Subsidy

The payment made by governments to the producers of goods and services is called a subsidy.

It is the amount of money provided by government to firms in the form of cash, grants or tax breaks as an incentive to help reduce production costs which can then be passed on to customers as lower prices, and this can encourage consumption.

Types of subsidies include production subsidies to manufacturers in specific industries, export and import subsidies, employment subsidies, tax subsidies, industry-specific subsidies, direct subsidies and indirect subsidies.

Why do Governments Give Subsidies?

There are many reasons for governments giving subsidies to the producers including:

- to reduce the prices of commodities which are necessities for example to reduce the fuel prices or the prices of products like bread. This will not only decrease costs of food but also fuel costs.

- to promote the consumption of merit goods having positive externalities such as healthcare- consumption subsidy

- to contribute to a less unequal distribution of income

- to provide services that the free market does not provide

- to increase income of producers, especially farmers and this will result in supply of certain goods like agriculture produce.

- to enable exporters to increase their production output and to sell more goods abroad - export subsidy

- to reduce reliance on imports by subsidising domestic firms making close substitutes.

Subsidy Diagram - How do Subsidies Work?

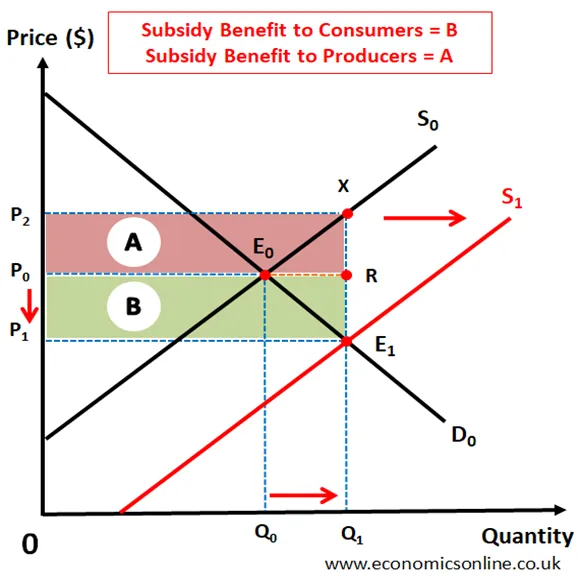

The following diagram illustrates the working of subsidy.

Before Subsidy

Before subsidy, market equilibrium is at E0, P0 and Q0. At point E0, initial demand curve D0 and initial supply curve S0 intersect, so quantity demanded equals quantity supplied to form market equilibrium at E0.

Equilibrium price = P0

Equilibrium quantity = Q0

After Subsidy

Due to subsidy, the supply curve is shifted to the right from S0 to S1.

New market equilibrium is at E1, P1 and Q1.

New equilibrium price = P1

New equilibrium quantity = Q1

Subsidy per unit=Vertical distance between new Equilibrium point (E1) & initial SC (S0) = E1X

Subsidy expense of government = Area A + Area B

Subsidy benefit to the consumers = Area B

Subsidy benefit to the producers = Area A

Effects of Subsidy

The equilibrium price is decreased from P0 to P1 which is beneficial for consumers because they are getting the product at a lower price.

The price received by producers is P2 which is higher than P0 which is beneficial for the producers.

The equilibrium quantity is increased from Q0 to Q1 which is beneficial for consumers because they are able to buy and consume more quantity. Also, sellers are able to sell more quantity which is good for producers.

Subsidy expense shown by areas A and B is a burden on the government.

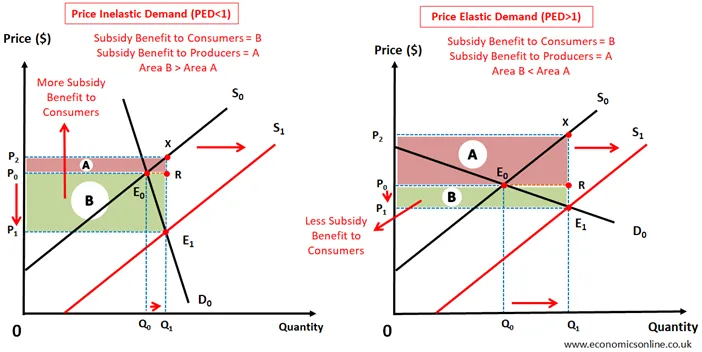

Subsidy and Elasticity

The distribution of the benefit of subsidy between the producers and the consumers depends on the relative price elasticity of demand and supply.

