Image showing air pollution from factories.

Pigouvian Tax

What is a Pigouvian Tax?

A Pigovian tax is a levy imposed on individuals or companies for engaging in actions that produce negative externalities, such as environmental pollution, strain on public healthcare from tobacco sales, and other external costs not reflected in the product's market price.

It is a tax on the generator of negative externalities, and is named after the Cambridge Economist Arthur Cecil Pigou (1877–1959). A Pigouvian tax is often referred to as a ‘sin tax’.

The British Economist, Arthur Pigou argued that a unit tax on harmful products, such as cigarettes, would be an effective way of establishing an efficient equilibrium price that took into account the negative effects on consumption.

On the other hand if a good has positive externalities and is under-consumed in a free market, then government can give a Pigouvian subsidy equal to the amount og marginal external benefit of the good.

Explanation

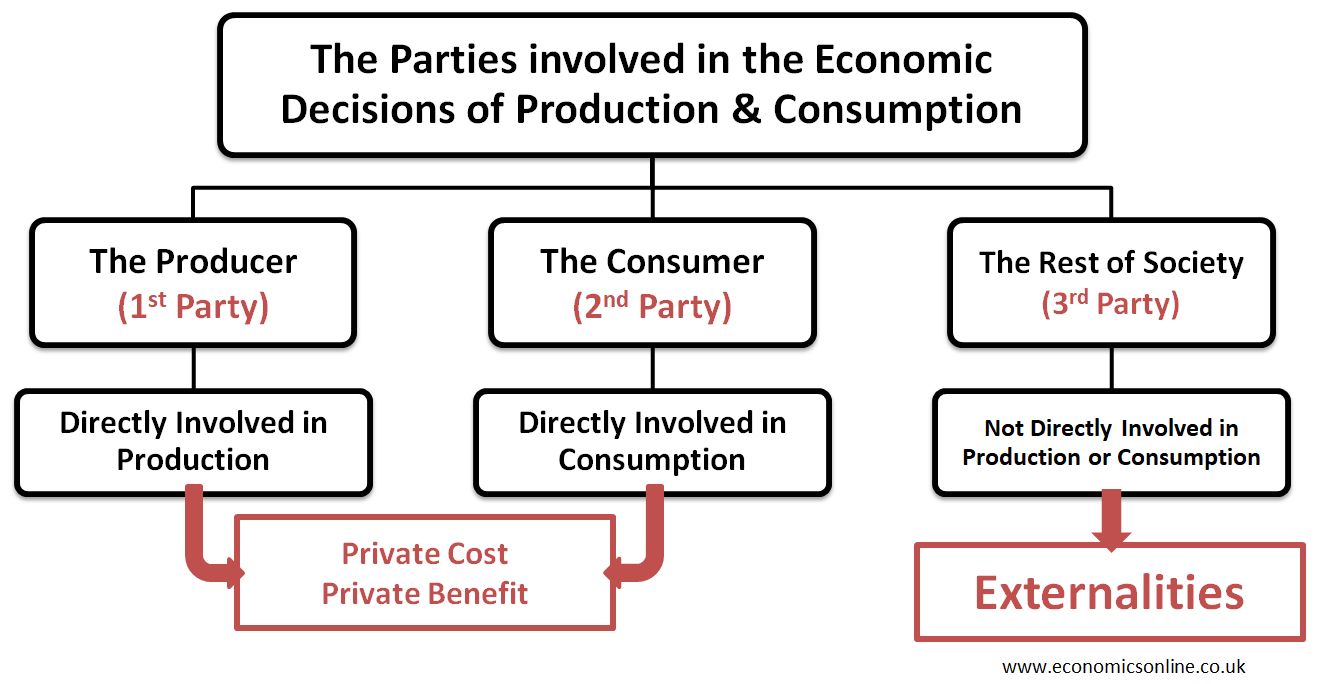

The Pigouvian tax is included in the wide system of taxation used by the governments to correct market failure, yet this tax is focused on negative externalities. Negative externalities or external costs are the costs of economic activities of the production or consumption to the third parties ot the rest of society. The producers and consumers don't consider these external costs while making their decisions due to self-interest. This is shown in the following flowchart.

The purpose of imposing a Pigouvian tax is to shift the burden of cost of the externality to the producers and consumers of goods by making them pay for the harm they cause to society. For instance, if a factory generates air pollution, a Pigouvian tax on this pollution would make the factory pay for the harm caused to the environment and public health. By making the factory pay the cost of its emissions, the Pigouvian tax creates an incentive for the factory to reduce or eliminate the emission of pollution into the air.

