Photo by Rowan Heuvel / Unsplash

Homeowning Grows the Economy

Introduction

In the United States and many other European countries, home ownership is the biggest dream for many. Homeowning is not only important in terms of providing independence and monetary security to the homeowners; it also contributes to economic growth and employment in many sectors of the economy. Many economists believe that a rise in the housing market is a driver of economic growth in the country. Home ownership in historically undeserved communities is a more profound benefit for families because it keeps them engaged in the neighborhoods where they live. From stepping forward for community events to becoming socially engaged, homeowners have a strong sense of belonging.

The Federal Reserve’s Survey of Consumer Finances

According to this survey, in 2016, the net worth of median home owners was $231,400, while renters’ was $5200. Although house prices have kept on rising since then, the wealth of home-owning Americans is also increasing day by day. According to the Federal Reserve, a median home owner will have 45 times greater net worth as compared to the median renter. But when we compare black and white families, the numbers are more deviating from normal and contributing to a widening wealth gap.

Constructing Generational Wealth

Home ownership is the key factor that contributes to improving generational wealth. But from the Brookings point of view, it is more difficult to achieve home ownership for black families in America, who have a homeownership rate of 46.4%, which is less than the 75.8% of white Americans.

According to Brookings, home ownership in the black neighbourhood in the United States has been valued at $48,000, which is predominately less as compared to the white neighbourhood, which creates a cumulative loss of equity of about $156 billion in the U.S. economy. These are some factors that contribute to this wealth gap.

But owning a home can lead to investment, buying power, and improving credits, and it allows families to pass this wealth or ownership to the children of homeowners, who then pass it on to their children, and this process continues through generations. But black families only rent a home and are not able to enjoy the benefits that home ownership delivers. This practice creates a wide wealth gap that keeps increasing over time and keeps black low-income homeownership families stuck in a cycle of disadvantage as compared to white families.

According to the Federal Reserve’s Survey in 2019, the net worth of a white family living in the United States was eight times higher as compared to black families living there. This can lead to a 30-point gap between the ownership rates of black and white families.

