Variable Cost Definition

Variable Cost

A cost that varies directly with the changes in the level of output produced or sold is called variable cost. Variable costs depend on increases and decreases in the company’s manufacturing or sales volume. Variable costs increase with an increase in production, and vice versa. The variable costs consist of direct labour costs, supplies, raw materials, utilities, commissions, credit card fees, packaging, and distribution expenses. The most common variable costs are direct labour, raw materials, supplies, packaging, and distribution, but they can be different in different industries.

Explanation

Variable costs change directly with the production volume. For example, the cost of raw materials used in producing output is a variable cost. For furniture manufacturer, wood is the raw material used in making furniture items. The cost of wood is a variable cost as it varies directly with the change in the production output of furniture items. If there is an increase in the level of production of wooden chairs, more wood will be needed as raw material, and the cost of wood will also increase. The variable cost is always the opposite of the fixed cost. In the service industry, the main variable costs are the direct labour, and supplies required for the service.

Variable costs appear on the income statement of any company under the cost of goods sold (COGS) or cost of sales and are subtracted from revenue to calculate gross profit. The variable cost is one of the major costs incurred by any business to smoothly run its operations. The other costs are fixed costs, and semi-variable costs. Fixed costs consist of rent, wages, property taxes, insurance, and interest. The semi-variable cost consists of maintenance expenses, electricity, phone, internet, vehicle, and employee compensation.