If the demand is price inelastic, more benefit of the subsidy will go to the consumers due to relatively higher price reduction.

If the demand is price elastic, less benefit of the subsidy will go to the consumers due to relatively lower price reduction.

Examples of Subsidy

1. Staple foods like rice, bread and cooking oil are subsidised in some developing economies. As world food prices continue to rise, the case for subsidy is a strong one, mainly to provide relief to the poorest groups in the economy.

2. Mass transit (public transport) is heavily subsidised in all parts of the world, especially in cities and large towns. This is done to give low wage earners the access to employment opportunities, to provide social mobility for older people, to reduce road congestion and to reduce the adverse environmental impact of the traffic. The benefits are to individuals and to the community as a whole.

Advantages of Subsidies

1. Increased Production and Consumption of Goods

Due to subsidy, production and consumption of certain goods are increased. This is especially true for merit goods which are under-consumed leading to the market failure yet they give extra benefits to the society because of positive externalities. Hence, subsidy can remove that under-consumption and can solve market failure leading to the efficient resource allocation. The increased production of goods will also create more job opportunities leading to lower unemployment.

2. Decreasing Prices to Essential Goods to Control Inflation

Subsidy given to some firms results in reduction in the prices of their goods due to greater supply of goods leading to the availability of cheaper products. If the subsidy is given for essentials such as foods products, it will result in lower prices of food products leading to controlled food inflation. An obvious fact is that if the subsidy is used in the area of production cost inputs like oil, gas and electricity, this will keep the cost of production low which means controlling the cost push inflation.

3. Supporting declining Industries

Many industries are important but declining and in need of support from the government to keep them alive and running such as farming. These industries may be important and essential for the people of the country. Subsidies may prevent the long-term decline of industries. Such benefits of subsidies may be important to these declining industries as well as the economy.

Disadvantages of Subsidies

1. Dependence on Subsidy

Supporting some industries through the subsidy means they may not feel the pressure and the need to reduce their costs to become efficient. These industries, depending on the subsidy, may remain inefficient and may not be able to compete in the global market if the subsidy will be removed. This is the first drawback od subsidy.

2. Subsidy has an Opportunity Cost

The governments have limited funds which must be allocated and used wisely. Giving the subsidy to one industry means the government is not using the same amount somewhere else, leading to the opportunity cost. For example, the opportunity cost of giving the subsidy to farmers may be a hospital which is not built.

3. High Taxes

The funds are needed by the governments to give subsidies. Giving the subsidies means higher taxes will be imposed by the governments on the people and the firms. So subsidy is given at the expense of taxpayers.

4. Working of the Price Mechanism

The subsidy is a form of government intervention in the price mechanism. This means that the free market is not working on its own without the government intervention.

5. Shortage of Supply

Though one of the advantages of subsidies is the greater supply of goods, a shortage of supply can also occur. This is because lowered prices can lead to a sudden rise in demand that many producers may find very hard to meet. Ultimately, it can lead to very high demand that causes an increase in prices. 2. Difficulty in measuring success Subsidies are usually effective and helpful

Factors affecting the success of subsidies

The success of a subsidy depends on the effectiveness of its design and implementation. Factors that can affect the success of a subsidy include:

- Targeting: Subsidies should be targeted to those who need them most, such as low-income households or small businesses.

- Timing: Subsidies should be timed to have the greatest impact, such as during economic downturns or periods of high inflation.

- Size: Subsidies should be of the appropriate size to have a meaningful impact on the intended recipients.

- Administration: Subsidies should be easy to access and administer, with minimal bureaucracy and red tape.

- Transparency: The design and implementation of subsidies should be transparent and accountable to ensure that they are being used effectively.

- Sustainability: The funding for subsidies should be sustainable in the long term, to ensure that they can continue to have an impact over time.

Conclusion

Subsidy has advantages and disadvantages. Giving subsidy to the firms should be considered as a short term solution to the problem of under-allocation of the resources. The governments should carefully analyse the industries to give subsidy as it has an opportunity cost and can lead to the higher tax burden on the people and the firms.