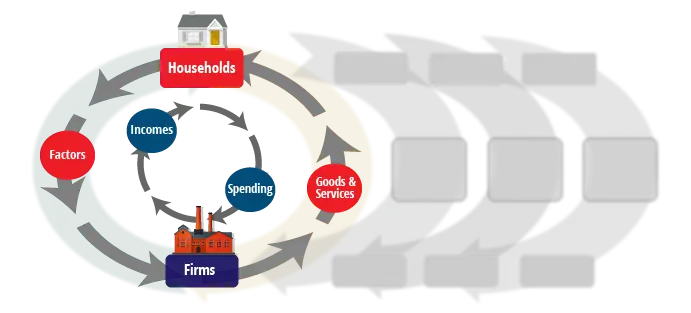

The circular flow of income

National income, output, and expenditure are generated by the activities of the two most vital parts of an economy, its households and firms, as they engage in mutually beneficial exchange.

Households

The primary economic function of households is to supply domestic firms with needed factors of production – land, human capital, real capital and enterprise. The factors are supplied by factor owners in return for a reward. Land is supplied by landowners, human capital by labour, real capital by capital owners (capitalists) and enterprise is provided by entrepreneurs. Entrepreneurs combine the other three factors, and bear the risks associated with production.

Firms

The function of firms is to supply private goods and services to domestic households and firms, and to households and firms abroad. To do this they use factors and pay for their services.

Factor incomes

Factors of production earn an income which contributes to national income. Land receives rent, human capital receives a wage, real capital receives a rate of return, and enterprise receives a profit.

Members of households pay for goods and services they consume with the income they receive from selling their factor in the relevant market.

Production function

The simple production function states that output (Q) is a function (f) of: (is determined by) the factor inputs, land (L), labour (La), and capital (K), i.e.

Q = f (L, La, K)

The Circular flow of income

Income (Y) in an economy flows from one part to another whenever a transaction takes place. New spending (C) generates new income (Y), which generates further new spending (C), and further new income (Y), and so on. Spending and income continue to circulate around the macro economy in what is referred to as the circular flow of income.

The circular flow of income forms the basis for all models of the macro-economy, and understanding the circular flow process is key to explaining how national income, output and expenditure is created over time.