Graphs

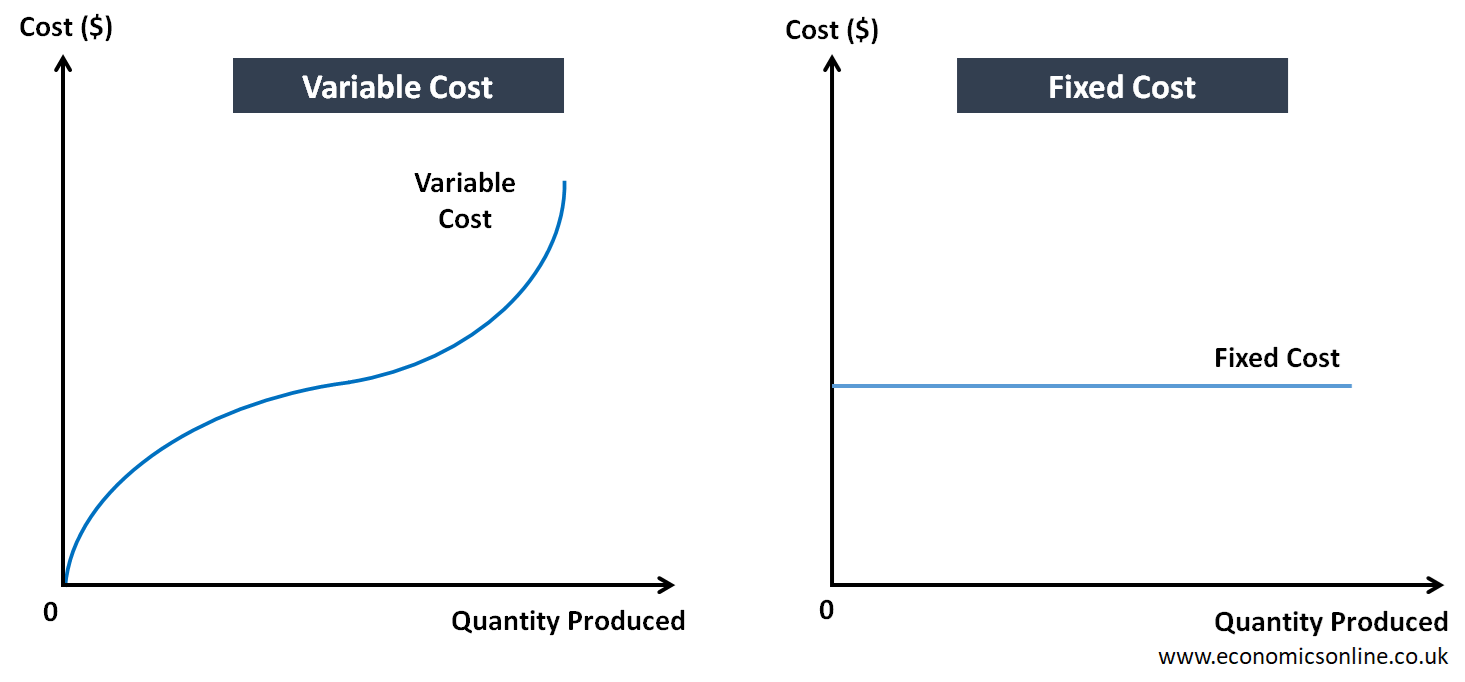

The following graphs illustrate the behaviour of variable cost and fixed cost.

In both of the above graphs, we have taken quantity produced on the horizontal axis (x-axis) and the cost on the vertical axis (y-axis). The graph on the left shows the variable cost curve, which goes upward with the increase in the quantity produced. It starts from origin because when variable cost is zero, no output is produced.

Initially, variable cost increases at a decreasing rate because of increasing returns, according to the law of diminishing marginal returns. Finally, variable cost increases at an increasing rate because of decreasing returns, according to the law of diminishing marginal returns. Variable cost always increases when we increase output. The graph on the right side shows the fixed cost curve, which remains constant no matter whether the quantity produced increases or decreases.

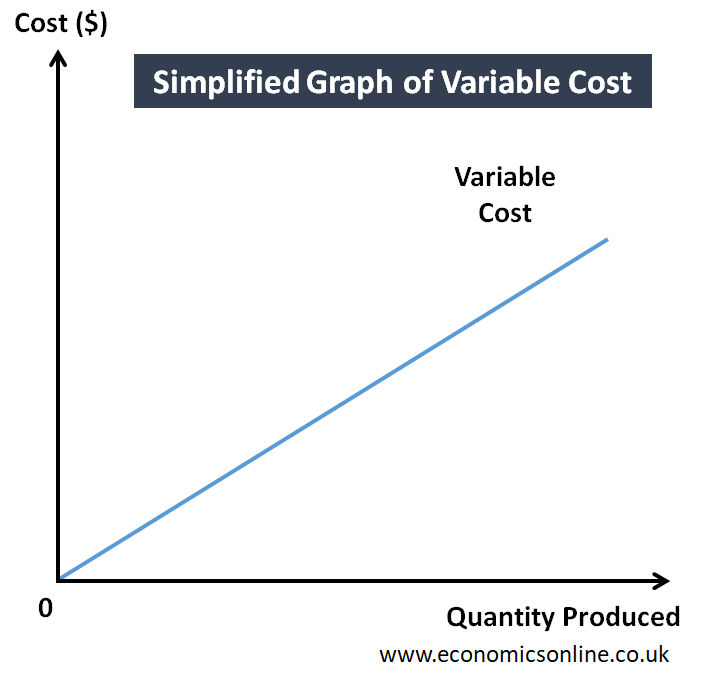

In some case, the following simplified graph of variable cost is used for easy understanding and analysis.