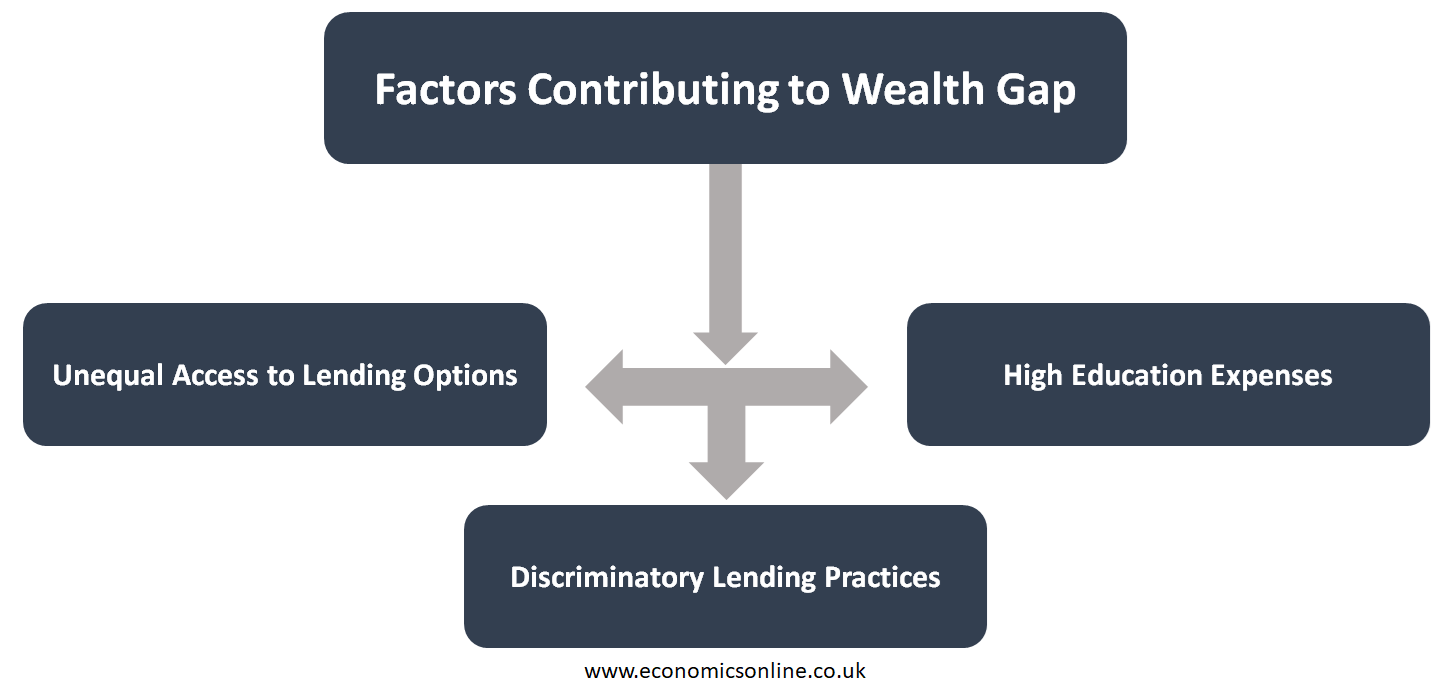

Factors Contributing to the Wealth Gap

According to Brookings, the following are some factors that contribute to the wealth gap in the United States:

Unequal Access to Lending Options

46% of blacks are underbanked or unbanked alone as compared to whites, which is almost three times greater than the 14% of whites. The Blacks remain far away from the necessary financial tools, which are important to generate finances or buy a home.

High Education Expenses

A shortage of banking options for black students can cause unsubsidized or subprime loans with high interest rates, which keep them plagiarising and leave them in debt after educational attainment in terms of graduation.

Discriminatory Lending Practices

A long history of underinvestment or alternative banking makes black people more likely to have discriminatory lending practices. This affects the credit scores, which automatically stops banks from giving loans for home purchases or businesses.

Reducing the Wealth Gap

Homeownership provides an opportunity to accumulate wealth, which helps reduce wealth inequality among American citizens. The following are some suggestions to reduce the wealth gap:

Assistance Programme

The down-payment assistance programme helps first-time buyers buy their own houses with debt or a mortgage with fixed interest rates who do not have access to intergenerational wealth.

Improving and Expanding Mortgages

Expanding credit access and improving lending and mortgage rates help black people generate equity to buy homes faster.

Appraisal Changes

In 2021, President Baiden addresses home appraisal inequity by changing discriminatory patterns within appraisal and home buying systems. By removing terms like crime-ridden, affordable, desirable, and integrated, we can make appraisal more equitable.

New Constructions

By making new construction changes to the existing programmes, such as easing land use restrictions and zoning to allow two-to-four units, the single-family homes to one unit in the neighbourhood, encouraging more buying opportunities.

Advantages of Home Ownership

According to the Urban Policy Brief review, home ownership has the following advantages:

Increased Personal Wealth

According to the surveys and collected data, it has been noticed that equity in a home is the major source of wealth for most families and serves as an important economic divide in American society. The median net worth for median homeowners exceeds $78,400 as compared to $2300 for renters. The home owner’s wealth in the form of home equity is more than 60%.

Increase Personal Well-Being

Homeownership promotes personal well-being as there are social benefits of homeownership. It is important as a symbol of social status and increases the home owner’s satisfaction and self-esteem.

Stimulates Economic Growth

Housing market is a large sector contributing to the GDP growth of a country. In the construction process of 1000 houses, there are 2100 full-time job opportunities, as home construction and other related industries employ approximately 6 million Americans.

