or from an overseas supplier. It may take considerable search time to find alternatives.

- Households and firms do not purchase consumer durables very often, so changes in exchange rates only take effect when decisions to purchase are made.

- Consumers may be loyal to overseas brands.

- Price is not the only factor that affects demand for imports – indeed, there are many other non-price factors.

Direct controls

A third option to help reduce a current account deficit is to impose direct controls on imports by erecting barriers against imports or by providing assistance to exporters.

Specific measures include:

- Tariffs

- Non-tariff barriers, such as quotas, subsidies to domestic firms and discrimination against imports and in favour of domestic firms.

Evaluation

In the short run, trade barriers may help to reduce imports and help improve the current account. However, retaliation is a likely response, and any short-term gains will be eroded away. Therefore, direct controls are not generally considered an effective long-term solution to a current account deficit.

Supply-side policy

Finally, supply-side policy could be used to help improve an economy’s ability to produce. There are several actions that a government can take to improve supply-side performance. These measures include improving labour productivity and labour market flexibility.

Evaluation

Supply-side policy can provide a highly effective policy framework for long term improvement in competitiveness and current account performance. The main problem is that supply-side policy may take decades to work and is not a quick-fix.