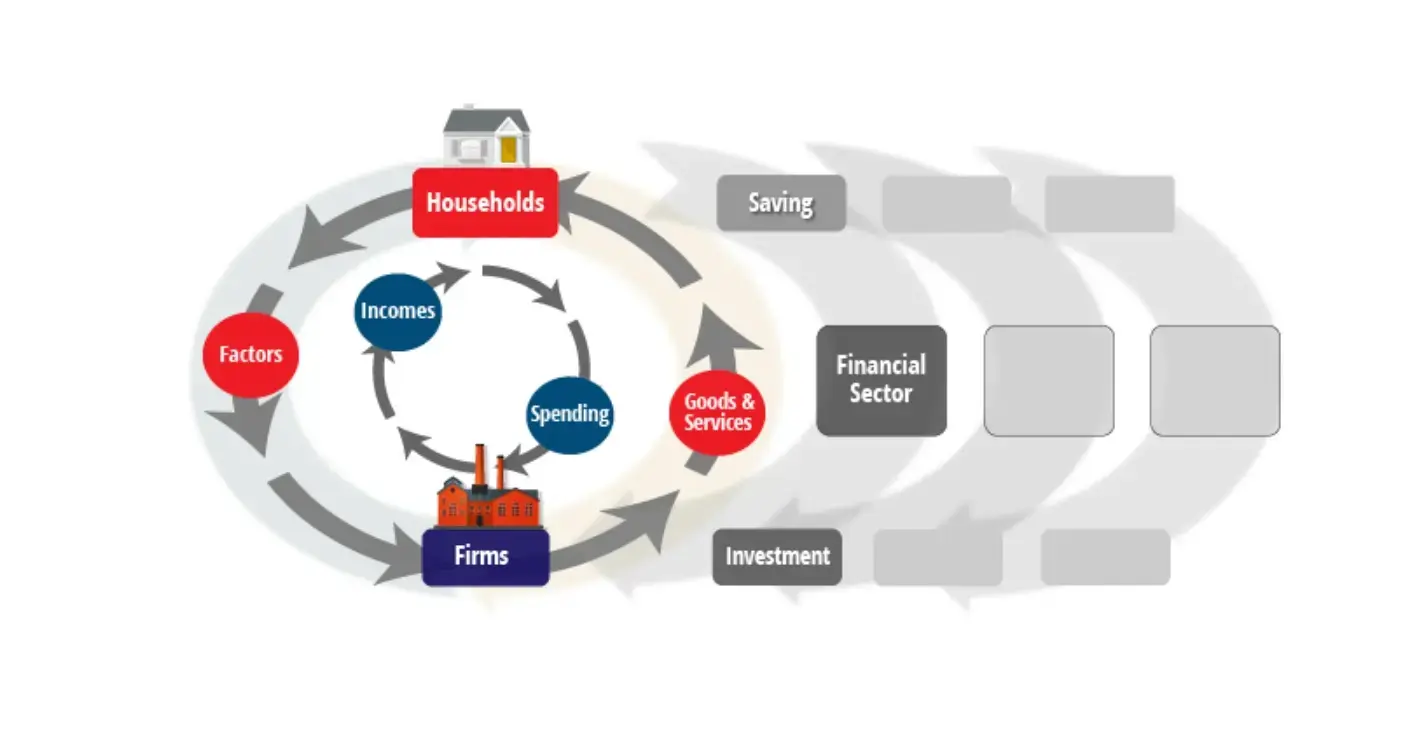

Injections and withdrawals

The circular flow will adjust following new injections into it or new withdrawals (aka leakages) from it. An injection of new spending will increase the flow. A net injection relates to the overall effect of injections in relation to withdrawals following a change in an economic variable.

Savings and investment

The simple circular flow is, therefore, adjusted to take into account withdrawals and injections. Households may choose to save (S) some of their income (Y) rather than spend it (C), and this reduces the circular flow of income. Marginal decisions to save reduce the flow of income in the economy because saving is a withdrawal out of the circular flow. However, firms also purchase capital goods, such as machinery, from other firms, and this spending is an injection into the circular flow. This process, called investment (I), occurs because existing machinery wears out and because firms may wish to increase their capacity to produce.

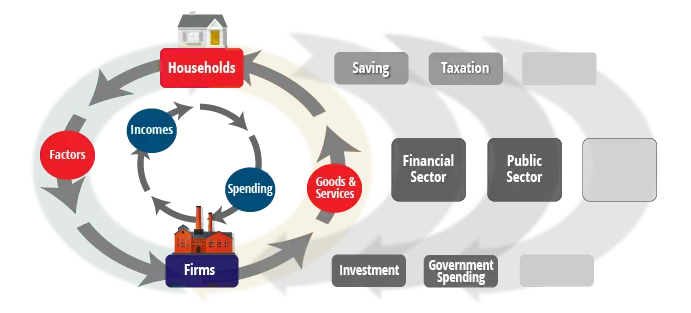

The public sector

In a mixed economy with a government, the simple model must be adjusted to include the public sector. Therefore, as well as save, households are also likely to pay taxes (T) to the government (G), and further income is withdrawn out of the circular flow of income.

Government injects income back into the economy by spending (G) on public and merit goods like defence and policing, education, and healthcare, and also on support for the poor and those unable to work.

Including international trade

Finally, the model must be adjusted to include international trade. Countries that trade are called ‘open’ economies, the households of an open economy will spend some of their income on goods from abroad, called imports (M), and this is withdrawn from the circular flow.

Foreign consumers and firms will, however, also wish to buy domestic products, called exports (X), and this is an injection into the circular flow.