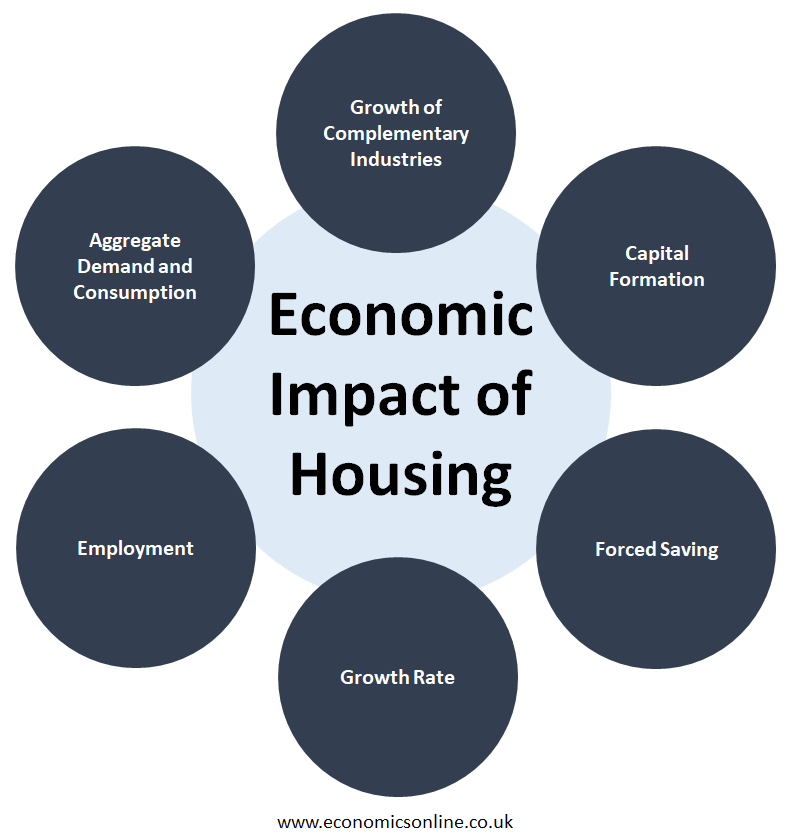

Economic Impact of Housing

The following are some of the major impacts of homeownership on economic growth:

Aggregate Demand and Consumption

The aggregate demand is the total demand for goods and services in an economy. Total consumption, total investment, net trade, and saving are indicators of the economy’s size. Consumption is the major part of aggregate demand, and housing makes up the majority of consumption. In this way, the buying and selling of owner-occupied houses contributes a larger portion to a country’s economy.

Growth of Complementary Industries

Some sectors of a country’s economy take the benefits of homeowning growth. Construction and repair industries, such as home renovation, benefited from housing industries. Including durable goods firms in the economy that sell durable goods that have a relatively long life span also benefits economic growth. Durable goods, such as furniture or appliances, benefit home furniture businesses, including bankers and real estate agents.

Capital Formation

It is also a way to stimulate economic growth. For example, remortgaging or mortgaging mechanisms are only ways in which a housing loan system creates potential capital in an economy and also encourages the consumption of goods that are related to housing.

Forced Saving

The concepts of consumption and investment lead to forced saving. The long-term nature of the housing loan system leads to wealth accumulation, and after selling and purchasing a house, the home owner has a significant amount of money in hand. For people whose income is below average, the value of their homes is one of the biggest components of wealth and savings.

Saving money for future consumption is an important part of an economy. This is equal to the investment in the long run. The amount of money that is not consumed now will be used to generate aggregate demand and investment in the future, which will result in unexpected capital gains.

Growth Rate

Some factors contribute to the growth of Aboriginal economies, such as capital formation, which enhances small business growth. For example, aggregate demand increases with savings, which increase the gross domestic product (GDP) of a country. The underlying growth rate is a measurement of how an economy can consistently expand with each passing year.

Employment

Due to increased housing, the construction and repair industries require the recruitment of more workers. Employees are not only hired in the housing industry but also in many ancillary firms. The result is a significant fall in unemployment in the country.

Conclusion

In the end, home ownership is an important factor in the economic growth of a country. The growth rate, employment rate, forced saving, and capital formation are some of the major impacts of the housing boom on a country’s economy. However, there are also some non-economic impacts, such as productivity growth, future wealth, and skill development, that contribute to a country’s economy.