Supply-side policy

Supply-side policy

Supply side policy includes any policy that improves an economy’s productive potential and its ability to produce. There are several individual actions that a government can take to improve supply-side performance.

Improving productivity of factors

Measures to improve factor productivity, which is the marginal output generated by factors inputs, include the following:

- Using the tax system to provide incentives to help stimulate factor output, rather than to alter demand, is often seen as central to supply-side policy. This commonly means reducing direct tax rates, including income and corporation tax. Lower income tax will act as an incentive for unemployed workers to join the labour market, or for existing workers to work harder. Lower corporation tax provides an incentive for entrepreneurs to start and so increase national output.

- Other supply-side policies include the promotion of greater competition in labour markets, through the removal of restrictive practices, and labour market rigidities, such as the protection of employment. For example, as part of supply-side reforms in the 1980s, trade union powers were greatly reduced by a series of measures including limiting worker’s ability to call a strike, and by enforcing secret ballots of union members prior to strike action.

- Measures to improve labour mobility will also have a positive effect on labour productivity, and on supply-side performance. This improves labour market flexibility.

- Better education and training to improve skills, flexibility, and mobility – also called human capital development. Spending on education and training is likely to improve labour productivity and is an essential supply-side policy option, and one favoured by recent UK governments. A government may spend money directly, or provide incentives for private suppliers to enter the market. Government may also set and monitor standards of teaching, and force schools to include a skills component in their curriculum.

- The adoption of performance-related pay in the public sector is also seen as an option for government to help improve overall productivity.

- Government can encourage local rather than central pay bargaining. National pay rates rarely reflect local conditions, and reduce labour mobility. For example, national pay rates for Postmen do not reflect the fact that in some areas they may be in short supply, while in other areas there may be surpluses. Having different rates would enable labour to move to where it is needed most.

OECD Video on skills

Improving the performance of firms

Measures to improve competition and efficiency in product markets, especially in global markets, are also a significant part of supply-side policy. Example of measures include:

- Government may help to improve supply-side performance by giving assistance to firms to encourage them to use new technology, and innovate. This can be done through grants, or through the tax system.

- Deregulation of product markets may be implemented to bring down barriers to entry, encourage new and dynamic market entrants, and improve overall supply-side performance. The effect of this would be to make markets more competitive and increase efficiency. Promoting competition is called competition policy.

- Privatisation of state industry was a central part of supply-side policy during the 1980s and 1990s, and helped contribute to the spread of an enterprise culture. As long as privatisation is accompanied by measures to promote competition, there are likely to be efficiency gains for the firm, and productivity gains for the employees.

- Supply side performance can also be improved if there is a constant supply of new firms. Small businesses are often innovative and flexible, and can be helped in a number of ways, including start-up loans and tax breaks.

The effects of supply-side policy

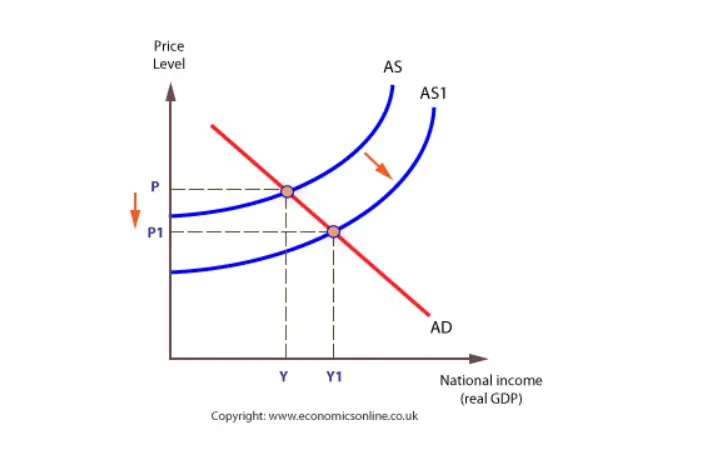

Successful supply-side policy will shift the AS curve to the right.

Evaluation

The advantages

- Supply-side policies can help reduce inflationary pressure in the long term because of efficiency and productivity gains in the product and labour markets.

- They can also help create real jobs and sustainable growth through their positive effect on labour productivity and competitiveness. Increases in competitiveness will also help improve the balance of payments.

- Finally, supply-side policy is less likely to create conflicts between the main objectives of stable prices, sustainable growth, full employment and a balance of payments. This partly explains the popularity of supply-side policies over the last 25 years.

The disadvantages

- However, supply-side policy can take a long time to work its way through the economy. For example, improving the quality of human capital, through education and training, is unlikely to yield quick results. The benefits of deregulation can only be seen after new firms have entered the market, and this may also take a long time.

- In addition, supply-side policy is very costly to implement. For example, the provision of education and training is highly labour intensive and extremely costly, certainly in comparison with changes in interest rates.

- Furthermore, some specific types of supply-side policy may be strongly resisted as they may reduce the power of various interest groups. For example, in product markets, profits may suffer as a result of competition policy, and in labour markets the interests of trade unions may be threatened by labour market reforms.

- Finally, there is the issue of equity. Many supply-side measures have a negative effect on the distribution of income, at least in the short-term. For example, lower taxes rates, reduced union power, and privatisation have all contributed to a widening of the gap between rich and poor.