Variable Cost vs. Fixed Cost

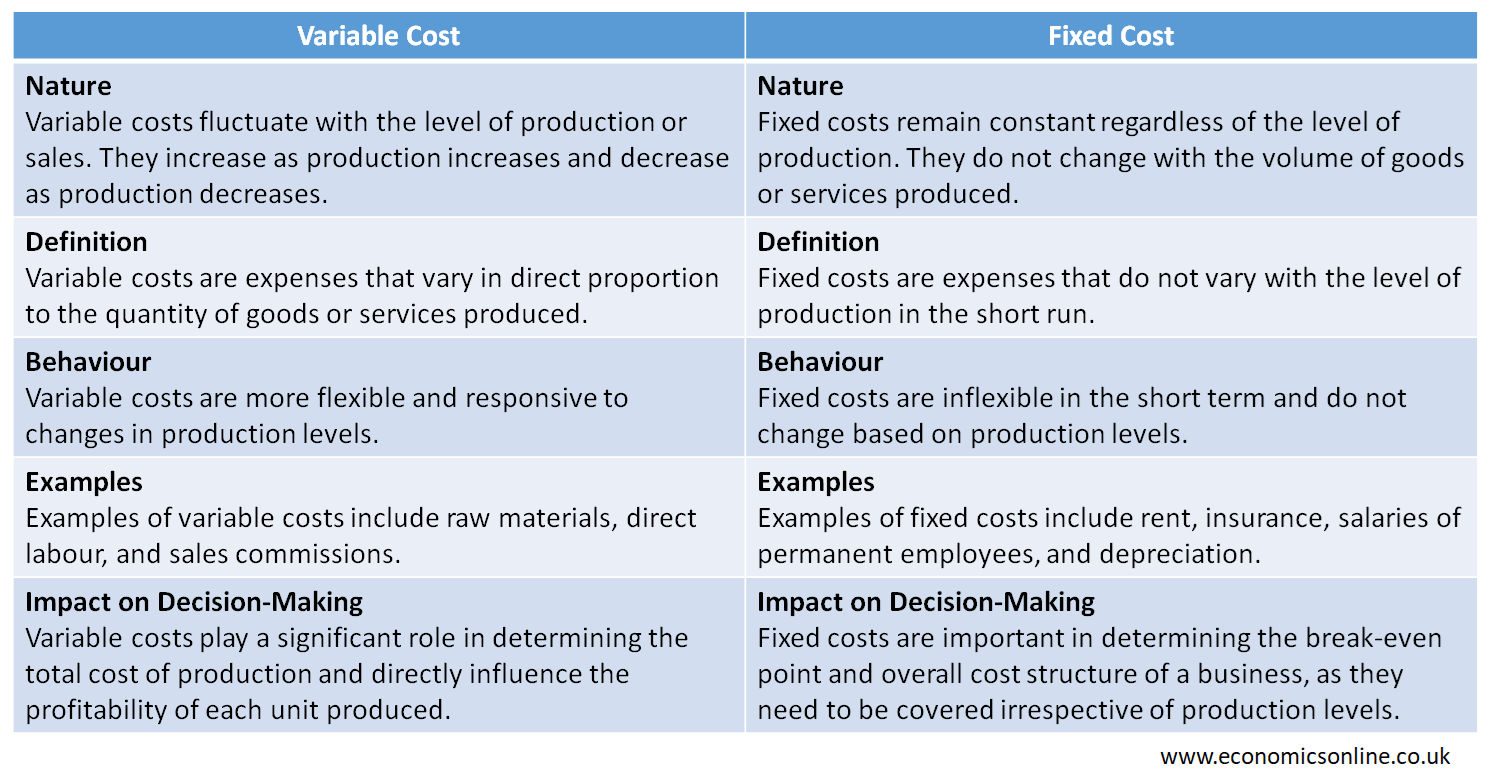

The following table contains the main points of difference between variable cost and fixed cost.

Types of Variable Costs

The following are the types of variable costs:

