Price Elasticity of Supply

Price elasticity of supply

Price elasticity of supply (PES) measures the responsiveness of quantity supplied to a change in price. It is necessary for a firm to know how quickly, and effectively, it can respond to changing market conditions, especially to price changes. The following equation can be used to calculate PES.

While the coefficient for PES is positive in value, it may range from 0, perfectly inelastic, to infinite, perfectly elastic.

A firm’s market price increases from £1 to £1.10, and its supply increases from 10m to 12.5m. PES is:

The positive sign reflects the fact that higher prices will act an incentive to supply more. Because the coefficient is greater than one, PES is elastic and the firm is responsive to changes in price. This will give it a competitive advantage over its rivals.

Extreme cases

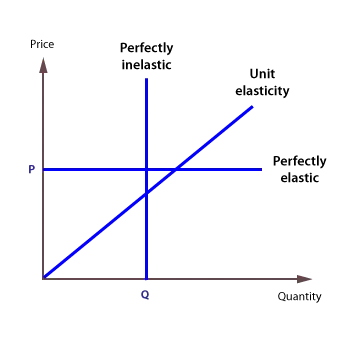

There are three extreme cases of PES.

-

Perfectly elastic, where supply is infinite at any one price.

-

Perfectly inelastic, where only one quantity can be supplied.

-

Unit elasticity, which graphically is shown as a linear supply curve coming from the origin.

Determinants of PES

How firms respond to changes in market conditions, especially price, is an important consideration for the firm itself, and to an understanding of how markets work.

The key considerations are:

-

Are resource inputs readily available?

-

Are factors mobile – are workers prepared to move to where they are needed?

-

Can finished products be easily stored, and are there existing stocks?

-

Is production running at full capacity?

-

How long and complex is the production cycle or production process?

What is the most desirable PES for a firm?

It is desirable for a firm to be highly responsive to changes in price and other market conditions. This is because a high PES makes the firm more competitive than its rivals and it allows the firm to generate more revenue and profits.

Improving PES

Because a high PES is desirable, it may be necessary for firms to undertake actions that improve their ability to respond quickly to changes in market conditions. Examples of these actions include:

-

Creating spare capacity

-

Using the latest technology

-

Keeping sufficient stocks

-

Developing better storage systems

-

Prolonging the shelf life of products

-

Developing better distribution systems

-

Providing training for workers

-

Having flexible workers who can do a range of jobs

-

Locating production near to the market

-

Allowing inward migration of labour if there is a labour shortage

See also: Aggregate supply