Working of the Pigouvian Tax

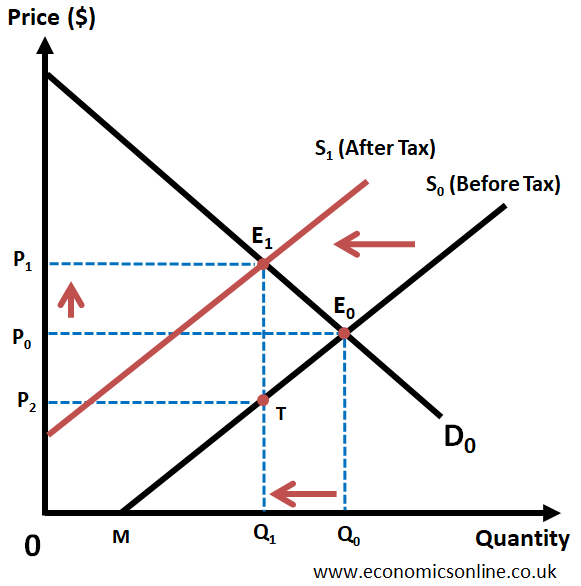

The following diagram illustrates the working of the Pigouvian tax.

Before Tax

Market Equilibrium is at E0, P0and Q0.

Equilibrium Price = P0

Equilibrium Quantity = Q0

After Tax

Market Equilibrium is at E1, P1and Q1.

Equilibrium Price = P1

Equilibrium Quantity = Q1

Tax per unit = E1T (This should be equal to the amount of marginal external cost or the negative externality per unit)

Tax Revenue of Government = Area P1E1TP2

Result

Price is increased from P0 to P1.

Equilibrium Quantity (quantity produced and consumed) is decreased from Q0 to Q1. The decrease is quantity produced and consumed is the desired end result of the Pigouvian tax. This means that the socially efficient quantity of the good will be produced and consumed.

Examples of the Pigouvian Tax

Pigouvian taxes can be applied to a wide variety of negative externalities, including pollution, carbon emissions, smoking, the purchase and use of alcohol, and water usage.

One example of a Pigouvian tax is the carbon tax which is imposed on the burning of fossil fuels in order to reduce carbon emissions and mitigate climate change. When burned, fossil fuels emit greenhouse gases, the cause of global warming, which is damaging our planet in a multitude of ways. The pupose of carbon tax is to ensure that the producers of carbon products should pay the external cost.

Another example is the water usage tax which is imposed on businesses that use large amounts of water in order to conserve resources and protect the environment.

In practice, Pigouvian taxes have been implemented in a number of countries, including Europe and Canada, where carbon taxes have been introduced to reduce carbon emissions. In the United States, some states have implemented Pigouvian taxes, including a carbon tax in Washington and a water usage tax in California.

Advantages of the Pigouvian Tax

Environmental benefits

Pigouvian taxes can effectively reduce negative externalities such as pollution and carbon emissions, which can have significant benefits for the environment and public health.

Economic efficiency

Pigouvian taxes create incentives for individuals and firms to reduce or eliminate negative activities, which can lead to a more efficient allocation of resources in the economy.

Revenue generation

Pigouvian taxes can raise revenue for government, which can be used to fund public goods and services.

Disadvantages of the Pigouvian Tax

Determining the appropriate level of the tax

One challenge is determining the appropriate level of the tax, as setting it too high could be economically burdensome, while setting it too low would not be an effective incentive for change.

Economic burden

Pigouvian taxes can be economically burdensome for individuals and firms, particularly for low-income households and small businesses.

Political opposition

Pigouvian taxes may be opposed by industries that would be affected by the tax, and by individuals and organizations who argue that the taxes are regressive or that the government should not be involved in such issues.

Conclusion

Overall, Pigouvian taxes are a tool to internalize the external costs of negative activities and create incentives for change. While the implementation of Pigouvian taxes can be complex and controversial, they have been shown to be effective in reducing negative externalities and raising revenue for government.

It is worth noting that Pigouvian taxes are not the only tool to address negative externalities, and other policies such as cap-and-trade systems, regulations, subsidies, or education campaigns may be more appropriate in some cases.

- Read more on negative externalities