Total Variable Cost

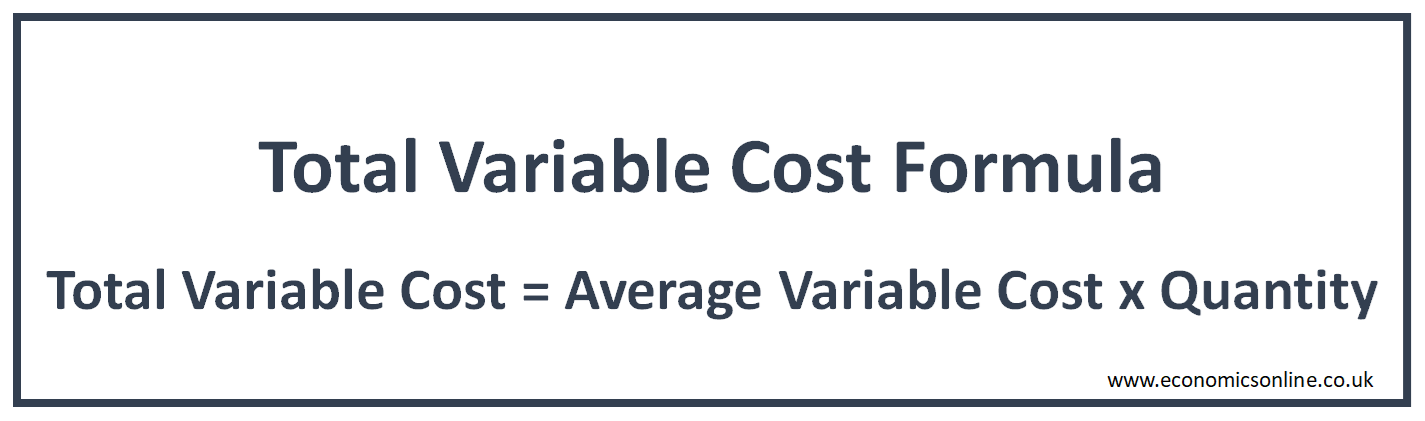

Variable cost shows its true variable behaviour on total basis. Total variable cost is defined for a given level of output and is calculated by multiplying the total quantity of output by the variable cost per unit of output (average variable cost). The total variable cost formula is given below:

Total Variable Cost = Average Variable Cost × Quantity

Total variable cost can also be calculated by adding all the variable expenses incurred to produce a product or provide a service. For example, in a plumbing service, the variable cost in this case is the direct labour cost, fuel for transportation to the destination, and supplies required for the job, such as shower units, piping, etc. But in a manufacturing company, suppose a cake manufacturer, the variable cost in this case is the direct labour cost needed to make cake, the bakery products, like paper liners for cake pans, flour, eggs, milk, chocolate, sugar, and many more. The electricity cost is also included, as it is used to operate the oven to bake cakes.

Average Variable Cost

This is the variable cost defined for a single unit of output. It is also called variable cost per unit. This can be calculated by dividing the total variable cost by the number of units produced. The formula for average variable cost is:

Average Variable Cost = Total Variable Cost / Quantity

Examples of Variable Cost

The following are some examples of variable costs:

Raw Materials

The raw materials are the inventory of unprocessed materials purchased to produce a final product. The raw materials are tangible items that can be identifiable and measurable. For example, steel is a raw material used in the construction of buildings, and fabric is used in the production of clothing.

Direct Labour

Direct labour is also a variable cost, and it varies depending on the number of units produced. If no units are produced, there will be no direct labour costs. As the quantity produced increases, the cost for direct labour also increases.

Commissions

These are the types of variable costs that refer to a percentage of sales generated that are awarded to the sales people as additional compensation. When there is no sale, the commission expense is zero. The sales commission is given to the salesperson when he meets his given target, otherwise, there is no commission. This expense varies with different activity levels.

Utilities

Utilities are also variable in cost and are important when a manufacturing line turns on equipment and starts production. There is a need for utilities because equipment consumes energy to operate. When they shut down their production machines, there is no utility consumed. Therefore, the utility varies with the production process.

Shipping/Freight

The shipping cost of a product or the cost to package the product is only incurred when a particular activity is performed. The cost of shipping varies with the number of units shipped. But there are some fixed-cost components associated with shipping. For example, an in-house mail distribution network with a personalised packaging product line.

Importance of Variable Cost

The following points explain the importance of variable costs:

Costing

Costing means the process of calculating the cost of making a product. Variable cost is considered part of product cost in all the costing methods, such as contribution costing or absorption costing.

Pricing

Variable cost is an important factor affecting the price of a product. Setting the right price, which covers the cost of making a product, is essential for any business in order to generate profits.

Total Contribution

Total contribution is the difference between total revenue and total variable costs. A positive value of total contribution means that the business can cover its fixed cost and generate some profit.

Cost Analysis and Control

For any business, cost analysis and control are important in improving its efficiency. The knowledge of variable cost and how it changes with output helps a business control its cost.

Break-even Point

The variable cost is important because firms use it when calculating break-even point which is the number of units for which there is no profit or loss. Breakeven point helps in setting the production and sales targets to cover all the costs

Conclusion

In conclusion, the variable cost in the production process is a cost that only increases when the quantity of output increases. The production process also has other costs that are equally important as the variable cost. Those costs are fixed costs and semi-variable costs. The fixed cost remains constant over a relevant range, but the variable cost changes with every additional unit produced.